A platform was fully recovered tax, must pay attention to the tax risk of the application of Split System

Editor's Note: Split-accounting system is favored by the booming platform enterprises in the Internet era because of its convenient settlement, fund security and high flexibility. However, in practice, some platform enterprises lack compliance awareness, and the invoicing or fund settlement method is unreasonable, which easily puts them into tax risk. In this article, the author will combine two cases in which platform enterprises were required by tax authorities to bear the full amount of VAT tax obligations for all the money received, analyze the tax risks under the split account mode of platform enterprises, and give the defense ideas and compliance suggestions to help platform enterprises to prevent and resolve tax risks.

I. Settlement mode of platform enterprise Split System

The scale of modern business is increasing, upstream and downstream settlement involves cumbersome reconciliation and other processes, and there is constant friction between enterprises due to billing issues. In this case, the sub-accounting system comes into being, which can settle the accounts efficiently and guarantee the safety of funds through the bank custodian funds earmarked for special purposes. In addition, the use of multi-level bank virtual accounts to support public-to-private transfers not only meets the compliance requirements, but also is not subject to the limitations of the payment amount, with a high degree of flexibility. These features make the Split Account System an ideal choice for all types of platforms, including flexible employment platforms, e-commerce, live social streaming, supply chain, and gaming platforms.

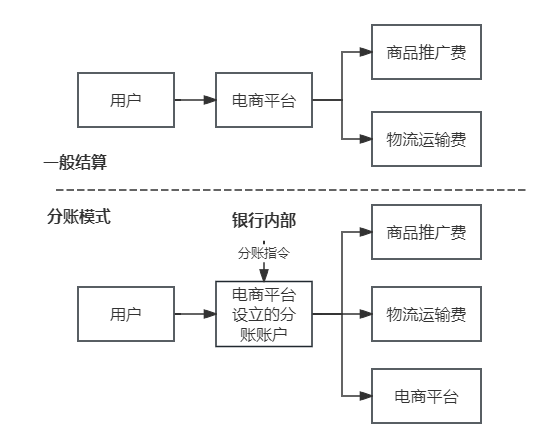

Under the split-account model, funds are automatically allocated according to pre-determined rules before they enter the accounts of the main enterprises, which simplifies the settlement procedures of all parties in the complex supply chain and cuts down on the management costs caused by frequent reconciliations and multi-step transfers. Specifically, the sub-accounting platform changes the traditional one-to-one linear fund flow to one-to-many bifurcated fund flow, advances the fund settlement steps, and simplifies the process of fund settlement through the third-party platform and the rules set up in advance. Take the e-commerce platform as an example, its settlement path is as follows:

However, while the sub-accounting system helps the development of platform enterprises, it has also been utilized by some intentional people as a tool for transferring income to evade tax obligations. For example, the sub-account is set up as a private account of an enterprise's affiliated company or individual, so as to divest the money that should have been entered into the public account, thus achieving the purpose of concealing income. The sub-accounting company may be a self-employed or sole proprietorship enterprise which is “ready to use and throw away”, although it has tax obligations for the received money, but it will be canceled after receiving the money and does not declare tax, and it is difficult for the tax to trace a large number of self-employed households, so as to achieve the purpose of tax evasion and avoidance. In this case, the platform enterprises take the initiative to divest the income that should be attributed to them and deliberately conceal the income, which is a typical tax evasion and tax evasion behavior, and at this time, it is reasonable for the tax authorities to require the platform enterprises to make up the tax, late payment fees and impose fines according to the entire income. However, in some other cases, although the supervisory account belongs to the platform enterprise, but all the money collected in the account is not all attributable to the platform, is it reasonable to require the platform enterprise to bear the tax obligation for all the money collected?

Ⅱ.Case Observation: Several Platforms Were Fully Recovered for VAT Due to the Split System

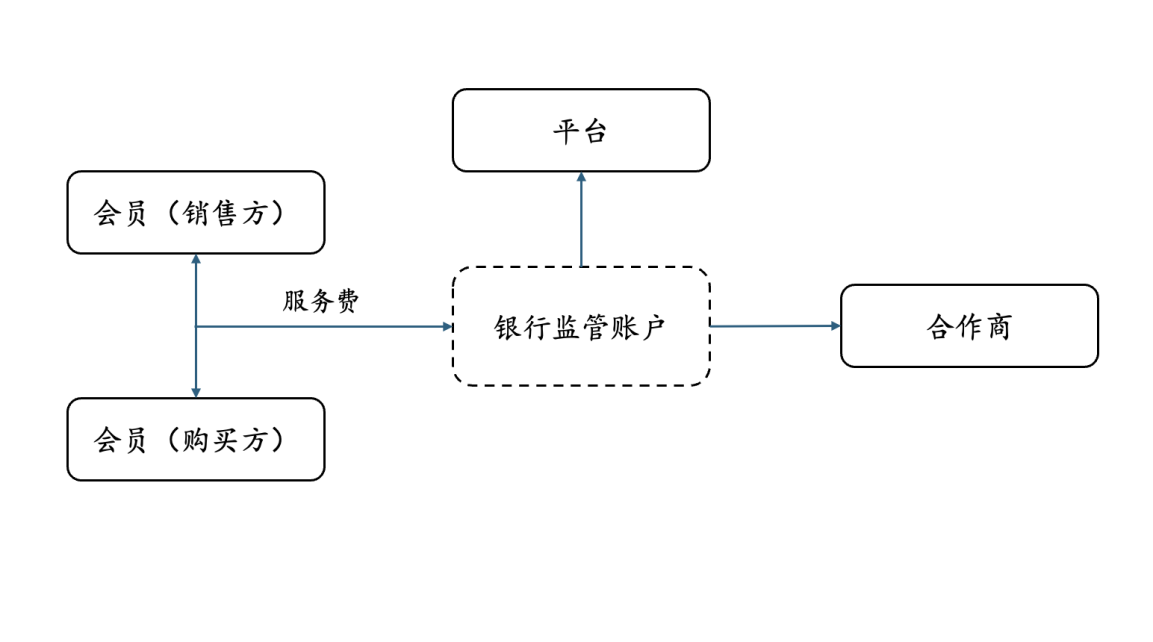

(I) Case 1: Commodity trading platform's service fees were fully recovered for VAT

In 2022, a commodities trading platform was required by the tax bureau to pay back VAT on the tax base of all platform service fees received by its sub-ledger account. The specific business model of the case was that, at the initial stage of its establishment, the commodities trading platform, in order to expand its market and introduce platform members (i.e., purchasers and sellers of goods) to participate in the purchase, sale and delivery of goods, reached a promotion and cooperation agreement with a group of cooperators. According to the agreement, if a platform member is introduced to the platform through a cooperative and completes a transaction, the platform allocates about 70% of the 1.5% platform service fee of the extracted member transaction to the cooperative, and the platform retains 30% of the service fee itself. Different partners enjoy different percentages of commission.

In order to minimize disputes and facilitate fund settlement, the platform set up a supervisory account in the bank and signed a sub-accounting agreement, agreeing that the service fee paid by the platform members would first enter the supervisory account of the trading platform, and that after closing the trading system on each trading day, the bank would automatically settle the service fee that should be obtained by the cooperator according to the trading record, and the service fee would be automatically settled to the cooperator.

Upon completion of the transaction, the trading platform argued that, according to the agreement on the bank's supervisory account, the funds entering the bank's supervisory account were not owned by the platform and could not be controlled or utilized by the platform, but were instead settled directly to the cooperator on a daily basis. Therefore, the trading platform paid VAT only on the actual platform service fees charged.

Later, the tax authorities considered that since the trading platform had collected the platform service fees in full in its own name, it should calculate and pay VAT on all the service fees collected, and therefore required the platform to pay a huge amount of VAT.

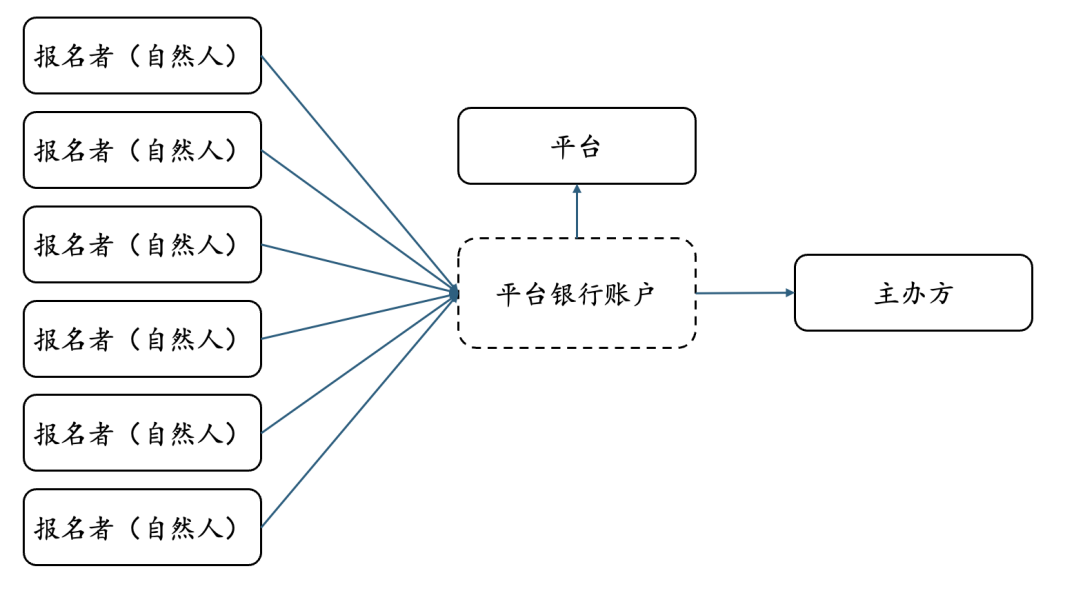

(Ⅱ) Case 2: The case of a tournament and event organization platform being fully recovered from the VAT charge

Similar cases have occurred in other platforms. An event organizing platform was responsible for hosting a sports event. In order to facilitate the settlement, the platform set up a supervisory account in a bank to collect the registration fees from the participants who were natural persons, and paid them in full after deducting the expenses to the organizer of the sports event. As the purchaser of the service is a natural person, invoices are rarely required and therefore rarely invoiced, and the platform only declares the service fee. The organizer usually registers an individual or a sole proprietorship for a match, and then cancels it after the match and does not declare the income. However, the platform is a long-term business, the risk of tax evasion also accumulated tax to the platform, and ultimately the tax authorities require the tournament platform to the entire amount received in its account for the tax base to pay back taxes.

Ⅲ. the tax authorities tax reasons and defense ideas

(I) Reasons for taxation by tax authorities

In the above case, the tax authority abides by the idea of formal taxation, thinking that the sub-account is opened for the platform enterprise, then the platform enterprise should pay full tax on all the service fees of the income of the account, and the platform enterprise account to other sub-accounts of the main sub-accounts of the expenses, the platform enterprise should obtain invoices from other main bodies by itself to solve the problem of the inputs.

The core reason for the tax levy by the tax authorities lies in the fact that the platform essentially carries out two transactions, firstly, the platform provides platform services for members, that is, the sale and purchase of goods, fund settlement, delivery of goods right, etc.; secondly, the cooperators provide services for the platform, that is, services to help the platform to promote and introduce members. The service fee is also divided into two payments, the first by the platform and members of the transaction, and then by the platform and the cooperative settlement of payments. Therefore, the platform is liable for tax on the full amount of the service fee collected. The arguments are mainly based on the following two points:

1. The sub-account is set up by the platform, the platform has the ownership of the account, and the funds entering the sub-account are regarded as having been controlled by the platform. At this time, the flow of funds is the flow of general settlement in the first part of the illustration, then the platform is the main body of the transaction, and should bear the tax obligation on the income of the transaction.

2. In part of the business, the platform has issued invoices for service fees in its own name, and should bear tax obligations on the full amount of the invoiced income. According to Article 5 of the Circular of the Ministry of Finance and the State Administration of Taxation on Certain Policies and Regulations on Value-added Tax and Business Tax (Cai Shui Zi [1994] No. 26), the receiving party can not pay VAT as a trustee of the collection only under the condition that it meets the conditions of not advancing funds, invoicing by the real seller, and settling the payment for the goods with the commissioner on the basis of the actual amount received and charging the commissioner a separate handling fee. If the platform enterprise invoices the full amount to the outside world in its own name, it needs to bear the full amount of VAT on the collected amount according to the above provisions.

(Ⅱ) Defense Ideas

In the author's view, the handling of some tax authorities in practice is improper. In the face of tax audit, the platform enterprise refers to the following defense ideas:

1. The platform enterprise actually acts as a collection and payment agent through the bank system sub-accounts

The key to this case is whether the platform collection behavior belongs to the act of collection and payment or the act of selling services twice. For the platform enterprise, the whole transaction is a transaction on behalf of collection and payment, not two transactions. In other words, both the platform and the partner are providing services directly to the members. The platform provides members with the service of platform transaction; the cooperator provides members with the service of introducing the platform and brokering the transaction. Both are directly serving the members, rather than what the tax authorities believe: the platform provides services to the members; the partner provides services to the platform.

In fact, this has been clearly stated in the membership agreement of the commodity trading platform: the platform and the cooperators provide services to the members respectively, and the service fees paid by the members will be collected by the platform and paid to the cooperators. Some of the cooperators, after obtaining the service fees collected by the platform on behalf of the members, directly issued invoices for the members and paid the VAT, which also indicated that the cooperators were directly serving the members rather than serving the platform.

The tax authorities recognized the platform enterprise as the owner of the fund account and regarded the platform enterprise as a party subject of the transaction. However, in terms of civil relationship, whether the funds are first transferred to the real service provider through the collection account controlled by the platform, or directly collected by the real service provider, the fact of collection and payment cannot be changed. Although the account is opened by the platform enterprise, but the account is under the supervision of the bank with a fixed sub-payment agreement of the account, the platform enterprise is not to enter the account of the funds have all the ownership, from the substantive point of view, in the name of the platform to open the supervisory account is only the funds “conduit”, belong to the collection and payment.

2. Payment in lieu of receipt shall not pay VAT when the conditions are met.

According to the Circular of the Ministry of Finance and the State Administration of Taxation on the Comprehensive Pilot Program of Changing Business Tax to Value-added Tax (Cai Shui [2016] No. 36), the scope of value-added tax (VAT) is the sale of services, intangibles or immovable property. In addition, according to Article 37 of Cai Shui [2016] No. 36, the amount of money collected on behalf of the principal by issuing invoices in the name of the principal is not an out-of-the-price expense and should not be included in the sales to bear the VAT tax obligation. Under the split-account model, although the funds are passed from the account of the platform enterprise, the services sold by the platform enterprise are only intermediary services providing trading opportunities, and the consideration is not the entire amount collected by the account, but only the management fees therein; therefore, the platform enterprise is only required to pay VAT on the income obtained from its provision of intermediary services when the conditions are met.

IV. Compliance Recommendations for Platforms Applying Split Account System

In the era of increasingly rapid business operations, the sub-accounting model is favored by many platform enterprises for its advantages in settlement and fund security. However, in practice, the sub-accounting parties of many projects are individuals or self-employed individuals who “use and throw away”, and these sub-accounting parties often do not declare taxes, and the related tax risks are gradually concentrated on platform enterprises with long-term experience. In addition, some platform enterprises lack compliance awareness and invoice the whole amount in their own name, but do not obtain invoices from the real seller, and once they are audited by the tax authorities, they are often faced with the situation of full tax reimbursement, and years of operating results will go down the drain. It is suggested that the majority of platform enterprises pay attention to the following points when using the sub-accounting system:

(Ⅰ) Platform enterprises do not issue invoices in full in their own names

In terms of VAT regulation, although the Provisional Regulations on Value-added Tax stipulate that the tax obligation of VAT shall be evaluated based on the sales behavior, the tax treatment is generally based on the bills. Cai Shui Zi [1994] No. 26 and Cai Shui [2016] No. 36 both make it clear that if the invoice is issued in the name of the entrusted party, the entrusted party may not pay VAT, in other words, if the platform has issued invoices in full to the outside world, it is difficult to claim the defense of not being liable for the VAT tax obligation. However, in practice, platform enterprises as the first payee sometimes issue full invoices in their own names and do not obtain input invoices from the real seller or service provider, and once audited, they are often required to make up the full amount of tax on the invoices issued, and even have the administrative and criminal risks of tax evasion. Moreover, the real buyer or service receiver is often an individual or a self-employed person, and it is difficult to obtain input invoices or go through civil procedures to recover the tax burden, so the platform enterprise needs to absorb the tax loss by itself.

Theoretically, the platform enterprise can also ask for input invoices from the seller or service provider in a timely manner after the full invoice is issued, but since the seller or service provider is often an individual or a self-employed person, it is more cumbersome to go through the entrusted invoicing procedure. And in a specific project, the service provider is often written off after the end of a project, and does not declare tax, the platform enterprise as the recipient of the invoice is easily implicated, the invoice is also difficult to change the opening of the replacement, and the ultimate loss is also borne by the platform enterprise. Therefore, it is recommended that platform enterprises do not issue invoices in their own names to avoid the transmission of tax risks.

(Ⅱ) Not directly deducting management fees from the fees collected on behalf of others

Article 5 of Cai Shui Zi [1994] No. 26, in addition to the provisions of the invoice, also considers whether to advance funds, and the way to settle the payment. Platform enterprises generally do not advance funds, but under the split-account model, the management fee is often deducted from the amount collected and then settled to the seller, which is different from the requirement of settling the payment according to the actual amount collected and separately charging a handling fee as stipulated in Article 5 of Cai Shui Zi [1994] No. 26. Although Cai Shui [2016] No. 36 only regulates bills, in order to prevent risks from arising, it is recommended that platform enterprises in a position to do so do not adopt the split-account model, but settle the payment for goods with the commissioning party on the basis of the actual amount of sales and value-added tax collected and separately charge a handling fee.

(Ⅲ) The contract specifies that the funds are collected and paid on behalf of the platform enterprise

In order to realize the collection and payment relationship between the platform enterprise and the real service provider and seller, in addition to the funds, it is better to have written documents. The platform enterprise can explicitly agree in the contract that the money collected on behalf of the platform enterprise account is only collection and payment, the platform enterprise is not the main body of the transaction, and the tax obligation is not borne by the platform enterprise.