Recovery of financial rebates, characterization of false driving? What will happen to renewable resources recycling enterprises under the strict investigation of illegal tax rebates?

Editor's Note: Since this year, audit, taxation and other departments in the form of meetings or documents clearly to strictly investigate local investment in the form of tax-related violations, Jiangxi, Shanxi, Zhejiang and other places have also carried out remedial action to clean up undue interference in the market and subsidies or rebates linked to tax revenue. Due to the inherent source invoice dilemma of the industry, resources recycling industry mostly exists in the business operation mode relying on the financial rebate policy, recycling enterprises through the enjoyment of financial rebates to reduce the tax burden due to the impossibility of obtaining input invoices and the full amount of tax. Under the background of strict investigation of tax rebates, recycling enterprises applying the financial rebate policy are facing serious tax-related risks. This article analyzes the tax-related risks under this business model from the motivation for recycling enterprises to set up a trade chain in the park to enjoy the fiscal rebate, and further puts forward tax compliance suggestions for enterprises' reference.

I.Why do recycling companies rely on financial rebates for their business operations?

(i) the source of waste materials recycling without tickets, first levy and then return, tax exemption policy, such as the gradual elimination of

The source of waste materials in our country is mainly industrial or domestic waste. In the industrial waste, waste enterprises based on its dominant position in the industry, or for off-the-books sales, tax avoidance and other purposes, usually without a ticket will be sold to the recycling station and other individual operators of waste materials; and in the life of waste, the residents of daily life generated by the collection of waste materials from the scavengers, waste recycling stations and other individual operators, in the source will not be issued invoices. Therefore, at the source of the chain of sales of waste materials, value-added tax invoicing and deduction of the chain has been broken, in order to alleviate this tax dilemma, China has introduced a waste materials recycling business first levy and then return, tax exemption and other policies.

In the early stage, the waste enterprises usually directly from the local operation of waste materials recycling retailers for procurement, but due to the retailer's independent tax willingness is generally low, not willing to declare their own taxes and invoices, resulting in the use of waste enterprises are unable to obtain legal and effective VAT input deduction and pre-tax deduction of enterprise income tax vouchers. In order to solve this general problem in the industry, before 2008, the Ministry of Finance and the State Administration of Taxation had successively introduced the policy of first levy and then return and tax exemption for the business of recycling waste materials. Especially under the tax exemption policy, the recycling enterprises are exempted from value-added tax on the sale of waste materials acquired by them, and the enterprises using the waste can calculate the input tax credit according to the ordinary invoices issued by the recycling enterprises. Under this policy, coupled with the fact that recycling enterprises can utilize the acquisition vouchers for pre-tax deduction, the business model of "retailer-recycling enterprises-waste-using enterprises" has become the mainstream, and the waste-using enterprises can purchase waste materials through recycling enterprises, obtain corresponding invoices, and realize the value-added tax (VAT) and enterprise income tax (EIT). Enterprises using waste will purchase waste materials through recycling enterprises and obtain corresponding invoices, so as to realize VAT credit and pre-tax deduction of enterprise income tax.

(ii) After the tax exemption policy is canceled, the recycling business relying on financial rebates has become the mainstream of the industry.

In the application of the aforesaid tax exemption policy, some waste enterprises have the phenomenon of offsetting input tax beyond the actual transaction, and there are even waste enterprises setting up affiliated recycling enterprises and utilizing the affiliated enterprises to make false purchases to offset the tax. In addition, the purpose of the preferential tax policy for the resources recycling industry is to "utilize" rather than "recycle", and there is a view that the recycling enterprise is only a circulation channel, which does not process and reproduce waste materials, and the application of the preferential tax policy for it defeats the original purpose of the policy. There is a view that the recycling enterprise is only a circulation channel, which does not process and reproduce waste materials, and the application of preferential tax policies to it is against the original intention of policy formulation. Based on the aforementioned background, in 2008, the Ministry of Finance and the State Administration of Taxation issued the Notice on Value-added Tax Policies for Renewable Resources (Cai Shui [2008] No. 157), which canceled the tax exemption for renewable resources recycling enterprises and the calculation of deduction policies for waste enterprises, and in some areas, recycling enterprises are no longer permitted to make deductions for EIT on homemade vouchers, which has led to the sharp increase in the tax burden of renewable resources recycling enterprises, and the "retailer-recycling enterprise-recycling enterprise-recycling enterprise-recycling enterprise" policy. The business model of "retailer-recycling enterprise-waste-using enterprise" is facing challenges, and the problem of invoicing for waste-using enterprises has also come to the forefront again - on the one hand, the "Administrative Measures for Recycling of Recyclable Resources" has been adopted.

On the one hand, the "Management Measures for Recycling of Renewable Resources" stipulates that business registration is required for engaging in recycling activities of renewable resources, therefore, no matter the waste materials are in the hands of retailers or recycling stations, they need to be collected to the recycling enterprises with business qualifications, and the waste materials are sold to the waste enterprises in the name of the recycling enterprises; on the other hand, obtaining the value-added tax (VAT) invoice is one of the prerequisites for the waste enterprises to enjoy the policy of "comprehensive utilization of resources". On the other hand, obtaining VAT invoices is one of the prerequisites for waste-using enterprises to enjoy the policy of "tax-as-refund" for the comprehensive utilization of resources, and waste-using enterprises will certainly ask the upstream recycling enterprises to issue VAT invoices to them to carry out input deduction, enjoy tax-as-refund, and deduction before enterprise income tax.

In this context, most of the recycling enterprises chose to carry out their recycling business in regions with fiscal rebate policies in order to alleviate the tax burden arising from issuing invoices and paying full tax to waste-using enterprises.The Announcement on Improvement of Value-added Tax Policies for the Comprehensive Utilization of Resources (Announcement of the Ministry of Finance and the State Administration of Taxation No. 40 of 2021, hereinafter referred to as the "No. 40"), which was issued in 2021, provides that enterprises engaging in the comprehensive utilization of resources may be subject to VAT. business mode of adding another recycling enterprise at the front end of the park enterprise applying the simplified tax calculation of Article 40. In the trade chain of the resources recycling industry, most of the enterprises still rely on the fiscal rebate to build the trade chain and run their business.

II.What are the tax-related risks faced by renewable resources recycling enterprises under the strict investigation of tax rebate violations?

(i) What financial rebate policies may be cleaned up?

Since the beginning of this year, the National Audit Work Conference proposed to reveal in-depth some local investment promotion in violation of the introduction of "small policies", the formation of "tax puddles" and other issues, and seriously investigate and deal with irregular tax rebates, since the State Administration of Taxation, deputy director of the State Administration of Taxation, Rao Lixin, at a press conference held by the State Council Information Office on the quality development of tax services, also pointed out that we should seriously investigate and deal with illegal tax-related issues. Rao Lixin, deputy director of the State Administration of Taxation, also pointed out at a press conference on the high-quality development of tax services held by the State Council Information Office that the tax-related issues in the illegal investment promotion should be seriously investigated and dealt with, and the national tax work conference also explicitly put forward to strictly prohibit the tax department and tax cadres from participating in and cooperating with the illegal investment promotion, financial rebates and government subsidies. Specifically in the field of renewable resources, No. 40 also made it clear that financial cadres should be investigated in accordance with the law to give taxpayers engaged in renewable resources recycling business in violation of the law, financial rebates, incentives and subsidies behavior responsibility.

In the aforementioned policy background, renewable resources enterprises can apply the financial rebate policy, the key is to determine the enjoyment of the policy is "illegal", and the current documents, policies have not yet been issued on what is "illegal" or what is a legitimate financial rebate to make a clear definition. Clearly defined. Throughout the policies after the "Decision of the State Council on Deepening the Reform of the Budget Management System" (Guo Fa [2014] No. 45), the fiscal return policy linked to tax revenue has become the focus of the cleanup, and this type of policy usually manifests itself in the form of "the amount of tax paid by the enterprise reaches a certain threshold, and then the local government will return a certain percentage of the retained portion of the tax or a certain percentage of the amount of tax paid by the enterprise", or directly agree on a certain percentage of the tax. "or directly agree on the tax burden rate. This kind of financial rebate policy linked to tax revenue is facing a greater risk of liquidation for reasons such as destroying fair competition in the market and becoming a means for unlawful elements to falsely open and cheat taxes.

In practice, there are also some local governments that give financial incentives to enterprises based on their economic contribution, fixed asset investment or specific support systems. In the author's view, financial incentives, subsidies and other policies belong to the local government's financial expenditures, the local government enjoys autonomy over local finances, by the local budget expenditures or adjustments to the procedures of the expenditure procedures are legal. The aforementioned financial incentives and subsidies do not of course constitute a violation of the law as they are generally not linked to the amount of taxes actually paid by the enterprises.

(ii) What are the tax-related risks faced by enterprises enjoying the fiscal rebate policy?

In practice, some enterprises enjoy fiscal rebates by building trade chains in the park, which are characterized as false openings due to the lack of real business and face the risk of administrative and criminal liabilities; some enterprises have resorted to the court due to the problem of cashing in the fiscal incentives with the government; and in the context of clearing up the irregular tax rebates, the fiscal rebates obtained by some enterprises have been recovered. Specific cases are shown below:

A renewable resources enterprise obtained fiscal rebate invoices that were characterized as false invoicing

A criminal judgment on China Judicial Instruments Website showed that on November 25, 2016, Company A and the county people's government signed a Project Agreement, which stipulated that Company A would set up Branch B in the local area to operate waste materials recycling; if Branch B's annual income tax was more than 10 million yuan, the county people's government would give it a rebate of 48% of the actual amount of value-added tax (VAT) paid, and 100% of the additional tax fee. Branch B relied on this policy to issue VAT invoices to downstream enterprises, which was later characterized as false invoicing. The court held that Branch B took advantage of the preferential policy of tax rebate and incentives of the local government and violated the national regulations on the management of VAT special invoices by issuing false VAT special invoices for other people without real transactions, resulting in a loss of more than 7 million yuan in national tax revenue.On September 2, 2020, the court of first instance ruled that Branch B was guilty of the crime of falsely issuing VAT special invoices and sentenced it to a fine of 500,000 yuan; the relevant two directly responsible persons committed the crime of false invoicing of VAT and were sentenced to eleven years' imprisonment.

A government's promise of financial incentives to investors was found to be illegal.

In the case of Ren Mou and a government's administrative promise dispute, a government promised in the minutes of a meeting that "the reward standard for individual investors is 39.5% of the actual individual income tax paid for the reduction of shares on sale in the local area and the payment of tax", and the Supreme Court held that the reward promised by the government in fact reduced the tax payable by taxpayers in disguise. The Supreme Court held that the incentives promised by the government in fact reduced the tax payable by the taxpayer in disguise, alleviated the taxpayer's tax obligation, and violated the tax rate and the purpose of taxation stipulated in the Circular on Issues Concerning Individual Income Tax on the Transfer of Restricted Shares of Listed Companies by Individuals (Cai Shui [2009] No. 167). The administrative promise made by the government violated Article 3(2) of the Tax Collection and Administration Law, which stipulates that "No organ, unit or individual shall, in violation of the provisions of laws and administrative regulations, make unauthorized decisions on the commencement or suspension of taxation, as well as on tax reduction, exemption, tax rebate, tax reimbursement, tax compensation and other decisions that are in conflict with the tax laws and administrative regulations", and was beyond the scope of its own legal authority. The court of second instance did not err in concluding that the act was unlawful, as it exceeded the scope of its own legal authority.

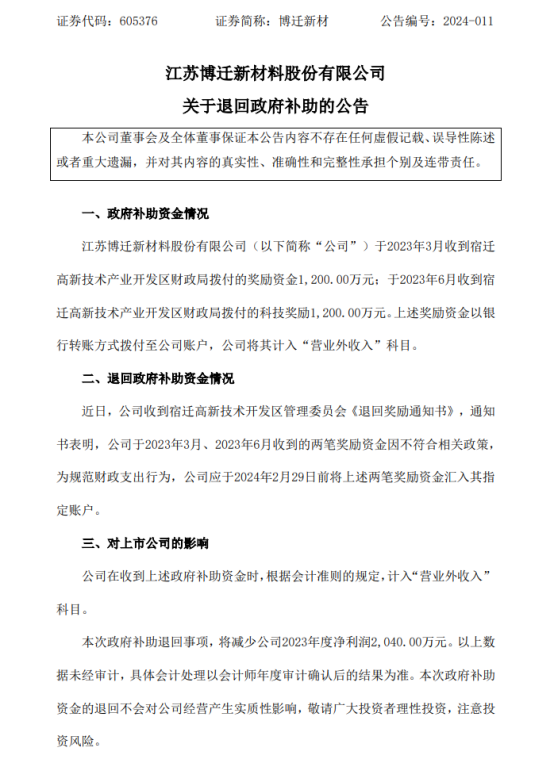

Listed Company Recovers $24 Million in Financial Incentives

On January 30, 2024, a listed company issued the ''Notice of Return of Government Subsidy'', stating that the company obtained a total of RMB24 million of incentive funds allocated by the Finance Bureau of Suqian Hi-Tech Industrial Development Zone in March and June 2023. Due to non-compliance with the relevant policies, the Suqian Hi-Tech Industrial Development Zone Management Committee made a Notice of Return of Incentive to the company, requiring it to return the said incentive funds. The reasons for the recovery of the financial incentives have not been disclosed for the time being.

III.How to Prevent Tax-Related Risks for Recycling Enterprises under the Strict Inspection of Illegal Tax Rebates?

(i) Enterprises that have already enjoyed the financial rebate need to "look back" and check the risk of applying the financial rebate policy.

From the previous section, we can see that the financial return policy linked to tax revenue has a greater risk of violation of the law, and enterprises that have already obtained the financial return policy should "look back", review the reward conditions in the signed investment promotion agreement, pay attention to the latest regulatory developments, and adjust the content of the agreement in a timely manner; at the same time, renewable resources recycling enterprises should review whether they fulfill their obligations under the agreement during the process of applying the investment promotion agreement, such as whether the financial returns obtained are used to fulfill the obligations under the agreement. At the same time, in the process of applying the investment promotion agreement, the renewable resources recycling enterprise should review whether to fulfill the obligations agreed in the agreement, such as whether to obtain the financial rebates for the agreed areas or projects, to avoid improper use of financial rebates and face legal risks.

(ii) Focus on the effectiveness and stability of the financial rebate policy

Renewable resources recycling enterprises should do due diligence before choosing a park to settle in, and choose an industrial park with high government credibility and policy stability to settle in. Enterprises need to review the cooperation agreement signed with the local government or investment platform, focusing on the verification of the legitimacy of financial and tax incentives, focusing on the conditions to be met to give financial rebates, incentives and other supportive policies to analyze and assess the feasibility of financial and tax policies and the risk of payment. Enterprises can also hire tax professionals to participate in investment and financing negotiations and decision-making meetings, and issue professional financial and tax opinions and suggestions.

(iii) Recycling enterprises should grasp the authenticity of their own business

Having real business is the basis for issuing invoices and the prerequisite for obtaining financial rebates. Recycling enterprises should complete the business process and pay attention to the retention of written agreements. At the same time, enterprises should pay attention to the retention of business information, if there are instructions for delivery, advances on behalf of payment and other behaviors, must be retained on the other side of the description of the documents or agreements, etc., in order to prove the authenticity of their own business. After the transaction is completed, relevant contracts, invoices, transportation documents, remittance statements and other transaction-related information need to be retained. It should be noted that in recent years, some recycling enterprises have retained business data through electronic deposit platforms, and enterprises should pay attention to the real-time uploading of data on such platforms, so as to avoid the situation of backdating the information and to better support the authenticity of their business in the event of disputes.

If a recycling enterprise enters a tax audit program or judicial program due to invoices, financial refunds, etc., it should actively seek professional support and legal remedies, provide information proving the authenticity of its business, and safeguard its legitimate rights and interests.