Analysis of the actual case: in order to enjoy the local financial rebate and the establishment of additional purchase and sale link does not constitute the crime of false opening

Prior to the implementation of the "two-invoice system", it was common for pharmaceutical companies to increase the number of trading links in the purchase and sale chain in order to increase the price of medicines and obtain sales rebates. In addition to pharmaceutical enterprises, many trading enterprises also take the first sale of goods to enterprises enjoying local policies, and then the enterprise's external sales in order to increase the performance of affiliated enterprises or enjoy financial rebates. In practice, many case-handling authorities on these intermediate increase in the purchase and sale of links hold a negative attitude, that may constitute false opening. In view of this, the author combined with a pharmaceutical enterprise to increase the purchase and sale of links accused of false opening of the acquitted case, the authenticity of the business, the return of funds and the determination of tax losses to be analyzed for the benefit of the readers.

Ⅰ. A pharmaceutical company inserted into the purchase and sales chain was accused of false billing, and the court ruled that it was not guilty of the charge

(Ⅰ) Basic Case and Business Model

Company A is an enterprise engaged in the purchase and sale of medicines, and Wang Mou is the actual operator of the company. between 2012 and 2014, in order to obtain huge profits, Company A, Wang Mou and other key persons in charge of the company made fictitious transactions with four third-party units, including Company B, and obtained fictitious VAT invoices issued by the third-party units, falsely inflated the prices of medicines, and evaded payment of taxes by 66.21 million yuan. The Public Prosecution Bureau held that Company A and Wang Mou had violated the provisions of Article 205(2) of the Criminal Law, and referred them for trial for the crime of falsely issuing VAT invoices.

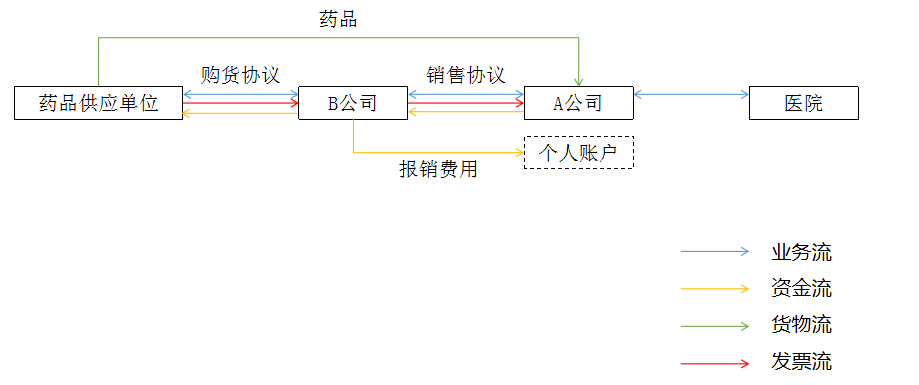

Among other things, the business model between Company A and third-party units such as Company B was as follows:

In terms of business flow, Mr. Wang contacted the drug supply unit as a salesman of Company B. Company B signed a purchase agreement with the drug supply unit, and Company A signed a sales agreement with Company B. Company A remitted the payment to Company B, and Company B remitted the base price of the drugs to the drug supply unit.

In the flow of funds, company A will remit the payment to company B, company B will remit the drug to the drug supply unit, due to company B to enjoy the "development fund return policy", of which, the value-added tax return 50%, enterprise income tax return, company B will be the remaining amount of money after deduction of tax and profit, in the name of reimbursement of expenses back to the Wang Mou master of the personal account, "profit distribution".

In terms of the flow of goods, the drug supply unit sends the drugs directly to Company A or Company A picks them up according to Company B's requirements.

In terms of invoice flow, the drug supply unit issued VAT invoices to Company B at the base price, and Company B issued VAT invoices to Company A at a price several times higher than the base price of the drugs, and Company A recorded the invoices at the higher price.

(Ⅱ) Points of contention of the case and the court's view

From the perspective of the criminal facts alleged by the public prosecution and the main aspects of the defense, there are three points of contention in this case, namely, whether the business model of this case constitutes false invoicing; whether the "profit distribution" in the sales link constitutes the return of funds; and whether the financial return constitutes the loss of national tax.

Regarding the question of whether the business model in this case constituted false opening, the court held that in this case, the evidence provided by Wang, such as the contract signed between Company A and Company B and other four companies, payment vouchers, warehousing vouchers, invoices, accompanying pass list, and State Administration of Taxation Document No. 39, etc., could confirm that there existed the real pharmaceutical products of signing the contract, making payment, dispatching the goods, receiving the goods, accepting the goods, and issuing invoices between Company A and Company B. The transaction process between Company A and Company B was very simple. Company A and Company B did not engage in false transactions. As the direct transfer business model agreed between Company A and Company B is not prohibited by law, the business model should be permitted by the law of China, Company A through Company B to purchase drugs from pharmaceutical manufacturers, the price increase to the hospitals to sell the activities are in line with the winning price and the national price limit range, is a normal phenomenon in the market economic activities. Since neither Company A nor Wang Mou had the subjective purpose of evading or cheating national tax, even if there was tax deduction, it should not be evaluated as constituting the crime of false VAT invoicing. The profit distribution between the parties also belongs to the civil lawful behavior and is not illegal.

Regarding the question of whether the return of money in the sales process constituted the return of funds, the court held that the behavior of Company B, after issuing invoices at the "inflated price" and receiving the payment from Company A, deducting the tax payable and profit and returning the balance to Wang, belonged to the normal transaction behavior in the market economic activities, which did not have administrative illegality or criminal illegality and would not cause the state to be in breach of law. It is not administratively illegal or criminally illegal, does not cause loss of national tax and is not a return of funds that should be recognized as false opening.

Regarding the question of whether the return of funds constituted the loss of state tax, the court held that according to the provisions of Article 205(2) of the Criminal Law, the amount of loss caused to the state interests is an important basis for convicting and sentencing the perpetrators, and that the evidence in the case was not sufficient to confirm that Company A and Wang Mou subjectively had the purpose of fraudulently obtaining the tax and objectively caused the loss of state tax, and it could not be concluded that they constituted the crime of fraudulently issuing VAT special invoices. Crime. Therefore, although the judicial authorities did not make a clear determination, they tended to believe that the fiscal refund was not a tax loss.

Accordingly, the court ruled that Company A and Wang were not guilty.

(Ⅲ) Summary

This case is a case in which a pharmaceutical company increased its profits by grafting over-invoicing companies in the purchase and sale chain, by sharing profits with distribution channels, and by reimbursing sales expenses. With the full implementation of the "two-invoice system" for the purchase and sale of medicines in 2017, it is clearly required that the pharmaceutical production enterprises open an invoice to the distribution enterprises, and the distribution enterprises open an invoice to the medical institutions, and there is no room for the survival of the pharmaceutical distribution enterprises, and the above business model has gradually disappeared in recent years. However, this case involves the increase in the purchase and sale of links to the impact of business authenticity, whether the return of funds constitutes the return of funds and financial return whether it will cause the loss of national tax is still recognized as an important aspect of the crime of fraudulent invoicing, and is also a common mode of many trading enterprises, so the following will be elaborated in detail on the three issues.

Ⅱ. the authenticity of the business: increase the purchase and sale of links is the scope of autonomy, real and legitimate

(Ⅰ) adjust the transaction mode is a civil autonomous behavior, there is no illegality

First of all, it must be pointed out that increasing or changing the transaction mode or link is in line with the requirements of civil law and has no illegality. The object of adjustment of the tax law (object of taxation) should respect the provisions of civil law. Article 143 of the Civil Code first stipulates that "civil legal acts with the following conditions are valid: (a) the actor has the corresponding civil capacity; (b) the true meaning of the expression; (c) does not violate the mandatory provisions of laws and administrative regulations, and does not contravene public order and morals." Then the current law in addition to the pharmaceutical "two-ticket system", did not restrict the sale of goods more than one hand, increase the trade purchase and sale of links is real and legitimate.

Secondly, Article 227 of the Civil Code, "Before the establishment and transfer of the right of property in movable property, the third party in possession of the movable property, the person who has the obligation to deliver may request the third party to return the original property through the transfer of the right to replace the delivery." Instead of delivery, instructions to deliver the provisions, also recognizes such acts of merely selling back the ownership of goods.

As a matter of fact, the establishment of additional trading links is a common and normal phenomenon in the field of bulk trade, as long as the establishment of additional trading links has a reasonable commercial value, the proper use of the provisions of the Tax Law, and does not violate the legal prohibitions, the parties should be allowed to make adjustments to the mode of trading in accordance with the principle of market economic activities in the field of private law that "there is no prohibition that is free", and should not only be allowed to adjust the mode of trading, but should not only be allowed to adjust the mode of trading. In accordance with the principle of market economic activities in the field of private law, "no prohibition is freedom", the parties should be allowed to adjust the mode of transaction, and the authenticity of the business should not be denied only by the long transaction chain and many transaction links.

(Ⅱ) Whether the intermediate links are involved in transportation or warehousing is not the key to determine the authenticity of the business.

According to the provisions of the Civil Code, the delivery of ownership of movable assets, namely, the transfer of the right to goods can be delivered in reality, can also be conceptual delivery. In the case of real delivery, the physical flow of goods and ownership changes are unified, while in the case of conceptual delivery, the physical flow of goods can be different from ownership changes. In the field of bulk trade, in order to save transportation costs and warehousing costs of economic rationality, grafted in the purchase and sale of intermediate links in the chain of enterprises usually do not actually participate in the transportation and warehousing of goods, but through simple delivery, instructions for the delivery of the delivery of the concept of delivery, such as change of possession to complete the transfer of the right of goods in the form of delivery, has been formed in the industry's usual practice, but also in line with the provisions of the law. In fact, the judgment of the authenticity of the business should pay attention to and restore the whole transaction chain, focusing on whether the source enterprise is actually supplying and whether the terminal enterprise is actually receiving the goods, and should not be unilaterally confined to the judgment of whether the intermediate enterprises are involved in transportation or warehousing.

(Ⅲ) Tax collection based on civil law relationship

Civil legal relationship is the premise and foundation of tax legal relationship. As mentioned above, as long as the parties to the transaction within the scope of civil law autonomy to make adjustments and changes to the transaction mode with commercial reasonableness, in line with the provisions of the tax law, and not contrary to the mandatory provisions of the law, should be considered to increase the purchase and sale of the behavior of the civil legal relationship is legal. The tax law should be respected, rather than arbitrarily breaking through the appearance of civil legal acts and recognizing the legal business relationship in civil law as an administrative violation or even a criminal violation. In the above case, Company A grafted four enterprises, including Company B, between Company A and the drug supply unit with the commercial reasonableness of integrating the advantages of resources, Company A has the qualification of supplying to the tertiary hospitals, and Company B enjoys the preferential tax policy of "levy first and return later" in the local area, and the business model in question is able to fully integrate the advantages of its advantages to realize the commercial value of each of them. Business value.

Ⅲ. Return of funds: the return of funds with reasonable explanation does not constitute the return of funds for false invoicing

In the logic of determining the crime of false VAT invoicing, the core is the judgment on the authenticity of the business. One of the characteristics of the absence of real business is the existence of false fund payment, and one of the appearances of the false fund payment is the return of funds, therefore, the return of funds is an important indicator of the judgment on the authenticity of the business. Based on the premise of rational economic man, the actual funds received by the invoicing enterprise should be consistent with the amount of the invoice, if there is the invoicing enterprise will receive the funds back to the invoiced enterprise, there may be false funds payment, thus generating the suspicion of no real business. In other words, if the invoiced enterprise truthfully paid the funds, can support the authenticity of the business, should not be recognized as false invoicing.

In fact, the return of funds is not direct evidence of false opening, the return of funds is not necessarily false opening. In practice, there are a large number of real funds to pay the "funds back" phenomenon, common deposit return, advance return. In addition, this case involves the "balance" return also belongs to this kind of situation, that is, after company B receives company A payment, through reimbursement of sales expenses and other ways to share the business profits with company A, belongs to the normal market economic activities, should not be recognized as a false opening. Therefore, there is a reasonable explanation for the return does not constitute a false opening of funds back.

Ⅳ. Tax Loss: Fiscal Returns Do Not Constitute National Tax Losses

In the past, financial incentives and tax rebates are local investment "killer app", but also many enterprises rely on the basis of survival and development. Since the "State Council on the cleanup and standardization of tax and other preferential policies notice" (Guo Fa [2014] No. 62) put forward to the local financial rebate policy to be canceled, part of the judiciary there will be the enterprise to obtain the local financial rebates, awards and subsidies recognized as a loss of tax revenue tendency. In the author's view, there is no direct correlation between the acquisition of financial rebates and the loss of national taxes.

For one thing, from the legal nature, the enterprise pays tax and obtains financial return belongs to two different legal relations. In the legal relationship of tax collection and management, the taxpayer shall fulfill the obligation of tax declaration in accordance with the law if the taxable behavior occurs, and the tax paid constitutes the financial income, which shall be paid to the state treasury in its entirety. It is reported that the Supreme People's Procuratorate seeks the opinion of the State Administration of Taxation (SAT) on the issues related to the fraudulent "levy first and then return" enterprise development fund, and the SAT replies that "in order to realize the goal of attracting investments and other objectives, in the form of 'enterprise development fund', the part of the tax that has been returned to the treasury shall be returned to the State Treasury. In order to realize the goal of attracting investment, the General Administration of Taxation replied that "the part of tax that has been deposited in the treasury is returned to the enterprises, which belongs to the behavior of fiscal expenditure". In accordance with Article 32(2) of the Budget Law, "the expenditures of all levels of governments, departments and units must be based on the approved budget, and no expenditures may be made that have not been included in the budget". Therefore, the financial return as a matter of financial expenditure should be approved by the budget, which leads to although the main source of financial funds is tax revenue, but after the budget approval, the treasury issued, the nature of the nature has been transformed, the tax paid by the enterprise and its subsequent acquisition of financial returns, awards and subsidies are of different legal nature, and should not be confused with each other. In the above case, from the point of view of tax payment, Company B did not underpay the tax, and even if it subsequently obtained the fiscal refund, it would not cause the loss of state tax.

Secondly, Article 59 of the Budget Law stipulates that "the right to control the treasury funds at all levels belongs to the financial departments of the government at that level". Accordingly, local governments have the right to dispose of their retained portion of fiscal revenues on their own. Therefore, the local government through the signing of agreements with enterprises, to give enterprises financial returns, incentives and subsidies belongs to its independent exercise of financial revenue allocation authority, with the basis of legality. This point of view is also recognized for our judicial practice, such as the supreme people's court in weifang xunchi property development co., ltd v. Anqiu municipal people's government administrative agreement in the case of the reexamination of the ruling that, "the business tax, income tax local retention in the XUNCHU company to be returned to the issue of the above costs belong to the local government fiscal revenue, Anqiu municipal government enjoys the autonomy of domination, the contract terms entered into on this basis. The contract terms concluded on this basis do not violate the mandatory provisions of laws and administrative regulations, and should also be a valid agreement".

Ⅴ. Summary: enterprises should focus on tax compliance

For pharmaceutical enterprises, since the meeting of the National Health Commission in July 2023, in which the National Health Commission joined hands with a number of departments to focus on rectifying corruption in the pharmaceutical field, the anti-corruption work in the pharmaceutical field has continued to advance, and in the process of investigating and dealing with corruption cases, after the disciplinary commissions and supervisory committees have transferred the case to the source of the case and the people involved in the case have reported and uncovered to each other, the pharmaceutical enterprises are facing an extremely high risk of tax violations. In order to effectively prevent and resolve such risks, it is necessary for pharmaceutical enterprises to properly retain business-related contracts, documents, original vouchers, bookkeeping vouchers and other information in the process of carrying out their business in order to be ready to prove the authenticity of their business.

For trading enterprises and enterprises enjoying local policies, in January 2024, the National Audit Work Conference required "in-depth revelation of some local investment promotion in violation of the introduction of small policies, the formation of tax puddles and other issues, and seriously investigate and deal with illegal tax rebate chaos". Since then, the local investment in illegal tax rebates again triggered heated debate. Once the loss of financial rebates, awards and subsidies to support the renewable resources, network freight, flexible labor and other industries will be a serious challenge to the business model, the legitimacy of the financial rebate policy, the agreement of the payment problem for the enterprise buried the tax-related risks, taxpayers should pay attention to timely tax counseling and other ways to maximize the benefits, to avoid being caught in the false opening, tax evasion risk.