Taxation by case: enjoyment of financial and tax incentives need to pay attention to the four tax-related risks

Editor's Note: In order to encourage the development of specific industries and regions, the State and some localities have introduced preferential fiscal and tax policies, such as giving enterprises engaged in encouraging industries a preferential income tax rate of 15%, and exempting or reducing the local sharing portion of the income tax and other tax incentives. Some enterprises in the application of preferential fiscal and tax policies in the process, due to misunderstanding, the application of the risk of paying back taxes, late fees, and with the recent crackdown on illegal tax return action, some of the application of preferential fiscal and tax policies also greatly increased the risk. This article takes four actual cases as the entry point to analyze the four major tax-related risk points that enterprises should pay attention to when applying preferential policies on finance and tax, and puts forward suggestions to deal with them for readers' reference.

Risk 1: Neglecting the impact of non-recurring profit and loss items on the percentage of income from main business, resulting in non-compliance with the preferential conditions and being required to pay back tax

(I) A listed company was required to pay back tax of RMB14.93 million plus late payment charges for its subsidiary's investment income, which resulted in the percentage of income from main business not meeting the preferential conditions.

On April 8, 2023, a listed company issued the "Announcement on the Accounting Treatment of the Financial Impact on the Company's Financials of Subsidiary Company A's Payment of Back Taxes for the Year of 2022": Company A opened in 2009 and was approved by the Guizhou Provincial Commission of Economy and Information Technology as a "State Encouraged Industrial Enterprise". ...... Since 2017, Company A has been enjoying the enterprise income tax concessions for the encouraged industries in the western region in accordance with the regulations. In 2020, Company A realized a total income of RMB219,023,500 (of which RMB143,781,200 was from ropeways, RMB69,481,000 was from investment income from scenic spot development projects and RMB5,761,300 was from other and non-operating income), and its income was RMB5,761,300. income of 5,761,300 yuan) and total profit of 149,302,200 yuan. Company A should pay the total enterprise income tax payable of RMB22,395,300 in accordance with the preferential income tax rate of 15%, and completed the 2020 annual enterprise income tax remittance by May 31, 2021, with no risk hints after the completion of the remittance, and the tax payment was normal.2022 In June 2022, the Guizhou provincial tax system initiated the risk analysis of the big data, and the 2020 enterprise income tax filing of Company A was included in the "Risk Analysis". In June 2022, Guizhou tax system launched big data risk analysis and Company A's 2020 enterprise income tax return was included in the risk indicator of "enjoying the western development and not meeting the proportion of main business income" (the tax system calculated that Company A's 2020 main business income accounted for 65.65%, which did not reach 70%).On December 23, 2022, the tax authorities issued a Notice of Tax Matters to Company A, informing Company A to make up for the 2020 enterprise income tax payment. Company A to pay back the 2020 enterprise income tax of RMB14.93 million and to bear the corresponding late payment fees. Company A has completed the payment of the retroactive tax of RMB14.93 million and late payment fee of RMB4,332,700.

The listed company disclosed in its reply to the enquiry of the Shenzhen Stock Exchange on its 2022 annual report that the reason for Company A to incur the tax risk is that the investment income from a scenic spot company's development project in 2020 was included in the main business income of that year, and Company A considered that the investment income from the project should be included in the accounting of the main business income, and therefore could still enjoy the preferential enterprise income tax rate of 15% in that year.

(II) A number of tax incentives specify the requirements on the proportion of main business income, and enterprises should pay attention to the dynamic change of the proportion of income.

In order to encourage the development of specific industry sectors or part of the region, the State has introduced tax incentives, such policies usually set requirements on the proportion of revenue from encouraged industries, such as the Western Development Policy in the aforementioned case, which reduces the enterprise income tax rate by 15% for the enterprises in encouraged industries located in the western region, while the enterprises in encouraged industries refer to the industries stipulated in the Catalogue of Encouraged Industries in the Western Region, and their income tax rate is 15%. projects as their main business and their main business revenue accounts for more than 60% of the total revenue of the enterprise (originally 70%, which was adjusted to 60% as of January 1, 2021 pursuant to the Announcement of the Ministry of Finance, the State Administration of Taxation and the National Development and Reform Commission on the Continuation of the Enterprise Income Tax Policy on the Development of the Western Region (Announcement of the Ministry of Finance No. 23 of 2020)).

In this case, Company A included the investment income from the development project in its main business income and thus continued to apply the preferential enterprise income tax rate of 15%, while the tax bureau considered that the investment income was not part of the main business income, and the enterprise did not comply with the requirement of the percentage of the main business income after excluding such investment income, so it adjusted the enterprise tax payable for the current year and added a late payment fee. It should be noted that the main business must be a project in the industrial directory, the main business income is based on the operation of the project and the income generated by the enterprise to dispose of long-term equity investments, fixed assets and other income, government grants, recognized debt restructuring gains and losses, asset replacement gains and losses, and other non-recurring gains and losses do not belong to the scope of the main business income. Such non-recurring gains and losses are usually not directly related to the operating business of the enterprise, or although they are related to the operating business, the nature, amount or frequency of occurrence of such gains and losses affect the income and expenses that truly and fairly reflect the normal profitability of the enterprise.

Tax incentives such as Western Development generally adopt the processing method of "self-identification, declaration and enjoyment, and retention of relevant information for inspection", while the frequency of non-recurring gains and losses is low, but the amount of a single occasion is usually high. In the year of obtaining the income, the enterprise shall dynamically pay attention to the changes in the proportion of the income from the main business, and timely measure the impact of non-recurring gains and losses on the enterprise's enjoyment of tax incentives, and make reasonable decisions to enjoy the tax benefits. Enterprises should pay dynamic attention to the changes in the proportion of main business income in the year in which the gains are made, timely assess the impact of non-recurring gains and losses on the enterprises' enjoyment of tax incentives, and make reasonable adjustments, so as to avoid the risk of paying additional taxes and charging late fees due to wrong application.

Risk 2: Improper tax treatment of financial incentives required to pay back taxes and late charges

(I) A company obtaining financial incentives of more than RMB 27 million is not "non-taxable income" and is required to pay back tax.

An enterprise obtained financial incentives of RMB 27,132,315.87 during the period of carrying out automobile insurance service business, and the enterprise did not make tax declaration of the financial incentives obtained. The tax authorities, based on the "Notice of the Ministry of Finance and the State Administration of Taxation on the Enterprise Income Tax Treatment of Special Purpose Fiscal Funds" (Cai Shui [2011] No. 70), considered that the financial incentives obtained by the enterprise did not comply with the conditions of "non-taxable income" for enterprise income tax, and required the enterprise to adjust the back-tax.

(II) Whether subsidies such as financial incentives belong to "non-taxable income" for enterprise income tax needs to be judged in conjunction with the type of subsidies.

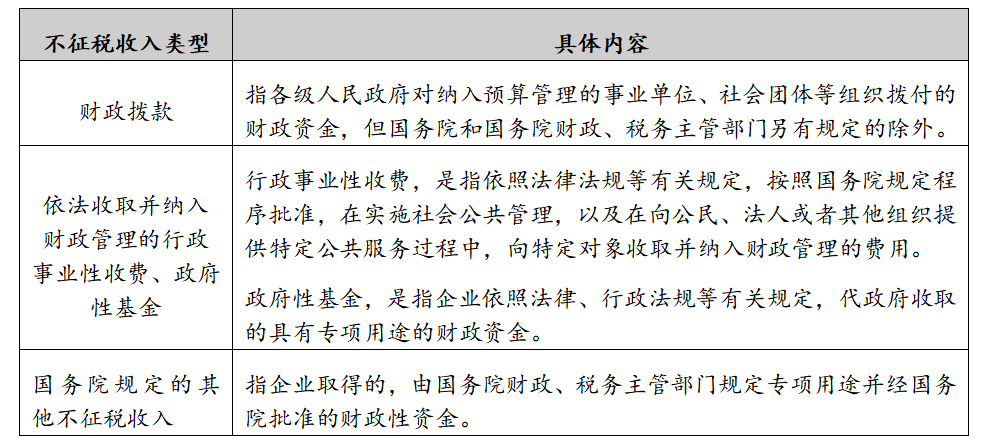

In order to promote local economic development and support the development of specific industries, some local governments issue government grants, financial incentives and other subsidies to eligible enterprises, and it is necessary to judge whether such financial subsidies belong to the taxable income for enterprise income tax in conjunction with the types of subsidies. According to the provisions of the Enterprise Income Tax Law and its implementing regulations, "non-taxable income" for enterprise income tax includes three categories.

The third category refers to fiscal funds, which are the type of subsidies more often involved in practice. According to the Circular of the Ministry of Finance and the State Administration of Taxation on the Issues of Enterprise Income Tax Treatment for Fiscal Funds for Special Purposes (Cai Shui [2011] No. 70), enterprises obtaining such fiscal funds are required to meet three conditions before they are considered as "non-taxable income": firstly, the enterprise is able to provide documents of allocation and disbursement of funds for special purposes; secondly, the financial department is able to provide documents of allocation and disbursement for special purposes; and secondly, the financial department is able to provide documents of disbursement for special purposes. First, the enterprise can provide the fund allocation documents that stipulate the special purpose of the fund; second, the financial department or other government departments that allocate the fund have special fund management methods or specific management requirements for the fund; third, the enterprise accounts for the fund and the expenditure incurred with the fund separately.

Therefore, when an enterprise obtains financial subsidies, it should accurately determine whether the subsidies belong to the category of non-taxable income for enterprise income tax, whether it has obtained the relevant documents to support the subsidies, and whether its accounting is in compliance with the requirements, so as to avoid the risk of not making timely declarations that may lead to the payment of additional taxes and late payment fees.

Risk 3: Wrongful application of tax incentives resulting in back taxes and late payment charges

(I) A listed company incorrectly enjoyed tax incentives for investment promotion and was pursued by the tax bureau to pay more than RMB47 million in back taxes and late payment fees

Recently, a listed company issued the Announcement on Payment of Back Taxes, in which the company enjoyed the preferential policy of exemption of local retention portion of enterprise income tax for the period from 2018 to 2021 due to deviation in the understanding of the conditions for the application of the tax policy, and the Inspection Bureau required the company to make back payment of enterprise income tax for the period from 2018 to 2021 in the amount of RMB29,323,187.10, with the addition of a late payment fee.

Upon searching, the author found that the listed company was registered in Lhasa, Tibet Autonomous Region, and according to the Circular of the People's Government of the Tibet Autonomous Region on the Issuance of Certain Provisions on Preferential Policies for Attracting Investment in the Tibet Autonomous Region (for Trial Implementation) (Zangzheng Fa [2018] No. 25) in force at that time, enterprises registered in Tibet and with business entities that meet the relevant conditions are exempted from enterprise income tax from January 1, 2018, to December 2021 31, 2018, are exempted from the local sharing portion of the enterprise income tax. The conditions required by this preferential policy are mainly that the enterprises need to be engaged in specific encouraged industries, such as enterprises or projects engaged in the production and processing of characteristic advantageous agricultural, forestry and animal husbandry products, or for qualified poverty alleviation enterprises or projects, or qualified innovation and entrepreneurship enterprises or projects. According to the announcement of the listed company, it was improperly applied due to the deviation in the understanding of the conditions of application of the policy, and was required to make up for the tax exemptions and reductions it had already enjoyed.

(II) Paying attention to the prerequisites for enjoyment of preferential fiscal and tax policies and accurately defining whether they meet the applicable conditions

At present, the existing regional tax preferential policies require enterprises to engage in the industries specified in the catalog of encouraged industries, such as the preferential policies on enterprise income tax of Hainan Free Trade Port, which require that the industries belonging to the enterprise should belong to the "Guidance Catalogue for Industrial Structure Adjustment (2024 Edition)", "Catalogue of Encouraged Industries for Foreign Investments (2022 Edition)" or "Catalogue of Encouraged Industries for Hainan Free Trade Port (2024 Edition)". . In addition, enterprises should also meet substantive operational requirements. For example, the Circular of the Ministry of Finance and the State Administration of Taxation on Preferential Policies for Enterprise Income Tax in Guangzhou Nansha (Cai Shui [2022] No. 40) stipulates that an enterprise should satisfy four substantive operational requirements, namely, first, that the production and operation is in the Nansha Launching Zone, second, that the personnel is in the Nansha Launching Zone, third, that the accounts are in the Nansha Launching Zone, and fourth, that the property is in the Nansha Launching Zone.

Enterprises should accurately screen whether the industry they are engaged in belongs to the industry fields encouraged by the tax incentives in the region, correctly understand the tax incentives, and judge whether they meet the conditions, so as to avoid erroneous enjoyment of the tax incentives resulting in back taxes and late payment charges.

Risk 4: Under the background of strict investigation of tax rebate irregularities, enterprises enjoying fiscal rebates face the risk of being recovered

(I) Actual case: in order to regulate the behavior of fiscal expenditure, a listed company was required to surrender 24 million yuan of fiscal incentives

At the end of January 2024, a listed company issued the Announcement on Returning Government Subsidies: the listed company received 12 million yuan of fiscal incentives allocated by a district finance bureau in March 2023, and 12 million yuan of science and technology incentives in June of the same year. Recently, the listed company received a Notice of Return of Incentive from the management committee of the district, stating that the company should remit the above two incentive funds to its designated account before February 29, 2024 for the purpose of regulating the financial expenditure behavior due to non-compliance with the relevant policies. The listed company's announcement also set out that this government subsidy return matter would reduce the Company's net profit for the year 2023 by RMB20.4 million.

(II) Enterprises should pay attention to the legality of the fiscal return policy and make investment decisions prudently

The Legislative Law amended in 2015 clarifies that "the basic system of taxation, such as the establishment of tax types, the determination of tax rates and the management of tax collection" can only be enacted by law; Article 3 of the Law on Administration of Tax Collection stipulates that "the levy and suspension of taxes, as well as tax reductions, exemptions, refunds, and tax reimbursements, shall be implemented in accordance with the law; the law authorizes the State Council to provide for the implementation of the provisions; the law authorizes the State Council to provide for the implementation of the provisions of the law. Where the State Council is authorized by law to make such provisions, they shall be implemented in accordance with the provisions of the administrative regulations formulated by the State Council. No organ, unit or individual shall, in violation of the provisions of laws and administrative regulations, make unauthorized decisions on the introduction and suspension of taxes, as well as tax reductions, exemptions, refunds, tax supplements and other decisions that contradict tax laws and administrative regulations", i.e., tax reductions, exemptions and refunds should be based on the law. Since the clean-up of irregular tax preferential actions in 2014, tax exemptions, tax rebates and approved levies and other preferential policies directly reflecting tax exemptions and reductions have been tightened; based on the autonomy of the local government of the tax revenues attributable to the local retention of part of the tax revenue to the full amount of tax paid by enterprises and then given by the local government to the financial return model has become the mainstream of some areas of the investment promotion and fiscal policy. However, this type of financial return policy in the application of the destruction of fair competition in the market, local tax competition, triggering the problem of false and fraudulent tax issues and so on. At present, the audit, tax and other departments have clearly put forward a strict investigation of investment promotion in the illegal tax rebate problem, many places also issued a document to clean up the financial rebate policy linked with tax revenues, the local government based on tax revenues to be exempted from local retention of the part of the policy or rebate of the application of the policy there is a greater risk.

In fact, financial rebate policies linked to tax revenues should not be recognized as unlawful across the board. For example, the policy of exempting the local retention of enterprise income tax in the Tibet Autonomous Region mentioned above is based on the exception authorization of tax collection and management authority under the Law on Regional Ethnic Autonomy, which reads: "The autonomous organs of the national autonomous areas, in the implementation of the national tax law, may implement the policy of reducing or exempting certain items of the local fiscal revenue that are in need of tax care and encouragement, in addition to those items that should be uniformly approved and exempted by the state, and may implement the policy of reducing or exempting certain items that are in need of tax care and encouragement. tax reductions or exemptions that need to be taken care of and encouraged in terms of taxation. Autonomous prefectures, autonomous counties decide to reduce or exempt taxes, shall be reported to the provinces, autonomous regions, municipalities directly under the Central People's Government for approval", such preferential policies in accordance with the law, the enterprise meets the relevant conditions, can be normal to enjoy the corresponding concessions.

The author suggests that enterprises should pay attention to the legitimacy of the policy and the stability of the past policy, analyze and assess the feasibility of the policy and the risk of redemption before choosing the investment place to apply the preferential policy; enterprises which have already enjoyed the preferential policy should look back to review the legitimacy of the signed investment agreement, analyze the applicable risk according to the regulatory dynamics, and adjust the business model in a timely manner; in addition, the investing enterprises should also review whether they have fulfilled the obligations under the agreement, such as obtaining the financial rebate. In addition, the investing enterprises should also review whether they fulfill the obligations agreed in the agreement, such as whether the financial rebates obtained are used in the agreed areas or projects, so as to avoid facing legal risks due to improper use of the financial rebates.