After receiving the auction proceeds, who has priority: the mortgagee exercising the mortgage right or the tax bureau pursuing the unpaid taxes?

Editor's Note: In recent years, the real estate industry has been experiencing an economic downturn, and real estate enterprises, serving as debtors and mortgagors, have simultaneously become tax debtors. On the one hand, when the debtor is unable to repay debts, the real estate mortgagee may have the priority to be compensated for the debts through discounted sale or auctioning or selling the mortgaged property, as stipulated in the Civil Code. On the other hand, after obtaining auction proceeds through the auction of real estate conducted by the people's court, it becomes possible for the tax authorities to pursue unpaid taxes and auction corresponding tax payments, thus creating a conflict between taxes and mortgage claims. So, what is the order of repayment for auction proceeds in such cases? This article will discuss the distribution order of auction proceeds between real estate mortgage rights and the state's tax collection rights to satisfy the readers' curiosity.

01

Case Introduction: Auction of Debtor's Property Leads to Objection Regarding Tax Department's Priority in Deducting Taxes

Company A, a real estate development enterprise, signed a "Loan Contract" and a "Real Estate Mortgage Guaranty Contract" with Company B on June 30, 2019. The agreement stipulated a loan amount of 300 million yuan with an annual interest rate of 6%. The principal and interest were to be repaid in a lump sum at maturity, and a penalty interest rate of 10% would be applied for overdue payments. Company A used a commercial property already in use as collateral for the loan's principal and interest, and completed the real estate mortgage registration procedures in July of the same year. The project to which the commercial property belonged completed its land value-added tax settlement in October 2019, with taxes payable of 210 million yuan. Although Company A reported the taxes in that month, it was unable to pay them. The tax authorities announced the tax arrears in December 2019.On June 30, 2022, Company A was unable to repay the loan and interest totaling 354 million yuan. Company B filed a lawsuit in court, won the case, and applied for enforcement, requesting the court to auction the commercial property to repay the principal and interest.

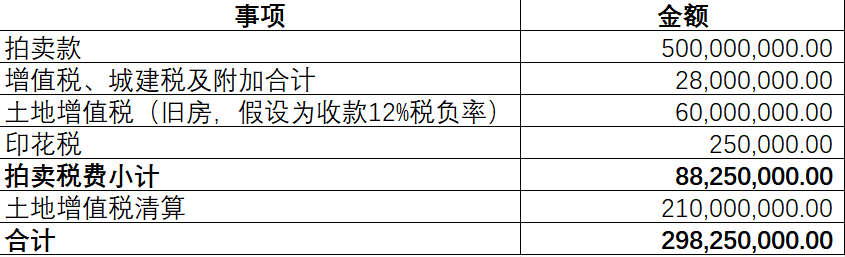

The enforcing court issued a "Bidding Announcement" on October 1, 2023, stating that the taxes and fees involved in the auction would be borne according to legal and regulatory provisions. The auction was conducted online on December 5th, and Company C purchased the commercial property for 500 million yuan, paying the auction price the next day. On December 10th, Company C received an enforcement ruling from the court, stating that the auctioned real estate belonged to the buyer, and the ownership of the aforementioned property transferred from the date of the service of this ruling.According to relevant tax laws, Company A was involved in value-added tax, land value-added tax (for the transfer of old housing), urban construction tax and surcharges, and stamp duty totaling 88.25 million yuan during the property transfer. Upon learning that Company A had received 500 million yuan from the auction proceeds, the tax department applied to the enforcing court for assistance in deducting the above-mentioned taxes of 298.25 million yuan (as detailed in the following table) based on tax priority. Upon learning of this, the enforcing applicant immediately filed a written objection to the enforcing court, arguing that the auction proceeds should first be used to repay its secured creditor's rights (including the principal of the loan of 300 million yuan, interest of 54 million yuan, and penalty interest of 45 million yuan calculated up to December 31, 2023), and then the taxes and other expenses should be paid.

The applicant for enforcement raised an objection to the auction proceeds that the tax bureau demanded for execution. The focus of the dispute between the two parties lies in the order of priority for the applicant for enforcement to exercise the real estate mortgage right of 399 million yuan and the tax bureau to pursue the payment of the following taxes:

(1) Historical unpaid taxes of 210 million yuan arising from the land value-added tax settlement in December 2019;

(2) Value-added tax, urban construction tax and surcharges, and land value-added tax totaling 88 million yuan incurred during the auction process;

(3) Stamp duty of 250,000 yuan incurred immediately upon the completion of the auction.

Next, we will analyze these issues in detail based on the relevant legal provisions related to tax laws, auctions, and guarantees, in conjunction with the specifics of this case.

02

The priority of real estate mortgage rights is over the tax authorities' pursuit of historical unpaid taxes

To discuss the order of repayment for the aforementioned taxes and real estate mortgage rights, it is crucial to consider two renowned principles in civil law and tax law: the principle of priority of mortgage rights and the principle of priority of tax payment.We will first examine the relationship between these two principles based on legal provisions, and then determine their precedence based on the specific circumstances of the case.

I. Two Statutory Priorities

Firstly, the priority of real estate mortgage rights over general creditor's rights is established. According to Article 410 of the Civil Code, "If the debtor fails to fulfill the due debt or if any circumstances stipulated by the parties arise for the realization of the mortgage right, the mortgagee may, by agreement with the mortgagor, receive priority compensation by converting the mortgaged property into money or by auctioning or selling the mortgaged property." Article 413 further stipulates that "After the mortgaged property is converted into money or auctioned or sold, any excess of the proceeds over the amount of the claim shall be owned by the mortgagor." This demonstrates the precedence of mortgage rights over general creditor's rights. In the case at hand, Company B established its mortgage right in July 2019. Since Company A, the debtor, failed to fulfill its due debt, Company B, as the mortgagee, is entitled to priority compensation from the proceeds of the auction.

Secondly, tax priority refers to the entitlement of taxes to priority compensation when they coexist with other creditor's rights. Taxation is a crucial tool for the state to organize fiscal revenue. Establishing tax priority has significant practical implications in safeguarding the stability of state tax revenue and preventing the loss of tax revenue due to the priority compensation of other creditor's rights. According to Article 45, paragraph 1, of the Tax Administration Law, "Except as otherwise stipulated by law, taxes collected by tax authorities shall have priority over unsecured creditor's rights." In the context of creditor's rights, unsecured creditor's rights refer to ordinary creditor's rights without the establishment of security interests. Based on the above provisions, taxes have priority status for compensation when they coexist with unsecured creditor's rights, unless otherwise stipulated by law.

Thirdly, when these two principles of priority conflict, how should they be reconciled? The aforementioned Article 45, paragraph 1, of the Tax Administration Law clearly states: "If the taxes owed by a taxpayer arise before the taxpayer's property is used to establish a mortgage, pledge, or lien, the taxes shall be enforced prior to the mortgage right, pledge right, or lien." This provision resolves the issue of the order of compensation when there is a conflict between tax creditor's rights and secured creditor's rights.

II. In this case, the real estate mortgage right prevails over the tax authority's pursuit of historical unpaid taxes.

Specifically in this case, the establishment of the real estate mortgage right of Company B was completed in July 2019 with the completion of the mortgage registration procedures. The formation of Company A's historical unpaid land value-added tax occurred when the tax authority announced the unpaid tax matters in December 2019, which was later than the establishment of the real estate mortgage right. Therefore, the real estate mortgage right of Company B should have priority over the historical unpaid tax. The tax authority's request to the executing court to prioritize the deduction of the unpaid land value-added tax from the auction proceeds lacks legal basis.

It is noteworthy to mention here that the timing of the formation of tax creditors' rights should be based on the tax authority's announcement of unpaid taxes, rather than the timing when the taxpayer fails to pay taxes and thus forms unpaid taxes. Although Article 46 of the Tax Collection and Administration Law requires taxpayers who have unpaid taxes and set up mortgages or pledges on their property to inform the mortgagee or pledgee of their unpaid tax situation, and the mortgagee or pledgee may request the tax authority to provide relevant information on unpaid taxes, it is unfair to have the security interest holder bear unfavorable consequences due to the taxpayer's failure to disclose the unpaid tax situation. Moreover, requiring security interest holders to inquire about whether the taxpayer owes taxes when setting up security interests would necessarily increase transaction costs and reduce transaction efficiency.

03

Does the real estate mortgage right have priority over the taxes and fees generated during the auction process?

It has already been clarified that taxes have priority over subsequently established security interests. If this principle is followed, the real estate mortgage right would certainly have priority over the taxes and fees generated during the auction process. However, in this case, the tax authorities ignored the fact that the mortgage right was established by Company B, the real estate mortgage holder, prior to the auction, and demanded priority in deducting taxes from the auction proceeds. What is the basis for their claim? The following response letter represents the views of some tax authorities and judicial institutions:

In the "Letter of Response of the Shenzhen Taxation Bureau of the State Administration of Taxation Regarding Proposal No. 20210039 of the Seventh Session of the Municipal People's Political Consultative Conference," the Shenzhen Taxation Bureau holds the view that "the taxes referred to in Article 45 of the Law of the People's Republic of China on the Administration of Tax Collection refer to the historical unpaid taxes of taxpayers, while the taxes and fees generated during judicial auctions of real estate are similar to auction expenses. These expenses arise from judicial auctions and are necessary expenses for judicial auctions. Therefore, they do not apply to the rules of repayment priority stipulated in Article 45 of the Law of the People's Republic of China on the Administration of Tax Collection and should be repaid with priority from the auction proceeds."

The Shenzhen Intermediate People's Court believes that "according to the first paragraph of Article 45 of the Law of the People's Republic of China on the Administration of Tax Collection, in cases where there is already a security interest established on the real estate subject to judicial auction, the taxes and fees arising from the auction necessarily arise later than the establishment of the relevant secured creditor's rights. Therefore, they should be repaid after the secured creditor's rights on the auctioned real estate have been repaid. Consequently, under the model where the buyer and seller each bear their respective taxes in auction transactions, it is possible that the auction proceeds may not be sufficient to pay the taxes and fees arising from the auction after repaying the secured creditor's rights on the auctioned real estate. Meanwhile, the tax authorities must adhere to the tax collection regulation of "tax before certificate," ultimately leading to the inability to complete the ownership change of the auctioned property and affecting the efficiency of execution."It can be seen that some tax authorities consider the taxes and fees related to real estate auctions as necessary expenses for judicial auctions, while some courts believe that, from the perspective of the efficiency of real estate auction executions, priority should be given to ensuring tax collection to safeguard the smooth completion of auctions.

Is the real estate mortgage right superior to the taxes and fees arising from the auction process? The understanding of the administrative and judicial authorities mentioned above is, in the author's opinion, unreasonable. The reasons are as follows:

Firstly, the necessary expenses of judicial auction are inevitable expenditures to ensure the smooth conduct of the auction. According to Article 34 of the "Provisions of the Supreme People's Court on Issues Concerning the Implementation of the Work of the People's Courts (Trial)" (Legal Interpretation [2020] No. 21), "After the auction or sale of the property of the person subject to execution, the money and property must be cleared up immediately. The actual expenses incurred in entrusting the auction or organizing the sale of the property of the person subject to execution shall be deducted in priority from the proceeds obtained." Article 6 of the "Provisions of the Supreme People's Court on Auction and Sale of Property in Civil Execution by the People's Court" states, "After the determination of the reserved price, based on the calculation using the reserved price of the current auction, if there is no possibility of any remaining proceeds after repaying the preferential creditor's rights and enforcement expenses, the relevant circumstances shall be notified to the applicant for enforcement before the auction is implemented. If the applicant for enforcement applies for continued auction within five days after receiving the notice, the people's court shall permit it, but the reserved price shall be re-determined; the newly determined reserved price shall be greater than the total amount of the preferential creditor's rights and enforcement expenses. If the auction fails to sell as stipulated in the preceding paragraph, the auction expenses shall be borne by the applicant for enforcement." It can be seen that the actual expenses incurred during the auction are necessary expenditures for the auction, such as the assessment fees and commission auction expenses for general auctioned property.

Secondly, taxes such as value-added tax, urban construction tax and surcharges, and land value-added tax are not necessarily incurred during the auction process. Except for small-scale taxpayers, the calculation method for value-added tax is the difference between the current output tax and the input tax. The calculation basis for urban construction tax and surcharges is determined based on the actual payment of value-added tax and consumption tax. Land value-added tax is calculated based on the difference between income and deductible items and the value-added rate. In other words, whether taxes need to be paid for the auction of real estate cannot be determined solely through the auction proceeds. In extreme cases, it is possible that the value-added amount is negative and no land value-added tax needs to be paid, or there may be a large amount of retained tax credits or a large amount of current input tax credits, resulting in no need to pay value-added tax, urban construction tax, and surcharges. Therefore, these taxes do not constitute necessary expenses for judicial auctions.

Thirdly, the necessary expenses of judicial auctions have simple market pricing rules. For example, assessment fees and expenses incurred for entrusting auction platforms can be determined promptly based on the auction proceeds. However, the determination of the amounts of value-added tax and land value-added tax requires the cooperation of the person subject to execution to provide relevant information; otherwise, the tax authorities cannot accurately determine the taxable amount. If it involves the land value-added tax settlement of real estate development enterprises, it may take at least half a year to determine the payable land value-added tax after the settlement and audit process. In general, the taxable amount cannot be accurately determined immediately from the auction proceeds.

Finally, regarding the viewpoint of the judicial authorities mentioned above that if the taxes are not deducted from the auction proceeds first, it may lead to the inability of the person subject to execution to pay taxes and difficulties in completing the transfer of ownership, we believe that the buyer should bear the taxes they should pay and proceed with the transfer of ownership accordingly. There are already local policies and regulations in this regard. According to the "Notice of the Beijing Municipal Taxation Bureau on Adjusting the Business Processing Procedures for Transactions of Existing Housing Among Enterprises" (Beijing Taxation Issuance [2021] No. 43), Article 2 stipulates: "The seller (transferor) shall pay the taxable fees within the prescribed time limit through online reporting and payment through the Beijing E-Tax Bureau. The completion of land value-added tax, property tax, and urban land use tax shall no longer be a prerequisite for accepting the declaration of deed tax." Whether the person subject to execution pays value-added tax, land value-added tax, etc., does not affect the buyer's application for deed tax and subsequent transfer of ownership.

Therefore, specifically in this case, we believe that the value-added tax, urban construction tax and surcharges, and land value-added tax arising during the auction process are later than the establishment of the real estate mortgage right.

04

Does the real estate mortgage right have priority over the stamp duty that is incurred immediately upon the successful conclusion of an auction?

In the auction process, there are actual expenses such as evaluation fees and auction commission fees, which have simple market pricing rules and are inevitable costs for completing the auction. In judicial auctions, the stamp duty incurred during the transfer of real estate falls into this category.

According to Article 1 of the Stamp Tax Law: "Units and individuals who establish taxable instruments or conduct securities transactions within the territory of the People's Republic of China are taxpayers of stamp tax and shall pay stamp tax in accordance with the provisions of this Law." This indicates that a taxable act gives rise to a tax obligation. Furthermore, Article 3(7) of the Announcement on the Policy Implementation Guidelines for Several Matters Concerning Stamp Tax (Announcement of the Ministry of Finance and the State Administration of Taxation No. 22, 2022) stipulates that "Stamp tax paid for unfulfilled taxable contracts and documents of property rights transfer shall not be refunded or used to offset other taxes." This means that once stamp tax is paid for the transfer of real estate, even if the contract is not fulfilled subsequently, the paid stamp tax cannot be refunded. This further confirms that stamp tax is a typical behavioral tax that is incurred immediately upon the occurrence of a taxable act.

Therefore, we believe that the stamp duty incurred immediately upon the successful conclusion of a judicial auction, as a necessary expenditure during the auction process, should have priority over the real estate mortgage right and be deducted in advance.

Conclusion

Although the order of repayment for taxes and secured debts is clearly stipulated in Article 45 of the Tax Administration Law, disputes surrounding these issues have not entirely dissipated in judicial practice. Particularly, there is significant controversy regarding whether the tax authorities have priority in recovering taxes and fees arising from auction processes. Based on the analysis presented above, we believe that stamp duties corresponding to auctions constitute necessary expenses for judicial auctions, while other taxes and fees should not be included in this category due to uncertainties surrounding their occurrence. These taxes and fees, as tax credits, have a priority of repayment determined by Article 45 of the Tax Administration Law. It is advisable for holders of real estate mortgage rights to closely monitor the disposition of the mortgaged property and keep track of the timing of the emergence of other credits, especially tax credits, when debtors fail to repay debts on schedule. They should safeguard their legitimate rights and interests according to the law and, if necessary, seek assistance from tax lawyers.