After Obtaining a False Invoice that is Qualified as Tax Evasion, Will it Still Constitute the Offence of False VAT Invoicing?

Editor's Note: With the emergence of new forms and modes of business in various industries, the characterisation and handling of cases involving fraudulent invoices have shown a trend of complexity. According to the relevant provisions of tax law, criminal law and judicial interpretations, enterprises obtaining fraudulently issued VAT invoices are exempted from the criminal punishment of tax evasion if they are qualified as tax evaders by the tax authorities if they pay the tax, late payment fees and fines in a timely manner. However, in recent law enforcement practice, there are cases in which the enterprises obtaining the invoiced special invoices are still filed by the judicial authorities for the offence of false VAT invoices after being qualified as tax evasion by the tax authorities. Based on this, this article will discuss the issue of whether the invoiced enterprises will still constitute the offence of false invoicing after being qualified as tax evasion by the tax authorities, starting from the current situation of the invoiced enterprises obtaining false invoices.

I. Why did the enterprise obtain false invoices?

In practice, there are mainly the following three situations for enterprises to obtain false invoices: (1) enterprises do not have real transactions with the invoicing party, and through fictitious business, etc., let them issue invoices for themselves , and after obtaining the invoices, they make VAT input deduction and pre-corporate income tax deduction, so as not to pay or underpay the tax or make false invoices to the outside world for profit-making; (2) enterprises have real transactions, but because they cannot obtain invoices from the counterparty, they obtain invoices by paying invoicing fees to third parties and use the invoices for VAT input deduction and pre-corporate income tax deduction. (ii) the enterprise has a genuine transaction, but as it is unable to obtain invoices from the counterparty, it obtains invoices by paying invoicing fees to a third party and uses the invoices for VAT input deduction and pre-tax deduction of enterprise income tax, which mainly occurs in certain industries where there is a lack of invoices at source for a long period of time and the VAT input deduction is insufficient, for example, the transport industry and the renewable resources industry, etc.; (iii) there is a genuine transaction between the enterprise and the invoicing party and the invoicing party is out of business or has been dealt with due to false invoicing. invoicing is dealt with, and the enterprise of the invoiced party obtains the invoice and is implicated and recognised as a false invoice.

II. Administrative and Criminal Risks Faced by Enterprises Obtaining Fraudulent Invoices

As mentioned above, the circumstances under which an enterprise obtains a false invoice are complex and varied, and the administrative and criminal risks faced by the enterprise under different circumstances are also different. Whether the transaction is real or not, whether and how the subjective fault is there, and the unfavourable consequences to the national tax management order and tax collection all affect what legal risks the enterprise may face in obtaining the false invoices.

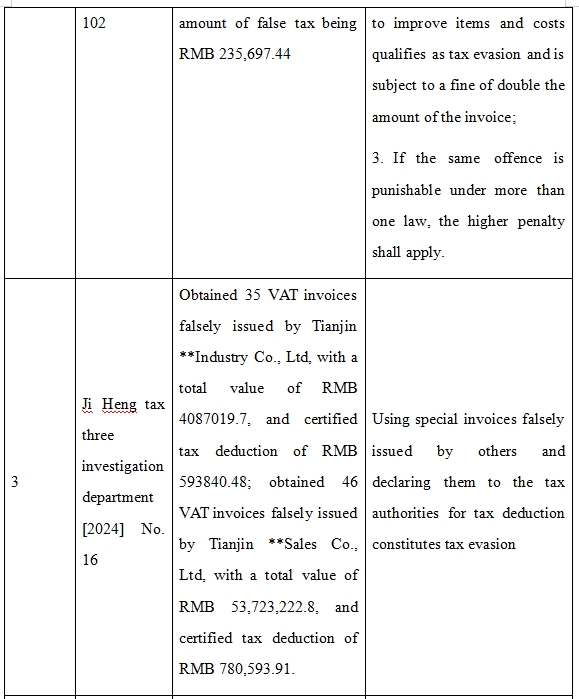

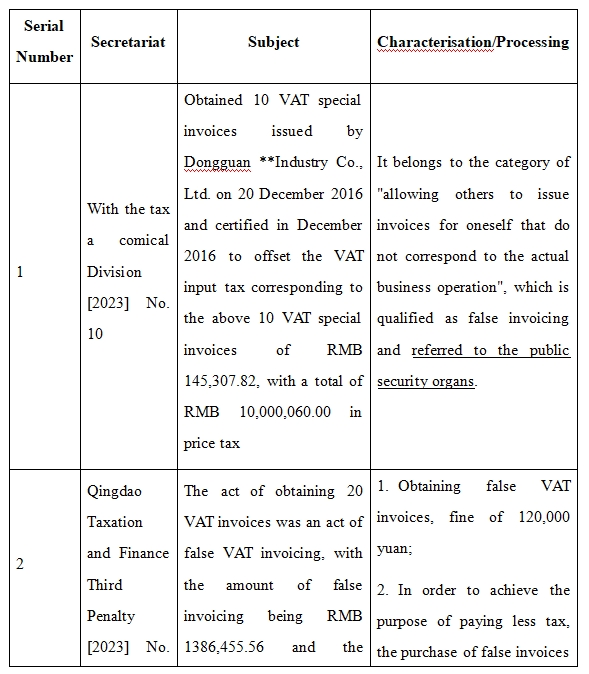

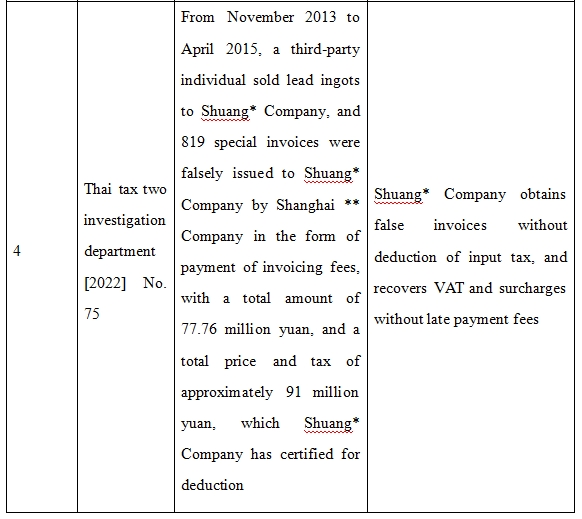

As far as the administrative level is concerned, if the invoiced enterprise obtains a fraudulent invoice without having a real transaction with the invoicing party, the tax authorities may qualify the fraudulent invoice in accordance with article 22 of the Measures for the Administration of Invoices, and if the enterprise is suspected of committing a criminal offence, it will be transferred to the judicial authorities. If the tax authority determines that the subjective purpose of the invoicee is not to pay or to pay less tax, and the obtaining of the invoice is only a means to do so, the tax authority may qualify the invoice as tax evasion in accordance with the Circular of the State Administration of Taxation on the Handling of Issues Concerning the Obtaining of Fraudulently-Opened VAT Special Purpose Vehicle Invoice by the Taxpayer (Guoshuifa [1997] No. 134), and the invoicee is subject to the risks of paying back the tax, charging a late payment fee, and being imposed with a fine. The recipient enterprise will face the risk of paying back the tax, adding late payment fees and being imposed a fine. In particular, in some cases, the tax authorities considered that the enterprise's act of obtaining false VAT invoices violated the relevant provisions of the Measures for the Administration of Invoices and imposed fines in accordance with the false invoices, and at the same time, the enterprise's act of falsely increasing items and listing costs through the false invoices was determined to be tax evasion and imposed fines, and was punished in accordance with the higher amount of the fines in accordance with the provisions of the Administrative Punishments Law. For the existence of real transactions and no subjective fault on the part of the recipient enterprise, the enterprise may actively strive to qualify the acquisition of false invoices in good faith, and strive for no adjustment of enterprise income tax after the payment of VAT tax.

From the criminal level, if the recipient enterprise is found by the tax authorities to have obtained the false invoices in good faith and paid the VAT in time, it can avoid criminal risks such as the offence of false invoicing and the offence of fraudulently issuing VAT special invoices. On the contrary, if the recipient enterprise is found to have falsely issued VAT special invoices and cannot prove that it has no purpose to fraudulently offset the tax and has not caused fraudulent loss of tax due to offsetting, it will face the risk of constituting the offence of falsely issuing VAT special invoices in accordance with Article 10 of the "Interpretation by the Supreme People's Court of the Supreme People's Procuratorate of Several Issues Concerning the Application of Law to the Handling of Criminal Cases of Harming the Collection and Administration of Taxes" (hereinafter referred to as the Two High Judicial Interpretations). offence. For the situation where the acceptance of falsely issued VAT invoices is found to be tax evasion, according to the provisions of the Criminal Law and the two High Judicial Interpretations, the enterprises of the recipient party are able to be exempted from the criminal liability for the offence of tax evasion if they are able to make timely payment of the tax, late payment fees and fines. However, a new situation in practice is that the invoiced enterprise is qualified as tax evasion by the tax authority and at the same time is referred to the judicial authority for the offence of false VAT invoices, or the judicial authority files a case for the offence of false VAT invoices after the tax authority has made a decision on the handling of the matter, such as the third case mentioned above, and at this time, the invoiced enterprise faces a serious risk of criminal liability.

III. Can an enterprise be held criminally liable for the offence of false VAT invoices after it has obtained false invoices that are qualified as tax evasion?

Firstly, according to Article 205 of the Criminal Law and Article 10 of the Judicial Interpretations of the Two High Commissions, if the perpetrator commits the act of fraudulently issuing VAT invoices, but subjectively does not aim at fraudulently offsetting the tax and does not cause fraudulent loss of tax as a result of the offsetting, it does not constitute the crime of fraudulently issuing VAT invoices. In this case, the tax authorities qualify the enterprise's act of obtaining the fraudulently issued invoices as tax evasion, i.e., it recognises that the actual subjective purpose of the enterprise is not to pay or underpay the tax, but not to cheat the tax. If the recipient enterprise can prove that it has not caused fraudulent loss of tax due to the offset, the judicial authorities shall not qualify and punish it in accordance with the offence of fraudulently issuing special invoices for value-added tax. In addition, one of the legislative purposes of the offence of endangering tax collection and management is to safeguard national tax collection. If the act of obtaining false invoices is qualified as tax evasion at the administrative level before pursuing the criminal liability for the offence of false invoices, then from the perspective of a rational economic person, the enterprise of the invoiced party may be inclined not to pay the tax, late payment fees and fines, which will not be conducive to the recovery of the lost tax by the tax authorities.

Secondly, combined with the provisions and interpretation of the two high judicial interpretations on the offence of tax evasion, if a taxpayer, within the scope of taxable obligation, makes a false enhancement of items for offsetting in order to pay less tax, even if the means of false invoicing for offsetting is adopted, the subjective purpose is still to not pay or to pay less tax, and according to the principle of the unity of the subjective and the objective, the offence of tax evasion shall be punished. Therefore, if the subjective purpose of the recipient enterprise which has real transaction to obtain false invoices is not to pay or to pay less tax, and if the false tax credit is not more than the taxable range, it is more appropriate to investigate the criminal responsibility of tax evasion according to the third paragraph of Article 1 of the judicial interpretation of the two high schools, and combining with the provisions of Article 201 of the Criminal Law and the two high schools' judicial interpretation on the reasons for the blocking of the offence of tax evasion, for the case of evasion and theft of tax, the tax authorities should be firstly For tax evasion cases, the tax authorities shall first investigate and deal with the case and make a notice of recovery according to law, and if the recipient enterprise pays the tax, late payment and fine in time, it can be exempted from criminal liability, which is the proper meaning of the provisions of the offence of tax evasion. In the case that the enterprise obtains false invoices for the purpose of non-payment or underpayment of tax, and the tax authorities qualify it as tax evasion, the enterprise is exempted from criminal liability for its purpose, and even more so for the means of false invoicing.

Finally, if the tax authorities qualify the act of obtaining a false invoice as tax evasion and then transfer it for the offence of false invoicing of VAT, the judicial authorities shall prudently judge whether the invoiced enterprise constitutes the offence of tax evasion or the offence of false invoicing. If the judicial organ determines that the act of false invoicing of the invoiced party is a means act and the real purpose is to evade payment of tax, and the invoiced party shall constitute the crime of tax evasion, then according to the provisions of the Administrative Punishment Law and the Provisions on the Referral of Suspected Crimes by Administrative Law Enforcement Organs, the judicial organ shall refer the case back to the tax authority, and the decision made by the tax authority shall be the first one to be dealt with. If the tax authorities have not recovered the tax evaded by the enterprise or made administrative treatment according to law, then according to the judicial interpretations of the two high courts, the judicial authorities shall not pursue criminal liability.

IV. Conclusion

In practice, the situation of enterprises obtaining false invoices is complicated and varied, both for the purpose of false tax credits and false cost increases and for the purpose of evading tax obligations, for which there are differences in the treatment of the tax authorities and the judicial authorities. Among them, the more controversial is the tax authorities will be the enterprise to obtain false invoices for tax evasion, whether the judicial organs can then false invoices for criminal responsibility. In our opinion, if the enterprise can pay the tax, late payment and fine in time after the tax authorities have dealt with it, it does not constitute the offence of false invoicing of VAT, and at the same time, it is exempted from the criminal liability of the offence of tax evasion by applying the blocking reasons of the offence of tax evasion. In practice, if an enterprise is qualified as tax evasion by the tax authorities and transferred to the judicial authorities, it shall be returned to the tax authorities for processing if the judicial authorities determine that it constitutes the offence of tax evasion. For cases of tax evasion, if the tax authorities fail to recover the tax in accordance with the law, the judicial authorities should not pursue criminal liability. At the same time, we suggest that after obtaining a false invoice, the enterprise should carry out its own inspection, analyse the business risks and legal liabilities, and at the same time actively communicate with the tax authorities on the characterisation of the case, so as to safeguard its own legitimate rights and interests, and to make the risk of involvement in the case stop in time in the administrative procedures.