Tariff Law Proposes to Delete Preliminary Provisions on Tax Clearance, Administrative Reconsideration to Play the Role of Main Channel for Dispute Resolution

On October 20, 2023, the Draft Tariff Law was submitted to the Sixth Session of the Standing Committee of the Fourteenth National People's Congress (NPC) for deliberation, and was made available to the public for comments on December 29, 2023, and the deadline for comments has now ended, and it is expected that it will be reviewed for the second time this year. Among the concerns, Article 65 of the Draft Customs Tariff Law removes the provision on tax clearance in tax collection matters, and only requires the implementation of the "reconsideration first, followed by litigation" order of relief. This change goes further than the 2015 Draft Revision of the Tax Collection and Administration Law (Draft for Public Comments). In view of this, this article analyzes the changes in Article 65 of the Draft Customs Tariff Law as a starting point, interprets its possible impact on the Tax Collection and Administration Law, and combines it with the highlights of the revision of the new Administrative Reconsideration Law, predicting that the number of tax administrative reconsideration cases may increase steeply in 2024, and that it may play a more substantial role in resolving disputes.

I. The Customs Tariff Law (Draft) proposes to delete the pre-clearance provision, and the threshold for taxpayers to seek legal remedies for tax payment no longer exists

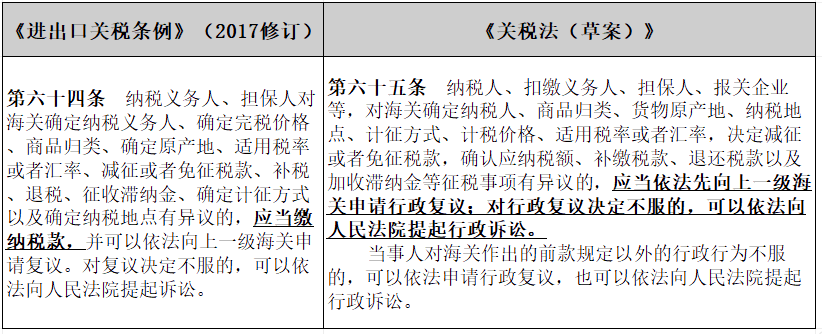

Compared with Article 64 of the Regulations on Import and Export Tariffs (2017 Revision), Article 65 of the Customs Tariff Law (Draft) makes drastic changes to the provisions on legal remedies, with the following main changes:

(i) Deletion of the provision on "prior to tax clearance" in respect of reconsideration and litigation of tax collection matters

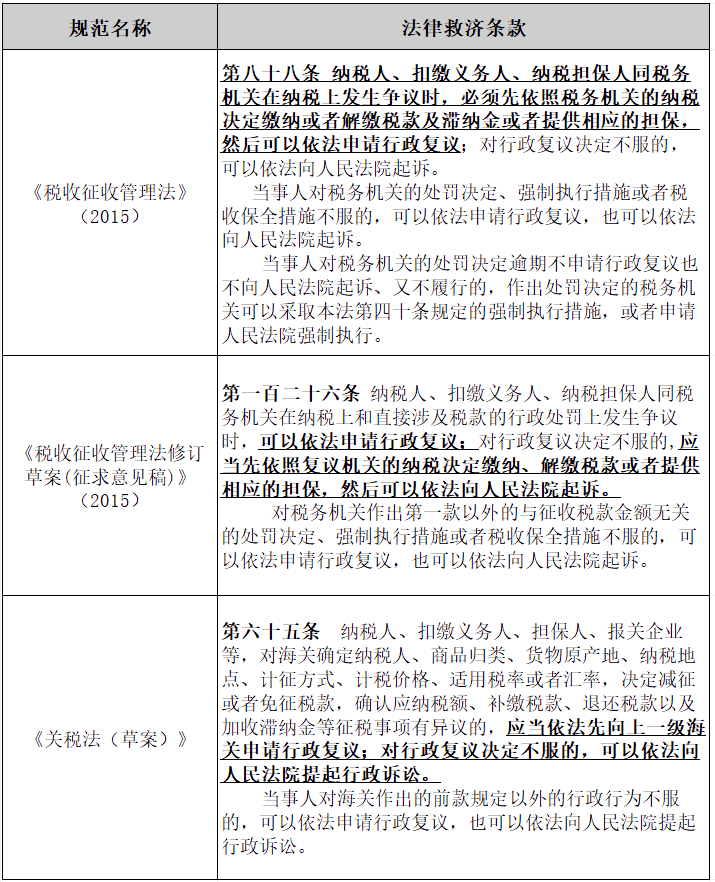

Article 65 of the Draft Customs Tariff Law stipulates that when there is a dispute between the administrative relative and the Customs over taxation matters, "the Customs shall, in accordance with the law, first apply to the Customs at the next higher level for an administrative reconsideration; and if the decision on the administrative reconsideration is unsatisfactory, the Customs may, in accordance with the law, institute an administrative litigation in the People's Court". This article directly gives the administrative relative the right to file an administrative reconsideration, administrative litigation, and no longer requires the administrative relative to pay the tax first. This amendment not only breaks through the provisions of the current Tax Collection and Administration Law, but also goes further than the 2015 Draft Revision of the Tax Collection and Administration Law (Draft for Public Comments). As shown in the table below:

The Draft Customs Tariff Law adopts the institutional design that neither reconsideration nor litigation requires the payment of tax first. Even in the Draft Revision of the Law on Administration of Tax Collection (Draft for Public Comments), the requirement to pay tax or provide guarantee is only extended from the stage of reconsideration to the stage of litigation, and is not directly deleted. It can be seen that Article 65 of the Draft Customs Tariff Law has changed a lot.

(ii) Retaining the "prior to reconsideration" to show the advantages of administrative organs in dealing with professional tax-related issues.

Article 65 of the Draft Customs Tariff Law retains the provision of "prior to reconsideration", i.e. "shall first apply for administrative reconsideration to the next higher level of Customs in accordance with law". The author believes that there are two reasons as follows:

First, because tax-related issues are highly specialized, administrative reconsideration is needed to play its important role in dispute resolution. Customs tax matters and the Tax Collection and Management Law tax-related disputes, as the same, more professional, the customs in the field of tariffs have professional knowledge and experience, can more accurately determine whether the taxpayer's complaint is valid.

Secondly, based on the efficiency and convenience of the reconsideration system, it is in line with the new Administrative Reconsideration Law's system requirements of fairness, efficiency and convenience for the public. The hearing period of administrative reconsideration is 60 days, and the relevant procedures and formalities are more concise. Moreover, if tax-related disputes are resolved within the system of administrative organs, the relevant facts and focuses of disputes can be quickly investigated, and the efficiency of dispute resolution can be improved.

(iii) Summary: The Draft Customs Law better protects taxpayers' rights

In addition to the above modifications, Article 65 of the Draft Tariff Law also adds new subjects of withholding agents and administrative counterparts of customs declaration enterprises, and expands the scope of taxable matters, while using the word "etc." as a backdrop through the front-loading method. At the same time, a new paragraph 2: "the parties to the Customs and Excise Department to make the provisions of the preceding paragraph other than the administrative act, may apply for reconsideration in accordance with the law, you can also bring a lawsuit to the people's court in accordance with the law". This paragraph does not involve the tax matters of the dispute, give the parties the right to choose the remedy, the parties can choose according to their own situation reconsideration or litigation in order to safeguard their legitimate rights and interests.

Overall, the Customs Law (Draft) legislation is a bigger step forward than the Import and Export Tariff Regulations (2017 Revision) or even the Tax Collection and Administration Law, and protects the rights of taxpayers more comprehensively. At the same time, it is highly likely to be a precursor to the revision of the Tax Collection and Administration Law, foreshadowing the direction of the reform of the tax-related dispute relief system.

II. The deletion of the pre-clearance provision in the Draft Customs Tariff Law provides a practical basis for the revision of the Tax Collection and Administration Law.

(i) Tariff legislation has a "pilot" effect on the revision of the Law on Administration of Tax Collection.

As an important part of national tax revenue, customs is authorized to collect tax due to the special nature of import and export links, but it is essentially the same as other taxes such as value-added tax and enterprise income tax, which are part of China's tax law system, and all of them have to take into account the balance of safeguarding the national tax revenue and protecting the rights of taxpayers. Therefore, the legislation of the Customs Tariff Law (Draft) will inevitably serve as a reference for the revision of the Tax Collection and Administration Law.

In fact, it is precisely because the customs area is managed by the customs rather than the tax authorities, and the scope of customs duties is relatively small, that this amendment is most likely to implement customs duties as a "pilot reform". If the deletion of the pre-clearance provision works well in the customs area, it may be extended to the general tax administration system.

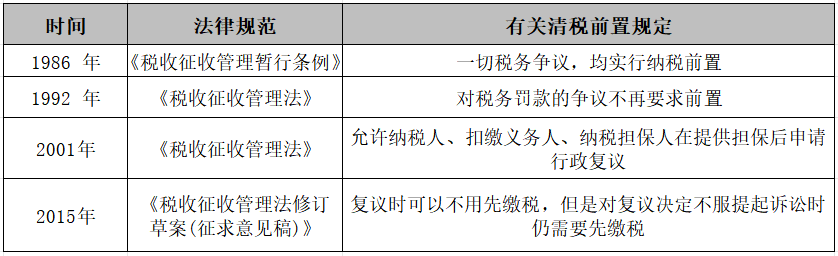

(ii) From the historical development of the Tax Collection and Administration Law, the deletion of preconditions for legal remedies is a general trend.

As a matter of fact, by observing the historical development of the Tax Collection and Administration Law and the legislative development, it can be found that the deletion of the pre-condition for tax clearance in Article 88 is a realistic choice for balancing the relationship between the levy and payment sides, and also an inevitable move to promote the rule of law and modernization of tax administration.

The pre-tax clearance provision originated in Article 40 of the 1986 Provisional Regulations on Administration of Tax Collection, which provides that "in the event of a dispute between a taxpayer, a collector, or any other party and the tax authorities over the payment of taxes or the handling of violations, the taxpayer, the collector, or any other party, must first pay the taxes, late fees, and penalties in accordance with the tax authority's decision, and then apply for a reconsideration to a higher-level tax authority within 10 days ".

The 1992 legislation elevated the Provisional Regulations on Tax Collection and Administration to law, still retaining the tax clearance front clause, with the point of progress being that tax penalty matters no longer require a front.In 2001, the Standing Committee of the National People's Congress (NPC) comprehensively revised the Law on Administration of Tax Collection, allowing taxpayers, withholding agents, and tax guarantors to apply for a reconsideration after providing the appropriate guarantees, thus forming the current tax clearance front clause.

However, the conditions of tax guarantee are not only extremely strict, but also the tax guarantee needs to be recognized by the tax authorities, and there are no few tax cases in practice where disputes arise from the tax guarantee. Even so, in the context of the lack of national tax collection and management capacity and the serious loss of tax money at that time, the establishment of the tax clearance provisions had the significance of the times, and to a certain extent, it safeguarded the tax interests of the country.

However, with the steady implementation of the "tax by numbers" reform, the national tax collection and management environment, collection and management capacity has undergone a fundamental transformation, and the era of the rule of law in taxation has come, it is reasonable to abandon the traditional thinking of collection and management, so that the Law on the Administration of Tax Collection can better protect the rights of taxpayers.

Article 126 of the 2015 Draft Revision of the Tax Collection and Administration Law (Draft for Public Comments) abolishes the precedence of reviewing tax clearance and replaces it with the precedence of litigating tax clearance, which is in fact the same as Article 65 of the Draft Customs Tariff Law that favors the protection of taxpayers' rights. Although the 2015 Law on Administration of Tax Collection did not amend this article, it reflects the drafters' determination to amend the tax clearance preliminaries to protect the taxpayers' right to remedy.

In June 2023, the State Council issued the Circular on the Legislative Work Plan for the Year 2023, and the Tax Collection and Administration Law returned to the legislative program, while the Draft Customs Tariff Law was submitted for deliberation as scheduled, with the deletion of the pre-tax clearance clause and the addition of the new administrative reconsideration commissioner system and allowing applicants to copy evidence in the new Administrative Reconsideration Law, which all laid a good foundation for the revision of Article 88 of the Tax Collection and Administration Law. All these have laid a good foundation for the revision of Article 88 of the Tax Collection and Administration Law.

(iii) Summary: Tax-related disputes will be reviewed by deleting the pre-tax clearance provision.

To sum up, the future Law on Administration of Tax Collection is expected to delete the provision of tax clearance before reconsideration, and tax disputes no longer require the payment of tax, late payment or provision of corresponding guarantees before reconsideration can be filed, which may lead to a spurt of growth in tax administrative reconsideration cases, and highlight the basic position of modern tax law for the protection of taxpayers' rights.

If they are not satisfied with the decision of the administrative reconsideration, they may, in accordance with the law, file a lawsuit with the people's court."

III. the deletion of the tax clearance provisions in line with the spirit of the revision of the Administrative Reconsideration Law, administrative reconsideration to play the function of dispute resolution

(i) the deletion of tax clearance provisions restore the nature of administrative reconsideration

As a legal remedy, administrative reconsideration can be applied for by citizens, legal persons or other organizations in accordance with the law when they believe that the administrative acts of the administrative organs violate their lawful rights and interests. From the constitutional point of view, when the taxpayer's rights have been infringed or are being infringed, the right to relief as a basic human right of the taxpayer should play its protective role, and should not apply for administrative reconsideration with shackles.

In the past, the payment of tax in advance undoubtedly created substantial obstacles for taxpayers to exercise their right to remedy, leading to inequality between taxpayers with and without financial resources, and bringing taxpayers the implied psychology of "spending money to buy the right to appeal", which is prone to intensify the conflicts between administrative organs and taxpayers. The Customs Tariff Law (Draft) to delete the tax clearance front clause and the new "Administrative Review Law" to play administrative review relief, supervision advantages, through the substantive resolution of administrative disputes more consistent with the goal, and people-oriented, the protection of the lawful rights and interests of citizens, legal persons and other organizations as the starting point of the revised law and the spirit of the spirit of the legislation is more in line with the landing point. From this point of view, the Tax Collection and Administration Law deletes the provision of tax clearance and becomes an unstoppable historical process.

(ii) Strengthening the supervisory function of reconsideration, avoiding taxpayers' inability to pay taxes and letting the "wrong" administrative behavior take effect.

In the past practice, due to the taxpayer's business difficulties, facing bankruptcy and other reasons, inability to pay taxes, to provide security, and thus fall into the loss of the right to relief cases abound. Such as the case of Xinjiang Hengcheng Cotton v. Manas Local Taxation Bureau ([2017] No. 6 of the new 2324 line, [2018] No. 8 of the new 23 line), Xinjiang Hengcheng Cotton Company's inability to pay the tax and late payment, ultimately leading to the inadmissibility of the administrative reconsideration, the tax levy entity disputes were not resolved, and the rights and interests of the taxpayers suffered damage.

Part of the taxpayers choose to save the country in a curved way, according to the provisions of the second paragraph of Article 88 of the Tax Collection and Management Law, choose the "Tax Administrative Penalty Decision" as the object of litigation at the same time, apply for a review of the "Tax Processing Decision". Although there are cases supported by the court in judicial practice, there are also cases in which the court has not conducted a comprehensive review of the determination of the same illegal facts of the penalty decision and the processing decision in the administrative penalty litigation on the ground that the taxpayer has not completed the tax, and has only reviewed other elements such as the procedure and the subject of the penalty, which has inappropriately derogated from the rights and interests of the taxpayers and undermined the credibility of the judicial organs.

(iii) Enhancing the clarity of legal remedies and eliminating disputes over the period of tax reconsideration

In addition to the above disputes, there are also disputes over the relationship between tax clearance and the deadline for reconsideration. For example, the Decision on Tax Treatment issued by the tax authorities usually states that "you (unit) are restricted to pay the above taxes and late payment fees into the treasury within 15 days from the date of receipt of this Decision, and to make relevant account adjustments in accordance with the regulations." In practice, some reconsideration authorities decided not to accept the decision on the ground that the taxpayer had paid tax for more than 15 days, and the taxpayer's administrative reconsideration authority was lost, which in fact replaced the 60-day period for reconsideration application with the 15-day period for tax payment.

However, with the deletion of the provision on tax clearance, the uncertainty, controversy and damage to taxpayers' rights and interests mentioned above will become history, and taxpayers can file a reconsideration of any tax disputes with the tax authorities, thus completely removing the many obstacles caused by the tax clearance.

IV.Forecast and Prospect in 2024: the number of tax administrative reconsideration cases will increase, and tax administrative reconsideration will play the role of the main channel to resolve disputes.

In addition to the deletion of tax clearance preliminaries, which may increase the number of administrative reconsideration cases, many highlights of the new Administrative Reconsideration Law provide a way for both parties to resolve disputes effectively, which greatly avoids the burden of lawsuits, and may prompt taxpayers to choose to resolve their conflicts by means of administrative reconsideration.

(i) Mediation and settlement through administrative reconsideration to resolve the risk of the investment promotion agreement being recognized as invalid.

From the statistics of the Ministry of Justice on administrative reconsideration cases every year, mediation and settlement of reconsideration have always been the main channels for resolving administrative disputes. The Rules for Administrative Review of Taxation also provides for mediation and settlement system in a special chapter. However, there are certain limitations in the past provisions, i.e., specific administrative acts made in the exercise of discretionary power, administrative compensation, administrative rewards and specific administrative acts with other reasonableness issues can be subject to administrative reconsideration and conciliation or mediation. For other matters, the tax review organs can not mediate. Such as investment promotion agreement belongs to the administrative agreement, no longer within the scope of administrative discretion, therefore, in the "administrative reconsideration law" before the amendment there is no way to mediation, conciliation.

But the new "administrative reconsideration law" is no longer on mediation, the scope of reconciliation to make restrictions on investment promotion agreement for the disputes arising from the provision of a new path of relief. Administrative relative subject can first on the legality of the investment promotion agreement, the validity of the administrative organs of the last level of reconsideration, application for conciliation, mediation, investment promotion agreement with the administrative organs, reconsideration organs to fully communicate with the recognition, to avoid the invalidity of the agreement and the risk of being recovered by the financial return, which will further play a mediation, conciliation and resolve disputes of the substantive role.

(ii) Establishing additional administrative reconsideration committees to improve the professionalism of resolving complex tax-related cases such as foreign trade

The new Administrative Reconsideration Law clearly enumerates the circumstances that should be referred to the Administrative Reconsideration Committee for advice in the hearing process, which helps to improve the professionalism of the hearing of tax-related cases and establishes a yardstick for tax-related cases of the same kind. Although Article 12 of the Administrative Review Rules for Taxation stipulates that administrative review organs at all levels may set up administrative review committees to study major and difficult cases and make suggestions for handling them, few tax organs have set up review committees in practice. Therefore, this article once became a zombie clause. However, according to the principle of legal superiority, the Rules for Administrative Review of Taxation should strictly abide by the provisions of the new Administrative Review Law, and those cases which are significant, difficult and complicated, and those which are specialized and technical must be submitted to the Administrative Review Committee for advice. Therefore, taxpayers can apply for tax administrative reconsideration to solve complex and difficult cases, which will help the reconsideration authority to find out the facts and guide both parties to apply the law accurately, so as to avoid the outbreak of the same kind of tax-related cases again.

(iii) Giving the authority to the personnel who read the documents to copy the evidence information, providing a powerful hand for the examination of the opinions.

The new Administrative Reconsideration Law grants the applicant, the third party and their authorized agents the right to copy the evidence, which facilitates the applicant to carry out the administrative reconsideration work in a better way. In the previous tax-related cases, the applicant and the third party could only access the written reply submitted by the respondent, the evidence, basis and other relevant materials of the specific administrative act, but could not copy the above materials, and the applicant and the third party were very likely to miss a certain detail in the process of accessing, which resulted in that the rights and interests of the applicant could not be well safeguarded. This gives the applicant and other copying rights to facilitate the applicant, the third party and its authorized agent to comprehensively sort out the respondent as a specific administrative act of the facts and the basis for the next step in the cross-examination of the opinion to provide a strong grip.

Based on the above analysis, the author predicts that in the new year, resolving the disputes between the taxpayers and the taxpayers through administrative reconsideration will become the main theme, whether it is to delete the provisions on tax clearance or expand the scope of conciliation and mediation, etc., which may lead to the growth of the number of tax administrative reconsideration cases, and the tax authorities also need to strengthen the team building and safeguards to enhance the strength of the administrative reconsideration of tax, and to handle and balance the protection of the national tax interests and the protection of taxpayers' interests. It is also urgent for tax authorities to strengthen team building and safeguard measures so as to enhance the power of tax administrative review, properly handle and balance the relationship between safeguarding national tax interests and protecting taxpayers' rights, so as to contribute to the rule of law in taxation.