Overview of Tax Risks in the Supply Chain of Epidemic Prevention Materials

Editor's note:At the end of 2019, faced with the sudden outbreak of COVID-19, the Central Committee of the Communist Party of China made a decisive decision and adopted the most comprehensive prevention and control measures. Local governments took active actions and purchased a large number of masks, protective clothing, goggles, thermometers, and testing reagents, effectively guaranteeing the supply of epidemic prevention materials. According to a speech by Liu Kun, former Minister of Finance, at the 2020 National Finance Work Conference, by the end of November 2020, the expenditure on epidemic prevention and control funds by fiscal departments at all levels had exceeded 400 billion yuan. It can be said that national financial support has made an indelible contribution to overcoming the epidemic. However, after the epidemic, we have successively received consultations and learned that several procurement units of epidemic prevention materials have been investigated by tax authorities for suspected fraudulent invoices. Based on the latest case information we have, this article will analyze the five major tax risks hidden in the supply chain of epidemic prevention materials

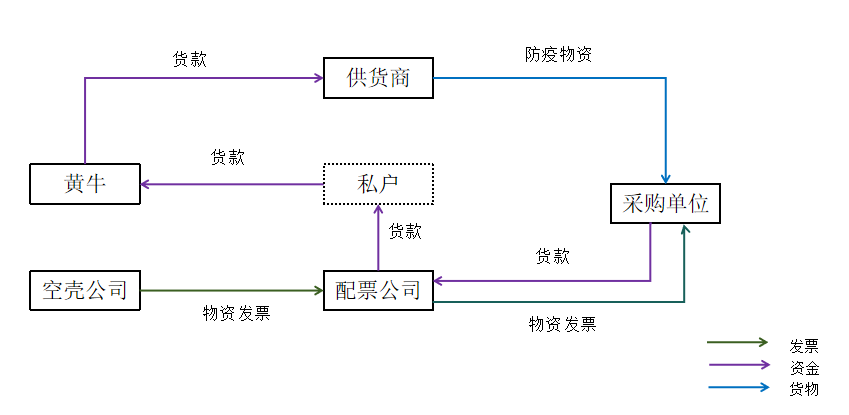

I. Overall Situation of the Supply Chain of Epidemic Prevention Materials

During the epidemic prevention and control period, government agencies, urban investment companies, and medical institutions had a huge demand for epidemic prevention materials. Coupled with the shortage of epidemic prevention materials and the high timeliness requirements, in order to facilitate procurement, the General Office of the Ministry of Finance issued the "Notice on Facilitating Procurement for Epidemic Prevention and Control" on January 26, 2020, allowing procurement units to establish a "green channel" when using fiscal funds to purchase epidemic prevention materials, without implementing the methods and procedures stipulated in the government procurement regulations. In order to avoid the risk of job-related crimes caused by the "green channel", ensure the transparency of the use of fiscal funds, and ensure the compliance of financial accounting, procurement units usually require suppliers to provide compliant value-added tax invoices before they can settle payment for goods. However, many suppliers in the market are small individual workshops that lack awareness of paying taxes according to law and are unwilling to issue invoices. In order to participate in business, they find scalpers to contact invoice providers and promise to give the scalpers a part of the benefit fee.

Scalpers have resources from many private entrepreneurs. These private enterprises have been affected by the epidemic prevention and control, with work and production suspended, and their operations have encountered serious difficulties. Some enterprises have faced the urgent risk of bank collection due to the reduction of book flow and no longer meet the conditions for bank loans. In order to increase income and falsely increase the flow of funds to avoid bank collection, these enterprises agree to provide invoices for suppliers contacted by scalpers by charging invoice fees. Since the invoice fee points charged by the invoice provider are about 8%, which cannot cover the tax cost of invoicing, the invoice provider also needs to purchase additional input invoices to deduct tax. The invoice selling enterprises contacted by them are mostly shell companies. After the scalper contacts the invoice provider and the supplier, it signs a contract with the procurement unit in the name of the invoice provider, thus forming the following supply chain of epidemic prevention materials:

1.Flow of Goods: The supplier produces epidemic prevention materials and transports them directly to the procurement unit.

2.Flow of Funds: The procurement unit, according to the information provided by the scalper, transfers the payment to the public account of the invoice provider. The invoice provider, after deducting the invoice fee, transfers the payment to multiple private accounts under its control, and then controls the private accounts to transfer the payment to the scalper's private account. The scalper, after deducting the benefit fee, transfers the payment to the supplier's private account.

3.1Flow of Invoices: The invoice provider, according to the requirements of the scalper, issues a 13% value-added tax special invoice to the procurement unit. It also purchases input invoices from shell companies at a lower invoice fee to deduct the output tax generated by issuing invoices externally.

II. Legal Risks Faced by Suppliers

-

Administrative Risks of Tax Evasion

According to Article 63 of the Tax Administration Law, “Taxpayers… who fail to list or under-list income… or fail to pay or underpay the tax payable shall be deemed to have evaded tax. For taxpayers who evade tax, the tax authorities shall recover the unpaid or underpaid tax and overdue fines, and impose a fine of not less than 50% but not more than five times the amount of unpaid or underpaid tax; if a crime is constituted, criminal responsibility shall be investigated according to law.” Article 32 stipulates that “Where a taxpayer fails to pay tax within the prescribed time limit… overdue fines shall be levied on a daily basis at the rate of 0.05% of the amount of overdue tax from the date the tax becomes overdue.”

In this case, the supplier shall recognize the revenue in the accounting for the payment collected from the sale of epidemic prevention materials to the procurement unit. At the same time, the sales behavior is a taxable behavior, so it shall declare and pay value-added tax, urban construction tax and surcharge, and corporate income tax to the tax authorities. However, by collecting the payment through private accounts, the supplier fails to list the income in the accounting books, resulting in the objective consequence of non-payment of tax, which is tax evasion by failing to list income. The supplier faces the risk of being characterized as tax evasion by the tax authorities, recovering unpaid tax, levying overdue fines at the rate of 0.05% per day, and imposing a fine of 0.5-5 times the amount of unpaid tax.

(ii) Criminal Risks of Tax Evasion

According to Article 201 of the Criminal Law, “Taxpayers… who evade paying a relatively large amount of tax by means of… failing to file tax returns, which accounts for more than 10% of the amount of tax payable… and the amount of tax evaded is huge and accounts for more than 30% of the amount of tax payable, shall be sentenced to fixed-term imprisonment of not less than three years but not more than seven years, and shall also be fined.” According to Article 1, Paragraph 2, Item (1) of the Interpretation of the Supreme People’s Court and the Supreme People’s Procuratorate on Several Issues Concerning the Application of Law in Handling Criminal Cases of Endangering Tax Administration (Fa Shi [2024] No. 4, hereinafter referred to as the Two Highs Judicial Interpretation), “One of the following circumstances shall be deemed to be the ‘failure to file tax returns’ as stipulated in Article 201, Paragraph 1 of the Criminal Law: (1) A taxpayer who has gone through the establishment registration procedures with the registration authority according to law, but fails to file tax returns when taxable behaviors occur; (2) A taxpayer who is not required to go through the establishment registration procedures with the registration authority according to law or who has not gone through the establishment registration procedures according to law, but fails to file tax returns after being notified by the tax authorities to do so according to law…” According to Article 52 of the Provisions of the Supreme People’s Procuratorate and the Ministry of Public Security on the Standards for Filing and Prosecuting Criminal Cases under the Jurisdiction of Public Security Organs (II) (hereinafter referred to as the Standards for Filing Cases), “For tax evasion, cases suspected of involving any of the following circumstances shall be filed and prosecuted: (1) The taxpayer evades paying tax by means of… failing to file tax returns, the amount of tax evaded is more than 100,000 yuan and accounts for more than 10% of the total amount of tax payable for all tax categories, and after the tax authorities issue a notice of tax recovery according to law, the taxpayer still fails to pay the tax payable, fails to pay overdue fines, or refuses to accept administrative penalties.”

In this case, if the supplier has gone through the tax registration procedures and has engaged in the taxable behavior of selling epidemic prevention materials, but fails to file tax returns to the tax authorities, it constitutes the act of failing to file tax returns in the crime of tax evasion. If the supplier has not gone through the tax registration procedures according to law, but still fails to file tax returns after being notified by the tax authorities, it also constitutes the act of failing to file tax returns in the crime of tax evasion.

If the total amount of value-added tax, urban construction tax, and corporate income tax that the supplier fails to pay reaches 100,000 yuan and accounts for 10% of the total amount of tax payable to the tax authorities, and after the tax authorities issue a notice of tax recovery, the supplier still fails to pay the tax payable, fails to pay overdue fines, or refuses to accept administrative penalties, it will face the risk of being transferred to the public security organs by the tax authorities. It should be noted that if the supplier pays the tax, overdue fines, and accepts administrative penalties after the public security organs file a case, it will not affect the criminal responsibility of the judicial organs for pursuing the crime of tax evasion by the supplier. If the amount of tax that the supplier fails to pay reaches 500,000 yuan and accounts for 30% of the total amount of tax payable to the tax authorities, it will face a maximum of 7 years of fixed-term imprisonment and a fine.

III. Legal Risks Faced by Invoice Providers

In this case, the invoice provider has two illegal acts: one is to fraudulently issue special value-added tax invoices for others, and the other is to have others fraudulently issue special value-added tax invoices for itself. Specifically:

(i) Legal Risks of Fraudulently Issuing Special Value-Added Tax Invoices for Others

1. Administrative Risks of Fraudulently Issuing Special Value-Added Tax Invoices for Others

According to Article 21 of the Invoice Management Measures, “No unit or individual may engage in the following acts of fraudulently issuing invoices: (1) Issuing invoices for others or for oneself that are inconsistent with the actual business operation status.” According to Article 35 of the Invoice Management Measures, “Those who fraudulently issue invoices shall have their illegal gains confiscated by the tax authorities; those who fraudulently issue invoices with an amount of less than 10,000 yuan may also be fined not more than 50,000 yuan; those who fraudulently issue invoices with an amount of more than 10,000 yuan shall also be fined not less than 50,000 yuan but not more than 500,000 yuan; if a crime is constituted, criminal responsibility shall be investigated according to law.” According to Article 29 of the Detailed Rules for the Implementation of the Invoice Management Measures, “’Inconsistent with the actual business operation status’ as mentioned in Article 21 of the Measures refers to any of the following acts: (1) Issuing or obtaining invoices without purchasing or selling goods, providing or accepting services, or engaging in other business activities.”

In this case, the invoice provider did not sell epidemic prevention materials to the procurement unit, but issued special value-added tax invoices to the procurement unit for the supplier. This is an act of issuing invoices for others that are inconsistent with the actual business operation status, which constitutes fraudulent invoicing in administrative law, and the invoice provider faces the risk of having its illegal gains of about 8% of the invoice fee confiscated by the tax authorities and being fined.

2.Criminal Risks of Fraudulently Issuing Special Value-Added Tax Invoices for Others

According to Article 205 of the Criminal Law, “Whoever fraudulently issues special value-added tax invoices or other invoices used to defraud export tax refunds or deduct tax shall be sentenced to fixed-term imprisonment of not more than three years or criminal detention, and shall also be fined not less than 20,000 yuan but not more than 200,000 yuan; whoever fraudulently issues invoices with a relatively large amount of tax or other serious circumstances shall be sentenced to fixed-term imprisonment of not less than three years but not more than ten years, and shall also be fined not less than 50,000 yuan but not more than 500,000 yuan; whoever fraudulently issues invoices with a huge amount of tax or other particularly serious circumstances shall be sentenced to fixed-term imprisonment of not less than ten years or life imprisonment, and shall also be fined not less than 50,000 yuan but not more than 500,000 yuan or have his property confiscated.” According to Article 10, Paragraph 1 of the Two Highs Judicial Interpretation, “One of the following circumstances shall be deemed to be the ‘fraudulent issuance of special value-added tax invoices or other invoices used to defraud export tax refunds or deduct tax’ as stipulated in Article 205, Paragraph 1 of the Criminal Law: (1) Issuing special value-added tax invoices or other invoices used to defraud export tax refunds or deduct tax without actual business.” According to Article 16 of the Standards for Filing Cases, the amount of fraudulently issued tax exceeding 100,000 yuan or causing a loss of state tax of more than 50,000 yuan has reached the standard for filing and prosecution.

In this case, the invoice provider and the procurement unit have no actual business, and the invoice provider fraudulently issues special value-added tax invoices to the procurement unit for the supplier. This is an act of “fraudulently issuing for others”, which meets the elements of the crime of fraudulently issuing special value-added tax invoices. If the amount of tax on the special value-added tax invoices fraudulently issued by the invoice provider to the procurement unit reaches 100,000 yuan or the amount of special value-added tax invoices fraudulently issued and deducted by the procurement unit reaches 50,000 yuan, it meets the standard for criminal filing by the public security organs, and the invoice provider faces the risk of being investigated for criminal responsibility for the crime of fraudulently issuing special value-added tax invoices. If the amount of fraudulently issued tax is more than 100,000 yuan but less than 500,000 yuan, the invoice provider will face fixed-term imprisonment of not more than 3 years or criminal detention. If the amount of fraudulently issued tax is more than 500,000 yuan but less than 5 million yuan, or the amount of tax that cannot be recovered before the procuratorial organ initiates a public prosecution is more than 300,000 yuan but less than 3 million yuan, the invoice provider will face fixed-term imprisonment of not less than 3 years but not more than 10 years. If the amount of fraudulently issued tax reaches more than 5 million yuan, or the amount of tax that cannot be recovered before the procuratorial organ initiates a public prosecution reaches more than 3 million yuan, the invoice provider will face fixed-term imprisonment of not less than 10 years or life imprisonment.

(ii) Legal Risks of Having Others Fraudulently Issue Special Value-Added Tax Invoices for Oneself

1.Administrative Risks of Having Others Fraudulently Issue Special Value-Added Tax Invoices for Oneself

According to Article 21 of the Invoice Management Measures, “No unit or individual may engage in the following acts of fraudulently issuing invoices: … (2) Having others issue invoices for oneself that are inconsistent with the actual business operation status.”

In this case, there is no actual business between the invoice provider and the shell company. The invoice provider has the shell company issue special value-added tax invoices for itself by paying invoice fees to offset the output tax. This is an act of having others issue invoices for oneself that are inconsistent with the actual business operation status, which constitutes fraudulent invoicing in administrative law, and the invoice provider faces the risk of being fined up to 500,000 yuan by the tax authorities.

2.Criminal Risks of Having Others Fraudulently Issue Special Value-Added Tax Invoices for Oneself

In this case, there is no actual business between the invoice provider and the shell company. The invoice provider has the shell company issue special value-added tax invoices for itself, which constitutes the act of “having others fraudulently issue for oneself”. If the amount of tax on the special value-added tax invoices that the invoice provider has the shell company fraudulently issue for itself reaches 100,000 yuan or the amount of tax loss reaches 50,000 yuan, it meets the aforementioned standards for criminal filing, and the invoice provider faces the risk of being investigated for criminal responsibility for the crime of fraudulently issuing special value-added tax invoices. If the amount of fraudulently issued tax reaches more than 5 million yuan, or the amount of tax that cannot be recovered before the procuratorial organ initiates a public prosecution reaches more than 3 million yuan, the invoice provider faces fixed-term imprisonment of not less than 10 years or life imprisonment.

However, it should be emphasized that, according to Article 11, Paragraph 4 of the Two Highs Judicial Interpretation, “Where both input special value-added tax invoices… and output special value-added tax invoices are fraudulently issued in the name of the same purchase and sale business, the larger amount shall be used for calculation.” In this case, if the invoice provider obtains fraudulently issued special value-added tax invoices from the shell company in the name of purchasing epidemic prevention materials, the standard for the amount of fraudulently issued tax is the larger amount of the input tax from the shell company and the output tax issued to the procurement unit.

IV. Legal Risks Faced by Procurement Units

(i) Tax Risks of Tax Adjustment

According to the Announcement of the State Administration of Taxation on the Collection and Payment of Value-Added Tax by Taxpayers Who Fraudulently Issue Special Value-Added Tax Invoices (Announcement No. 33 of the State Administration of Taxation in 2012), "Special value-added tax invoices fraudulently obtained by taxpayers shall not be used as legal and valid vouchers for deducting input tax." According to Article 12 of the Measures for the Administration of Pre-tax Deduction Vouchers for Enterprise Income Tax, "Invoices that are not compliant with regulations, such as those that are privately printed, forged, altered, invalidated, illegally obtained by the issuer, fraudulently issued, or improperly filled out (hereinafter referred to as 'non-compliant invoices'), as well as other external vouchers that are not compliant with national laws, regulations, and other relevant regulations (hereinafter referred to as 'non-compliant other external vouchers'), shall not be used as pre-tax deduction vouchers by enterprises."

According to these regulations, fraudulently issued special value-added tax invoices are non-compliant invoices and shall not be used as vouchers for deducting input value-added tax or pre-tax deductions . In this case, if the competent tax authority of the procurement unit determines that the invoices obtained by the procurement unit from the invoice provider are fraudulently issued and are non-compliant invoices, it may require the procurement unit to reverse the input tax, pay back the urban construction tax and surcharge, and corporate income tax, and levy overdue fines at the rate of 0.05% per day.

(ii) Administrative Risks of Tax Evasion

According to the Notice of the State Administration of Taxation on the Handling of Issues Related to Taxpayers Obtaining Fraudulently Issued Special Value-Added Tax Invoices (Guo Shui Fa [1997] No. 134), Article 1, "Where the recipient uses special invoices fraudulently issued by others to declare tax deductions to the tax authorities for tax evasion, the tax authorities shall recover the tax evaded in accordance with the Tax Administration Law and relevant regulations, and impose a fine of not more than five times the amount of tax evaded..."

In this case, if the special value-added tax invoices issued by the invoice provider to the procurement unit are determined to be fraudulently issued, the competent tax authority of the procurement unit may determine that the procurement unit has used the special value-added tax invoices fraudulently issued by the invoice provider to deduct tax, which constitutes tax evasion. Accordingly, in addition to tax adjustment, the procurement unit will also be subject to overdue fines at the rate of 0.05% per day and a fine of 0.5-5 times the amount of tax evaded.

V. Legal Risks Faced by Scalpers

(i) Administrative Risks of Introducing Others to Fraudulently Issue Special Value-Added Tax Invoices

According to Article 21 of the Invoice Management Measures, "No unit or individual may engage in the following acts of fraudulently issuing invoices:... (3) Introducing others to issue invoices that are inconsistent with the actual business operation status."

In this case, the scalper, as an intermediary, gathers the supply of goods from the supplier and finds an invoice provider that can issue special value-added tax invoices, ultimately forming a chain in which the invoice provider issues invoices to the procurement unit and the supplier sells goods to the procurement unit. The scalper does not engage in any business activities in this process, but only plays the role of matchmaking. The nature of its behavior is to introduce the invoice provider to issue invoices to the procurement unit for the supplier that are inconsistent with the actual business operation status, which constitutes fraudulent invoicing in administrative law, and the scalper faces the risk of having its illegal gains confiscated by the tax authorities and being fined.

(ii) Criminal Risks of Introducing Others to Fraudulently Issue Special Value-Added Tax Invoices

In this case, the scalper's act of introducing the invoice provider to fraudulently issue special value-added tax invoices constitutes the act of "introducing others to fraudulently issue" as stipulated in Article 205 of the Criminal Law. If the amount of tax on the special value-added tax invoices fraudulently issued through introduction reaches the aforementioned standards for filing a case, the scalper also faces the risk of being investigated for criminal responsibility for the crime of fraudulently issuing special value-added tax invoices.

VI. Criminal Risks Faced by Shell Companies

Fraudulent invoicing by shell companies refers to the act of criminal gangs registering multiple shell companies to issue a large number of invoices externally in a short period of time, and then absconding without declaring and paying taxes, showing the characteristics of "rat moving". According to Article 205, Paragraph 3 of the Criminal Law and Article 10, Paragraph 1, Item (1) of the Two Highs Judicial Interpretation, in this case, there is no real business between the shell company and the invoice provider, but the shell company issues special value-added tax invoices for the invoice provider, which constitutes the act of "fraudulently issuing for others" and constitutes the crime of fraudulently issuing special value-added tax invoices, and the shell company faces the risk of being investigated for criminal responsibility.

VII. Conclusion

At the National Work Promotion Meeting on Joint Crackdown on Tax-related Crimes by Eight Departments held on February 27, 2024, the Supreme People's Procuratorate clearly pointed out that tax-related crimes such as fraudulent invoicing by shell companies are one of the focuses of the joint crackdown by the eight departments. At the same time, since the beginning of this year, tax authorities in various places have announced a number of cases of fraudulent invoicing by shell companies that have been transferred to judicial organs, and the risk of shell companies being investigated and dealt with under the strong regulatory situation has increased dramatically. Value-added tax is a chain tax. In this case, after the fraudulent invoicing company is investigated and dealt with, its competent tax authority will send the Notice of Confirmed Fraudulent Invoices and the letter of assistance in investigation to the competent tax authority of the downstream recipient enterprise. The risk will be transmitted to the end-user enterprise in an unstoppable manner. All parties in the chain will be implicated and subject to tax and judicial investigation and punishment. All parties in the supply chain of epidemic prevention materials should pay close attention to, prudently identify, and properly respond to tax risks.