The National Association for the Promotion of the Joint Crackdown on Tax-related Violations and Crimes will deploy six key areas of crackdown in 2024

On February 27, 2024, the State Administration of Taxation, the Ministry of Public Security, the Supreme People's Court, the Supreme People's Procuratorate, the People's Bank of China, the General Administration of Customs, the State Administration for Market Regulation, and the State Administration of Foreign Exchange held a meeting in Beijing to jointly combat tax-related crimes and crimes by eight departments across the country, summarizing the results of the joint crackdown on tax-related crimes in 2023 and studying and deploying key tasks in 2024。 This article interprets the conference in combination with relevant news, judges the main trends of tax-related supervision in the future, reveals the tax-related risks faced by key enterprises and industries, and puts forward compliance suggestions to prevent tax risks.

I. From 2021 to 2023, remarkable results have been achieved in jointly cracking down on tax-related violations and crimes

The working mechanism for the joint crackdown on tax-related violations and crimes by eight departments across the country was formerly known as the two-year special action of "cracking down on issuing false invoice and fraud" carried out by the four departments of taxation, public security, customs and the central bank from August 2018 to September 2021. Since October 2021, the Supreme People's Procuratorate and the State Administration of Foreign Exchange have joined and formed a normalized working mechanism for six departments to crack down on tax-related violations and crimes related to the "three fakes". In 2023, the Supreme People's Court and the State Administration for Market Regulation will join the working mechanism and expand the working mechanism to eight departments. Looking at the work results from 2018 to 2023, it is not difficult to see that tax-related supervision can not only maintain a "strict and precise" high-pressure situation for many years, but also dynamically adjust according to the different directions and priorities of supervision every year.

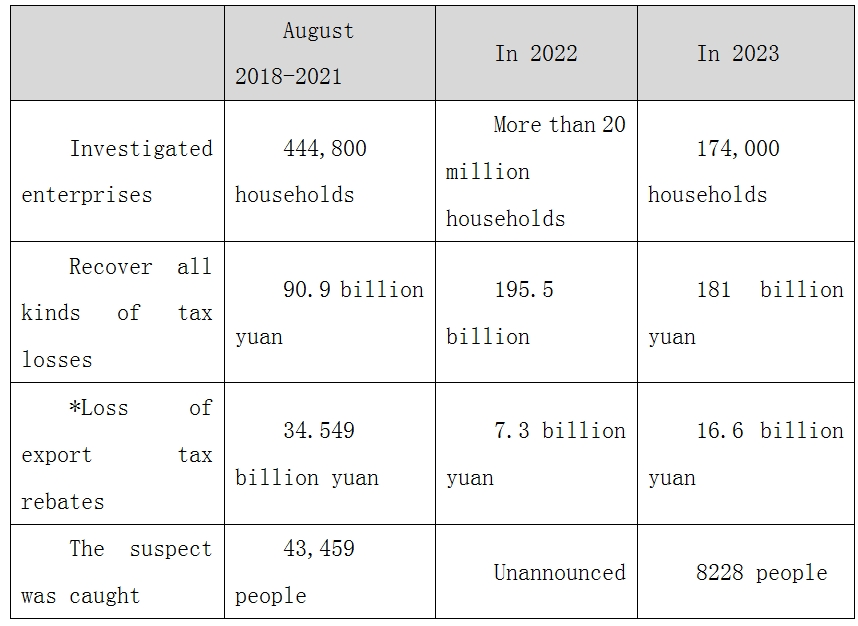

According to the official data disclosed by each year:

From August 2018 to the end of 2021, a total of 444,800 enterprises suspected of fraudulent tax issuance were investigated and dealt with across the country, and 90.9 billion yuan of tax losses were recovered, of which 34.549 billion yuan of export tax rebate losses were recovered, and 43,459 criminal suspects were arrested.

In 2022, more than 200,000 enterprises will be inspected through tax inspections nationwide, and 195.5 billion yuan of various tax losses will be recovered, of which 7.3 billion yuan will be recovered from export tax rebates.

In 2023, a total of 174,000 enterprises suspected of fraudulent tax issuance will be inspected by tax inspections nationwide, and compulsory measures will be taken against 8,228 criminal suspects in cooperation with the public security department, recovering 181 billion yuan of various tax losses, including 16.6 billion yuan of export tax rebate losses.

The details are shown in the following table:

From the above data, it can be seen that the joint efforts of departments to crack down on tax-related violations and crimes have achieved remarkable results, and there are the following characteristics:

First, continue to maintain high-pressure supervision. From 2018 to 2021, a total of 440,000 enterprises were investigated and punished, with an average of 110,000 enterprises per year. In 2022, the number of enterprises investigated and dealt with will double to 200,000. In 2023, about 170,000 households will also be investigated and punished, indicating that the linkage of departments has improved the efficiency of inspections. After the expansion into eight departments, it is bound to further improve the supervision capacity and inspection efficiency.

Second, the amount of money involved is huge. According to the rough calculation of the recovered tax losses, from 2018 to 2021, each enterprise will bear an average tax loss of 204,300 yuan, in 2022 it will bear an average of 977,500 yuan, and in 2023 it will bear an average of 1.04 million yuan. The tax of about 1 million yuan has exceeded the ability of many taxpayers, coupled with late tax fees and administrative penalties, the economic burden of the investigated enterprises has increased significantly.

Third, the criminal risk is enormous. According to the disclosed data, from 2018 to 2021, an average of 1 person in every 10 enterprises investigated and punished was involved in criminal liability, and in 2023, on average, 1 person in every 5 enterprises investigated and punished was involved in criminal liability. The associated criminal riskswill persist in 2024.

In such a strict tax regulatory environment, private enterprises should be more vigilant against the risk of tax-related violations, strengthen tax compliance, clarify the general trend of tax supervision will become stricter for a long time, and abandon the fluke mentality. In particular, in order to do a good job in tax compliance in 2024, we must first understand the trends and trends of tax-related supervision.

II. In 2024, three new key areas will be added to jointly crack down on tax-related violations and crimes

According to the official news disclosure of the Supreme People's Procuratorate on February 28, the joint crackdown mechanism of the eight departments in 2024 will focus on six key areas, "focusing on cracking down on serious tax-related crimes such as fraudulent export tax rebates, fraudulent tax refunds, financial returns and government subsidies by means of issuing false invoice, and the use of shell companies to violently issue false invoice, issuing false invoice in other places." Carry out special governance of "shell companies".

(I) The three traditional areas with a high incidence of violations and crimes will continue to be subject to high-pressure supervision

First, we will continue to crack down on fraudulent export tax rebates. According to the disclosure of the Supreme People's Procuratorate in 2023, it will mainly focus on "cracking down on illegal and criminal acts of defrauding export tax rebates by means of buying fake customs declarations, circulating exports, and high-value overreporting". This is also reflected in the surge in export tax rebate losses recovered in 2023. In 2024, tax fraud will continue to be the focus of the crackdown, and foreign trade companies and suppliers related to foreign trade and exports must still strengthen compliance construction.

The second is to continue to crack down on fraudulent retained VAT by false issue invoices. Fraudulent retained VAT is a key illegal and criminal act to be jointly cracked down on in 2022, and with the institutionalization of refund of retained VAT, such behavior will continue to attract attention. Enterprises such as commodity trade and petrochemical trade, which have a large amount of value-added tax input, must pay attention to it.

The third is to continue to crack down on the use of shell companies to issue false invoice and cheat taxes. The core focus of the continuous crackdown on fraud is to crack down on full-time criminal gangs, the main means of which is to grasp and control a large number of shell companies. Therefore, the majority of taxpayers should carefully choose counterparties and resolutely put an end to invoices issued on behalf of others and falsely.

(II)For the first time, three new areas have been included in the scope of key crackdowns

Added "fraudulent financial returns and government subsidies by issuing false invoice ". Cracking down on fiscal returns and tax depressions is an important task that has been continuously promoted in auditing, finance, and taxation since 2024. On January 11, 2024, the National Audit Work Conference explicitly called for the clean-up of local "tax depressions", and the State Administration of Taxation later announced at a press conference that it would "seriously investigate and deal with tax-related issues in illegal investment promotion". Recently, Shanxi, Jiangxi and other places have carried out the work of cleaning up tax-related issues in investment promotion.

It is worth noting that "fiscal rebate" usually refers to the financial incentives and subsidies given by the government that are linked to the actual tax payment of enterprises, which is clearly illegal. However, the government supports enterprises in the jurisdiction that meet certain standards, or enterprises in the jurisdiction of specific industries, and the government subsidies issued are generally not linked to the amount of taxes, which does not automatically constitute a violation. The eight departments will put financial returns on an equal footing with government subsidies, which may mean that the scope of reward and subsidy policies for cleaning up local violations will be expanded.

Industries that rely on financial returns, such as flexible employment platforms, online freight platforms, and waste materials will be hit hard, and business adjustments and tax risks need to be made in a timely manner.

Added "Remote issue false invoice ". This is the first time that the issuing false invoice of a different place has been seen in the scope of the work deployment of the eight-department joint strike mechanism. Invoicing in different places, that is, the mismatch between the registered place of the enterprise and the actual place of operation, leads to a large number of VAT invoices issued by enterprises to other provinces. In other words, the essence of such an act is that the enterprise is set up in a certain park with financial returns or preferential policies, but has no substantive business activities there, but "grafts" the business of other regions to the park enterprise. There is a high probability that such behavior will be suspected of false issuing, or the business model will be denied.

The suspected false issuance is mainly due to the fact that the enterprises in the park take advantage of the input tax refund policy to issue false invoices to affiliated enterprises to offset the input or costs, or simply "sell invoices" to the outside world. Since such tax-related parks are usually set up in remote and underdeveloped cities and counties, there is an obvious behavior of false issuing in different places. For example, pharmaceutical companies inflated sales expenses, flexible employment or online freight platforms inflated items, and transportation companies inflated fuel ticket purchases.

It is not uncommon for business models to be grafted into practice and thus have risks. For example, in order to obtain sales rebates, enterprises in Henan Province first sell the "ownership" of the goods to the enterprises set up in the Tibet Park, and then the enterprises in the Tibet Park sell the "ownership" of the goods to the buyers in Henan, resulting in abnormal invoicing in other places. We believe that this kind of behavior is a legal and compliant behavior, but some enterprises are considered by the tax and public security to be a false issuing behavior in different places because they do not properly and completely preserve the evidence of the authenticity of the transaction. This type of model is mostly seen in commodity trade such as coal, petrochemicals, steel, and scrap trade.

Added "False Ticket Change". Ticket change mainly refers to the obvious change of product name between the input invoice and the output invoice of the enterprise. Normally, when an enterprise carries out normal production and processing behaviors, the invoice will inevitably change, from raw materials to commodities, so "ticket change" itself is a normal business behavior. The so-called false issuance of invoices is still the separation of the link of invoice change from the actual production and processing behavior of the enterprise, resulting in the phenomenon of false invoicing that is inconsistent with the actual operation. Specifically, it can be divided into two categories:

The first is the false issuance of false bills for the purpose of defrauding the VAT payment. For example, after a transport enterprise issues a transportation invoice, in order to make input deductions and cost deductions, it allows others to issue false invoices for gasoline and diesel fuel for itself to offset VAT and income tax. Another example, in order to defraud the tax deduction, a trading enterprise indiscriminately allows others to issue false invoices for itself without looking at the name of the invoice, resulting in abnormal changes in the name of the input invoice and the output invoice.

The second is not to change tickets for the purpose of defrauding value-added tax. For example, in order to evade consumption tax, a petrochemical enterprise may change the name of the invoice by asking the trading enterprise instead of the production enterprise to change the name of the invoice and issue an invoice, although it is inconsistent with the actual operation, it does not cause a loss of state value-added tax.

For the second type of ticket change, we believe that it does not belong to the category of false issuance, but its risk will increase with the regulatory trend of the eight departments to investigate and deal with the "false ticket change", and even be considered by individual case-handling authorities to be false issuance of special VAT invoices and thus suspected of criminal liability, so relevant enterprises need to focus on prevention.

III. Reminders on compliance for enterprises to prevent tax risks in 2024

(I) Thoroughly investigate the fundamental risks of its own business model in terms of taxation

Through the analysis of the 2024 regulatory focus, it can be seen that some business models have "congenital deficiencies" and the tax risk is extremely high. Specifically, these include:

1. Enterprises that rely excessively on local financial returns or incentives and subsidy policies, such as some supported pharmaceutical enterprises, foreign trade export enterprises, flexible employment platforms, online freight platforms, waste materials trade, etc.

2. The enterprise has grafted the policy enterprise in the park, and has adopted the concept of "ownership of goods" for delivery, and has not actually participated in the two-end business model of warehousing and transportation.

3. There is an abnormal change of the name of the product, or the change of the name of the goods is of great significance, such as petrochemical products that are taxable goods subject to consumption tax, and the change of ticket will cause the risk of consumption tax; transportation enterprises obtain oil tickets and issue invoices for transportation expenses; processing enterprises that obtain invoices for the purchase of agricultural products and produce textiles, furniture and daily chemical products; pharmaceutical enterprises that obtain a large number of invoices for sales expenses, etc.

In addition, traditional regulatory areas such as foreign trade exports, online entertainment, tax incentives such as additional deductions, and gas stations must also pay attention to the tax risks of their own business models.

(II) Improve business processes and avoid the risk of abnormal invoices transmitted by upstream and downstream

Due to the institutional characteristics of the deduction chain, the risk will be transmitted along the deduction chain, so enterprises should strengthen the optimization of business development processes and tax compliance supervision, properly select the upstream and downstream enterprises of the transaction, and adhere to the bottom line of business authenticity and legitimacy.

In terms of obtaining invoices, enterprises should realize that the so-called "false issuing and substitution" behavior will inevitably lead to thunderstorms, so they should resolutely put an end to transactions with shell enterprises, actively carry out background investigations, conduct preliminary verification of the production capacity and business capacity of the enterprise, and fulfill the duty of care of the enterprise. At the same time, it is prudent to conduct business with enterprises that are late in incorporation, have inflated registered capital and have not been paid-in, and are registered in batches. For the purchase and sale of actual goods, it is necessary to investigate the source of the goods to avoid the situation of "separation of tickets and goods".

In terms of issuing invoices, enterprises, especially flexible employment platforms, online freight platforms, waste materials trading enterprises, petrochemical trading enterprises, etc., should strengthen the review of business authenticity, retain evidence of business authenticity, and avoid being fraudulently invoiced by downstream enterprises, which will cause administrative and criminal risks.

(III) Strengthen the review of the authenticity of transactions, and consolidate all kinds of evidence for the performance of review obligations

Enterprises in some specific industries often pay more attention to the scale of use of invoices and the maximization of ticket profits in the process of operation, but ignore the verification of the authenticity of transactions, which then buries huge tax-related risks. Enterprises must establish a business awareness of actively undertaking the obligation to verify the authenticity of transactions. As long as the enterprise obtains or issues invoices in the course of conducting business, it must fulfill the obligation to verify the authenticity of the procurement business or sales business. In practice, in many criminal cases of false issuance of special VAT invoices, the judicial authorities will often examine whether the enterprise involved in the case has fully fulfilled its obligation to verify the authenticity of the transaction in the course of its operation, and determine whether the enterprise has constituted the crime of "indirect intentional" false issuance. Once the enterprise is unable to provide evidence to prove or does not take any measures and means to ensure the authenticity of the transaction, it will be recognized by the judicial authorities as an indirect intentional crime of "knowing that there is a risk of false issuing and allowing the risk of false issuing to occur".

From a practical point of view, enterprises can strengthen the review of the authenticity of transactions, retain business materials, strengthen business traces, and isolate tax-related risks from the following aspects:

First of all, before the enterprise commits business, it should conduct a background check on the counterparty and ask for proof of the authenticity of the other party's business and transaction ability. If conditions permit, they can visit the other party's enterprise on the spot, take pictures, and keep the chat records and emails of the negotiation, indicating that the enterprise has carried out normal business from the beginning, and there is no illegal behavior such as false communication and tax fraud.

Secondly, in the process of business development, enterprises will collect materials that can prove the authenticity of the business. For intangible businesses such as services, it is even more important to retain relevant evidence, such as refueling fees, tolls, GPS routes, loading and unloading fees, weighing documents, records of entering and leaving ports or warehouses, etc. For the goods, the transportation fee, weighing documents, and quality inspection reports should be kept, and photos can be taken if necessary.

Finally, enterprises should strengthen the traces in the business approval process, and the specific content that the person in charge of the enterprise at all levels is responsible for should be clear and clear. If there are false approval materials provided by the basic business personnel of the enterprise, resulting in false invoicing by the enterprise, the person in charge can submit relevant evidence to isolate his own risks.

Conclusion

Due to the complexity and professionalism of tax-related cases, it is usually difficult for enterprises to effectively respond to tax inspections or tax-related criminal investigations, so they should hire a professional tax lawyer to intervene as soon as possible, sort out the business processes of the enterprise, analyze the legality of the enterprise's business, and do not act arbitrarily and cause the case to deteriorate. In the faceof the challenges of the new regulatory situation in 2024, enterprises should actively seek the professional support of tax lawyers, sort out the business processes and business models of enterprises, guard against various tax-related internal and external risks, properly handle risks and resolve tax-related disputes, and strive to achieve compliant operation and sustainable and healthy development.