How can the remedy process be effectively initiated through a tax bond when tax payment is required as a precursor to filing a reconsideration?

Editor's Note: Guarantee is a common means of credit enhancement in civil and commercial legal relations, which has the functions of reducing transaction risks and guaranteeing the realization of claims, and is of great significance to the financing of enterprises. In the field of tax administration, the role of tax guarantee should not be ignored, especially in the tax disputes that need to pay tax before starting the reconsideration procedure, the tax guarantee can be used as the “equalizer” for the payment of tax and late payment fee to protect the legitimate rights and interests of taxpayers while safeguarding the collection of national tax. The Trial Measures on Tax Guarantee have made relatively systematic provisions on tax guarantee, but it has not been revised since its promulgation in 2005, and it has not responded to the disputes such as the scope of collaterals and the period of confirmation of guarantee, etc., which existed in practice, and there exists a certain degree of lagging, and due to the requirement of the pre-positioning of tax payment for reconsideration, based on the justiciable nature of the tax guarantee, some of the disputed cases have undergone litigations on the establishment or otherwise of the tax guarantee before the filing of the rights and remedies. The tax guarantee is established or not, the formation of the “case within a case”. In this paper, two common disputes related to the confirmation of tax guarantee are discussed to analyze how enterprises can effectively complete the requirement of tax payment prior to tax payment through tax guarantee and successfully initiate relief procedures.

I. Tax disputes need to be reconsidered before payment of taxes, and the provision of tax guarantees can reduce the occupation of funds and effectively start the relief process.

The Law on Administration of Tax Collection provides that “taxpayers, withholding agents, tax guarantors and tax authorities in tax disputes, must first pay or unpaid taxes and late fees in accordance with the tax decision of the tax authorities or to provide the corresponding guarantee, and then can apply for administrative reconsideration in accordance with the law; administrative reconsideration of the decision is not satisfied, you can sue the people's court in accordance with the law. “That is to say, for “tax disputes”, taxpayers need to pay or pay the tax and late payment fees or provide guarantee before they can start the relief procedure - filing an administrative reconsideration, and then filing a lawsuit if they are not satisfied with the reconsideration. Tax disputes cover most of the matters of tax enterprise disputes, such as the confirmation of the tax subject, the scope of taxation, tax reduction or exemption, the applicable tax rate, the basis of taxation, the tax link and the way of tax collection, etc. In practice, before the review, the taxpayer has to pay the tax and late payment or guarantee.

In practice, the time for paying tax or providing guarantee before review is often very limited. The Rules for the Implementation of the Tax Collection and Administration Law provide that “if a taxpayer or withholding agent engaged in production or business fails to pay or release the tax in accordance with the prescribed period, or if a tax guarantor fails to pay the tax guaranteed in accordance with the prescribed period, the tax authorities shall issue a notice of tax payment by the deadline, and the maximum period for which the tax is ordered to be paid or released shall not be more than 15 days “Therefore, the time limit for the settlement of tax or provision of tax guarantee in the Decision on Tax Treatment is usually set at 15 days, and the common expression is “You are restricted to pay the above tax and late fee into the treasury at XXX Tax Bureau within 15 days from the date of receipt of this Decision. If the payment is not made after the deadline, it will be enforced in accordance with the provisions of Article 40 of the Tax Collection and Management Law. Your unit has a dispute with us on tax payment, you must first pay the tax and late payment or provide the corresponding guarantee in accordance with the deadline of this decision, and then you can apply for administrative reconsideration to XXX Taxation Bureau within 60 days from the date of the payment of the above amount or the provision of the corresponding guarantee is confirmed by the tax authorities”. It can be seen that in tax dispute matters, the deadline for taxpayers to file an administrative reconsideration is limited to 15 days, and if the tax is not settled or the tax guarantee is provided within 15 days of receipt of the processing decision, the taxpayer will lose the right to relief.

In summary, considering the protection of the national tax in full into the treasury, the tax dispute matters to bring relief procedures need to first pay the tax and late fees, and the time to pay the tax is often only 15 days, a lot of controversial cases involving large amounts of tax, a long time span, the corresponding amount of late fees is also large, the taxpayer is usually difficult to raise cash within 15 days to solve the problem of the tax, and the tax guarantee, as a flexible means of tax administration, can be used in guaranteeing the taxpayer to successfully exercise the remedy. As a flexible means of tax collection and management, the tax guarantee can provide a channel for the collection of national taxes while guaranteeing the taxpayers to exercise their right to relief smoothly.

II. The confirmation of the tax guarantee is justiciable, can be resolved through litigation, the scope of the tax guarantee, tax guarantee confirmation period and other disputes

The tax guarantee needs to be confirmed and agreed by the tax bureau. Due to the imperfections of the relevant regulations or the differences in the understanding of the tax bureau, there are many disputes arising from the confirmation of tax guarantee in practice. It is worth noting that the confirmation of a tax guarantee is actionable and does not require the prior payment of tax or a tax guarantee, and a person who is not satisfied with the non-confirmation of a tax guarantee by the tax bureau may file a lawsuit. The following is a further analysis of two common disputes over tax guarantees in practice:

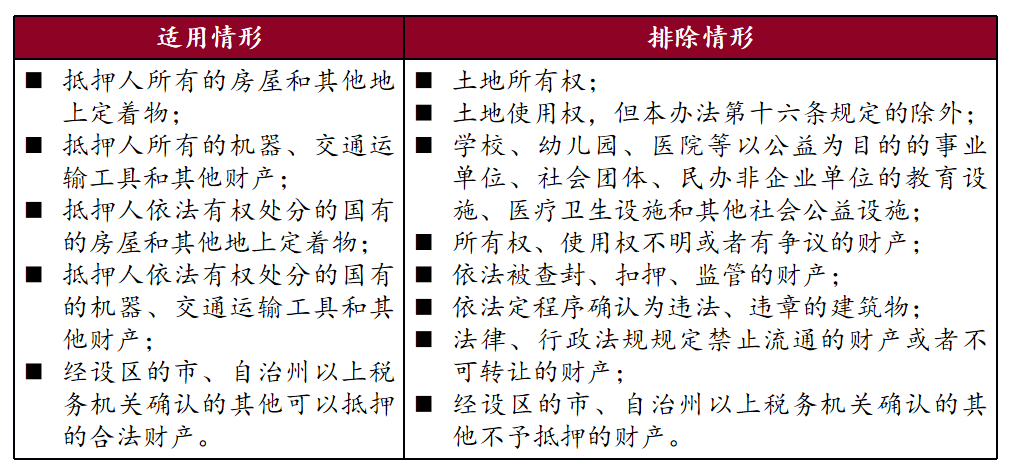

The tax guarantee is required to cover the tax and late payment as well as the cost of realizing the tax and late payment. The Trial Measures on Tax Guarantees clearly provide for three types of tax guarantees, including guarantees, mortgages and pledges, but the relevant provisions are relatively simple. Regarding the collateral, a more common dispute is whether the collateral for which a mortgage has been established can be used for tax guarantee. For example, after receiving the Decision on Tax Treatment, an enterprise is not satisfied with the treatment of the competent tax authority and intends to file an administrative reconsideration on the tax matter. Since it does not have sufficient funds to pay off the tax and the late payment fee, the enterprise provides a tax guarantee with the property in its name. The value of the property is 10 million yuan, a bank as the first mortgagee to set up a mortgage of 5 million yuan, the remaining value is sufficient to cover the tax and late payment, but the tax authorities have set up part of the security on the grounds of its mortgage not to confirm its tax guarantee. In practice, for the mortgage that has been established, the tax authorities, as the second mortgagee, need to verify the value of the mortgaged property and the amount of the first mortgagee's claim before the mortgage is established, and also need to coordinate with the first mortgagee in the liquidation stage to ensure the realization of the mortgage and the collection of the full amount of state taxes. Considering these factors, some tax authorities take a cautious attitude and do not recognize the collateral for which a mortgage has been established. However, in the author's opinion, the Trial Measures for Tax Guarantees do not explicitly exclude secondary mortgages of assets, and from the perspective of safeguarding the taxpayers' right to remedies and the collection of state taxes, the tax authorities should adopt an accommodating and prudent attitude to fully investigate the secondary mortgages, and if they meet the requirements, they should accept them as tax guarantees.

Another common dispute is the issue of the confirmation period of tax guarantee. The Trial Measures on Tax Guarantees do not stipulate the number of days within which the tax authorities have to confirm the acceptance of guarantees provided by taxpayers, which is prone to disputes - for example, if a taxpayer provides a tax guarantee within 15 days, and the tax authorities do not give a clear reply within 15 days as to whether or not they have confirmed the tax guarantee, will the taxpayer be penalized for failing to pay tax or provide a tax guarantee within the stipulated period of time? For example, if the taxpayer does not provide tax guarantee within 15 days, will the taxpayer lose the right to file a reconsideration because the taxpayer has not paid the tax or provided the tax guarantee within the prescribed period? In a dispute case between a real estate company and the inspection bureau about tax guarantee, the real estate company filed a tax guarantee within 15 days after receiving the processing decision, but the inspection bureau did not reply, and then the enterprise settled the tax and late payment and filed a reconsideration within 60 days, and the reconsideration authority did not accept the application for reconsideration on the basis that the enterprise failed to settle the tax and late payment or provide the guarantee in the stipulated time limit, and the court of the first instance held that, after the administrative counterparty filed the guarantee application, the administrative authority had the obligation to reply. The court of first instance held that after the administrative relative filed the application for guarantee, the administrative organ had the obligation to reply, and during the period when the administrative organ did not reply, the administrative relative had reasons to believe and expect the administrative organ to reply. Therefore, the period between the taxpayer's filing of the application for tax guarantee and the settlement of the tax shall be the company's expectation time for the confirmation of the tax guarantee, and its payment of tax and late payment in accordance with the processing decision during the expectation time meets the requirement of tax preposition for filing administrative reconsideration. In the author's opinion, the taxpayer filed an application for tax guarantee, the tax bureau should make a timely decision, for the tax authorities do not respond to the behavior, you can file a lawsuit on its administrative inaction, and for the taxpayer due to the tax authorities do not confirm the tax guarantee for the administrative action and filed a lawsuit, the original administrative reconsideration of the application period should be suspended from the date of filing an administrative lawsuit, in order to safeguard the rights and interests of the taxpayer's remedies. The taxpayer's rights and interests of relief shall be safeguarded.

III. How can taxpayers effectively initiate relief procedures through tax guarantees?

As can be seen from the foregoing, for the disputed matters that require tax payment before relief procedures can be initiated, the deadline for tax guarantee is very tight, and there are many disputes due to unclear policies and the existence of understanding bias in tax enterprises, etc. Whether or not tax guarantee can be handled for the exercise of the administrative counterparty's right of reconsideration and relief plays a key role, and thus plays an important role in whether or not the tax processing decision can be subject to the examination of the reconsideration and litigation, which will may have an impact on the substantive rights and interests of the administrative relative. Therefore, taxpayers should accurately understand and apply the tax guarantee to realize the initiation of administrative reconsideration relief procedures through the tax guarantee, and taxpayers may pay attention to the following points:

First, the tax guarantee shall be provided within the prescribed period. At present, there are many different understandings on the period of providing tax guarantee, the period of confirmation of tax guarantee by the tax bureau, and the period of administrative reconsideration initiated by the taxpayer. When the taxpayer receives the processing decision letter, he/she shall consider whether to initiate the relief procedure in a timely manner, and if he/she wants to realize the pre-payment of tax in the form of guarantee, he/she shall confirm the period of providing tax guarantee with the tax bureau, and whether the period can be suspended if corrections are required. The second is to choose suitable collaterals, try to choose the real estate or movable property with clear ownership, no dispute and no situation of being seized or impounded according to the law, and complete the assessment of the asset value in time; the third is to handle the tax guarantee procedures according to the law, fill in the tax guarantee and the list of tax guaranteed property, and have it signed and stamped by the taxpayer and confirmed by the tax authorities. In short, when the taxpayer intends to file a reconsideration and provide a tax guarantee, he/she should make clear the caliber of law enforcement of the tax bureau, and try to avoid the formation of a “case within a case” due to the dispute over the confirmation of the tax guarantee, which will affect the resolution of the substantive dispute.