Seven Tax Risks Brought by the Amendment to the Company Law for High Net Worth Shareholders (Part II)

Editor's Note: "Seven Tax Risks Brought by the Amendment to the Company Law for High Net Worth Shareholders (Part I)" elaborated on the main tax risks that high net worth individuals may face in the process of capital reduction, cancellation, non-monetary asset contribution, and equity transfer under the background of the Company Law revision. This article continues the main points of the previous part, systematically analyzing the tax risks that dissenting repurchase of shares, horizontal legal personality denial, nominee holding of shares restoration, and simplified cancellation system may bring to high net worth shareholders, for the benefit of the readers.

- Risk Four: Addition of Dissenting Shareholders Repurchase Clause, Failure to Declare Repurchase of Shares May Easily Trigger Tax Risks

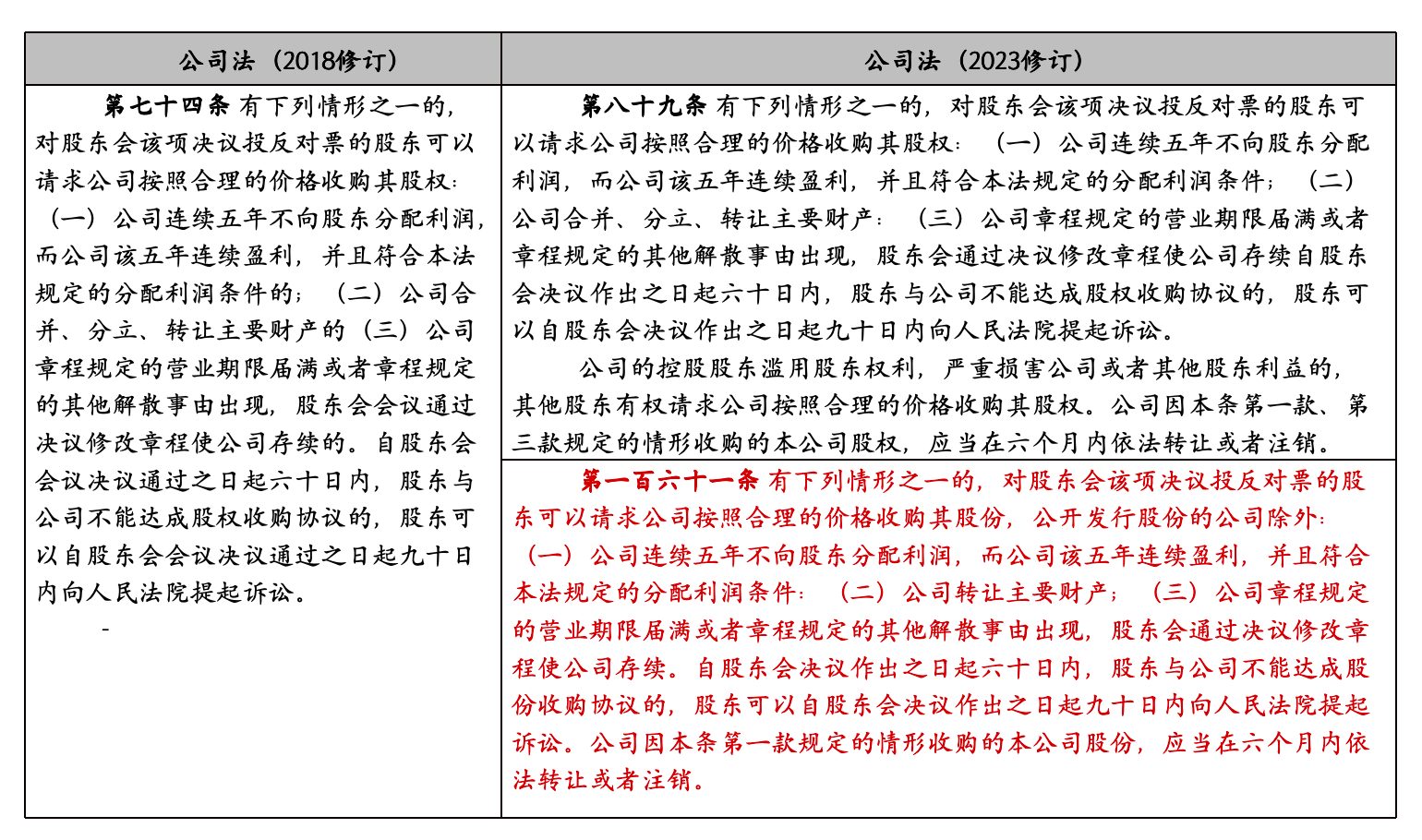

- Rule Changes

To further protect the legitimate rights and interests of minority shareholders in limited liability companies, the new Company Law clearly stipulates the circumstances in which dissenting shareholders may request the company to repurchase their shares, that is, when the controlling shareholder abuses shareholder rights and seriously damages the interests of the company or other shareholders, other shareholders have the right to request the company to repurchase their shares at a reasonable price. Considering that there is a considerable number of unlisted limited liability companies in China, and the transferability of shares of such companies is far less convenient than the trading of shares of listed companies, and there are also situations where controlling shareholders damage the legitimate rights and interests of minority shareholders, the new Company Law adds the right to request repurchase of shares for dissenting shareholders of limited liability companies, and also stipulates the deadline for the transfer or cancellation of repurchased shares by the company.

(II) Dissenting repurchase of shares belongs to equity transfer behavior, failure to declare may trigger tax risks

According to Article 3 of the "Measures for the Administration of Individual Income Tax on Income from Equity Transfer" (Announcement No. 67 of the State Administration of Taxation in 2014, hereinafter referred to as "Announcement No. 67"), "company repurchasing individual equity" belongs to equity transfer behavior and should be declared and taxed based on the transfer income. When natural persons transfer equity, the transferee is the withholding agent, that is, the repurchasing company as the withholding agent should fulfill the obligation of withholding and paying taxes. According to Article 69 of the Tax Collection and Administration Law, if the withholding agent fails to withhold the tax that should be withheld, the tax authorities shall recover the tax from the taxpayer and impose a fine of more than 50% but less than three times the amount of the tax not withheld on the withholding agent.

At the same time, Article 10 of the Individual Income Tax Law stipulates that taxpayers who have not withheld taxes should file tax returns on their own. In the case of the company failing to fulfill the obligation of withholding and paying taxes, if dissenting shareholders do not file tax returns on their own, the tax authorities have the right to handle tax matters of shareholders according to Article 64 of the Tax Collection and Administration Law, requiring shareholders to pay taxes, imposing late payment fines, and imposing fines of more than 50% but less than five times the amount of the tax in arrears.

In addition, Article 11 of Announcement No. 67 stipulates that tax authorities have the right to determine the transfer price of equity transfer income reported if the reported income is significantly lower than the market price and there is no justifiable reason. Therefore, enterprises and shareholders need to reasonably assess the repurchase price. If the tax authorities determine that the reported income is significantly lower than the market price, it may face tax risks. Since minority shareholders have less say in the decision-making of the company, they can only "passively accept" the repurchase price. With the tax authorities strengthening tax administration for high net worth individuals in recent years, significant differences between the equity repurchase price and the market price or secondary transfer price may arouse the suspicion of the tax authorities. If shareholders cannot explain the justifiable reason for the significantly lower repurchase price, they may face tax adjustments and even be deemed to have evaded taxes, resulting in administrative and criminal penalties.

- Risk Five: Addition of Horizontal Legal Personality Denial System, Company Tax Liability Can Penetrate to Other Controlled Companies of Shareholders

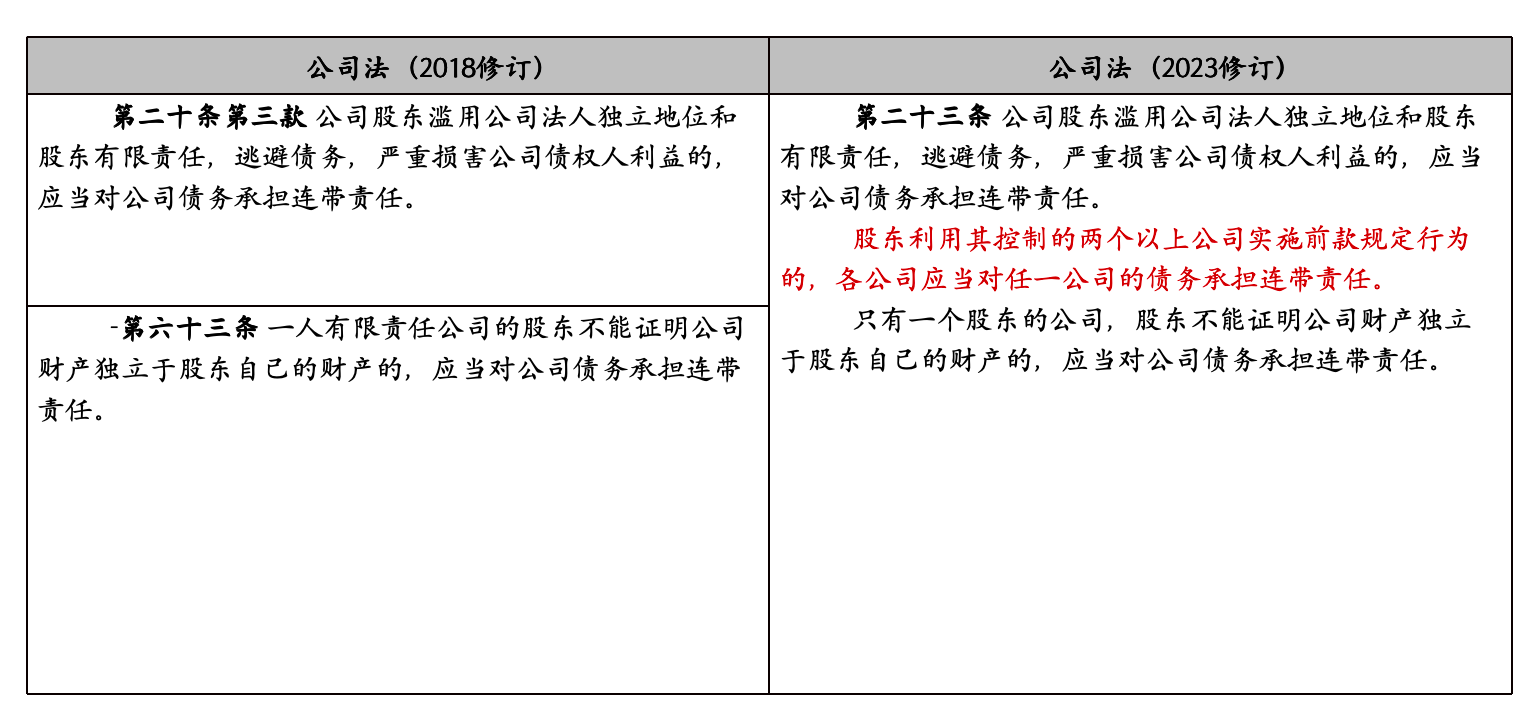

(I) Rule Changes

The original Article 20 of the Company Law stipulated the vertical denial of legal personality, holding specific shareholders of the company accountable. The new Company Law, Article 23, added the horizontal legal personality denial system, which means holding specific shareholders accountable for the joint liability of other companies controlled by them.

(II) Horizontal legal personality denial system will lead to the penetration of company tax liability to affiliated companies

Under the previous vertical legal personality denial provisions, tax authorities have the right to "pierce the corporate veil" to penetrate the abuse of corporate legal personality and limited liability of shareholders themselves and require them to bear joint liability for corporate debts. This provision has had a significant impact on curbing the behavior of shareholders abusing corporate legal personality to evade tax obligations. However, in practice, some shareholders establish multiple companies with independent legal personality status, engage in "shell operation," transfer profits, and engage in tax avoidance to isolate risks and evade debts. The vertical legal personality denial system alone is not enough to regulate the above behaviors. With the establishment of the horizontal legal personality denial system in the new Company Law, allowing creditors including tax authorities to treat these companies as a whole when shareholders abuse the independent legal status of the company, the tax risks of shareholders are further increased.

Based on the practical experience of the original Article 20 of the Company Law, the application of the provisions of Article 23 of the new Company Law by tax authorities should meet the following four conditions: First, shareholders legally establish two or more companies and have control over them; second, shareholders abuse their control position, resulting in confusion of legal personality; third, the company evades its tax obligations, making it impossible for the state to realize its taxation rights; fourth, there is a causal relationship between shareholder abuse and the evasion of the company's tax obligations, resulting in the inability to realize the state's tax rights.

Currently, it is not clear what specific procedures tax authorities should follow when applying this provision. Some opinions point out that although this provision creates conditions for tax authorities to recover taxes, it cannot serve as the basis for their compulsory enforcement. Tax authorities can still only enforce compulsory measures against taxpayers themselves, withholding agents, tax guarantors, etc., based on the provisions of the "Implementation Regulations of the Tax Collection and Administration Law." The application of this provision needs to go through litigation procedures. Further revision and implementation of the above provisions are needed.

- Risk Six: Prohibition of Nominee Holding of Listed Company Stocks, Share Reform of Prospective Listed Companies Faces Tax Liability Risks

(I) Rule Changes

Article 140 of the new Company Law incorporates provisions on the disclosure obligations of listed companies in the "Securities Law" and the "Measures for the Administration of Information Disclosure of Listed Companies," clearly prohibiting the act of holding shares of listed companies through nominees. For limited liability companies and closed-end companies holding equity through nominees, Article 24, 25, and 26 of the "Judicial Interpretation of the Company Law (III)" stipulate the effectiveness of nominee agreements and the dispute resolution path. At the same time, Article 28 of the "Minutes of the National Court Civil and Commercial Trial Work Conference" also specifies the restoration of nominee shareholding. Currently, in practice, nominee agreements are generally considered valid.

(II) Share reform for listing faces the restoration of nominee shareholding, triggering a large number of tax-related cases

Due to the support of laws, regulations, and some cases for the practice of nominee shareholding by limited liability companies and closed-end companies, the situation of equity holding by nominees has become more common in practice, leading to a large number of tax-related cases. As the new Company Law and related regulations prohibit the holding of shares of listed companies through nominees, during the process of companies' share reform for listing, anonymous shareholders need to terminate their nominee relationships. However, relevant tax laws and regulations have not clearly defined the tax-related issues of nominee shareholding restoration, resulting in significant differences in the handling methods of tax authorities regarding nominee shareholding restoration in practice.

Some shareholders believe that the termination of nominee relationships does not actually involve equity transfer or generate taxable income, and Article 13 of Announcement No. 67 also stipulates: "Equity transfer income that meets any of the following conditions is deemed to have a legitimate reason: ... (4) Other reasonable circumstances where both parties to the equity transfer can provide valid evidence to prove its legitimacy." They argue that "nominee agreements" belong to the circumstances stipulated in item (4), therefore, the transfer of equity at a price of 0 or a low price has legitimacy. After unanimous consent of all shareholders, the nominal shareholders can transfer the company's equity held by them to the actual shareholders at a price of 0. However, there is controversy over whether this understanding complies with the tax law provisions.

In some cases, tax authorities believe that the restoration of nominee shareholding does not involve taxable matters, so no individual income tax should be collected. For example, according to the information disclosed by Gongchuang Caojing (605099), as the transfer of equity by Wu Yurong and Chen Jingui is the restoration of the equity held by nominees, Wang Qiangzhong did not actually pay the transfer payment, and Wu Yurong and Chen Jingui did not actually receive equity transfer income, so there is no tax payable.

In addition, in some cases, tax authorities believe that the behavior of actual contributing shareholders restoring nominee shareholding does not belong to the reasonable circumstances stipulated in item (4) of Article 13 of Announcement No. 67, and the transfer of equity at a price of 0 or a low price should not be considered to have a legitimate reason. Therefore, the competent tax authorities have the right to determine the equity transfer income as significantly lower without a legitimate reason according to Article 11 of Announcement No. 67, and calculate the equity transfer income and collect individual income tax accordingly. For example, according to the information disclosed by Songjiu Shares, in July 2011, Wang Zhenhai transferred his 4% equity in Songjiu Limited (corresponding to a contribution of 400,000 yuan) to Li Liuyan, which was the restoration of Wang Zhenhai's equity held by Li Liuyan. The transfer price was 0. Subsequently, the tax authorities calculated and collected individual income tax based on the transfer income determined in this case, and it has been paid by the taxpayer.

Combining the above cases, when shareholders restore nominee shareholding, they should actively communicate with tax authorities on tax-related matters, and professional assistance may be sought if necessary.

- Risk Seven: Addition of Simplified Cancellation Procedure, Shareholders' False Commitment Requires Joint Liability for Company Tax Debts

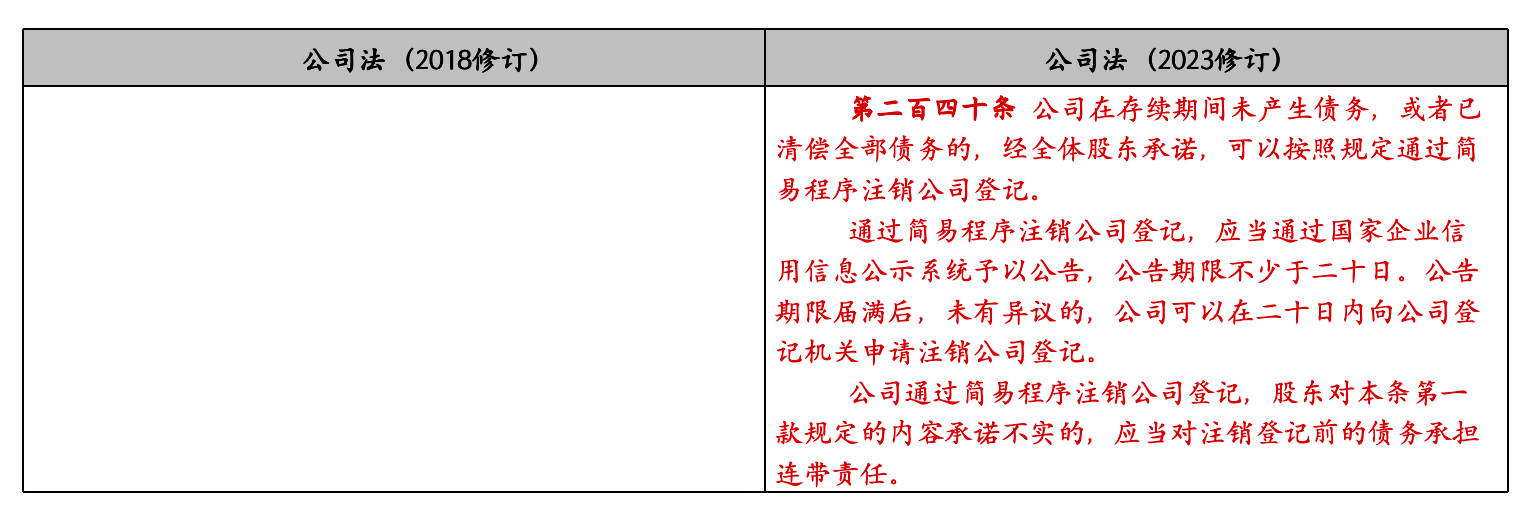

(I) Rule Changes

Since March 1, 2017, China has comprehensively implemented the enterprise's simplified cancellation registration reform. As a reform measure to further improve government efficiency and optimize the business environment, the simplified cancellation registration aims to allow enterprises with genuine exit needs and clear debt relationships to quickly and conveniently exit the market, facilitating the reintegration of social resources. Based on practice, the new Company Law stipulates the simplified cancellation procedure and the legal consequences of shareholders' false commitments in the form of law.

(II) Under the simplified cancellation, shareholders bear joint liability for the unpaid taxes of the cancelled company

Once the cancellation registration is completed, the company's civil subject qualification and tax subject qualification are extinguished, and the unfulfilled tax obligations may be extinguished due to the lack of responsible subjects. There are many controversies in various sectors about how to deal with tax issues caused by the cancellation of companies during operation, which subject should bear the responsibility, etc., and there are significant differences in the handling methods of tax authorities and judicial authorities across the country, triggering a large number of tax disputes. Article 240 of the new Company Law clearly stipulates that shareholders who make false commitments during the simplified cancellation of the company are liable for the debt jointly. This provision provides a legal basis for tax authorities to handle tax issues related to simplified cancellation in the future, and also provides a management idea for handling tax issues of cancelled companies.

Currently, the specific research on the joint liability of shareholders' false commitments is not yet clear, whether the nature of the liability belongs to the joint liability for the joint repayment obligation of shareholders for violating the liquidation obligation or the joint liability for joining the debt due to the commitment needs to be further discussed and improved.