How to Enhance Tax Compliance as Many Province Withdraw Financial Incentives?

Abstract: On August 1, 2024, the Regulation on Fair Competition Review will come into effect, making it clear that the formulation of policies and measures containing elements that affect the cost of production and business is prohibited without a legal or administrative regulatory basis or without the approval of the State Council. Recently, in order to implement the Audit Office, the Municipal Supervision Bureau, the Ministry of Justice and other departments to focus on cleaning up the spirit of the documents that impede the unification of the market and fair competition policies and measures, a number of places to clean up the illegal financial rebates, standardize investment policies to formulate a work program. However, due to the lack of accurate grasp of laws and regulations and specific standards, enterprises may be difficult to judge the legitimacy of the relevant policies and measures, which leads to some enterprises in the conduct of daily business in the center of the hidden worries. This article compiles recent cases of government subsidies and support funds being withdrawn in several places, and provides tax compliance suggestions for enterprises based on the new regulatory situation.

-

Multiple Companies Have Been Ordered to Return Government Subsidies and Support Funds

Recently, the Audit Office, the Municipal Supervision Bureau, the Ministry of Justice and other departments have expressed their opinions on cleaning up laws and regulations and policies that do not treat enterprises equally through notices and announcements, and the spirit of the above documents has been implemented in the work of abolishing illegal financial rebates and standardizing investment promotion policies in various regions. Based on the published information, the author has compiled a list of some of the cases in which government grants and support funds were ordered to be returned, with the highest amount reaching RMB 24 million.

1.Listed companies

(1)Jiangsu Boqian New Materials Co., Ltd. - Announcement on Refunding Government Subsidies

Reason for Return: The company has received a "Notice of Return of Rewards" from the Management Committee of Suqian High tech Development Zone. The notice indicates that the two reward funds received by the company in March 2023 and June 2023 do not comply with relevant policies. In order to regulate fiscal expenditure behavior, the company should transfer the above-mentioned two reward funds to its designated account before February 29, 2024.

Impact on the Company: a decrease of 20.4 million yuan in net profit for the year 2023.

(2)Angel Yeast Co., Ltd. - Announcement on Refunding Government Subsidies

Reasons for Return: on December 14, 2021, Hongyu Packaging, the controlling subsidiary, received the Notice on the Return of Government Subsidy Funds from Yiling District Bureau of Economy and Information Technology, which indicated that as the 2020 provincial-level special funds for high-quality development of the manufacturing industry declared by Hongyu Packaging were not in line with the current policy, the relevant subsidy funds were required to be returned in accordance with the requirements of the higher authorities. on December 15, 2021, Hongyu Packaging returned the government subsidy funds in full.

Impact on the Company: Reduction of the Company's net profit attributable to the owners of the parent company for the current period by RMB202,600,000, reduction of the Company's minority shareholders' profit and loss by RMB109,100,000, and reduction of the Company's deferred income by RMB2,361,600,000.

2.Deregistered companies

(1)Mr. Li - Notice on the Return of Tax Incentives and Industrial Support Funds

Reason for return: the Company received RMB2,453,000 in tax incentives and industrial support funds on three occasions during the period from January 1, 2023 to May 31, 2023 from a regional management committee. According to Article 3(2) of the Tax Collection and Management Law and Article 4 of the Circular of the State Council on Matters Relating to Preferential Policies on Taxation and Other Preferences (Guo Fa [2015] No. 25), etc., the aforesaid funds received by the Company violated the provisions of the national tax laws and regulations and policies. A regional management committee intends to decide to recover the tax incentives and industrial support funds of RMB2,453,000 received by the Company in accordance with the law.

Impact on Shareholders: You, as a shareholder and actual beneficiary of the company, shall bear the corresponding legal responsibility in accordance with the law, and it is proposed to order you to return the aforesaid funds received by the company in accordance with the proportion of 100% of the registered shareholding, and the amount of the return shall be RMB 2,453,000.

(2)Mr. Guo - Notice on the return of tax incentives and industrial support funds

Reason for Return: the Company received 8,534,150 yuan of tax incentives and industrial support funds on five occasions between January 1, 2022 and May 31, 2022 from a regional management committee. According to Article 3(2) of the Tax Collection and Management Law and Article 4 of the Circular of the State Council on Matters Relating to Preferential Policies on Taxation and Other Preferences (Guo Fa [2015] No. 25), among others, the aforesaid funds received by the Company violated the provisions of the national tax laws and regulations and policies. The Management Committee intends to decide to recover the tax incentives and industrial support funds of RMB8,534,150 received by the Company in accordance with the law.

Impact on Shareholders: As a shareholder and actual beneficiary of the Company, you shall bear the corresponding legal responsibilities in accordance with the law, and it is hereby proposed to order you to return the aforesaid funds received by the Company in accordance with the proportion of 50% of the registered shareholding, with the amount of return amounting to RMB4,267,075.

(3)****** Information Technology Co., Ltd - Notice of Return of Tax Incentives and Industrial Support Funds

Reason for Return: your Company received RMB24,325,310 in tax incentives and industrial support funds on 10 occasions during the period from December 1, 2021 to May 31, 2023 from a regional management committee in accordance with the "Cooperation Agreement on the Human Resources Sharing Economic Platform Project" and the relevant approvals of the county government. According to Article 3(2) of the Tax Collection and Management Law and Article 4 of the Circular of the State Council on Matters Relating to Preferential Policies on Taxation and Other Preferences (Guo Fa [2015] No. 25), among others, the aforesaid funds received by your Company violated the provisions of national tax laws and regulations and policies.

Impact on the Company: a regional management committee intends to decide to recover the tax incentives and industrial support funds of RMB24,325,310 received by the Company in accordance with the law.

(4)****** Information Technology Co., Ltd - Notification of Return of Tax Incentives and Industrial Support Funds

Reason for Return: the Company received RMB11,943,000 in tax incentives and industrial support funds twice between March 1, 2022 and March 31, 2022 from a regional management committee. According to Article 3(2) of the Tax Collection and Management Law and Article 4 of the Circular of the State Council on Matters Relating to Preferential Policies on Taxation and Other Preferences (Guo Fa [2015] No. 25), among other things, the aforesaid funds received by the Company violated the provisions of the national tax laws and regulations and policies. The Management Committee intends to decide to recover the tax incentives and industrial support funds of RMB11,943,000 received by the Company in accordance with the law.

Impact on Shareholders: As a shareholder and actual beneficiary of the Company, you shall bear the corresponding legal responsibilities in accordance with the law, and it is hereby proposed to order you to return the aforesaid funds received by the Company in accordance with the proportion of 50% of the registered shareholding, with the amount of return amounting to RMB5,971,500.

(5)****** Investment Consultant Group Limited - Notice of Return of Tax Incentives and Industrial Support Funds

Reason for Return: ****** Enterprise Service Company Limited received 7,157,510 yuan of tax incentives and industrial support funds on three occasions during the period from December 1, 2021 to March 31, 2022 from a regional management committee. According to Article 3(2) of the Tax Collection and Management Law and Article 4 of the Circular of the State Council on Matters Relating to Preferential Policies on Taxation and Other Preferences (Guo Fa [2015] No. 25), among others, the Company's receipt of the aforesaid funds violated the provisions of the national tax laws and regulations and policies. The Management Committee intends to decide to recover the aforesaid funds received by the Company.

Impact on Shareholders: the Management Committee intends to order your Company to return the tax incentives and industrial support funds of RMB7,157,510 in proportion to its 100% shareholding.

As can be seen from the above case, the important reason for ordering the company to return the funds is that the company's acquisition of government grants is not justified by law. In addition, we note that the subject of the return responsibility is the enterprise that received the government grants, financial incentives and subsidies. If the enterprise has been written off, there is a phenomenon of ordering shareholders and actual beneficiaries to return the government grants, financial incentives and subsidies they have received in proportion to their shareholdings. As a result, once the risk of returning financial refunds is triggered, shareholders and beneficial owners of canceled enterprises are also exposed to the risk of having their financial refunds recovered.

-

A Number of Companies are at Risk of Having Their Financial Returns Recovered

Even if the fiscal rebates obtained have not yet been ordered to be returned, the risk of their recovery affects the daily operation of the enterprise. In the past three years, a number of legal opinions published by enterprises have disclosed that there is a risk that the fiscal rebates obtained by them, which are linked to tax revenues, will be recovered.

For example, in the Legal Opinion on Initial Public Offering of Shares and Listing on the GEM Board, Guoscience Tiancheng Technology Co., Ltd. clarified that, "In September 2021, the Zhongguancun Science City Management Committee and the Issuer entered into the Strategic Cooperation Agreement on Support of Guoscience Tiancheng Technology Co., Ltd. by the Management Committee of Zhongguancun Science City, which stipulates that based on the fact that Guoscience Tiancheng will make a contribution of 1,000 million yuan to the district level in the 2021 district contribution of $13,825,000 in 2021, district contribution of $22,000,000 in 2022, and revenue district contribution of over $33,000,000 in 2023 under the measurement conditions, the enterprise will be granted a financial support of 50% of the ringgit increment of district contribution for three consecutive years in 2020, 2021 and 2022 to satisfy the enterprise's needs for housing leasing and space remodeling during the development period. According to Article 2 of the Circular of the State Council on Correcting the Policy of Localities Formulating Taxes on Their Own and Returning Them After Collection (Guo Fa [2000] No. 2), the Issuer's enjoyment of the aforesaid governmental subsidies calculated in accordance with the proportion of district-level contributions may be recognized as tax rebates and the policy has not been approved by the State Council, and there is a risk of being recovered." In this regard, the actual controller of the issuer made a commitment that "in the event of a situation where the financial subsidy payments obtained by the issuer as a result of the "Strategic Cooperation Agreement of Zhongguancun Science City Management Committee in Support of Guoketiancheng Science and Technology Co." are being recovered, I will undertake the issuer in cash in a timely manner, unconditionally, and in full amount."

As another example, Qiaoyi Logistics Co., Ltd. made it clear in the Supplemental Legal Opinion on Initial Public Offering of Shares and Listing on the Main Board (IV) that "According to Article 2 of the Circular of the State Council on Correcting the Policy of Localities Formulating Taxes on Their Own for Prior Levy and Later Refunding (Guofa [2000] No. 2), Qiaoyi of Suzhou based on the "Cebu City Zhongyun Network Freight Transportation and Digital Logistics Industrial Park Admission Enterprise Agreement", there is a risk that the incentive fund of RMB362,632, calculated in accordance with the corresponding proportion of the local retention of tax, received during the period from January 1, 2023 to June 30, 2023, will be recovered if it is not approved by the State Council." In this regard, the actual controller of the Issuer made a commitment that "If Cebu Qiaoyi receives incentive funds calculated in accordance with the corresponding proportion of the local retention of taxes based on the "Agreement on Enterprises Entering the Cebu City Zhongyun Network Freight Transportation and Digital Logistics Industrial Park" because of the non-compliance with the relevant provisions of the national laws and regulations, which results in Cebu Qiaoyi being required to return the incentive funds it has already received and/or Cebu Qiaoyi suffering any losses as a result I will unconditionally compensate Suzhou Qiaoyi for any losses incurred so that Suzhou Qiaoyi will not suffer any economic losses as a result of the failure to comply with the relevant provisions of national laws and regulations."

As another example, Suzhou Qingyue Optoelectronics Technology Co., Ltd. clarified in the "Legal Opinion on Initial Public Offering of Shares and Listing on Kechuan Board" that "On April 20, 2016, Gongqingcheng Municipal People's Government and Jiujiang Visuno entered into the "Visuno OLED Project Investment Contract Book" (No. 201604008A) and the "Visuno OLED Project (No. 201604008B), agreeing that the Municipal People's Government of Gongqingcheng will reward Jiujiang Visionox OLED Project with 80% of the local retention portion of the annual tax payment within 5 years from the tax payment year, and extend the period by 2 years if Jiujiang Visionox is recognized as a high and new technology enterprise; and that land use tax and property tax paid by Jiujiang Visionox will be paid at the rate of the local retention portion of the tax payment of 100% in the first year, 80% in the second year, 60% in the third year, 50% in the fourth year and 40% in the fifth year. RMB941,010.47 of the government subsidies enjoyed by Jiujiang Qingyue during the period from July 1, 2021 to December 31, 2021 were tax rebate support funds obtained pursuant to the aforesaid agreement. Pursuant to Article 2 of the Circular of the State Council on Correcting the Policy of Localities Formulating Taxes on Their Own for Prior Levy and Later Refund (Guo Fa [2000] No. 2), the aforesaid tax refund policy enjoyed by Jiujiang Qingyue has not been approved by the State Council, and there is a risk that it will be recovered." In this regard, the actual controller of the Issuer has made a commitment that "In the event that the tax rebates obtained as a result of the "Investment Contract for Visuno OLED Project" and the "Supplementary Agreement to the Investment Contract for Visuno OLED Project" are being recovered, I will promptly, unconditionally and in full in cash undertake to pay the back taxes payable and all the related expenses incurred as a result thereof; and irrespective of when such recovery occurs at any time, it has nothing to do with the new shareholders after this public offering."

The recovery of the rebate will have a direct impact on the company's net profit for the year. Enterprises with commercial arrangements such as listing and share issuance are required to disclose as a tax risk to the issuer the receipt of financial rebates linked to tax revenues. In practice, in order to obtain a legal opinion that "it does not constitute a substantial legal obstacle to the issuer's issuance and listing", the proposed listed company usually needs the issuer's actual controller to sign a commitment letter to provide assurance for possible recovery in the future. This puts higher requirements on the risk-bearing ability of the actual controller of the issuer.

-

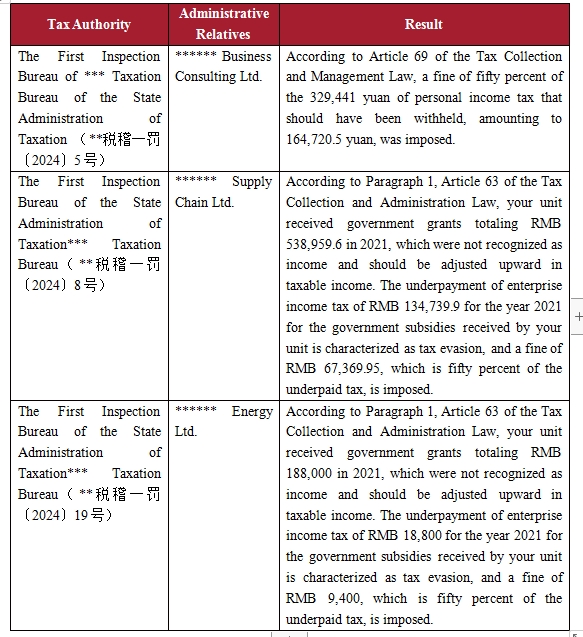

Several Companies Penalized for Obtaining Government Grants without Filing Tax Returns

In practice, even if an enterprise obtains financial subsidies in compliance with the law, there are cases in which some enterprises fail to make tax declarations in accordance with the law. During the year, a number of cases have been publicized in which enterprises were ordered by the tax authorities to pay back taxes and late fees, and fined for failing to file tax declarations for the government subsidies they received.

According to the relevant regulations, if an enterprise obtains financial incentives and subsidies and meets the following three conditions at the same time, it may treat them as non-taxable income for the purpose of enterprise income tax: (a) the enterprise can provide the fund allocation documents stipulating the special purpose of the funds; (b) the financial department or other governmental departments allocating the funds have special fund management methods or specific management requirements for the funds; (c) the enterprise accounts separately for the funds and expenditures incurred with the funds; and (d) the enterprise has a separate accounting system for the funds and for expenditures incurred with the funds. (c) the enterprise accounts for the funds and the expenditures incurred with the funds separately. If the above conditions are not met, the financial subsidy income received by the enterprise from the government department shall be included in the total income and calculated for the payment of enterprise income tax.

If the financial subsidies not meeting the above conditions are treated as non-taxable income, the enterprise will face the risk of tax adjustment; if it is considered to constitute tax evasion, the tax authorities have the right to order the enterprise to pay back the income tax, late payment fees and impose a fine of not less than 50% and not more than 50% and not more than 5 times of the unpaid or underpaid tax according to Article 63(1) of the Law of the People's Republic of China on the Administration of Taxation and Revenue Collection; and the enterprise may face the risk of criminal liability for the suspected crime of tax evasion in the event of a serious circumstance. risk of being held criminally liable for the crime of tax evasion.

-

Stricter regulation of fiscal rebates and tax incentives

Recently, there has been a surge in the number of cases in which government grants have been ordered to be returned, fiscal rewards and subsidies have been returned, and fiscal rewards have been unable to be paid. Throughout the laws and regulations related to fiscal rebates, fiscal rebates that break the national tax policy have long been the focus of China's tax supervision.

Initially, the regulatory focus was on tax incentives without laws and regulations as a basis. In the Notice of the State Council on Correcting the Policy of Localities to Formulate Taxes on Their Own and Return Them After Collection (Guo Fa [2000] No. 2), the Decision of the State Council on Deepening the Reform of the Budget Management System (Guo Fa [2014] No. 45), and the Notice of the State Council on Cleaning Up and Standardizing Preferential Policies on Taxes and Other Preferences (Guo Fa [2014] No. 62), it is emphasized that tax preferences of various regions shall not exceed their legal The documents emphasize that tax preferences in each region shall not exceed their legal authority and shall not break through the national unified fiscal and tax system, which corresponds to the spirit of the principle of tax legislation in article 3, paragraph 2, of the Tax Collection and Administration Law.

Subsequently, financial incentives formulated in violation of the law have also been brought into the regulatory focus. In the Opinions of the State Council on the Establishment of a Fair Competition Review System in the Construction of the Market System (Guo Fa [2016] No. 34), the Circular of the General Administration of Market Supervision and Other Five Departments on the Issuance of the Implementing Rules for the Fair Competition Review System (Guo Municipal Supervision and Anti-Monopoly Regulation [2021] No. 2), the Circular on the Cleanup of Policies and Measures Obstructing Unified Markets and Fair Competition (Guo Municipal Supervision and Competition Association [ 2023] No. 53), and the Announcement of the Ministry of Justice on Carrying Out the Cleanup of Policies Involving Laws and Regulations on Unequal Treatment of Enterprises, fiscal incentives linked to taxation were included in the scope of the cleanup. In addition, fiscal preferential policies affecting market access and exit, the free flow of commodities and factors, production and business behavior, and other policies affecting the cost of production and business have received similar attention.

In the recent cases of enterprises returning financial incentives, the reason was that the incentive policy on which they were based was in violation of the law because it was linked to tax and fee revenues. In the author's view, on the one hand, it should be noted that similar cases have revealed the legal risks faced by enterprises in obtaining financial reimbursement linked to tax and fee incomes; on the other hand, local governments enjoy autonomy over their local budgets, and granting a certain amount of space to financial reimbursement policies that have gone through the procedures of local budgetary expenditures or adjustments will help localities to tailor support for their special industries. In addition, some localities have the right to reduce or waive taxes in accordance with the law, for example, autonomous regions and prefectures have the right to make tax reduction or waiver decisions in accordance with Article 34 of the Law on Regional Ethnic Autonomy, which requires enterprises to pay attention to the legal basis of the fiscal rebate policy.

-

Suggestions for Corporate Tax Compliance Management under the Trend of Strict Regulation

According to the foregoing, enterprises that have received financial rebates and awards may face the following risks: first, if the policy on which the financial rebates are based is found to be invalid, the enterprise will face the risk of being ordered to return the financial rebates. The financial data of operating enterprises will be affected, and the shareholders and actual beneficiaries of canceled enterprises may also be ordered to return the financial rebates corresponding to their proportion of equity. Even if the policy on which the financial reimbursement is based has not been recognized as invalid, the risk of recovery of the financial reimbursement will have an impact on the conduct of the business activities of the enterprise. In addition to disclosure as information that has a material impact on investors' investment decisions, in order to obtain a legal opinion that there are no substantial legal impediments, the issuer's actual controller may also need to provide assurances as to the risk of recovery of the financial rebates. Secondly, if the company obtains a compliant financial rebate, the company should clarify the nature of the financial rebate and fulfill the tax declaration obligation in a timely manner. Otherwise, it may face the risk of paying back taxes and late fees, and being imposed a fine.

Under the new regulatory developments, enterprises should pay attention to the above risks in their tax compliance. For enterprises that have already obtained financial rebates, they should pay attention to the latest regulatory developments and regularly conduct self-examination on the compliance of obtaining financial rebates; they should keep sufficient information in the application, payment and use of financial rebates; they should pay attention to the nature of the financial rebates they have obtained, and fulfill the obligation of tax declaration in a timely manner. For enterprises that intend to strive for industrial support policies, they should review the compliance of preferential policies in terms of legal basis, conditions for application and payment, and contents of agreements, etc.; understand the stability of past preferential policies, assess the feasibility of the policies, and seek professional advice from tax professionals when necessary.