Just now! Upstream coal invoicing platform involved in criminal “false invoicing”, triggering a series of downstream enterprise tax and criminal risk

Ⅰ. The chronic problem of invoicing in the coal industry is difficult to solve, and the risk of false invoicing involves a wide range of issues

Recently, a coal business enterprise in NM has been investigated and dealt with for suspected false invoicing of VAT special invoices. In the course of investigation, the public security authorities found that the case involved a large number of invoiced enterprises and a wide range of geographic distribution, so through the public security economic investigation cloud system to the downstream areas of the crime clues. At present, some of the areas that received the clues have carried out investigation and verification work.

It is reported that the invoices of the coal business enterprises involved in the case were mainly issued to coal trading enterprises. The risk of false invoicing for trading enterprises is rooted in the coal industry's capacity limitation policy. In order to avoid the regulation of coal mining limit, some coal mines adopt off-the-books operation means, selling “cash coal” without invoices. A number of coal trading enterprises involved in the case were purchasing “cash coal” from coal-producing regions such as Inner Mongolia and Shanxi, and the coal customers they serve are mostly large-scale electric power enterprises and industrial enterprises, which must issue special VAT invoices. In order to solve the problems of “sales but no entry” and abnormally high tax burden, trading enterprises are forced to let others issue invoices on their behalf.

There are two main sources of invoices for coal trading enterprises: one is that trading enterprises contact coal invoicing enterprises on their own to issue invoices on their behalf; and the other is that coal mines take the initiative to introduce enterprises capable of issuing invoices for trading enterprises when they are selling “cash coal”, and intermediary facilitates the issuance of invoices on their behalf. Regardless of the mode, it is foreseeable that as the dust settles on the judicial characterization of the coal enterprise, all of the sales invoices issued by it will be characterized as false invoicing, thus triggering the tax and criminal risks of downstream enterprises receiving invoices.

Ⅱ What tax and criminal risks will the relevant enterprises face?

(Ⅰ) Upstream invoicing enterprises: characterized as shell invoicing platforms

The coal business enterprises involved in the case have now entered into criminal proceedings. In judicial practice, such invoicing enterprises are often characterized as shell invoicing platforms that “engage in the business of false invoicing”.

On the one hand, the numerous and widely distributed invoiced enterprises involved in the case have the characteristics of a false invoicing platform; on the other hand, there is a significant mismatch between the production and operation capacity of the invoiced enterprises and the amount of invoices, which makes it easy to be recognized as a shell false invoicing. Therefore, the coal enterprise faced serious criminal liability. At the tax level, since the invoicing enterprise was recognized as false invoicing without goods, it did not have taxable sales behavior and did not bear the VAT tax obligation; meanwhile, according to the Administrative Penalty Law, administrative penalty shall not be given to those who have already been criminally punished, so its economic loss was relatively small. However, the Audit Bureau shall, in accordance with the “Measures for the Administration of Invoice Co-investigation in Tax Violation Cases (for Trial Implementation)”, issue the “Letter of Co-investigation in Tax Violation Cases” and “Notification of Confirmed False Invoicing” to the Audit Bureau of the location of the invoiced enterprise, so that the risk is transferred to the downstream.

(Ⅱ) Downstream trading enterprises: the risk of fraudulent invoicing erupts centrally, and economic losses and legal liabilities are intertwined.

As the tax and public security authorities of the location of downstream trading enterprises receive the Letter of Concurrence on Tax Violations and the Letter of Clue, it will inevitably lead to tax audits or public security investigations. At this time, coal trading enterprises are first faced with the problem of administrative risk and criminal risk transformed into each other: for the tax referred to the public security to deal with, or by the public security directly investigate the case, if the response is appropriate, you can promote the public security to withdraw the case or return the case to the tax program. However, in the event of an improper response, the tax authorities may refer the case to the public security authorities as a clue to a crime during the inspection process, thereby triggering criminal risks. In addition, the tax authorities may also directly transfer cases that are difficult to handle, such as cases where the enterprise has been written off and the amount of tax is huge, to the public security authorities for handling.

1.Tax risk of the invoiced coal trading enterprise

The invoiced coal trading enterprise will be subject to the following tax treatments: First, if the coal trading enterprise can prove that it obtained the invoices subjectively in good faith and did not know that the invoices were fraudulently issued, the enterprise may strive to obtain the fraudulently issued VAT invoices in good faith, and only pay back the VAT amount to the public security authorities. special invoices, and only pay the VAT input; secondly, if the coal trading enterprise can prove that the business is real and the expenditure of the enterprise is real, and only obtains the invoices in non-compliance, it can seek to be dealt with in accordance with the “Announcement on Issues Concerning the Levy and Payment of Compensatory Taxes on Fraudulently Obtained VAT Special Invoices by Taxpayers” (Announcement of the State Administration of Taxation No. 33 of 2012), and only pay the VAT and the late fee; thirdly, if the coal enterprise fails to prove the authenticity of the business. Or the inspection bureau considers that the enterprise fails to obtain legal pre-tax deduction vouchers, then it also faces the risk of enterprise income tax adjustment in addition to VAT. The risk of tax administrative penalties faced by the invoiced enterprises is divided into the following two paths: first, false invoicing, i.e., characterizing the invoiced enterprises as having obtained false invoices, imposing fines of up to RMB 500,000, and transferring to the judiciary to deal with the false invoices exceeding RMB 100,000; and second, tax evasion, i.e., tax evasion, i.e., tax evasion in accordance with the “Law on the Management of Tax Levy” and the “Circular of the State Administration of Taxation on the Treatment of Issues Relating to the Obtaining of Fraudulently Opened VAT Special Purpose Invoice by Taxpayers” ( State Taxation [1997] No. 134), the VAT and enterprise income tax corresponding to the fraudulent invoices will be recognized as tax evasion, and a fine of 0.5 times to 5 times will be imposed.

2.Criminal Risks of Invoice-taking Coal Trading Enterprises

Part of the invoice-taking coal trading enterprises believe that as long as there is a real purchase of coal goods, it does not constitute the crime of fraudulently issuing VAT invoices. However, there are few invoiced enterprises investigated and punished in judicial practice, and their reasons for constituting false invoicing are mainly as follows:

(1)“False invoicing without goods”. Since the upstream coal enterprise has been characterized as “false invoicing without goods” by the effective judicial decision, as the recipient, the coal trading enterprise is presumed to be “falsely accepting invoices without goods”, which constitutes the crime of falsely invoicing VAT special invoices.

(2)“False invoicing with goods”. In some cases, the judicial authorities recognized that the coal trading enterprises had purchased coal and obtained invoices based on real coal purchases, but they believed that the trading enterprises first purchased coal from coal mines at “low prices without tax” and then paid invoicing fees lower than the tax rate to obtain invoices from a third party, which resulted in loss of state tax and still constituted the crime of false VAT invoicing. This constitutes false issuance of VAT invoices.

From the above, it can be seen that the coal trading enterprises, as the direct recipients of invoices, are facing tax treatment and criminal punishment at the same time, and the economic losses and legal liabilities they bear are extremely serious. Such coal trading enterprises are mostly enterprises with actual business operations, and once the risk breaks out, the person in charge of the enterprise will be detained, the account books and business data of the enterprise will be seized, and the enterprise will face huge amount of taxes, late payment fees, fines or penalties, which will lead to stagnation of operation or even lead to the enterprise's closure and bankruptcy.

(Ⅲ) End-use coal enterprises: invoice risk is likely to be consecutive conduction

Due to the risk of false invoicing is mainly undertaken by the front-end of the coal trading enterprises, the actual use of coal, power companies, industrial enterprises are generally not affected by the invoice risk. But nothing is absolute. If the trading enterprise has been shut down, canceled or has fled and lost contact, the coal-using enterprise still faces the conduction of invoice risk.

1.The conduction of abnormal voucher risk

the VAT invoices issued by a coal trading enterprise are abnormal vouchers when the enterprise has fled and lost contact, and has not declared tax or has a serious deviation in the names of inputs and outputs. If a coal trading enterprise obtains abnormal vouchers and has not yet declared the VAT input tax credit, it is not allowed to offset the VAT input tax credit; if it has declared the VAT input tax credit, unless otherwise specified, it will be treated as the input tax credit transfer.

2.The conduction of the risk of false invoicing

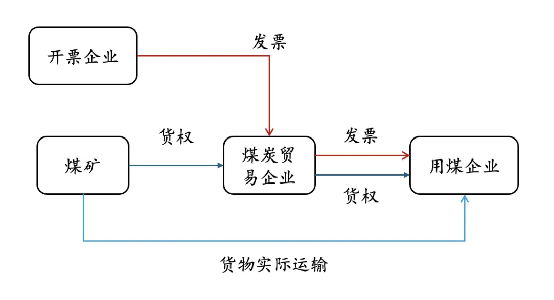

Some coal trading enterprises have been recognized as obtaining false invoices mainly because of the business model that the transfer of the right of goods is separated from the transportation of goods. Since coal trading enterprises have neither storage nor actual transportation capacity, they can only instruct coal mines to transport goods to coal-using enterprises in one-stop mode. As shown in the figure below:

In the above model, once the coal trading enterprise in the middle escapes or loses contact, it is unable to explain and restore the actual business situation, and also unable to bear the legal responsibility of paying back the input tax. In order to recover the tax loss, the sales invoices of the coal trading enterprise will also be characterized as fraudulent invoicing, which ultimately leads to the risk of fraudulent invoicing being transferred to the end-user enterprises.

Ⅲ. How can downstream invoiced enterprises apply the principles of tax law to strive for optimal results?

Under China's tax supervision system of “controlling tax by invoices”, invoices are given important legal significance, which are not only certificates of VAT deduction, but also certificates of enterprise cost deduction. Therefore, if the risk of invoice breaks out, the invoiced enterprise will bear the responsibility of severe tax, late payment fee and fine. The invoiced enterprises should actively organize business information, combine the principles of tax law and relevant regulations, and hire professionals to intervene and restore the original business appearance, so as to minimize the economic losses and legal liabilities.

-

Relying on evidence materials, restore the authenticity of business

Whether or not there is a real business is a prerequisite for discussing the issues that the taxpayer does not have the subjective purpose of malicious false invoicing and does not cause loss of national tax. In the case of “purchasing goods from A and invoicing by B”, the invoiced trading enterprise did purchase coal, but it still needs to establish a link between the goods and the invoice, so as to avoid the case-handling authority only recognizing that the invoice obtained is false invoicing without goods.

In terms of evidence, it is necessary for the enterprises to provide original business information to prove that the invoices obtained are related to the purchased coal goods in terms of amount and quantity, etc. At the legal level, the enterprises shall take into account the “Research Office of the Supreme People's Court” and the “Nature of the Acts of ‘Affiliation’ of the Company to Carry out Business Activities and Allow the Company to Falsely Issue VAT Special Purpose Invoices for Themselves”.

(Ⅱ) The business model of the invoiced trading enterprise is not a criminal offense.

The ticketed trade enterprises do not constitute the crime of false invoicing “two Supremes” “on the handling of criminal cases of endangering the tax collection and management of the interpretation of a number of issues on the application of the law” (legal interpretation [2024] No. 4), article 10, paragraph 2, provides for the crime of false VAT invoices of the crime of the crime of the crime of the second paragraph, that is, “for the purpose of falsely increasing the performance, financing, loans, etc. not for the purpose of fraudulently offsetting taxes, and no fraudulent loss of taxes is caused by the offsetting, the crime shall not be punished, and if it constitutes other crimes, criminal liability shall be pursued for other crimes according to law.”

In order to better understand the provisions of this paragraph, the judges of the Supreme People's Court, in the article “Understanding and Application of the ‘Two High Levels’ <Interpretation of Several Issues Concerning the Application of Law to the Handling of Criminal Cases of Endangering Tax Collection and Management>”, suggested that the demarcation between the crime of false VAT invoicing and the crime of tax evasion, “the most crucial difference is that The most crucial difference lies in whether the subjectivity is based on the intention to cheat the state tax or on the purpose of evading the tax obligation”; even if ‘the taxpayer, within the scope of the taxable obligation, makes deductions to pay less tax through the false invoices’, the subjectivity is for the purpose of non-payment or underpayment of tax, which should be dealt with in accordance with the crime of tax evasion. The coal trading enterprise in the case fits the above argument. According to this argument, the trading enterprise purchased the coal goods and then sold them to the downstream enterprises, for which it issued special VAT invoices and formed taxable obligations. In order to pay less VAT, the coal trading enterprise asked others to issue invoices for itself, with the subjective purpose of evading VAT, and objectively the national VAT was lost by “evasion” rather than “fraud”, and should be penalized as evasion of VAT. If the coal trading enterprise has entered into criminal proceedings, it should actively conduct defense based on the viewpoint of the Supreme Court.

(Ⅲ) Expenditures made by the business to which the note is issued are genuine and the costs are deductible

If the invoices obtained by coal trading enterprises and end-use coal enterprises are deemed to be falsely issued, they shall not be used as pre-tax deduction vouchers in accordance with Article 12 of the Measures for the Administration of Pre-tax Deduction Vouchers for Enterprise Income Tax (Announcement of the State Administration of Taxation No. 28, 2018, hereinafter referred to as the “Administration Measures”), which provides that “the invoices obtained by the enterprises from the invoicing party shall not be illegally obtained, In accordance with the provisions of Article 12 of the Administrative Measures, “the invoices that are not in compliance with the regulations (hereinafter referred to as ‘non-compliant invoices’) ...... shall not be used as pre-tax deduction vouchers by the invoicing party (hereinafter referred to as the ‘non-compliant invoices’)”, and the enterprise income tax is at risk of adjustment. However, the invoiced enterprise pays the enterprise income tax in the case of real expenses, which is not in line with the provisions and principles of the Enterprise Income Tax Law, and it should actively claim its legal rights:

Firstly, it is claimed that the costs are deducted without invoices within the framework of the Administrative Measures. According to Article 14 of the Administrative Measures, “In the process of reissuing or exchanging invoices or other external vouchers, if the enterprise cannot reissue or exchange invoices or other external vouchers due to the other party's cancellation, revocation, revocation of business license according to the law, or being recognized as a non-normal household by the tax authorities and other special reasons, the enterprise may allow its expenditures to be deducted before tax after confirming the authenticity of the expenditures with the following information “. The main business information includes the information proving the reasons why the enterprise is unable to reissue or exchange invoices or other external vouchers; the contract or agreement of the relevant business activities; and the payment vouchers of the payment made by non-cash means.

Secondly, it is claimed that the Management Measures contradict the provisions of the Enterprise Income Tax Law and the tax authorities are required to recognize the cost deduction in accordance with the provisions of the Enterprise Income Tax Law. Article 8 of the CIT Law provides that “reasonable expenses actually incurred by an enterprise in connection with the acquisition of income, including costs, expenses, taxes, losses and other expenditures, shall be allowed to be deducted in the calculation of taxable income”. Therefore, as long as the expenditures incurred by the enterprise meet the conditions of authenticity, relevance and reasonableness, they should be expensed before tax. In practice, some tax authorities have started to recognize the deduction of costs without invoices in accordance with the provisions of Article 8 of the Enterprise Income Tax Law.

(IV) Relevant departments should focus on protecting the VAT deduction rights and interests of the invoiced enterprises.

At present, once the input invoice is recognized as abnormal voucher or false invoice, the tax authority will certainly require the invoiced enterprise to pay or transfer the input VAT first, which reflects the supervisory idea of “controlling tax by invoice”. However, over-emphasizing the importance of invoices as the only deduction voucher will lead the invoiced enterprises to pay additional VAT when they have already paid the tax-inclusive price to the upstream enterprises, which is essentially subject to double taxation, contrary to the principle of deduction of VAT, and destroys the deduction chain of VAT, and infringes on the deduction rights and interests of the taxpayers. During the legislative process of the VAT Law, scholars have advocated the establishment of a deduction system around the construction of the “deduction right” of VAT taxpayers, but further arguments are needed.

(Ⅴ) Frequent occurrence of tax risks in the coal industry and the imminent need for compliance building

As one of the areas with high tax risks, the coal industry continues to receive key attention from various departments. On March 18, 2024, at the press conference on the judicial interpretation of the two high courts, the spokesman of the Supreme Prosecutor clearly pointed out that “petrochemical, coal and other industries are still the high incidence of fraudulent tax crimes”, and the tax supervision of the coal industry will be further strengthened. As the effectiveness of “tax control by numbers” continues to emerge, similar invoicing platforms will be subject to tax wind control warning, the risk of outbreak of time to accelerate.

At the same time, the invoice risk will be rapidly transmitted along the deduction chain of digital and electric invoices, and the risk of the invoiced enterprises will increase significantly. At the same time, the banking and tax information sharing mechanism has been established, and the tax and banking sectors have realized the sharing and verification of data such as bank accounts, fund flows and asset information of enterprises and individuals. It is particularly important to note that banks and other financial institutions have established mechanisms for early warning and supervision of large cash receipts and expenditures (accumulating 50,000 yuan per day). With the synchronization of such large cash receipts and expenditures information to the tax authorities, the phenomena of off-the-books operation and private collection of money, such as coal mines, are also subject to the outbreak of tax risks.

Therefore, coal enterprises should attach great importance to the construction of tax compliance in the course of operation, strengthen internal risk prevention and control and external risk isolation, and optimize the business model with the help of professional power to dissolve the risk at the front end. If the invoice risk has already erupted, they should actively respond to it by cooperating with the tax and public security investigations, providing true, comprehensive and complete business materials, and on the basis of which, they should put forward professional defenses and defense opinions in order to strive for a good characterization of the enterprises and parties involved in the case.