Overstatement of low-value product is not necessarily equal to tax fraud, case analysis of the core elements of the crime of fraudulent export tax rebates

Editor's Note: In March 2024, the “two high courts” announced eight typical cases together with the much-anticipated “Interpretation on Several Issues Concerning the Application of Law in Handling Criminal Cases of Endangering Tax Collection and Administration”, in which the case of Shi 's tax fraud through low-value and high-value declarations was exemplary for clarifying the definition of crimes and non-crimes of export tax rebates. Recently, many cases of tax fraud by under-reporting have broken out in practice. In view of this, this paper analyzes the core of the frequent low-value overstatement tax fraud cases by analyzing the tax fraud case of Shi , and gives the ideas of defending the low-value overstatement tax fraud cases for the benefit of the readers.

I. Typical Case Analysis: Shi 's “Low Value High Report” Tax Fraud Case

(Ⅰ) Two Supreme’s notification case

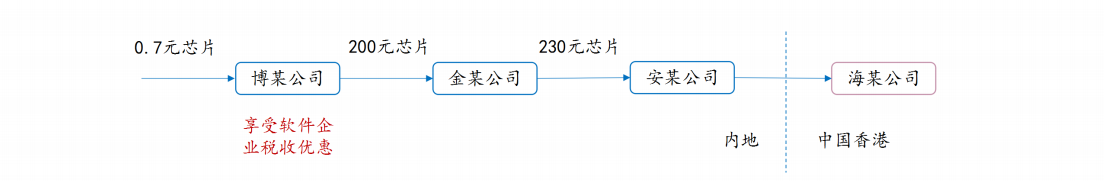

Party information: in December 2017, Shi registered to set up Bo company and Jin company, which Bo company as a software enterprise to enjoy tax incentives. Shi and find Huang, by Huang bo control foreign trade enterprise An company, at the same time, Huang set up in Hong Kong sea company, as a false foreign businessman.

Domestic sales : Shi control Bo company outsourcing 0.7 yuan 1 piece of blank chip, write current sampling control software, with 200 yuan 1 piece of price, sales to gold company and invoice. Shi and arrange Jin company will chip processing for module, to 230 yuan unit price of about sold to An company and invoicing.

Export: An company will export the module to Hai company, the module arrives in Hong Kong in accordance with the garbage disposal.

Declaration of export tax rebate: after the export of goods, Shi , Huang bo and other people to raise U.S. dollars, back to the capital, complete the settlement of foreign exchange in An company, by Jin company will be the VAT invoice mailed to An company, An company with the above VAT invoice and export declaration materials to the tax authorities to apply for an export tax rebate.

After appraisal, the market value of the chip produced by Bo Company was RMB 1.32 yuan, and the market value of the control module produced by Jin Company was RMB 7.31 yuan.

(Ⅱ) Judicial determination and processing results

The judicial authorities firstly recognized the domestic sales link, i.e. Bo Company sold the chip to Jin Company at the price of RMB 200, and Jin Company then sold the so-called module to An Company at the price of RMB 230, as false price increase, false sales, and false issuance of VAT invoices.

Then, the judicial authorities determined that Shi and others, by inflating the price of inexpensive products and issuing false VAT invoices, cheated the national export tax rebates with inflated export tax refunds, which constituted fraudulent export tax refunds, and sentenced the defendant Shi to eleven years of fixed-term imprisonment and imposed a fine of RMB 5,000,000 yuan; and sentenced the co-defendants to five to six years of fixed-term imprisonment and imposed a fine, respectively.

Ⅱ. The core dispute: whether there is false opening and tax fraud in this case?

(I) Domestic trade: there is no tax loss in buying low and selling high, and it does not belong to false invoicing

According to the description of the case, the judicial authorities determined that “Bo Company, in the name of selling current sampling control chips, falsely sold and falsely issued VAT invoices to Jin Company”, and “bought worthless chips at a low price, and sold them at a high price to the foreign trade enterprises” in the domestic trade link. Qualified as false invoicing, the domestic trade enterprise controlled by Shi and the foreign trade enterprise controlled by Huang bo conspired to use the false invoices to cheat tax, and was eventually found guilty of fraudulent export tax rebates. As can be seen from the description, it seems that the judicial authorities have determined that even if there is indeed a transaction of goods, the transaction price obviously deviates from the normal transaction price, and that part of the overstated value belongs to false invoicing.

However, from the principle of VAT deduction and the legal interests infringed by the crime of false invoicing category, regardless of the geometry of the transaction price of the goods, as long as the buyer truthfully pays the tax in accordance with the transaction price, the invoices issued, the goods sold, and the tax paid are all in line with the real transaction situation; as to whether the civil subject has a price in the transaction that obviously deviates from the fair value, it should belong to the category of meaningful autonomy, and in the case of not eroding the tax base, the The public right should not intervene and should not recognize the transaction invoice as false opening.

(Ⅱ) Export : the purchase of goods and export trade is real, and the overstatement of price is an objective crime-cannot, which does not constitute tax fraud

Export tax rebate refers to the state to export goods of raw materials import tax and in the domestic production and circulation of all aspects of the paid value-added tax, consumption tax and other indirect taxes tax refunded to export enterprises, so that export commodities to the international market at a price that does not include indirect taxes, to participate in the international competition of a tax system.

According to the Circular of the Ministry of Finance and the State Administration of Taxation on the Policies of Value-added Tax and Consumption Tax on Exported Goods and Services (CaiShui No. 39 of 2012), the ant of tax refundable for the current period shall be based on the lower value of the ant of tax retained at the end of the current period and the ant of exemptions and credits for the current period. It can be seen that export tax rebate is not a preferential tax policy, which is capped by the ant of VAT paid (input tax) and cannot exceed the ant of VAT paid. Therefore, in the case that the domestic trade has truthfully assumed the VAT tax obligation, the enterprise overstated the value of the goods objectively can not obtain more tax rebates, and it is not appropriate to qualify as the crime of obtaining export tax rebates by deception.

The above view is also supported by cases in practice. (2017) Qiong criminal final judgment No. 60 states that “as mentioned above, as long as the purchase of goods and export trade are real, the overstatement can not produce the benefit of more tax refunds. The evidence in the case cannot deny the existence of fictitious situation of 2158 single export trade of China Fishery Company, therefore, even if the two defendants subjectively have the intention of overstating the price, it belongs to the cognitive error, and it is the objective crime cannot be.”

III. Possibility analysis: Bo Company, as a software enterprise, there is something fishy in the immediate tax refund

Through the above analysis, in the disclosed details of the case, it seems impossible to conclude that Shi belongs to the crime of tax fraud. Due to the adjudication documents of the case have not been published, it is impossible to determine what kind of behavior of Shi is the cause of its final was convicted of fraudulent export tax rebate, the author speculates that there may be two reasons: one is a false opening behavior, and the low value of the high report is the result of the false opening behavior, and eventually the whole case is found to be tax fraud; two is Shi using Bo company software enterprise can enjoy the qualification of the policy of immediate tax rebate, to obtain the undue tax benefits, and is found to be as tax fraud. For the first possibility, it meets the constitutive elements of tax fraud, caused the result of the loss of national tax, and it is reasonable to find the tax fraud is also in line with the previous analysis. However, if there is no false opening behavior, only using the policy of instant tax refund to cause tax loss, should it be recognized as tax fraud crime?

(I) The policy of immediate tax refund and the possibility of the case

The policy of “immediate refund” is a policy whereby the tax authority first collects the full ant of VAT and then refunds all or part of the collected VAT to the taxpayer. For software enterprises, after selling their self-developed and produced software products and collecting VAT at a rate of 13%, the policy of immediate refund can be implemented according to the portion of their actual VAT burden exceeding 3%.

In the second possibility, after Shi wrote the blank chip of 0.7 yuan into the simple current sampling control software, he inflated the price to the price of 200 yuan, and then refunded the part that exceeded the actual tax burden of more than 3% through the qualification of Bo Company's instant tax refund. This link, the inflated price is meaningful, the higher the price the greater the ant of refund, thus explaining the motivation of low value overstatement. And then, Shi and Huang conspired to complete the export tax refund through the foreign trade enterprises and foreign businessmen controlled by Huang .

(Ⅱ) If the policy of immediate tax refund is utilized, does it constitute tax fraud or tax evasion?

According to the “Ministry of Finance State Administration of Taxation on software products VAT policy notice” (Cai Shui [2011] No. 100), Article 1, enjoy the value-added tax that is refundable policy of the scope of the software products for its self-development and production of software products and localized transformation of imported software products, are required to apply for the enterprise has a substantial contribution to the software products. However, from the disclosed details of the case, the current sampling control software written by Bo Company is not self-developed and does not belong to the product with originality, and it should not enjoy the policy of immediate tax refund. For this part of the tax, the behavior of Shi and others did cause tax loss, but this part of the tax loss should be characterized as tax fraud or tax evasion?

The core of export tax rebate is to refund the negative tax of the real export goods, so that they do not bear tax to participate in the international market competition, while the core of the crime of cheating export tax rebate lies in the false enhancement of the item, the abuse of the right of deduction, resulting in the part of the tax that should be borne by the negative tax but not the negative tax is returned, so that the ant of tax rebate is higher than the ant of the tax that has been borne by the negative ant of the tax, which results in the loss of national tax. Combined with the previous analysis, the policy of instant tax refund will not increase the item falsely, and the exported commodities are real and have been tax-negative, which satisfy the substantive conditions of export tax refund and do not meet the behavioral elements of fraudulent export tax refund. From another point of view, the policy of immediate refund is a tax preference policy, and it should be a cheating of tax preference, not export tax refund, to obtain immediate refund through false means to meet the requirement of immediate refund. In summary, after the above analysis, it may be more reasonable to deduce the conclusion that the use of the instant refund policy is tax evasion rather than tax fraud.

At present, the adjudication documents of Shi's case have not yet been published, so the specific details and the court's reasoning process are not known. All of the above analysis is based on one possibility assumed by the article, and is not a restoration of the real case.

IV. Risk Warning: Increase in the number of low-value and high-reporting tax fraud cases and tightening of investigation and handling

We concerned that there are many cases of low value overstatement fraudulent export tax refund cases breaking out recently, for example, Hunan tax announced a low value overstatement fraudulent tax case. The enterprise involved in the case fraudulently obtained export tax refund through obtaining false VAT invoices, low value overstatement and other illegal means, and the tax department recovered 29.55 million yuan of fraudulent export tax refunds, Liu and Ruan were sentenced to 12 years' and 3 years' fixed-term imprisonment for the crime of fraudulent export tax refunds, and Deng and Wu were sentenced to 3 years' fixed-term imprisonment for the crime of falsely opening VAT invoices, and the above four people were also punished with 29.5 million yuan; the company committed the crime of fraudulently obtaining export tax refund and was sentenced to 3 years' fixed-term imprisonment. million yuan; the company committed the crime of fraudulent export tax rebate and was sentenced to a fine of 29 million yuan.

For example, Shandong Provincial Tax Bureau of the State Administration of Taxation recently announced a case in which a food company purchased low-quality shiitake mushroom powder to fake shiitake mushroom agricultural products, and fraudulently obtained tax rebates by understating and overstating false exports. The case of fraudulently obtaining export tax rebates anted to RMB 4.63 million, and the legal representative was sentenced to eleven years' imprisonment for the crime of fraudulently obtaining export tax refunds and a fine of RMB 5 million, which is not a bad sentence. The persons and enterprises involved in the above two cases have the behavior of fraudulent invoicing and promotion, and it is reasonable and lawful to punish them for fraudulent export tax rebate.

It is worth noting that in March this year, after the two new judicial interpretations were issued, the description of the old judicial interpretations about the type of export tax fraud of low-value overstatement was changed from “although there are goods exported, but fictitious export of goods, such as name, quantity, unit price, etc., and fraudulently obtaining the part of the export tax rebate without actually paying tax” to “although there are exports, but fictitious refundable items are not refundable,” to “although there are exported, but fictitious refundable items are not refundable. Although there are exports, but fictional tax refundable export business name, quantity, unit price and other elements, to inflate the ant of export tax refunds declared export tax refunds. It can be seen that the two high judicial interpretations did not extend the old judicial interpretation of only “fraudulent untaxed portion” to pursue criminal liability for tax fraud, but will result in the elements to change to behavioral elements, only “inflated export tax refunds” as a means of tax fraud, which may lead to The part of the tax that the perpetrator did not inflate and for which he or she has borne the tax has also been recognized as the ant of tax fraud, resulting in the perpetrator bearing inappropriate criminal liability.

The outbreak of many low-value overstatement cases in practice and the policy orientation revealed by the judicial interpretation indicate that the low-value overstatement cases will be focused by the tax authorities in the future, and their tax-related risks are increasing, which need to draw the attention of the taxpayers.

V. Suggestions for defense: “overstatement of low-value production” is not equal to tax fraud

First of all, it should be clear that the fact that there is a low value overstatement in the case does not directly lead to the conclusion that it constitutes the crime of tax fraud. The core of the low-value overstatement tax fraud case lies in the inflated VAT input, therefore, the defense should be centered on whether the business has inflated the input and whether it has caused the loss of national tax.

(I) The deviation of transaction price does not affect the authenticity of the transaction, and the consistency of the three streams does not belong to false invoicing

First of all, it can be claimed that the ant of invoicing does not need to be equal to the fair value, and the actual transaction price is consistent with the false invoicing, and the overstated transaction price belongs to the category of civil subject's meaning of autonomy, and does not have the harmfulness of the tax law.

The core of the essence of false VAT invoices lies in the abuse of the right of deduction through false invoicing, which results in the output not being negatively taxed but the input being deducted, and the simple low value overstatement will not affect the chain of VAT invoice deduction, which should not be false invoicing. For example, in the case of Shi 's tax fraud, if Bo Company fully burdened VAT on the sale of chips with a unit price of RMB 200 and issued an invoice of RMB 200, then Jin Company's deductible inputs would also be RMB 200, which would not result in a loss of VAT payment.

(Ⅱ) There is no tax loss in the case of no false invoicing of inputs, which cannot constitute the crime of obtaining export tax rebate fraudulently.

As mentioned above, in the case of truthfully bearing the tax obligation, it will not cause the loss of national tax, therefore, in the low-value high-reporting type of export tax rebate, it is inevitable that it involves “false enhancement of inputs”. Therefore, on the basis of discussing the domestic trade link low value high report does not belong to the false opening, it can be clearly pointed out that no false enhancement of the behavior can not cause tax loss, belongs to the cognitive error, is the objective crime can not, can not constitute the crime of fraudulent export tax rebate.

In practice, since the low value overstatement is usually associated with the false enhancement, once the phenomenon of overstatement of export is found, some authorities tend to qualify the whole case as fraudulent export tax rebate. At a time when the overall supervision is tightening, taxpayers should actively engage professionals to intervene in the face of questioning or even auditing by tax authorities, and defend themselves from the harmfulness of the act, whether it has caused loss of tax, and the completeness of the evidence of the accusation, so as to protect the legitimate rights and interests of the taxpayers.