The exchange of tax intelligence between China and the United States helps China recover 10 million yuan in taxes, and tax compliance in asset allocation in the United States cannot be ignored

Abstract:Recently, through a special tax information exchange between China and the United States, China's tax authority investigated a case of a company evading corporate income tax by fabricating overseas equity transactions and falsely reporting equity investment losses. The tax authorities have recovered more than 10 million yuan of corporate income tax that the enterprise evaded, and imposed a fine of 0.5 times the amount of underpaid tax on the enterprise. In recent years, the act of evading taxes through overseas asset allocation has not only received attention from international tax management cooperation, but also been a focus of inspection by China's tax authorities. This article combines a tax bureau disclosure case to share the current situation of tax information exchange practices between China and the United States, and combines the dynamic of tax inspections on high net worth individuals in China's taxation system to reveal tax risks for domestic high net worth individuals who have assets or income in the United States.

I.A Domestic Enterprise Falsely Reported Losses on the Transfer of Equity in a US Subsidiary

In 2012, Company A was approved by the Ministry of Commerce to establish a wholly-owned subsidiary, Company B, in the United States. Within four years, Company A remitted $7 million in investment funds to Company B. According to Article 32 of the Implementation Regulations of the Enterprise Income Tax Law and the Announcement of the State Administration of Taxation on the Treatment of Income Tax on Enterprise Equity Investment Losses (国家税务总局公告2010年第6号), if an enterprise incurs equity investment losses, they can be deducted as a one-time loss in the year of the recognized loss when calculating the taxable income of the enterprise. In order to artificially reduce the corporate income tax burden, Company A plans to lower the corporate income tax amount by falsely transferring the equity of Company B and declaring equity investment losses.

In 2016, Company A transferred 40% of Company B's shares to Company C in the United States for $100. In 2018, Company A transferred 60% of Company B's shares to Company C for $750000, and applied to deduct $6.25 million (700-75=$6.25 million, or RMB 40.22 million) as equity investment losses in the 2018 pre tax deduction item.

In October 2023, the tax authorities launched a tax inspection on Company A and found that there were abnormalities in the pricing of equity in the above-mentioned transaction. Through a special information exchange program, the tax authorities obtained the balance sheets of Company B from the US tax authorities for the years 2016 to 2018. It was found that Company B's equity was approximately $8.6 million in 2016, $8.84 million in 2017, and $8 million in 2018, with an initial investment of $7 million. This confirms that Company B did not incur any losses during the equity transfer. Based on the balance sheet, in 2016, the original value of 40% equity of Company B was 3.44 million US dollars, and in 2018, the original value of 60% equity of Company B was 4.8 million US dollars. The transfer price of Company A's equity was significantly lower than the corresponding original value of Company B. At this point, if the above-mentioned equity transfer truly occurs, the tax authorities will have the right to adjust the tax payment of Company A in accordance with Article 35 of the Tax Administration Law; If the above-mentioned equity transfer has not actually occurred, Company A may have engaged in the behavior of evading corporate income tax through false tax declaration.

In November 2023, the tax authorities once again requested information exchange with the State Administration of Taxation. According to the feedback from the United States, Company B did not actually undergo any equity changes in 2016 and 2018. Based on this, the tax authorities have determined that Company A's behavior of underpaying corporate income tax through false tax declarations constitutes tax evasion. The taxable income for 2018 corporate income tax has been increased by 40.22 million yuan, and Company A is required to pay approximately 10.0555 million yuan in corporate income tax and a fine of 0.5 times the underpaid tax. Company A is required to pay a total of approximately 15.0832 million yuan in corporate income tax and fines.

II.Practice of Sino US Tax Information Exchange and Cooperation

There is specialized tax information exchange and cooperation between China and the United States. Article 25 of the Agreement on the Avoidance of Double Taxation and the Prevention of Fiscal Evasion between China and the United States specifies that both parties shall cooperate in the exchange of tax information to prevent tax fraud and tax evasion. The scope of information exchange includes but is not limited to the information necessary for the implementation of the Agreement and the information necessary for the domestic laws of both parties regarding income tax. At the domestic legal level, the "Work Regulations for International Tax Information Exchange" (国税发〔2006〕70号) clarify the implementation procedures for special tax information exchange. When tax authorities at or below the provincial level need the assistance of relevant contracting state authorities to provide tax information in order to implement tax treaties and the domestic laws of the tax categories involved, they can submit special information exchange requests and report them to the General Administration at all levels. In this case, the tax authorities in the location of Company A obtained the balance sheet and equity transfer information of Company B from the United States through a special tax information exchange, and the above terms are the legal basis for Sino US cooperation.

The exchange and cooperation of tax information enables China's tax authorities to obtain clues about the economic activities of Chinese tax residents in the United States, improving the tax collection and management capabilities of the tax authorities. The international tax evasion behavior implemented in the past due to the poor exchange of financial and tax information between China and the United States has become a focus of tax inspection work, and will trigger tax risks, administrative risks, and even criminal risks.

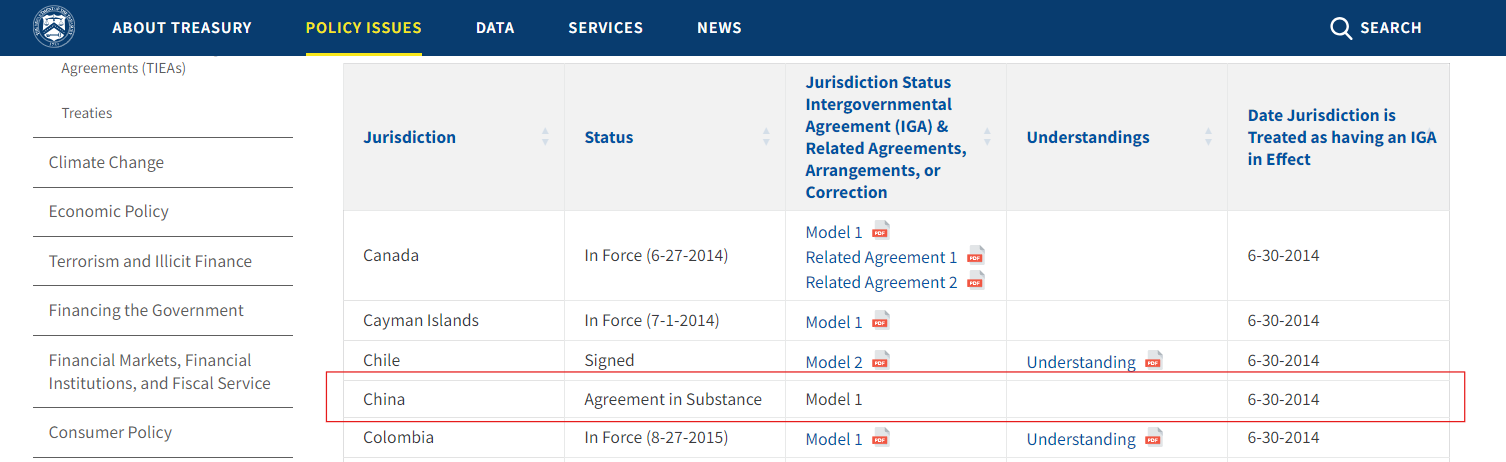

In addition, the United States requires tax jurisdictions to engage in automatic information exchange cooperation under the Foreign Account Tax Compliance Act (FATCA). The Act provides two modes of cooperation for tax information exchange among Partners. In Mode 1, the partner agrees to report to the US Internal Revenue Service the US account information maintained by all financial institutions within its jurisdiction. The financial account information is exchanged to the US through the path of "financial institution partner tax authority US Internal Revenue Service"; The cooperating party adopting Mode 2 agrees to guide and allow all financial institutions within its jurisdiction to directly report the US account information it maintains to the US Internal Revenue Service, and the financial account information is exchanged to the US through the path of "Financial Institutions - US Internal Revenue Service". For non compliant financial institutions and accounts, the United States will impose a withholding tax of 30% on their accrued income sourced from the United States. According to the official website of the US Treasury Department, China has reached an agreement with the United States on the substantive content of FATCA Model 1, and China has been treated as a jurisdiction with effective intergovernmental agreements since June 30, 2014. However, as of now, China and the United States have not signed an intergovernmental agreement on Mode 1, and China's domestic laws have not made unified provisions on the compliance requirements of FATCA.

III.Potential tax risks for Chinese tax residents in asset allocation in the United States

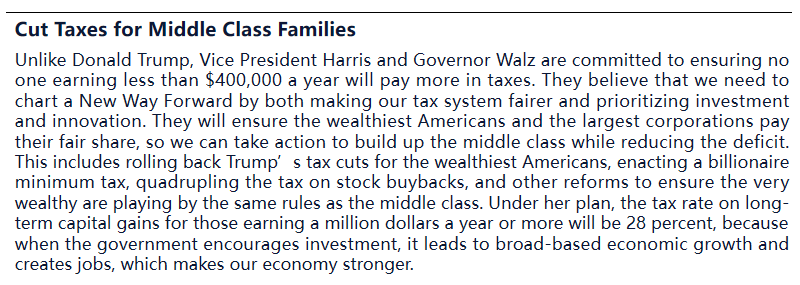

Due to China being considered a tax jurisdiction with effective FATCA intergovernmental agreements, the United States has not yet imposed a 30% withholding tax on Chinese financial institutions. However, in 2021, the Biden administration expressed its desire to strengthen cooperation with international organizations and other countries to combat tax evasion by American taxpayers, sparking discussions on the possibility of "rebooting" the FATCA bill. On the eve of this year's US election, Harris made it clear in his campaign promises that he would set a minimum tax rate for American billionaires and increase the capital gains tax rate for millionaires. These actions also rely on the control of overseas account information of high net worth individuals. In combination with China's recent strengthening of tax compliance supervision for high net worth individuals, if China and the United States choose to restart cooperation on tax related information exchange of reciprocal financial accounts under the FATCA framework, the account information of Chinese tax residents with assets in the United States or income obtained from the United States may be handed over to Chinese tax authorities. This will result in some commercial arrangements that violate China's anti tax avoidance rules being inspected, and any improper tax benefits obtained will be collected.

The tax avoidance behavior of high net worth individuals has always been a focus of China's tax inspection work. In 2018, the Decision of the Standing Committee of the National People's Congress on Amending the Individual Income Tax Law of the People's Republic of China added Article 8, which specifies that the tax authorities have the right to make tax adjustments for improper tax benefits obtained from arrangements that do not have reasonable business purposes, such as reducing the amount of tax payable through connected transactions that do not conform to the principle of independent transactions, controlling enterprises established in countries with significantly lower actual tax burdens not to distribute or distribute less profits, etc. In 2021, the Central Office and the State Council issued the "Opinions on Further Deepening Tax Collection and Management Reform", which pointed out the need to strengthen risk prevention and supervision in key areas, increase the prevention and control, supervision and inspection of tax evasion behaviors such as concealing income, falsely listing costs, transferring profits, and using "tax havens", "yin-yang contracts" and related party transactions; Strengthen tax and fee services and supervision for high-income and high net worth individuals in accordance with the law. In recent years, tax authorities have increasingly focused on and regulated the overseas asset allocation and investment and financing activities of high net worth individuals.

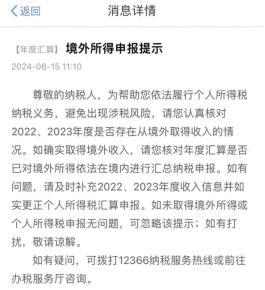

In June of this year, many taxpayers reported receiving a "Notice on Overseas Income Declaration" on their personal income tax app, requesting them to conduct a self-examination of their overseas income for the years 2022 and 2023.

In October of this year, Bloomberg released a report titled "China Moves to Tax the Ultra Rich for Overseas Investment Gains", which was widely shared by multiple authoritative investment information platforms. According to informed sources, some wealthy individuals in major Chinese cities were told in recent months to conduct self-assessments or summoned by tax authorities for meetings to evaluate potential payments, including those in arrears from past years, said the people, asking not to be identified discussing a private matter.

Against the backdrop of increasingly mature cooperation in tax information exchange, the feasibility of Chinese tax residents hiding their assets and income in the United States and using their foreign identity to evade taxes is gradually decreasing. Using radical methods for tax planning carries the risk of being subject to tax adjustments; Those who engage in false tax declaration through deception and concealment, fail to pay underpaid taxes, may also be identified as tax evaders and face risks such as being required to make up for tax payments, imposing late fees, and imposing fines; If it constitutes a crime, it may also be suspected of criminal liability such as tax evasion.

Conclusion: It is imperative for high net worth individuals to comply with tax regulations in asset allocation in the United States

Although the tax information exchanged by the US tax authorities cannot serve as a direct basis for China's tax authorities, the economic activities reflected in it will become inspection clues for potential tax violations. Therefore, the increasingly mature tax collection and management cooperation between China and the United States has improved the collection and management capabilities of China's tax authorities, and raised higher tax compliance requirements for Chinese tax residents' asset allocation behavior in the United States.

On the one hand, high net worth individuals should strengthen their tax compliance construction. Chinese tax residents who allocate assets in the United States should accurately assess their tax obligations, based on a comprehensive review of income sources, understanding the economic essence of related asset allocation activities, and clarifying their own tax resident status. High net worth individuals who have tax obligations to both China and the United States should pay attention to tax incentives related to their asset allocation activities, timely declare tax credits, and reduce their tax burden in accordance with laws and regulations. On the other hand, high net worth individuals should also conduct tax compliance self inspections on their asset allocation in the United States. If asset allocation activities in the United States trigger tax risks such as inspections, one should respond with a positive attitude, actively communicate with tax authorities to strive for favorable processing results, and seek the help of tax lawyers when necessary to safeguard their legitimate rights and interests.