Whether a refining enterprise should be deemed to have carried out taxable production activities when directly selling externally purchased naphtha as raw material

Editor's Note: In the field of consumption tax, the production of taxable consumer goods is a taxable activity, while pure trading activities are not within the scope of taxation and naturally do not require the payment of consumption tax. However, a refining and chemical enterprise received a notice from its competent tax authority requiring it to pay back taxes on the sale of purchased naphtha raw materials. Is there a legal basis for the tax authority to do so? Should the refining and chemical enterprise pay consumption tax on its trading business of purchasing and selling naphtha? This article intends to analyze this issue.

I. Case Introduction: Refining and Chemical Enterprise Required to Pay Back Taxes for Selling Purchased Naphtha Raw Materials as Deemed Production

(i) Basic Case Facts

Enterprise A is a naphtha refining and chemical enterprise. The enterprise has two production processes, one is the atmospheric distillation process, which produces straight-run naphtha (commonly known as crude naphtha) after direct fractionation of crude oil, and the other is the hydrogenation process, which purchases crude naphtha and produces refined naphtha by hydrogenation to reduce sulfur, nitrogen and other impurities in the raw materials. At the end of 2019, Enterprise A purchased a batch of crude naphtha a as raw material, intending to process it into refined naphtha for external sales. However, the outbreak of the COVID-19 pandemic nationwide in 2020 led to the home isolation of most of Enterprise A's employees, causing its naphtha production and processing business to come to a semi-standstill. In order to recover funds, Enterprise A changed its business strategy and adjusted its original plan of deep processing of naphtha to direct external sales. In March 2020, Enterprise A sold not only the purchased crude naphtha a, but also part of its self-produced crude naphtha b. However, when filing its consumption tax return, it only declared and paid consumption tax on the business of selling self-produced crude naphtha b, and did not declare and pay consumption tax on the business of directly selling purchased crude naphtha a.

At the end of 2020, Enterprise A received a "Notice of Tax Matters" served by the competent tax authority, which stated that Enterprise A needed to pay back taxes on the sale of purchased crude naphtha a. What puzzled Enterprise A was that the sale of crude naphtha raw material a by Enterprise A was clearly a pure trading business, without any production and processing activities, and should not have generated any consumption tax liability. However, the competent tax authority, based on a tax collection document issued by the State Administration of Taxation in 1997, claimed that Enterprise A's trading activities were deemed to be production activities and subject to tax, and that the tax already included in the raw materials could not be deducted, thus triggering a tax dispute between the tax authority and the enterprise.

(ii) The Root of the Dispute: SAT Circular [1997] No. 84

According to the "Interim Regulations on Consumption Tax", the entities that produce, entrust the processing of, and import taxable consumer goods are the taxpayers of consumption tax and are required to pay consumption tax. In this case, Enterprise A's direct sale of purchased crude naphtha a is a trading activity, not a taxable activity for consumption tax, and no consumption tax is required to be paid.

However, Article 2 of the "Notice of the State Administration of Taxation on Several Issues Concerning the Levy of Consumption Tax" (SAT Circular [1997] No. 84, hereinafter referred to as "Circular 84") stipulates that "for industrial enterprises that both produce taxable consumer goods and purchase the same taxable consumer goods as their own for sale, consumption tax shall be levied on the sale of purchased taxable consumer goods, and the consumption tax already paid on the purchased taxable consumer goods may be deducted. The purchased taxable consumer goods for which the deduction of tax already paid is allowed as mentioned above are limited to cut tobacco, alcoholic beverages, alcohol, cosmetics, skin and hair care products, jewelry and jade, firecrackers and fireworks, automobile tires and motorcycles".

According to the above provisions, although the sale of crude naphtha a raw materials by Enterprise A is a trading business, it is also required to declare and pay consumption tax, and the consumption tax already included in the crude naphtha cannot be deducted. If the tax is declared and paid in this way, it will inevitably lead to double taxation and cause substantial property losses to Enterprise A.

In practice, if refining and chemical enterprises have business activities similar to those of Enterprise A, do they all strictly declare and pay taxes in accordance with the provisions of Circular 84?

II. Impact of Changes in Consumption Tax Return on Tax Liability of Refining and Chemical Enterprises' Trading Business

The author assumes that Enterprise A should declare and pay consumption tax on its business of directly selling purchased crude naphtha a, then the core issue is how Enterprise A should declare and pay consumption tax on this business, i.e. how the consumption tax return should be filled out, and whether it can make Enterprise A both declare and pay taxes and deduct the raw material tax, so as to achieve the purpose of no tax burden in substance. In fact, the calculation logic of China's refined oil consumption tax return has a crucial impact on whether the deduction can be achieved.

(i) The "Reverse Squeeze" Return Before 2014 Could Achieve Tax Deduction for Trading Business

In 2006, while naphtha was included in the scope of consumption tax as a new tax item, in order to strengthen the administration of consumption tax deduction, the State Administration of Taxation issued the "Notice on Further Strengthening the Administration of Consumption Tax Return and Tax Deduction" (SAT Letter [2006] No. 769), which adjusted the checking relationship between the items in the return. The "Purchase Price (Quantity) of Purchased Taxable Consumer Goods Deductible in the Current Period" in the adjusted return was calculated by the method of reverse squeeze, i.e., equal to the Purchase Price (Quantity) of Purchased Taxable Consumer Goods in Beginning Inventory + Purchase Price (Quantity) of Purchased Taxable Consumer Goods Purchased in the Current Period - Purchase Price (Quantity) of Purchased Taxable Consumer Goods in Ending Inventory, and this filling logic continued until 2014. Accordingly, according to the consumption tax return filling rules during this period, Enterprise A could achieve tax deduction for its trading business, specifically:

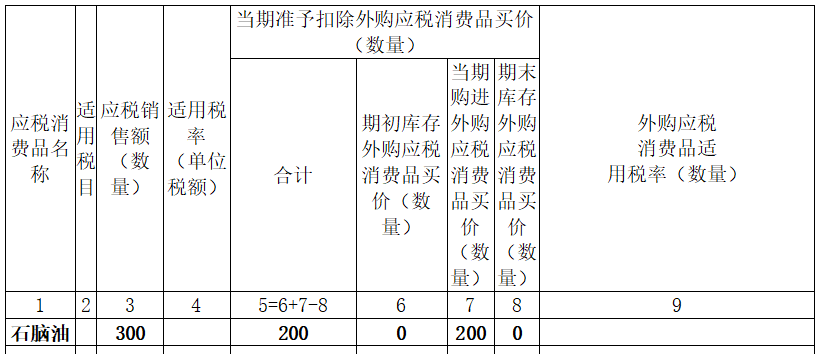

Assuming that the quantity of purchased naphtha in Enterprise A's beginning inventory in the current period is 0, and the quantity of purchased crude naphtha a purchased in the current period is 200 tons, Enterprise A's output ratio of crude naphtha to refined naphtha is 1:1, and Enterprise A uses crude naphtha a to continuously produce and process 100 tons of refined naphtha. At the same time, Enterprise A also self-produced 100 tons of crude naphtha b. In the current period, Enterprise A sold all the remaining 100 tons of purchased crude naphtha a, 100 tons of self-produced crude naphtha b, and 100 tons of refined naphtha, and the quantity of purchased crude naphtha in ending inventory was 0. Taking the 2006 tax return as an example (only the quantity part is taken as an example and the conversion between tons and liters is not considered, all in tons, the same below), the taxable quantity should be filled in as 300 tons, and the quantity of purchased naphtha allowed to be deducted in the current period is "0 tons + 200 tons - 0 tons = 200 tons".

In fact, this 200 tons of naphtha allowed to be deducted includes 100 tons used for continuous production and 100 tons sold directly externally. This reverse squeeze filling method essentially enables Enterprise A to deduct the consumption tax already paid on purchased naphtha whether it is continuously produced and processed or sold directly externally. In other words, if a refining and chemical enterprise had this trading business activity similar to Enterprise A's before 2014, then in fact, both the trading quantity and the continuous production and sales quantity were fully covered in the taxable sales quantity in the return, and at the same time, the consumption tax already paid on the purchased raw materials corresponding to the trading business could be deducted, so there was a small probability that this tax dispute would arise.

(ii) The "Picking List" Return from 2014 to 2018 Excluded Trading Business from the Scope of Deduction

From November 2014 to January 2015, the Ministry of Finance and the State Administration of Taxation raised the unit tax amount of refined oil three times. At the same time, the State Administration of Taxation issued the "Announcement of the State Administration of Taxation on Further Adjusting Issues Related to the Collection and Administration of Consumption Tax on Refined Oil" (Announcement of the State Administration of Taxation No. 71 of 2014) in December 2014, which made major adjustments to the refined oil tax return. In particular, the filling instructions for the attached schedule "Calculation Table of Tax Amount Allowed to be Deducted" clearly stated that this table could only be filled out by "taxpayers who have continuously produced taxable refined oil after purchasing, importing or receiving taxable oil from entrusted processing", and at the same time required that the "Tax Amount Used for Continuous Production" be consistent with the data in the "Tax Deduction Ledger", and the "Continuous Production Picking" data in the deduction ledger came from the enterprise's accounting data. Therefore, it can be seen that this filling method changed the original calculation logic of the reverse squeeze method and calculated the deductible quantity in a positive way, requiring that the deductible quantity be consistent with the actual production picking situation, which means that for the direct sale of purchased refined oil, the consumption tax already paid on the purchased refined oil is no longer included in the scope of deduction and cannot be deducted by filling in the form.

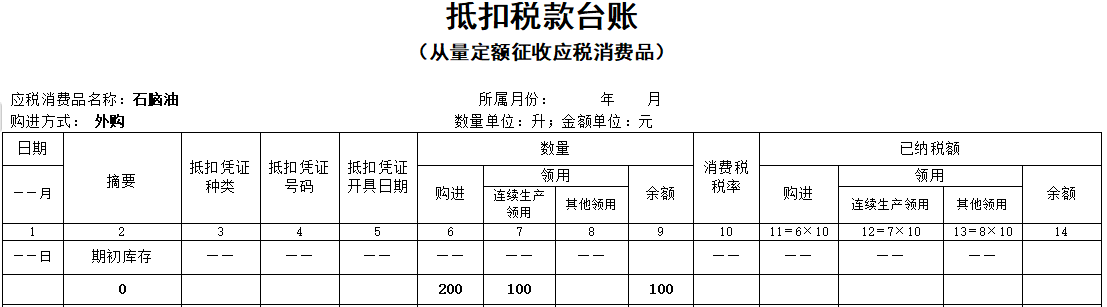

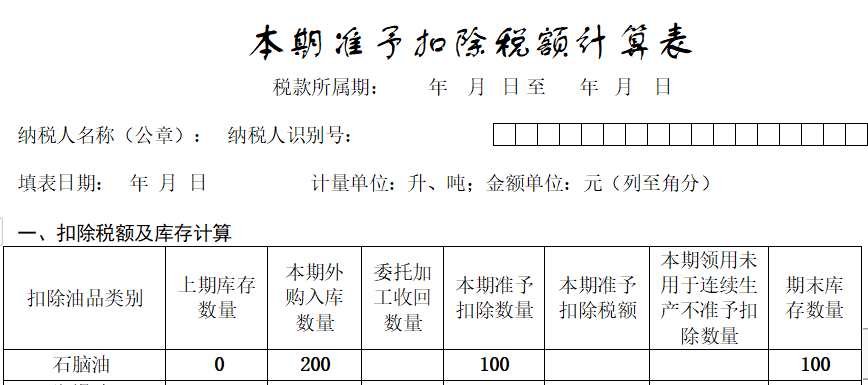

If Enterprise A's assumed business occurred during this period, according to the filling instructions, after filling in the beginning inventory quantity, the current period purchase and warehousing quantity, and the current period deductible quantity of purchased naphtha in the "Tax Deduction Ledger", the ending inventory quantity, i.e. "Balance" in column 9, is calculated as follows:

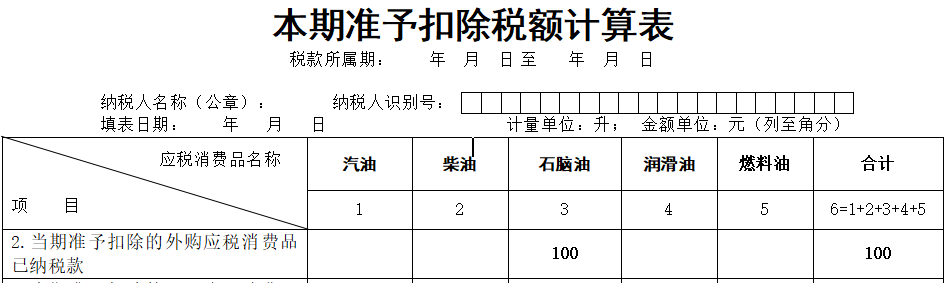

Fill in the consumption tax already paid on purchased taxable consumer goods allowed to be deducted in the current period (replaced by "quantity") in the "Calculation Table of Tax Amount Allowed to be Deducted in the Current Period", as follows:

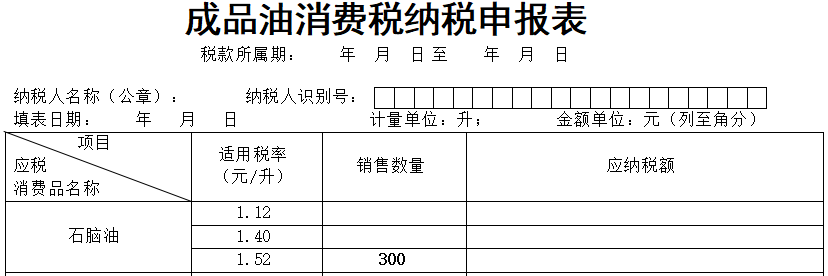

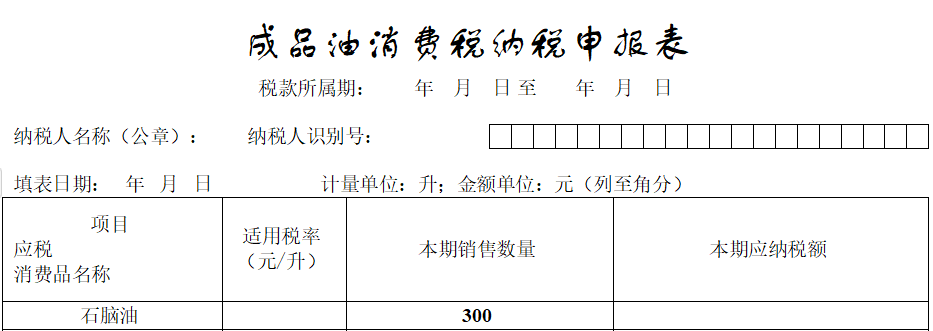

Fill in the sales quantity of 300 tons in the "Refined Oil Consumption Tax Return", as follows:

However, the problem is that, according to the filling instructions of the table, the "Sales Quantity" column should be filled in according to the "sales quantity of taxable consumer goods of refined oil that should be declared and paid consumption tax in the current period according to tax laws and regulations (excluding export tax exemption)". Accordingly, if a refining and chemical enterprise only has trading business, it does not need to fill in this column according to tax laws and regulations, resulting in the effect that the quantity of purchased naphtha directly sold is not included in the table, and at the same time, this trading business will not be reflected in the "Calculation Table of Tax Amount Allowed to be Deducted in the Current Period".

However, if there are both production and sales business and trading business, then according to the provisions of Circular 84, the total quantity of refined oil actually sold in the current period needs to be filled in, and at the same time, the purchased part does not belong to the scope of deduction, resulting in the situation that for refining and chemical enterprises that have both production and sales business and trading business, the sales quantity of the trading part still needs to be fully declared and taxed. From the perspective of the economic man hypothesis, because the purchased part cannot be deducted, the refining and chemical enterprise will probably not declare the trading quantity part. In addition, in practice, it was difficult for the tax authorities in this period to find out that the refining and chemical enterprises had not declared the trading quantity part due to the limited tax collection and administration capacity, so the above-mentioned tax disputes and the risk of refining and chemical enterprises being pursued for consumption tax have begun to emerge.

(iii) The "Picking List" Return from 2018 to 2021 Did Not Change the Deduction Logic and Clearly Stated that the Sales Quantity Included the Trading Quantity

The year 2018 was a watershed year for enterprises engaged in the refined oil business. The State Administration of Taxation issued the "Announcement on Issues Related to the Collection and Administration of Consumption Tax on Refined Oil" (Announcement of the State Administration of Taxation No. 1 of 2018). The "Refined Oil Module" was launched, which made the tonnage of refined oil invoices logically related to the declared sales quantity and deducted quantity. If the invoiced quantity was greater than the declared sales quantity, or the deducted invoice quantity was less than the declared deducted quantity, an early warning would be generated. At the same time, the announcement abolished the previous return and formulated a new refined oil tax return and its attached schedules.

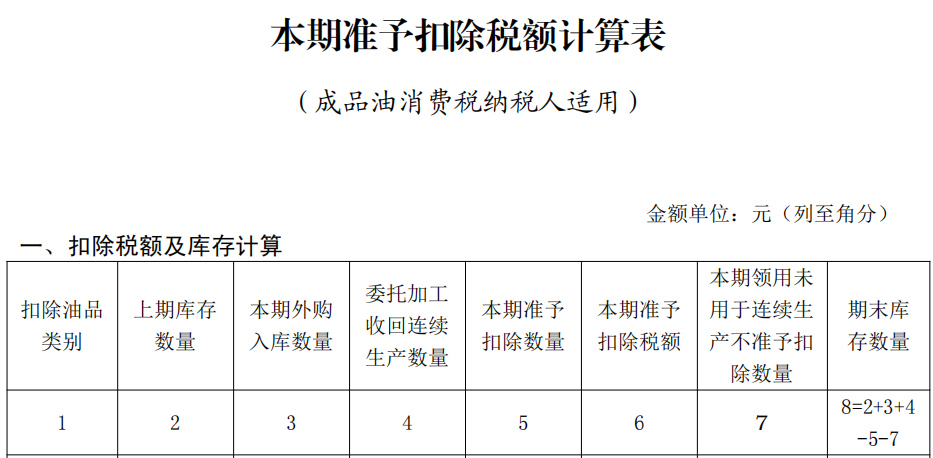

If Enterprise A's assumed business occurred during this period, it would no longer need to fill in the "Tax Deduction Ledger", but it would need to fill in the previous period inventory quantity, the current period purchase and warehousing quantity, and the current period deductible quantity in the "Calculation Table of Tax Amount Allowed to be Deducted in the Current Period", and the ending inventory quantity would still be derived through the logic of positive calculation, as follows:

At the same time, fill in the "Refined Oil Consumption Tax Return", as follows:

It should be particularly emphasized that, according to the filling instructions of the table, the "Sales Quantity in the Current Period" column should be filled in according to the "sales quantity of taxable consumer goods of refined oil declared and paid consumption tax according to tax laws and regulations (including purchased and imported taxable consumer goods directly sold, excluding export tax exemption and taxable consumer goods directly sold after being recovered from entrusted processing)". This means that the sales quantity includes the trading quantity, in other words, the refining and chemical enterprise needs to declare and pay taxes on the total sales quantity. If during this period, the refining and chemical enterprise does not fill in the trading quantity but issues invoices according to the total sales quantity, there will be a great probability of triggering the risk of being pursued for consumption tax. Then we can look back at the reason behind Enterprise A being pursued for consumption tax is that the tonnage recorded on the refined oil invoices issued by Enterprise A was larger than the sales tonnage declared for consumption tax, which is why it attracted the attention of the tax authorities.

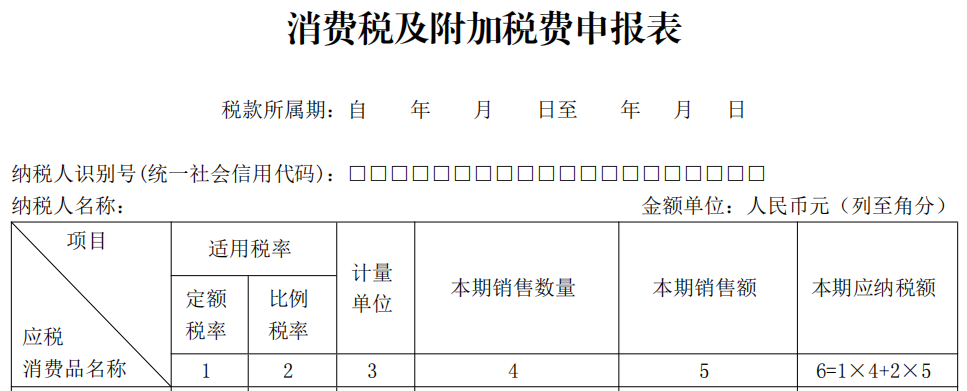

(iv) The "Picking List" Return from 2021 to Date Removed the Statement that the Sales Quantity Includes the Trading Quantity

From 2021 to date, in order to implement the "Opinions on Further Deepening the Reform of Tax Collection and Administration", the State Administration of Taxation has integrated the consumption tax and surcharges return and simplified the submission of the return in terms of form. In terms of substance, the content filled in is similar to that of the previous return. The core difference is that in the filling instructions for the "Sales Quantity in the Current Period" of the "Consumption Tax and Surcharges Return", the 2021 return deleted the statement that the sales quantity includes the trading quantity in the previous return, i.e., it was changed to that the sales quantity should be filled in according to the "sales quantity of taxable consumer goods that should be declared and paid consumption tax in the current period according to national tax laws, regulations and relevant provisions (hereinafter referred to as "tax laws") (excluding export tax exemption sales quantity)". The integrated table is as follows:

Accordingly, from the perspective of deleting the statement "including the sales quantity of purchased taxable consumer goods directly sold", does it mean that the State Administration of Taxation believes that there is something wrong with Article 2 of Circular 84? The deletion of this note will make the scope of "sales quantity" unclear, and the tax dispute over whether the quantity of purchased and directly sold by refining and chemical enterprises should be declared will recur. In addition, if the refining and chemical enterprise does not declare, it will trigger the early warning mechanism for comparing refined oil invoices with declared sales data, and the risk of being investigated will increase dramatically. The author believes that the key problem still lies in Article 2 of Circular 84, so let's take a closer look at it.

III. Legal Analysis of the Provisions of Article 2 of Circular 84

In fact, Article 2 of Circular 84 imposes consumption tax on the trading business of refining and chemical enterprises, which is an act of treating trading activities as production activities and does not allow deduction, resulting in double taxation, which is neither legal nor reasonable, and needs to be analyzed and discussed in detail. At the same time, the author also has doubts, didn't the State Administration of Taxation know this when it formulated this document? What consequences will it lead to in practice?

(i) The Provisions of Article 2 of Circular 84 Violate the Superior Law and Are Unreasonable

As mentioned earlier, according to the "Interim Regulations on Consumption Tax", the production, entrusted processing and import of taxable consumer goods are taxable activities for consumption tax, while the trading activities of purchasing taxable consumer goods and then selling them externally are not taxable activities. At the same time, it is in line with basic business logic for refining and chemical enterprises to engage in trading business, which is a free civil and commercial act and is not prohibited by law. Therefore, if a refining and chemical enterprise has trading business, whether it only has trading business in the current period or both self-produced business and trading business, the trading business part does not belong to the scope of taxation.

From the perspective of legal hierarchy, Circular 84 is a normative document formulated by the State Administration of Taxation, while the "Interim Regulations on Consumption Tax" is an administrative regulation formulated by the State Council. Circular 84 requires refining and chemical enterprises that have both self-produced business and trading business to declare consumption tax on the trading business part, which obviously breaks through the provisions of the "Interim Regulations on Consumption Tax" and obviously violates the superior law, and also violates the basic principle of one-time levy of consumption tax. In addition, in order to avoid double taxation of consumption tax, this article also breaks through the superior law to set the right to deduct consumption tax, but it only allows the deduction of consumption tax already paid on purchased cut tobacco, alcoholic beverages, alcohol, cosmetics, skin and hair care products, jewelry and jade, firecrackers and fireworks, automobile tires and motorcycles, resulting in the business of direct sale of purchased refined oil not being included in the scope of deduction, which fails to solve the problem of double taxation of the trading business of refining and chemical enterprises and violates the principle of tax fairness.

(ii) Legislative Considerations of Article 2 of Circular 84

In the late 1990s, tax collection and administration was relatively backward, mainly relying on manual invoicing, manual bookkeeping, and tax inspectors' checking of accounts, and could not achieve the effect of invoice-based tax control as it is today. At the same time, tax supervision at that time was also relatively weak and it was impossible to accurately distinguish the source of taxable consumer goods sold by refining and chemical enterprises, i.e., the tax authorities could not find out whether the taxable consumer goods sold by refining and chemical enterprises were self-produced or purchased, resulting in some refining and chemical enterprises taking advantage of the inadequate tax collection and administration to falsely report self-produced sales business as trading business in order to evade consumption tax. Therefore, in order to ensure that national taxes are collected in full, the State Administration of Taxation adopted a one-size-fits-all approach to impose consumption tax on all taxable consumer goods sold by refining and chemical enterprises. At the same time, it tried to make corrections by deducting the consumption tax already paid on purchased taxable consumer goods, so as to achieve the basic principle of imposing consumption tax on taxable production activities and levying consumption tax at a single stage. However, it should be pointed out that this provision has not been updated with the upgrading of tax collection and administration means and the development of consumption tax policy. It has neither been abolished because of the launch of the Golden Tax Phase III or even Phase IV to achieve accurate tax collection, nor has it expanded the scope of taxable consumer goods for which the consumption tax already paid on external purchases can be deducted, resulting in its inability to match the current industry situation and making a large number of pure refined oil trading activities included in the scope of taxation.

(iii) Article 2 of Circular 84 May Force Refining and Chemical Enterprises to Evade Taxes

As mentioned above, the "reverse squeeze" return before 2014 essentially allowed the deduction of consumption tax already paid on external purchases, which made refining and chemical enterprises choose to truthfully declare the sales quantity. From 2014 to 2018, there were disputes over how to fill in the "sales quantity" in the "deduction" return, and the consumption tax already paid on external purchases was not allowed to be deducted, so refining and chemical enterprises generally did not fill in the trading quantity, and even if invoices were issued for the total external sales quantity, it was difficult to attract the attention of the tax authorities. However, all this has changed since 2018, when the tax system has achieved the effect of comparing refined oil invoices with declared quantities, which may force refining and chemical enterprises to not issue refined oil invoices even though they have trading business. In this way, the invoiced tonnage will not be larger than the declared sales quantity, and the system will not give an early warning, which will eventually lead to refining and chemical enterprises selling off the books without invoices, thus evading consumption tax, VAT, and corporate income tax.

IV. Conclusion

Even though there are inappropriate points in Article 2 of Circular 84, it has not been abolished yet. For Enterprise A, the only way to protect its substantive rights and interests is to take up legal weapons. It can choose to file an administrative reconsideration with the tax authority at the next higher level of the competent tax authority and at the same time file a legality review of the normative document on Article 2 of Circular 84. If no favorable result is obtained through the reconsideration procedure, an administrative lawsuit can still be filed, and at this time, a review of Article 2 of Circular 84 can still be requested. It is believed that this move will attract the attention of the tax authorities and force the State Administration of Taxation to abolish Article 2 of Circular 84. In addition, if any refining and chemical enterprise has a business similar to that of Enterprise A, it can actively communicate with the competent tax authority before filing its return to seek guidance on tax filing, and can even apply for an advance tax ruling on the matter to resolve tax disputes at the front end.