New tax-related judicial interpretations to combat "fake exports", new provisions or exacerbate the criminal risk of foreign trade enterprises transformed

The Interpretation of the Supreme People's Court of the Supreme People's Procuratorate on Several Issues Concerning the Application of Law in Handling Criminal Cases of Endangering the Administration of Tax Revenue (Legal Interpretation [2024] No. 4, hereinafter referred to as the Judicial Interpretation of 2024), which was formally implemented on March 20, has made major modifications to the behavioral elements and sentencing standards for tax-related crimes, especially the crime of obtaining export tax refunds fraudulently. Compared with the previous judicial interpretations and judicial practice, the new judicial interpretation has added tax fraudulent means such as "fraudulent use of other people's goods for export" and "circular export", and deleted the controversial provision of "four self and three missing". Generally speaking, the new judicial interpretation has made the regulations for export enterprises more strict and the crackdown on tax fraud more vigorous, which has led to a sharp increase in the criminal risk of export enterprises, but it has also made it clear that the path of compliance for entity enterprises is lenient, and the majority of export enterprises, especially foreign trade enterprises, should pay great attention to it.

Ⅰ. The eight departments continue to crack down on tax fraud crimes, the criminal risk of foreign trade enterprises concentrated outbreaks

(Ⅰ) Judicial and Law Enforcement Jointly Control Fraudulent Export Tax Refunds

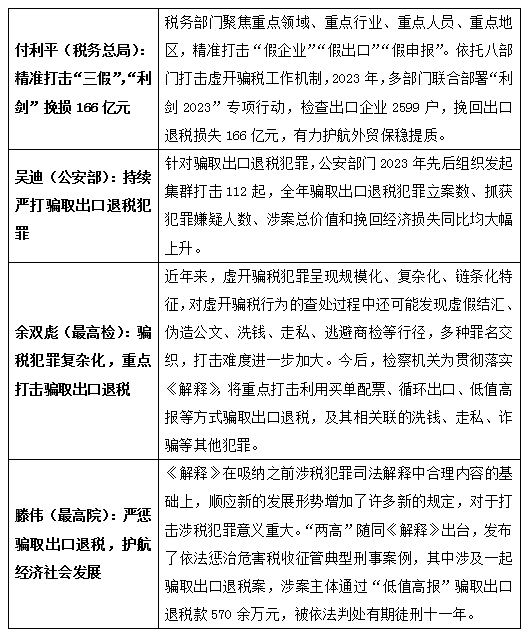

On March 18, 2024, the Supreme People's Court, in conjunction with the Supreme People's Procuratorate, the Ministry of Public Security and the State Administration of Taxation (SAT), held a press conference to release the Interpretation of the Two High Committees of the Supreme People's Courts on Several Issues Concerning the Application of Laws in Handling Criminal Cases of Endangering Tax Collection and Management, and typical criminal cases of endangering tax collection and management in accordance with the law. Teng Wei, President of the Fourth Criminal Division of the Supreme People's Court, introduced the background and main contents of the 2024 Judicial Interpretation, focusing on the situation of fraudulent export tax refunds in recent years, and clearly listed the manifestations of "false declaration of export", and delineated the "red lines" and "minefields" of the export business of market entities. "red line" and "minefield" of export business of market entities.

It can be seen that all departments have taken the illegal and criminal acts of cheating export tax rebates as the top priority of investigation and handling, and the criminal risks faced by foreign trade enterprises remain high and may even continue to climb.

(Ⅱ) Data on criminal cases show high criminal liability in tax fraud cases

Through searching statistics and analyzing in the database of Beida Fabo and China Judicial Instruments Network, the criminal risk of cheating export tax rebates remains severe. Before the introduction of this 2024 Judicial Interpretation, those who cheated the state export tax rebate amounting to more than 2.5 million yuan faced more than ten years of imprisonment or even life imprisonment. In this paper, after preliminary statistics of more than 500 referees' documents made public, of which the main culprits were sentenced to more than ten years of imprisonment, accounting for more than 40% of the total, and the main culprits were sentenced to imprisonment for more than five years and less than ten years of imprisonment, accounting for more than 30% of the total, as well as the main culprits were sentenced to more than 30% of the total. The main offender can get a sentence of less than three years only accounted for about a quarter, of which less than 10% can be sentenced to probation, and can be able to get out of the whole body, to get a not guilty verdict is even more rare, accounting for only 0.5%. Therefore, the fraudulent export tax rebates not only high criminal risk, and often bear the criminal responsibility is very heavy.

Ⅱ. The new judicial interpretations to combat 7 types of "false export", 4 kinds of behavior by the two high "named"

(Ⅰ) absorbing the judicial practice in recent years, the type of tax fraud has been significantly updated

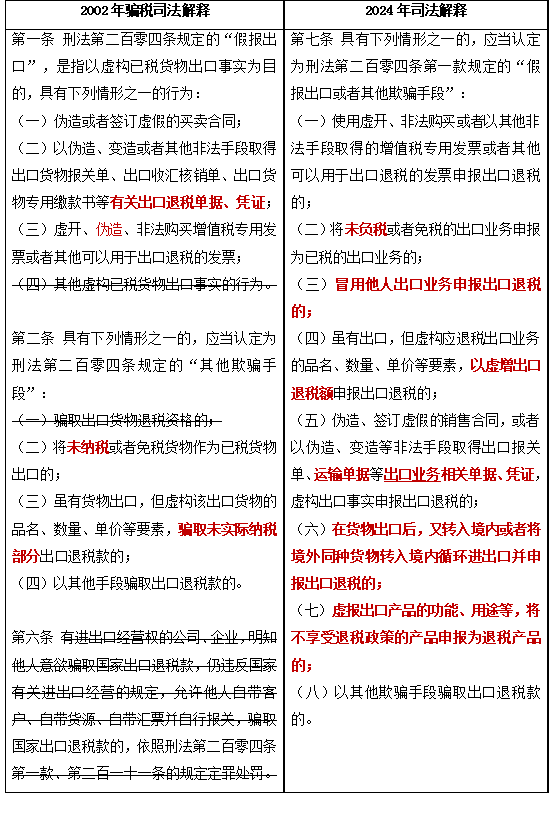

The crime of cheating export tax rebate stipulated in Article 204(1) of the Criminal Law is relatively simple, and the offense is described as "fraudulently obtaining national export tax rebate by falsely declaring export or other deceptive means", and the judicial practice of "falsely declaring export" and "other deceptive means" has been greatly updated. Judicial practice has been controversial over the terms "false export declaration" and "other deceptive means". Therefore, in 2002, the Supreme People's Court on the trial of criminal cases of fraudulent export tax rebates on the specific application of the law on a number of issues of the Interpretation (Legal Interpretation [2002] No. 30, referred to as the "2002 Tax Fraud Judicial Interpretation") lists a false declaration of exports, other deceptive means, and the "four from the three do not see the fraudulent tax" behavior.

With the emergence of tax fraudulent means such as "buying a bill with a ticket", "low value and high declaration" and "circular export" in recent years, the original judicial interpretation cannot adapt to the current needs of combating tax fraud. Therefore, Article 7 of the Judicial Interpretation of 2024 provides for "false export declaration or other deceptive means" by enumeration, and at the same time, it has been greatly updated. The details are shown in the table below.

Comprehensively, the above table shows that the Judicial Interpretation 2024 firstly addresses the situation of frequent fraudulent export tax refunds in recent years, and explicitly adds three types of behaviors, namely:

1. "exporting by fraudulently using other people's business";

2. "Circular import and export";

3. "Misrepresenting the functional use of products".

The above scope basically covers the common behaviors of "buying a single ticket", "circular export" and "tampering with customs declaration" in current practice. In addition, for the behavior of "low value overstatement", the Judicial Interpretation of 2024 modifies the result element of "fraudulently obtaining part of the export tax refund without actually paying tax" to the behavior element of "declaring the export tax refund with an inflated export tax refund amount". The Judicial Interpretation modifies the result element of "fraudulently obtaining a portion of export tax refund that has not been actually taxed" to the behavioral element of "declaring export tax refund by inflating the amount of export tax refund", which strengthens the crackdown on false declaration.

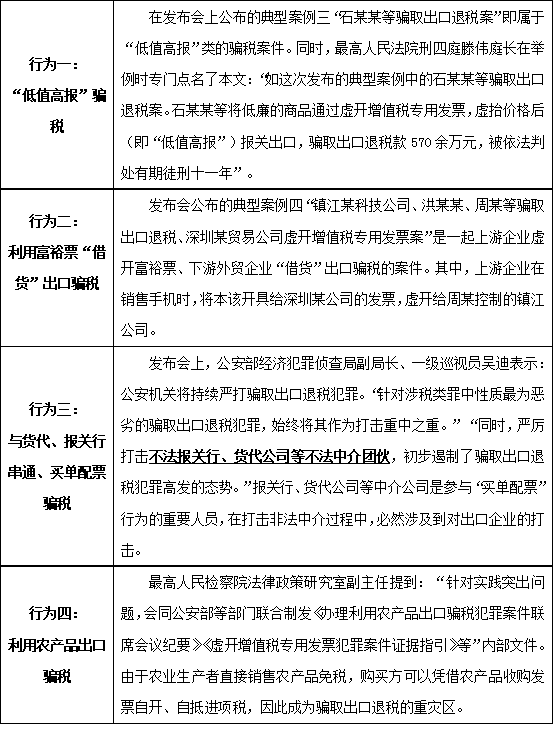

Therefore, on the whole, the introduction of the Judicial Interpretation 2024 demonstrates the determination of the "two high courts" to crack down on fraudulent export tax refunds and maintain the export order. In fact, the "Supreme People's Court Supreme People's Procuratorate Judicial Interpretation of Tax-Related Crimes and Typical Cases Press Conference" on March 18th also reflected this trend of cracking down on fraudulent export tax refunds, and explicitly "named" four types of tax cheating behavior.

(Ⅱ) The "two high courts" conference explicitly named four types of tax cheating behavior, and the "fight against cheating" has continued to increase

On March 18, the press conference of the Supreme People's Court and the Supreme People's Procuratorate on judicial interpretations of tax-related crimes and typical cases highlighted four types of tax fraud, which can be seen as the attitude of the "two high courts".

(Ⅲ) Summary: New Judicial Interpretations Tighten Overall, Risks of Foreign Trade Enterprises Increase

Through the overall review of the Judicial Interpretation 2024 and the "two high" conference, it is easy to see that with the Supreme People's Court joining the eight departments to jointly fight against tax-related crimes, the state's crackdown on tax cheating has been increasingly strengthened, and the supervision of the export industry has also been increasingly strengthened, and the risk of foreign trade enterprises has been rising.

At the same time, we must draw taxpayers' attention to the fact that at present, when the tax authorities handle administrative cases of fraudulent export tax rebates, they also rely heavily on the relevant provisions of the judicial interpretation of the crime of fraudulent export tax rebates. As the State Administration of Taxation (SAT) does not provide for fraudulent export tax rebates at present, the judicial interpretation is transformed into a normative document in the form of the Notice of the State Administration of Taxation on the Publicity and Implementation of the Interpretation of the Supreme People's Court on Several Issues Concerning the Specific Application of Laws in the Trial of Criminal Cases of Fraudulent Export Tax Refunds (Guoshifa 〔2002〕 No. 125). Therefore, this paper predicts that the General Administration should also transform the Judicial Interpretation 2024 into a normative document through the form of forwarding for reference and application by the tax authorities, and therefore the administrative risk will be aggravated.

Ⅲ. The new judicial interpretation modification and new provisions or exacerbate the conversion of criminal risk of export enterprises

(Ⅰ) Multiple tax fraud is heavily penalized and criminal liability is increased by one grade

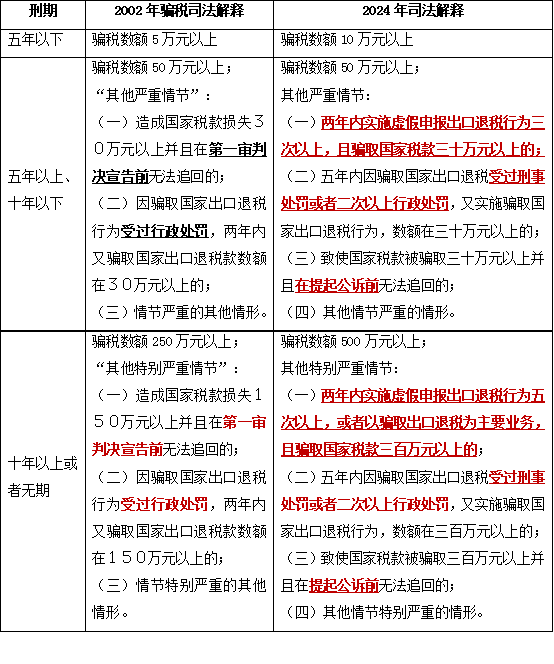

The Judicial Interpretation of 2024, in terms of sentencing circumstances, although the Judicial Interpretation of 2002 Tax Fraud stipulates that the tax amount of fraudulent export tax refunds is more than 50,000 yuan, the amount of tax is more than 500,000 yuan, and the amount of tax is particularly huge for more than two and a half million yuan, adjusted to more than 100,000 yuan, more than 500,000 yuan, more than five million yuan, and the relevant amount of standard has been improved. However, compared to the 2002 Judicial Interpretation of Tax Fraud, the 2024 Judicial Interpretation also makes stricter provisions on "other serious circumstances" and "other particularly serious circumstances", which essentially lowers the sentencing standards and makes it easier for defendants to apply higher penalties. to be subject to a higher level of punishment. Specifically:

The above changes indicate that:

Firstly, if the judicial authority determines that those who have committed multiple tax frauds or are shell tax fraud companies, the sentence can be upgraded and aggravated. The Judicial Interpretation 2024 clearly stipulates that if a person commits false declaration of export tax refund more than three times within two years, and the amount of tax cheated is more than 300,000 yuan, a sentence of more than five years or less than ten years shall apply; if a person commits the act of false declaration of export tax refund more than five times within two years or if the act of fraudulent export tax refund is the main business and the amount of tax cheated from the state is more than three million yuan, a sentence of more than ten years or life imprisonment shall apply. Moreover, this article does not require that the defendant/unit has been subjected to criminal punishment or administrative punishment, which means that as long as the judicial authorities confirm that it has multiple tax cheating behaviors or is a shell tax cheating company, it can be upgraded and aggravated.

Secondly, the time limit for recovering the loss of national export tax rebates is from the time before the first instance judgment to the time before the public prosecution is filed. The 2024 Judicial Interpretation stipulates that the penalty of five to ten years' imprisonment, ten years' imprisonment or life imprisonment shall be applicable if the fraudulent tax is more than 300,000 yuan or more than 3 million yuan and cannot be recovered before the filing of the indictment. Moreover, it should be noted that, unlike Article 11 of the crime of fraudulent issuance of VAT invoices, which stipulates that "the amount of tax that cannot be recovered before public prosecution is instituted reaches more than 300,000 yuan/three million yuan", the crime of tax cheating does not stipulate the amount of tax loss that cannot be recovered, which may lead to the judicial authorities requesting that the loss of tax be recovered. This may result in the judicial authorities requiring full recovery of the fraudulent export tax rebates before the provisions of this Article on increasing the sentence are not applicable.

Again, those who have been criminally punished for the crime of fraudulent export tax rebates can be sentenced to a heavier sentence. This provision is also a new addition to the judicial interpretation, not only can be upgraded to aggravate the criminal punishment, and may overlap with the provisions of recidivism. However, the judicial interpretation of the provisions of the "five years for cheating the state export tax rebates have been criminal punishment", which "has been" time nodes are not clearly defined, there are two interpretation space: the first is calculated from the date of entry into force of the judgment, without waiting for the penalty to be carried out, because the penalty is carried out, this is because the sentence is not a criminal offense. The first one is calculated from the date when the judgment comes into effect, without waiting for the completion of the execution of the penalty, which is because the execution of the penalty is usually uncertain, especially the tax fraud crime has a high fine penalty; the second understanding is calculated from the date when the execution of the penalty is completed, which is similar to the provisions of the recidivism. According to the Criminal Law, recidivism refers to criminals sentenced to fixed-term imprisonment or more, who commit another crime and are sentenced to fixed-term imprisonment or more within five years after their release.

In this paper, the judicial interpretation does not adopt the concept of recidivism, but separately puts forward the new concept of "having received criminal punishment", therefore, the first understanding should be adopted, that is, from the date of entry into force of the judgment on the crime of fraudulent export tax rebate, the calculation of "having received criminal punishment" should be carried out. The first understanding should therefore be adopted, i.e., the period of five years from the date of entry into force of the judgment convicting the crime of cheating export tax rebates. However, even so, there still exists the possibility that the defendant who commits the crime of fraudulent export tax rebate is subject to the aggravated treatment of recidivism and the aggravated punishment of tax fraud at the same time.

(Ⅱ) Deletion of the subjective element of "false export declaration" and high risk of "objective imputation".

A prominent change in the Judicial Interpretation of 2024 compared with the Judicial Interpretation of 2002 on Tax Fraud is that, firstly, there is no distinction between the behavior of "False Declaration of Export" and "Other Deceptive Means", but rather, the two parts are merged into a single provision. On this basis, the subjective element of the act of "falsely declaring export" as stipulated in Article 1 of the Judicial Interpretation of Tax Fraud of 2002, "with the purpose of fictionalizing the fact of export of taxed goods", has been deleted.

In order to clearly explain the differences, it is necessary to sort out the provisions of the 2002 Judicial Interpretation of Tax Fraud. Article 1 of the 2002 Judicial Interpretation of Tax Fraud stipulates that the act of "falsely declaring export" refers to the act of "fictitious export of taxed goods" for the purpose of implementing the act of forging a contract of sale, falsely or illegally obtaining invoices, forging and altering documents for export and tax rebate, and so on. It can be seen that the core of "false export declaration" is "fictitious export facts of taxed goods".

The second article provides for "other means of tax fraud", including fraudulent export of goods tax rebate qualification, will not be taxed or tax-exempted goods as taxed goods exported, "although there are goods exported, but fictitious export of goods, such as name, quantity, unit price and other elements, fraudulent part of the export of tax refunds are not actually paid taxes " and so on. It can be seen that the "other means of tax fraud" is the core of the real goods exported, but cheated in the domestic tax exemption, not taxed part of the tax.

Why "false export" behavior must be subject to the "fictitious export of taxed goods" subjective purpose restrictions? This is because some of the behaviors listed in the Judicial Interpretation of Tax Fraud of 2002 and the Judicial Interpretation of 2024 may not be subjectively aimed at "fictitious exportation of taxed goods" to obtain export tax refunds, but rather there are other objective factors. For example, according to the provisions of the Judicial Interpretation, the use of falsely issued, illegally purchased or obtained by other unlawful means VAT invoices to declare export tax refunds belongs to the behavior of "falsely declaring exports". However, if the foreign trade enterprises do have real goods export, also has paid the full amount of tax-inclusive payment to the supplier enterprises, just because the supplier enterprises can not issue invoices, in order to meet the declaration of export tax rebates in order to meet the form of the elements of the foreign trade enterprises from the third party to truthfully open the value-added tax invoices. Or, the foreign trade enterprise is in good faith to obtain the supply enterprise false invoices. In these two cases, although the foreign trade enterprise has used the false invoice, it does not meet the subjective purpose of "fictitious export of taxed goods", and "cheats" the tax it has already borne in the country, and in fact, it does not cause the loss of export tax rebate for the state, and it should not be charged with fraudulent export tax rebate. It should not be punished for the crime of fraudulent export tax rebates, but by the tax authorities to pursue its administrative responsibility.

Of course, this article believes that the 2024 Judicial Interpretation deleted the above provisions, does not mean that it denies that the core constituent element of "false export" is "fictitious export of taxed goods", and in fact, the 2024 Judicial Interpretation has also mentioned many times that In fact, the "2024 Judicial Interpretation" has also mentioned many times the concepts of "negative tax", "taxed export business" and "fictitious export fact", but it is just that it is not like the "2002 Judicial Interpretation of Tax Fraud", which is the same as the outline, the beginning of the definition, and may lead to the mechanical application of individual case-handling authorities. This may lead to the mechanical application of the provisions of the Judicial Interpretation by individual authorities, and the business which has not caused the loss of national export tax rebate will be recognized as the crime of tax fraud.

(Ⅲ) Expanding the scope of forged, altered or illegally obtained "documents", and increasing the risk of false filing documents.

The 2002 Judicial Interpretation of Tax Fraud stipulates that the scope of forged, altered or illegally obtained documents is "customs declaration for export goods, export collection and remittance cancellation bill, special payment book for export goods and other relevant export tax refund documents and vouchers", while the 2024 Judicial Interpretation stipulates that "customs declaration for export, Transportation documents and other documents and certificates related to export business".

Obviously, the export business and the export tax rebate business itself can not be equated. The relevant documents and certificates in the export tax rebate business are divided into tax return declaration materials and filing documents. Among them, the "2002 Tax Fraud Judicial Interpretation" lists the customs declaration, export collection and cancellation of bills of exchange, etc., are tax return declaration materials, therefore, at this time, the scope of forged, altered, illegally obtained documents are in fact limited to the tax return declaration materials. The Judicial Interpretation of 2024 explicitly provides for the filing of transportation documents, indicating that the scope of documents regulated by it has been expanded.

The impact of the expansion of the scope of the documents is mainly due to the fact that, due to the complexity of the export business, many of the documents are obtained from third parties by the export enterprises. For example, if the supplier is responsible for domestic transportation, foreigners are responsible for international transportation, the domestic and international transportation documents must be obtained from the supplier, foreigners, after many changes of hands, the export enterprise is difficult to audit the authenticity of the documents. The Judicial Interpretation of 2024 also takes this into account and adds the restriction of "fictitious export fact", but it may still lead to the export enterprise with real goods exported being characterized as a tax fraud for reasons such as discrepancies in some of the transportation documents.

(Ⅳ) "Fraudulent use of another person's export business" does not specify the subjective ignorance of the real exporter.

The Judicial Interpretation of 2024 has added a new tax fraud behavior of "fraudulent use of other people's export business to declare export tax refund". In this paper, this provision mainly regulates the behavior of "buying and matching", i.e., tax cheats collude with illegal customs brokers and freight forwarding companies, so that the customs brokers and freight forwarding companies can provide information on goods that are not refundable for export, and then forge them into the tax cheats' own goods, which are exported and declared to be refunded by matching with the falsely-issued VAT special invoices and other documents. In the above case, the real export owner does not know that his goods information is sold by the illegal intermediary and used to declare tax refund, so it is in line with the situation of "fraudulent use".

In practice, there are also some suppliers and exporters export cooperation, export agency, this paper that these suppliers and exporters have reached the agreement of the meaning of the civil transaction arrangements, does not belong to the "fraudulent use". For example, the practice of the widely disputed "four from the three do not see" behavior, in essence, the export enterprise and the supplier enterprise cooperation, in the name of self-managed exports, the implementation of the administrative violations of the agent exports, but if in line with the "real export of taxed goods," the substantive elements. However, if the substantive elements of "real export of taxed goods" are met, it still does not constitute fraudulent export tax refund. This is also the reason why the Judicial Interpretation of 2024 deleted the article of "four from three missing".

However, since the Judicial Interpretation does not clearly define the meaning of "fraudulent use", there may be a danger of expanding the interpretation of the meaning of the term "fraudulent use", and recognizing the commercial transaction arrangement between the supplier and the exporter as "fraudulent use". "This paper believes that export enterprises should focus on preventing related risks.

(Ⅴ) strengthen the intermediary organization obligations and responsibilities, foreign integrated service enterprises increased criminal risk

The second paragraph of Article 9 of the Judicial Interpretation of 2024 on "intermediary organizations and their personnel engaged in freight forwarding agency, customs brokerage, accounting, taxation, foreign trade comprehensive services" provides for a clear "violation of state regulations on import and export operations, and provide others with false supporting documents "in accordance with the Criminal Law, the two hundred and twenty-nine" to provide false documents, the issuance of documents to prove the crime of material misrepresentation "to deal with. In this paper, the favorable aspects of the article is that the above intermediary organizations are not necessarily in accordance with the fraudulent export tax rebate crime of complicity in the treatment, to achieve the "crime and responsibility of the criminal justice", but, on the foreign trade service enterprises, the criminal liability may face an increase.

The special feature of foreign trade comprehensive service enterprises is that, according to the "Announcement of the State Administration of Taxation on the Adjustment and Improvement of Matters Relating to the Handling of Export Goods Tax Refunds (Exemptions) by Foreign Trade Comprehensive Service Enterprises" (Announcement of the State Administration of Taxation No. 35 of 2017), the foreign comprehensive service must undertake higher risk control and audit obligations for the authenticity of the export business, including designation of the system of internal control of the tax refund on behalf of the manufacturer, analysis of the manufacturer's operations and production capacity, analyzing and auditing the authenticity of trade, consistency of exported goods with the information in the customs declaration, matching with the production capacity of the production enterprise, and so on.

Prior to Article 9 of the Judicial Interpretation of 2024, if a foreign integrated service had "illegally provided bank accounts, invoices, certificates or other convenience", it was only penalized in accordance with Article 93 of the Rules for the Implementation of the Law of the People's Republic of China on Tax Collection and Administration. However, after the implementation of the Judicial Interpretation 2024, if the foreign integrated service enterprises do not strictly follow the provisions of the State Administration of Taxation Announcement No. 35 of 2017 to fulfill their auditing obligations, and issue documents that are false, even if they do not constitute an accomplice to the crime of fraudulently obtaining export tax refunds, they may still constitute the "crime of providing false certifying documents, or the crime of issuing materially inaccurate certifying documents" as stipulated in Article 229 of the Criminal Law. The crime of providing false supporting documents and issuing materially inaccurate supporting documents".

Ⅳ. The new judicial interpretation of the new measures to protect the entity enterprises

(Ⅰ) Emphasize the concept of "negative tax", or help foreign trade enterprises to clarify the responsibility of tax fraud.

Although the Judicial Interpretation of 2024 deleted the subjective and substantive elements of the Judicial Interpretation of 2002 on Tax Fraud regarding the "fictitious export of taxed goods", the above principle is still continued in the specific provisions. Article 7(2) stipulates: "Declaring the export business which is not tax-negative or tax-exempt as taxed", compared with the Judicial Interpretation of Tax Fraud in 2002, the core of which is to adjust "not taxed" to "not tax-negative". Tax Negative".

According to the Provisional Regulations on VAT and the principle of VAT deduction, in a purchase and sale transaction, the seller is a VAT payer and the buyer is a VAT negative taxpayer. The purchaser bears the VAT by "paying the tax-inclusive price". This paper argues that, according to the above principle, as long as the foreign trade enterprises in the purchase of goods, full payment of tax-inclusive price, that is, already meet the conditions of "negative tax", and does not require the seller to pay tax truthfully or not.

This is because, as the system design of VAT which separates tax payment from negative tax payment, the negative tax party is unable to supervise whether the taxpayer pays the tax faithfully or not, or the taxpayer pays the tax and then evades tax by way of false enhancement of the item, which can not be attributed to the foreign trade enterprise.

Based on the provision of "negative tax" in this article, this article further holds that if the foreign trade enterprise has paid the tax-inclusive price when purchasing the goods, and the supplying enterprise is unable to issue the VAT special invoice for various reasons, resulting in the foreign trade enterprise being unable to obtain the refund of the tax though it has borne the burden of VAT in substance but lacks the formal elements, so it can not obtain the refund of the tax through the way of grafting the third party to issue the VAT special invoice. Therefore, the issuance of VAT special invoices by grafting on a third party has not caused the loss of national export tax refund, and with reference to the relevant provisions of Article 10 of the Judicial Interpretation of 2024, it is not appropriate to deal with the crime of fraudulently obtaining export tax refunds.

(Ⅱ) Deleting the "four from three missing" clause and returning to the theory of joint criminal law.

The Judicial Interpretation of 2024 deleted Article 6 of the Judicial Interpretation of Tax Fraud of 2002 on the provision of "four from three do not see", indicating the attitude of the "two high courts" towards the behavior of four from three do not see, and should be dealt with in accordance with the theory of criminal law, i.e., the application of the provisions of Article 19 of the Judicial Interpretation of 2024 on "four from three do not see". Article 19 of the Judicial Interpretation of 2024 stipulates that "Anyone who knows that another person has committed a crime against tax collection and management but still provides him with an account number, proof of credit or other assistance shall be punished as an accomplice to the corresponding crime."

The core of the behavior of "four from the three do not see" is that the supply enterprises and export enterprises to cooperate, in the name of self-managed exports to implement the export agency business, and this behavior itself is not a "fictitious export of taxed goods", does not belong to the fraudulent state export tax rebates. Therefore, the export enterprise must be required to "know" the supplier enterprise to implement the fraudulent export tax rebate behavior, only to be able to pursue the responsibility of the export enterprise tax fraud.

Although the Judicial Interpretation of Tax Fraud in 2002 requires that the export enterprise must "knowingly", however, the original judicial interpretation still exists a big problem, mainly: on the one hand, the provisions of Article 6 will be a joint crime of the accomplice of the "separate", that is, it can not be treated in accordance with the On the one hand, the provisions of Article 6 of the joint criminal conspiracy "alone", that is, can not be dealt with in accordance with the accomplices, directly in accordance with the separate crime of the export enterprises of fraudulent export tax rebates responsibility; on the other hand, the provisions of Article 6 may lead to part of the help offenders "principal offender", that is, part of the export enterprises may be the implementation of the "four from the three do not see" behavior only to provide help On the other hand, the provisions of Article 6 may lead to the "principalization" of some of the helpers.

Therefore, the 2024 Judicial Interpretation returns to the theory of joint criminal offense to ensure that some foreign trade enterprises do not constitute a crime, or the foreign trade enterprises that provide assistance constitute an accessory rather than a principal offender, which is in line with the principle of "appropriateness of crime and punishment".

(Ⅲ) The provision of false documents by intermediary organizations does not necessarily constitute tax fraud.

As mentioned above, the second paragraph of Article 9 of the Judicial Interpretation of 2024 stipulates that "intermediary organizations and their personnel engaged in freight forwarding agency, customs brokerage, accounting, taxation, and comprehensive foreign trade services", and if there is any provision of false documents, it will be dealt with in accordance with the provisions of Article 229 of the Criminal Law. Meanwhile, Article 19 stipulates that if it constitutes a joint crime, it shall be dealt with in accordance with the complicity in tax fraud. The above provisions indicate that the intermediary organizations such as freight forwarders, customs brokers and foreign integrated services shall be accurately evaluated depending on the objective behavior and subjective intention of the participating crimes, and shall not be dealt with as accomplices to the crime of cheating export tax rebates.

(Ⅳ) Entity export enterprises can actively carry out compliance

Article 21 of the Judicial Interpretation 2024 provides in principle for criminal compliance by enterprises, namely, "If the implementation of a crime against tax collection and management results in a loss of state tax, the perpetrator pays back the tax, recovers the loss of tax, and effectively complies with the rectification of the situation, he may be leniently punished; if the circumstances of the crime are minor and do not require the imposition of a sentence, he may not be prosecuted or be exempted from criminal penalties; if the circumstances are significantly slight harm is not significant, it is not treated as a crime."

Article 21 does not impose any sentencing restrictions on the initiation of the criminal compliance system, but rather emphasizes that the perpetrator may comply and rectify the situation as long as he or she "pays back the tax and recovers the loss of tax" and obtains the positive consequence of a lenient punishment. Therefore, this article may imply that compliance rectification can be initiated even in cases that may be sentenced to more than 10 years of imprisonment.

Of course, the initiation of compliance rectification of the enterprise involved in the case also needs to comply with the relevant provisions of criminal compliance, i.e., the enterprise is a real enterprise with good prospects for development, etc. If the enterprise is a shell enterprise, no matter how much tax is involved in the case, the enterprise involved in the case can not be carried out compliance rectification.

(Ⅴ) Deletion of aggravating circumstances for state employees

The 2024 Judicial Interpretation also deleted Article 8 of the 2002 Judicial Interpretation of Tax Fraud, which provides that "State officials who participate in the implementation of the criminal activity of fraudulent export tax refunds shall be severely punished in accordance with the provisions of Paragraph 1 of Article 204 of the Criminal Law." It may be considered that the aggravating circumstances of the accomplices should follow the "principle of the law of crime and punishment", which is stipulated in the Criminal Law, and it is not appropriate to be established by the Judicial Interpretation.

Ⅴ. To resolve the criminal risk of tax fraud, all parties in the export chain should grasp the following points

Under the joint promotion of eight departments to combat tax-related crimes, all parties in the export chain, especially foreign trade enterprises, should focus on risk prevention to avoid criminal liability.

(Ⅰ) Optimize the design of cooperative export mode to avoid export tax-related risks

According to the provisions of the State Administration of Taxation on the management of export tax rebates, the State Administration of Taxation has cracked down on the phenomenon of inconsistency between the real export and the subject of declaration of tax rebates, such as "fake self-management, real agency". It may not only constitute administrative tax rebate violation and illegal behavior, but also may constitute the crime of fraudulent export tax rebate. Therefore, this paper argues that, with the "2024 Judicial Interpretation" clearly stipulates that "fraudulent use of other people's business exports" is one of the means of tax fraud, at the same time, the concept of "fraudulent use" is unclear, the scope is not clear. If the business model of foreign trade enterprises cooperating with others to export is flawed, it may be considered that there is the behavior of "fraudulent use", which may lead to the risk of tax fraud.

Therefore, this paper believes that export enterprises should avoid the illegal export behavior of "fake self-management, real agent". At the same time, for the cooperative export business, it is necessary to realize the optimization of the business model, or to carry out the agent export business.

(Ⅱ) Strengthen the management of export tax rebate declaration documents and filing documents.

In practice, there is no lack of export enterprises due to export tax rebate declaration documents, filing documents do not match or false investigation and handling, light due to non-compliance with the documents can not be refunded, or heavy involved in the case of false opening, tax fraud. (acquisition of bank filing documents), declaration of export tax rebates and other documents, certificates, tickets, contracts and other information to form a complete chain of evidence related to the authenticity of the business.

(Ⅲ) Timely response to administrative violations to avoid the risk of administrative penalties into criminal risk

Export enterprises have been dealt with and penalized, they should start the administrative reconsideration procedure as early as possible, through the internal error correction mechanism of the tax authorities, communicate effectively with the tax authorities, and slow down the rhythm of the criminal judicial procedure, once the defense is successful, not only may knock off the false opening qualification by combing through the complete flow of funds, the enterprise's raw material procurement, production and processing, and the sales ratio, but also may reduce the tax payable by the enterprise from the angle of the business model and the amount of money involved in the case. From the perspective of the business model and the amount of money involved, it may also reduce the responsibility of the enterprise to pay back taxes and late payment fees, and in this way, it may directly block the pursuit of criminal liability. Even if it enters the criminal justice process, since the 2024 Judicial Interpretation does not impose any restriction on the quantum of punishment for initiating criminal compliance rectification, even an entity export enterprise with a false tax amount of more than 5 million yuan may apply for compliance rectification in combination with the circumstances such as tax reimbursement to strive for non-prosecution in the review and prosecution segment and probation in the trial segment.

(Ⅳ) Grasp the stage of tax recovery before instituting prosecution

In addition to the aforementioned application for compliance rectification with back taxes as a prerequisite, before the introduction of the Judicial Interpretation of 2024, the provisions of the Judicial Interpretation of Tax Fraud of 2002, foreign trade enterprises can be in the first instance before the judgment to pay back taxes. The 2024 Judicial Interpretation advances the time node for payment of back taxes to before the filing of the indictment, and the relevant subjects should pay attention to the changes in the amount and the period to prevent missing the deadline and other reasons for missing the good opportunity for relief.

(Ⅴ) Intermediaries should strengthen their prudential obligations

In the case of fraudulent export tax refunds, intermediary institutions are also one of the common subjects, depending on their functions engaged in registering enterprises on behalf of the record for export tax refunds, providing bank accounts, invoices, supporting documents and other helping behaviors. As mentioned above, even if the intermediary institution engaging in the above acts is not necessarily recognized as an accomplice to the crime of obtaining export tax rebates by deception, it is still facing the criminal liability of "providing false documents and issuing documents with material inaccuracies". Therefore, the intermediary organization should ensure that the authenticity of the business, single goods in line with the documents, documents in line with the circumstances of the prudent review obligations to avoid being implicated by the wrongdoers.

Ⅵ. The new judicial interpretations still have five major remaining problems need to be resolved

Comprehensive analysis of the above, this paper believes that the "2024 Judicial Interpretation" is based on the position of cracking down on the criminal act of fraudulent export tax rebates, and has better absorbed the new changes in judicial practice in recent years. However, there are still five types of problems that need to be solved urgently:

First, the judicial interpretation of Article 204 of the Criminal Law to distinguish between "false declaration of export" and "other means of deception" has a positive significance, the 2024 Judicial Interpretation of the two types of behavior is not strictly enumerated. As mentioned above, in the "2002 Tax Fraud Judicial Interpretation", "false declaration of export" refers to "fictitious export of taxed goods", fraudulent export tax rebate behavior; "other deceptive means "refers to the export of goods, but cheated the goods in the domestic part of the tax rebate without paying taxes. The two have certain differences.

At the same time, for the "false export" behavior, should also be clear with the "fictitious export of taxed goods" subjective elements, to avoid part of the administrative violations as a crime to combat.

Secondly, the criteria for determining the tax-paid status of "taxed goods" should be clarified. Should be in accordance with the "2024 Judicial Interpretation" Article VII (2) "negative tax" concept, to determine that as long as the export enterprise purchases goods, paid the price of tax-inclusive, that is, the negative tax status, in order to accurately distinguish between the foreign trade enterprises and upstream supply enterprises responsibility;

Thirdly, regarding the issue of criminal amount of low value overstatement, the Judicial Interpretation of 2024 did not extend the provisions of the Judicial Interpretation of Tax Fraud of 2002, which only investigates the criminal responsibility of tax fraud for "fraudulently obtaining the untaxed portion of the tax", and changed the result element to behavioral element, which only stipulates that "falsely increasing the amount of export tax rebate", which is a means of tax fraud, should be considered as a criminal liability. "This means of tax fraud may lead to the fact that the part of the tax that the perpetrator has not inflated and has borne the tax himself is also recognized as the amount of tax fraud.

Meanwhile, the so-called "low-value high-reporting" behaviors in practice (including the typical cases released by the "two high courts" this time) are associated with the behavior of false VAT invoices. For export enterprises, the tax basis for export tax refund of foreign trade enterprises is the amount of tax recorded in the "input VAT special invoice", therefore, it is impossible for foreign trade enterprises to "understate the value and overstate the value" to cheat tax without falsely opening input invoices; although the tax basis for export tax refund of production enterprises is the amount of tax recorded in the "input VAT special invoice". Although the tax basis for export tax rebate is the f.o.b. price of goods, theoretically there is the possibility of overstating the export amount to cheat the tax, but if it is not through false invoices to offset the cost of overstating the export amount of part of the 25% EIT will be higher than the 13% export tax rebate it obtained, but the loss. Therefore, only very few EIT exempted enterprises, such as agricultural products processing enterprises, may have "low value overstatement" tax fraud without false invoicing behavior. Usually, the "low value overstatement" behavior does not exist independently, but is associated with false opening.

Fourthly, the Judicial Interpretation of 2024 deleted the provision of "forged invoices" for tax fraud based on the current status quo of informationization management, probably in consideration of the fact that under the current "Golden 3" or even "Golden 4" management system, the declaration of tax refund is not subject to the requirement of "false invoices", but rather to the requirement of "false invoices" for tax fraud. Under the current "Golden 3" or even "Golden 4" management system, the invoices have to be verified for tax refund declaration. However, in practice, there is still the possibility of "hackers" invading the invoice management system and forging or altering invoices. Therefore, this article believes that it is necessary to explicitly delete "forged invoices" for tax fraud, which does not mean that it will not combat such behavior, and should be restored if necessary.

Fifth, the provisions of the Judicial Interpretation of 2024 on circular import and export tax fraud are not clear enough. Article 7(6) stipulates that "after the goods are exported, they are transferred to the territory again or the same kind of goods outside the country are transferred to the territory for circular import and export and declared for export tax refund", which is one of the acts of tax fraud. However, as mentioned before in this article, circular export does not necessarily constitute tax fraud, and the perpetrator should subjectively have the purpose of tax fraud, and objectively fraudulently obtain the tax refund for the unpaid part of the goods. Specifically, if the goods are exported and imported with normal customs clearance and import VAT and customs duty are paid faithfully at the import stage, which are tax-paid goods, even if the goods are imported and exported in a circular manner, it is not a tax fraud.