Cases of Scalpers Manipulating the Separation of Fuel and Invoice Should not be Treated as Makes out False Value-Added Tax Invoices and the maximum sentence should not exceed five years

Abtract:The latest case shows that for the group of scalpers who manipulate the fuel and invoice to separate and assist the invoice-buying units to obtain chemical invoices or refined oil invoices in a fraudulent manner, according to the spirit of the judicial interpretation of the two high courts that limits the application of the offence of fraudulent invoicing and the rule of purpose of tax cheating + result of tax losing, the conviction should be based on the offence of unlawfully purchasing VAT invoices, that is, the maximum statutory sentence should not exceed five years. The maximum statutory penalty shall not exceed five years. The author suggests that parties involved in such pending cases should effectively defend the application of the charges, and those who have been convicted of the offence of false invoicing for more than ten years can actively seek to change the sentence through appeal in accordance with the law.

In the oil circulation area, there has long existed a group of scalpers who manipulate the separation of oil invoices and take advantage of the phenomenon of petrol stations, transport teams, construction sites and other terminals asking for oil but not invoices to link up the oil-using terminals, the invoicing units and the oil-selling units, and then purchase oil from the oil-selling units in the name of the invoicing units and deliver the goods to the oil-using terminals. At the same time, the invoice-buying unit can obtain chemical invoices or invoices for refined oil products.

Prior to the issuance of the judicial interpretations of the two high courts, such subjects were usually convicted and punished for the offence of falsely opening VAT invoices. After the issuance of the Judicial Interpretations of the two high courts, the constituent elements of the offence of fraudulent VAT invoices have been added with the qualifying elements of the purpose of the tax fraud and the result of the tax fraud. In response to such scalping cases, some courts began to follow the principle of the two high judicial interpretations limiting the application of the offence of false invoicing, and convicted and punished the offence of illegal purchase of VAT invoices. This article will analyse the changes in the qualification of scalping convictions in the context of three cases and make suggestions for the parties involved to effectively conduct their defence or appeal.

01

(2022)辽04刑初16号:Kou sentenced to 10 years for false VAT invoicing offence

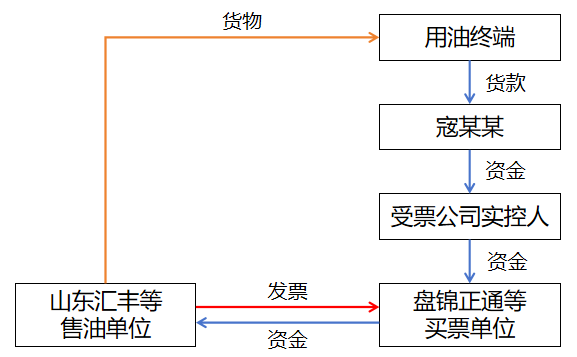

In 2019, Zhumoumou operated oil trading in Panjin, Liaoning. After investigation by the case authorities, Kou Moumou, in order to obtain benefits, using the oil invoice separation method, after first contacting the retail customers who buy refined oil but do not need invoices, he used his personal bank card under his control to collect the retail customers' oil purchase money and transferred it to the bank accounts of Panjin Zhengtong Company, Panjin Jincheng Company and other units, and then purchased in the name of the abovementioned companies with the invoices of the chemical products category from Shandong Huifeng Company, Zibo Haiyi Company, and Shandong Jincheng Company. Finished oil products. Zhumoumou handed over the refined oil products to the retailers to pick up the goods, and Shandong Huifeng Company, Zibo Haiyi Company, Shandong Jincheng Company issued chemical product invoices to Panjin Zhengtong Company, Panjin Jincheng Company and other units. Kou Moumou used the above method of separation of votes and goods to assist downstream units in obtaining chemical VAT invoices totalling more than 225 million yuan, involving a tax amount of more than 29.8 million yuan, and Zou Moumou's personal unlawful profit of more than 415,000 yuan.

On 29 July 2023, the Intermediate People's Court of Fushun City, Liaoning Province, rendered a judgement in this case, finding that the act of Zhumoumou's introduction of others to falsely issue VAT invoices objectively existed, constituting the crime of falsely issuing VAT invoices, and sentencing Zhumoumou to ten years' fixed-term imprisonment.

02

(2019)赣0502刑初407号:Liao sentenced to 10 years for false VAT invoice offence

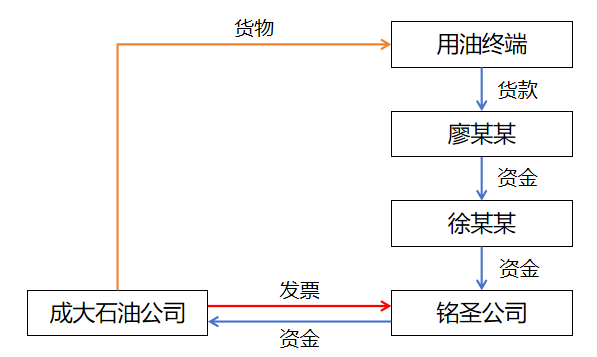

In early 2014, Liao Moumou and others joined together in the fuel business, purchasing fuel from Chengda Petroleum Company and then selling it to neighbouring mines, construction sites and petrol stations. As most of these purchasers do not need invoices, Liao Moumou has accumulated some invoices in Chengda Petroleum Company that have not yet been issued.In September 2014, Xu Moumou operated Ming Sheng Company due to the lack of invoices, Xu Moumou agreed with Liao Moumou to pay Liao Moumou an advantageous fee for the purchase of invoices from Liao Moumou.

Thereafter, Liao signed an oil purchase contract with Chengda Petroleum Company in the name of Ming Sheng Company, and Xu Moumou used the bank account of Ming Sheng Company to pay for the goods to the public account of Chengda Petroleum Company, and Liao then went to Chengda Petroleum Company to pick up the oil in the name of Ming Sheng Company and sold it to the oil-using terminal, and Liao used his private account to collect the money paid by the oil-using terminal and withheld a small portion of the benefit fee before returning the remaining money to the personal account provided by Xu Moumou. . As of September 2015, Ming Sheng Company obtained a total of 20.21 million yuan of VAT invoices issued by Chengda Petroleum Company, involving a tax amount of more than 3.43 million yuan. After the case, Liao Moumou and his defence argued that Liao Moumou did not have the subjective intention of conspiring with Xu Moumou to cheat the state tax, and provided the bill of lading of the oil products sold by Chengda Petroleum Company to confirm the real existence of the goods transaction.

On 24 July 2020, the Yushui District People's Court of Xinyu City, Jiangxi Province, made a judgement that Liao Moumou, in the absence of actual purchase and sale of goods with Xu Moumou, falsely issued VAT invoices to Xu Moumou's Mingsheng Company for the purpose of tax deduction, and that his conduct constituted the crime of falsely issuing VAT invoices, and sentenced Liao to ten years' fixed-term imprisonment.

Liao did not accept the judgement of the first instance and appealed to the Intermediate People's Court of Xinyu City, Jiangxi Province. The court of second instance held that the purpose of Xu Moumou's purchase of invoices was to make profit by issuing false sales invoices to the outside world, and the behaviour of Ming Sheng Company in obtaining the invoices of Chengda Petroleum Company and then issuing false sales invoices to the outside world was the key link causing the loss of national tax in this case, and that Liao Moumou, although objectively did not participate in Xu Moumou's false sales invoices, did not conspire with Xu Moumou to issue false sales invoices to the outside world and make profit based on the purpose of the invoice. Purpose. However, based on the fact that liao moumou in and xu moumou no actual goods transaction situation to provide into the big oil company invoice and profit, presumption that liao moumou subjectively should know xu moumou will be false invoices to further profit, and liao moumou to assist xu moumou to obtain invoices of the behaviour of xu moumou external invoices is an important part of false invoices, so that liao moumou constitutes xu moumou false invoicing of the crime of complicity and accessory, still ruled that liao moumou constitutes false invoices of the offence. It still ruled that Moumou Liao constituted the offence of false VAT invoicing, but could be subject to mitigating punishment. The court of second instance rendered a judgement of second instance on 30 December 2020, sentencing Liao to three years’ imprisonment and five years’ probation.

The author believes that the second instance judgement of Liao's case has realised the basic principle of the appropriateness of crime and punishment for Liao in terms of the result, i.e. the author's view that the maximum sentence should not exceed five years. However, the judgement still insisted that Liao constitute the offence of false invoicing, there are certain historical limitations. First of all, the second trial judgement has not yet two high judicial interpretation, false invoicing crime of ‘tax fraud purpose + tax fraud results’ rules have not yet been introduced, the second trial court can not break through the criminal law article 205 ‘act crime’ expression, justifiable. Secondly, the second trial judgement on liao moumou subjective awareness of the harmful consequences of tax fraud and will to adopt the ‘subjective to objective’ presumption method to determine, essentially also due to the false invoicing offence ‘conduct crime’ of the statement of the crime. Perhaps it is because the court of second instance realised that the ‘act crime’ on Liao moumou conviction and sentence is too heavy, so it adopted the accessory rule, so as to reduce Liao moumou sentencing.

However, more similar cases, the trial court may be like the first case of this paper did not realise that the yellow cattle according to the false invoicing offence sentenced to more than ten years does not comply with the principle of appropriateness of crime and responsibility, or although aware of the crime and responsibility and punishment do not adapt to the problem, but still stubbornly sentenced to more than ten years of sentencing, so that there are still many parties suffered from the results of the judicial unfairness of the judgement.

03

(2023)湘1224刑初54号:Chen sentenced to three years' imprisonment for illegal purchase of VAT invoices

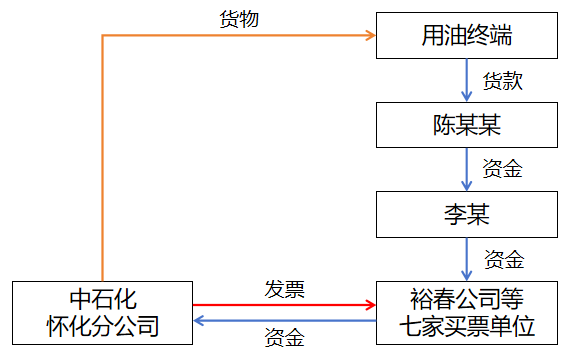

Between 2016 and 2022, Chen Moumou was engaged in oil sales business in Huaihua, Hunan and other places. During the period, Chen Moumou discussed with Li Mou (the beneficial owner of Yuchun Company) and others that Chen Moumou would purchase oil products from Sinopec Huaihua Branch in the name of Yuchun Company, and the oil payment would be aggregated by Chen Moumou contacting the local petrol stations in Huaihua, construction sites, tanker truck drivers, and other operators that did not require invoices for payments to Chen Moumou and then transferring them to Li Mou and Yuchun Company, and Yuchun Company would then make up for the taxes corresponding to the oil payment and then transfer the money to Sinopec Huaihua Branch's The public account of Sinopec Huaihua Branch. Chen received electronic fuel cards from SINOPEC Huaihua Branch in the name of Yuchun Company's agent, withdrew fuel and sold it to small petrol stations and other terminals around Huaihua that did not require invoices, and SINOPEC Huaihua Branch issued invoices to Yuchun Company. Chen earned a small portion of the profits.

In addition, in addition to helping Yuchun to obtain invoices in the manner described above, Chen Moumou also used the same method to assist six other units to obtain invoices issued by Sinopec Huaihua Branch. According to the investigation of the case-handling authorities, Chen Moumou helped seven units to obtain invoices totalling more than RMB 226 million in value and tax during the period of the case, involving a tax amount of more than RMB 26.69 million.

On 6 May 2024, the People's Court of Xupu County, Hunan Province, rendered a judgement in the case of Chen Moumou, finding that Chen Moumou's unlawful purchase of VAT invoices in collusion with others by way of separating the invoices from the goods constituted the crime of unlawful purchase of VAT invoices and sentenced Chen Moumou to three years‘ fixed-term imprisonment and three years’ probation. The judgement particularly emphasised that Chen Moumou's conspiracy with Yuchun Company and other units to illegally obtain VAT invoices was a kind of disguised payment of consideration for the purchase of VAT invoices, and then illegally purchased VAT invoices, and the existing evidence could not prove that Chen Moumou had subjective knowledge that the invoices obtained by the Yuchun Company and other seven units were to be used for the purposes of VAT deduction, tax evasion or other purposes, and therefore it was inappropriate to punish Chen Moumou for the offence of false invoicing of VAT invoices. Therefore, it is not appropriate to evaluate Chen Moumou for the offence of false invoicing of VAT.

In the author's opinion, the judgement of this case was made after the judicial interpretations of the two high courts were issued, and was greatly influenced by the spirit of the judicial interpretations of the two high courts on the restriction of the application of the offence of false invoicing and the positive influence of the rule of ‘tax cheating purpose + tax cheating result’; compared with the previous two cases, the judgement of this case not only fully complied with the principle of the law of crime and punishment, but also fulfilled the basic principle of appropriateness of the punishment to the crime. The basic principle. This case, in which the scalper Chen Moumou was punished for the crime of illegally purchasing VAT invoices, has a significant impact and reference significance for the first case similar to the one mentioned in this article, and the relevant parties should refer to this case to focus on the application of the crime and the spirit of the provisions of the judicial interpretations of the two high courts in order to make an effective defence and appeal to defend their rights.

04

The case of scalping oil ticket separation does not constitute the offence of false invoicing, and the maximum penalty should not exceed five years' imprisonment

Throughout the above cases, before the introduction of the two High Judicial Interpretations, cases of scalping oil ticket separation were usually sentenced to the offence of false invoicing, while after the introduction of the two High Judicial Interpretations, there were cases in which the offence of unlawful purchase of VAT invoices was dealt with according to the offence of unlawful purchase of VAT invoices. This change is not only in line with the provisions and spirit of the two High Judicial Interpretations, but also follows the principle of the statute of limitations and the principle of appropriateness of crime and punishment.

The second paragraph of Article 10 of the Judicial Interpretation of the Two High Command clearly stipulates that if the purpose is not to fraudulently offset the tax, and if there is no fraudulent loss of tax due to the offset, it does not constitute the offence of fraudulently issuing special invoices. In the case of separation of yellow cattle oil tickets, according to the above provisions, if the public prosecutor accuses yellow cattle of constituting the crime of false invoicing, it should prove that yellow cattle have the purpose of cheating taxes and prove that the behaviour of yellow cattle has a direct impact on the result of cheating taxes, in addition, as a party of the defendant, yellow cattle can also be defended by itself that it does not have the purpose of cheating taxes.

From a practical point of view, the purpose of illegally purchasing chemical invoices or invoices for refined oil products by ticket-buying units is various, some of which are for the purpose of dispensing sales, some for the purpose of evading consumption tax, and some for the purpose of accumulating chemical inputs for the purpose of altering the invoices, which are all different. The scalpers usually do not participate in the specific use of invoices by the buying units, and there is no collusion or conspiracy between them and the buying units for the purpose of using the invoices. Therefore, in the vast majority of such cases, scalpers actually do not have direct and clear tax fraud purpose, but only the purpose of illegally selling invoices for profit, and scalpers do not participate in the specific activities and links of illegal use of these invoices by the invoice-buying units, and do not have any direct and effective objective role in promoting and influencing the invoice-buying units whether to evade the consumption tax or to fraudulently offset the value-added tax. Therefore, it is more difficult for the prosecution to have direct and clear evidence to prove that the scalper had the purpose of tax fraud and the result of tax fraud, but on the contrary, the scalper can more effectively prove that it did not have the purpose of tax fraud.

Therefore, in accordance with the spirit of the judicial interpretations of the two high courts on limiting the application of the offence of false invoicing and the provisions of Article 10(2), the subject of scalping can not be punished in accordance with the offence of false invoicing, and it is more appropriate to be punished in accordance with the offence of illegally purchasing VAT invoices by the perpetrator who assists the invoice-buying unit to illegally purchase invoices. Since the maximum statutory sentence for the offence of illegal purchase of VAT invoices is five years, the author believes that the maximum sentence for cases where scalpers manipulate the separation of oil invoices cannot exceed five years.

In addition, the conviction of the scalper and the conviction of the ticket-buying unit should be delineated, and the two cannot be deemed to be accomplices to the same offence in a broad-brush manner. For example, if the purpose of a ticket-buying unit is to evade consumption tax by purchasing oil tickets through a scalper, the ticket-buying unit may be punished for the offence of tax evasion, whereas there is no tax evasion agreement between the scalper and the ticket-buying unit, so the scalper may not be punished as an accessory to the offence of tax evasion, and should be punished as an accessory to the offence of unlawful purchase of VAT special invoices. Although the main offender is not clearly revealed, it does not prevent the scalper from constituting an aiding offender. The reason is that as far as the ticket-buying unit is concerned, one of its ticket-buying behaviours violates both the crime of illegal purchase of VAT invoices and the crime of tax evasion, and according to the principle of imaginative competition, it chooses one of the felonies to be punished, and so it can be punished according to the crime of illegally purchasing VAT invoices by scalping as the helper of the crime. For example, if the purpose of purchasing oil invoices through the scalper is to further fraudulently issue sales invoices to offset the tax, the purchasing unit constitutes the offence of false invoicing, and there is no tax fraudulent consent between the scalper and the purchasing unit, so the scalper cannot be punished as an aiding and abetting offender of the offence of false invoicing, and should be punished as an aiding and abetting offender of the offence of unlawfully purchasing VAT invoices alone. In the same way, the buyer of the invoices also committed the offences of illegal purchase of VAT invoices and false invoicing of VAT invoices at the same time.

The author predicts that in the future, more judicial organs will recognise the limitations of past judgments, and there will be voices in the judgments that are more in line with the relevant provisions and spirit of the two high judicial interpretations. Taking Case 3 as an example, the court held that the burden of proving that the scalper who manipulated the separation of oil invoices had the purpose of fraudulently offsetting tax or evading tax lay with the public prosecutor; the evidence in the case did not prove that the scalper had subjective knowledge that the invoices obtained by the purchasing unit were to be used for VAT deduction, evasion of tax, or for other purposes, and it was inappropriate to punish the scalper with the offence of fraudulently issuing a special invoice. The judgement undoubtedly better reflects the spirit of the law of crime and punishment and the spirit of appropriateness of crime and punishment, and is a reflection of the judicial authorities' initiative in correcting the thinking of previous decisions.

05

How can a party who has been convicted of false invoicing seek the same treatment for the same case?

Article 4 of the Provisions of the Supreme People's Court and the Supreme People's Procuratorate on the Temporal Effect of the Application of Criminal Judicial Interpretations (高检发释字[2001]5号) provides that, for cases that have been completed before the implementation of the judicial interpretations, no further changes will be made if there are no errors in the determination of the facts and the application of law in accordance with the then existing laws and judicial interpretations. According to this provision, although some cases before the two high judicial interpretation has completed the first and second instance procedures, become a case of res judicata, seemingly can no longer apply the two high judicial interpretation. However, the above provision leaves an opening for the application of the new judicial interpretations to resolved cases, i.e., if the judgement of a resolved case has made mistakes in the determination of facts or the application of law, it can be corrected by applying the new judicial interpretations. In the case of scalping manipulation of oil ticket separation, it can be seen that the judgements of many decided cases have gaps in determining whether scalping subjectively has the purpose and intention of tax fraud, which is an important manifestation of the error in the determination of facts, and meets the conditions for the application of the new judicial interpretation for a new trial. Therefore, the parties to the decided cases can still actively appeal and strive for the re-sentencing of the offence of false invoicing to the offence of illegally purchasing VAT invoices in accordance with the law, so as to lower the sentence and safeguard their legitimate rights and interests. The people's courts should also take the initiative to initiate special trial supervision and review of the judgements of the relevant decided cases on the basis of the judicial interpretations of the two high courts, and should take the initiative to correct mistakes and change the judgements of cases that are indeed wrongly decided or heavily decided.

Article 3 of the 高检发释字[2001]5号 stipulates that, for acts that occurred prior to the implementation of the new judicial interpretations, where relevant judicial interpretations existed at the time of the act, the act shall be handled in accordance with the judicial interpretations in place at the time of the act, but where the application of the new judicial interpretations is favourable to the suspect or the defendant, the new interpretations shall be applied. According to this provision, if the relevant case is in the first or second instance proceedings, the new judicial interpretation may be applied despite the fact that the offence was committed before the new judicial interpretation was issued. The parties involved in the case, whether in first or second instance proceedings, can effectively defend themselves against the application of the offence in full accordance with the provisions of Article 10(2) of the two high level water-related judicial interpretations.

Conclusion:

Against the background of the judicial interpretations of the two high courts clarifying the rules for the determination of the offence of false invoicing, if the perpetrator has the act of manipulating the separation of oil invoices but does not have the purpose of fraudulently offsetting the tax and does not cause fraudulent loss of value-added tax, it does not constitute the offence of false invoicing, and should be punished as the helper of the offence of illegally purchasing value-added tax special invoices, and the maximum sentence should not be more than five years' imprisonment. The parties to the decided cases who were sentenced to more than ten years' imprisonment for the offence of false invoicing in the past may actively appeal in accordance with the law, and strive for the revision of the sentence through the trial supervision procedure, so as to safeguard their lawful rights and interests in accordance with the law. Parties to pending cases should take into account the judicial interpretations of the two high courts and the spirit of the latest jurisprudence, and actively and effectively carry out defence work to safeguard their legitimate rights and interests.