China's Common Reporting Standard rules are working effectively, and tax compliance for overseas income is urgent

Editor's Note: China's version of the CRS rules has been implemented for years, and the mechanism of automatic exchange of information on the offshore financial accounts of China's tax residents has helped China's tax authorities to significantly improve their effectiveness in detecting tax evasion on overseas income. In the process of global tax transparency, the tightening of tax regulations has imposed stricter tax compliance requirements on Chinese tax residents with offshore income and assets. This article suggests that HNWIs should pay great attention to the tax compliance of overseas income, proactively comply with the trend of upgrading global tax regulation, and accurately identify and properly deal with the potential risks hidden in overseas financial accounts.

01 CRS Helps Collect Personal Tax Cases on Overseas Income

Company A is a well-run Hong Kong-funded enterprise with a certain degree of popularity in China, and the founder of the company is a Chinese tax resident A. The shareholding structure of the enterprise is as follows: Domestic resident taxpayer A has incorporated a wholly-owned holding company, Company D, in the British Virgin Islands (BVI), which holds a 30% equity interest in the Cayman Islands-based Company C Investment Holding Company. Company C, which is listed on the Hong Kong Stock Exchange, holds a 100% equity interest in the Hong Kong-based Company B Investment Holding Company, which holds a 100% equity interest in Company A. The Company A is listed on the Hong Kong Stock Exchange. According to the announcement of Company C, all the operating activities of the listed company are carried out by Company A.

At the end of 2024, a Hong Kong account under A's name receives an incoming payment of 5 million RMB. A local tax authority initiated an investigation after obtaining this tip through the CRS automatic exchange of financial account information mechanism. A initially refused to cooperate in the face of the tax authorities' inquiries. Subsequently, the investigators followed the clue that A is the founder of Company A. The investigation found that the shareholding structure of Company C, the Hong Kong-listed subject of Company A, is that Company D holds 30% of the shares, and the rest of the shares are held by overseas investors, but it is impossible to further inquire about the shareholding of Company D. The investigation also found that Company D has a shareholding in Company C, which is listed in Hong Kong. However, through the financial account information exchange intelligence shows that the name of A Hong Kong account of 5 million yuan payment institution is D company. Investigators then hypothesized that the payment may be A's overseas income, and the probability is related to Hong Kong-listed company C. However, as the investigators were unable to enquire about the shareholding of Company D, they were not yet in a position to make a final judgment.

After grasping these clues and evidence above, the investigators began to investigate from the listed announcement of Company C. Through the analysis of a large number of announcements of listed companies found that Company C issued a dividend announcement at the same time, in which the amount of dividends distributed to Company D in proportion to 30% of the shareholding is exactly the same as the amount of 5 million yuan received by A's account. Investigators initially judged that the 5 million yuan of A Hong Kong account is the dividend income of Company C obtained by A. From the point of view of the chain of evidence, it is only necessary to obtain the shareholding structure of Company D to prove the relationship between A and Company D, to form a complete chain of evidence. However, if one wants to obtain the relevant information of Company D, it is necessary for the tax authorities to report to the State Administration of Taxation (SAT) on a level-by-level basis to initiate a special tax intelligence exchange with the tax authorities of the government of BVI, which will have a large negative social impact on A as a well-known entrepreneur in China, and will not be conducive to Company A's reputation and development. Therefore, the investigators decided to utilize the existing evidence materials to start another round of questioning to A, in order to make A actively cooperate with the investigation and pay taxes in compliance with the law.

In the end, in the financial account information and listed company announcements and other hard evidence, the investigators finally persuaded A, A finally admitted that its wholly-owned holding company D and the amount of dividend distribution for the fact, and took the initiative to complete the 1 million yuan of personal income tax payment.

In this case, the reason why the tax authorities can obtain the information of A's overseas financial account is due to the multilateral exchange network of cross-border financial account information constructed by China's version of the CRS rules.CRS provides an effective solution to the information asymmetry of both sides by establishing a cross-border automatic exchange mechanism of financial account information, and then supplementing it with a special tax intelligence exchange mechanism, which is a combination of the two mechanisms that can break down the information barriers that have existed in the cross-border tax collection and management, and provide an effective solution to the problem of information asymmetry. The combination of the two mechanisms effectively breaks down the long-existing information barriers in cross-border tax administration and provides an effective solution for cracking the information asymmetry between the two sides.

02 CRS Opens New Era of Information Transparency in Global Financial Accounts

(i) Institutional background of CRS and China's practice

In 2014, the OECD released the Standard for Automatic Exchange of Tax-Related Information on Financial Accounts (AEOI Standard) under the impetus of the G20, of which the CRS, as a core component, establishes, for the first time, rules for the automatic exchange of information on cross-border financial accounts.The CRS sets out the requirements and procedures for financial institutions to identify, collect and report information on the accounts of non-resident institutions and individuals, and aims to improve tax transparency and combat cross-border financial account evasion through enhanced global tax The CRS sets out the requirements and procedures for financial institutions to identify and collect information on non-resident institutions and individuals, with the aim of enhancing tax transparency through strengthened global tax cooperation and combating cross-border financial account tax evasion. Previously, it was difficult to regulate the asset concealment of HNWIs with the help of offshore trusts, shell companies and other structures due to the information silos in various countries, but CRS realizes the goal of exchanging information on individuals' offshore financial accounts to their tax resident countries through unified reporting standards and multilateral cooperation.

CRS information exchange is operated in a multilateral mode, and participating countries need to complete the following steps in sequence: firstly, incorporate CRS into national laws by signing the Multilateral Competent Authorities Agreement (MCAA), and then submit to OECD their national CRS regulations, information encryption methods, data security treatment, and a list of names of intended exchanges, and then exchange non-resident account information automatically among member countries on an annual basis, after OECD has confirmed that both sides have successfully selected each other for pairing. The exchange of non-resident account information between member countries is automatic on an annual basis. This batch and periodic exchange mode enables tax authorities to continuously and accurately grasp the overseas financial account information of tax residents in their own countries, enhances the accuracy, timeliness and sustainability of the third-party information obtained by tax authorities, and provides long-term information support for cross-border tax source monitoring.

China has been deeply involved in this process and has gradually built a domestic implementation framework. after committing to join the CRS at the G20 meeting in September 2014, the National People's Congress (NPC) ratified the Multilateral Convention on Mutual Assistance in Tax Administration in July 2015, laying a multilateral legal foundation for the implementation of the CRS; in the same month, the State Administration of Taxation (SAT) signed the Multilateral Inter-agency Agreement for the Automatic Exchange of Tax-Related Information on Financial Accounts (MIAA) to build a normative framework for the mechanism of cross-border exchange of financial account information. information mechanism to construct a normative framework; in May 2017, the State Administration of Taxation, the Ministry of Finance, the People's Bank of China, the China Banking Regulatory Commission, the China Securities Regulatory Commission and the China Insurance Regulatory Commission jointly issued the "Measures for the Administration of Due Diligence of Tax-Related Information on Non-Resident Financial Accounts", or China's version of the CRS rules, which clarified the behavior of Chinese financial institutions with respect to due diligence of tax-related information on non-resident financial accounts and fulfilled the commitment of multilateral exchange; in 2018 In September, China completed the first exchange of information with other CRS-implementing countries and regions.

(ii) Key elements of the Chinese version of the CRS rules

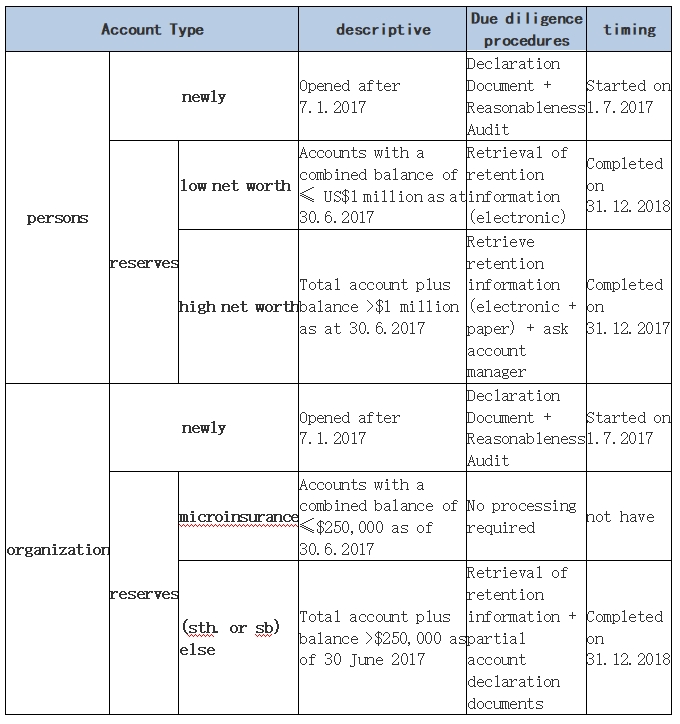

According to the model CRS rules issued by OECD, financial institutions in each participating country, as collectors of tax-related information on financial accounts, are responsible for collecting tax-related information on the financial accounts of non-resident enterprises and individuals. The Chinese version of the CRS rules, Administrative Measures for Due Diligence on Tax-Related Information on Non-Resident Financial Accounts, specifies the scope of financial institutions, including depository institutions, custodian institutions, investment institutions, specific insurance institutions and their branches. Financial accounts are categorized into individual and institutional accounts based on the account holders, and are further differentiated into new accounts and stock accounts using June 30, 2017 as the time point. The due diligence requirements and procedures differ for different categories of accounts. Simply put, the due diligence requirements for newly opened accounts are relatively stringent, requiring account holders to provide documents declaring their tax residency status and financial institutions to conduct a reasonableness review based on the account opening information. The due diligence procedures for stock accounts are relatively simple, with financial institutions mainly relying on retained information to conduct searches.

After completing the appropriate due diligence, financial institutions are required to report to the competent authorities on a regular annual basis the details of non-resident financial account holders, including name, taxpayer identification number, address, account number, balance, interest, dividends and income from the sale of financial assets. This information is exchanged between the State Administration of Taxation and the tax authorities of the account holder's country of residence.

In addition, the CRS has a strong pass-through policy that strongly breaks down the secrecy of offshore companies.The CRS rules differentiate between non-financial institutions (NFIs) as active NFIs and passive NFIs. Positive NFIs are generally not required to identify, collect and report financial account information, but may still exchange information on beneficial owners back to the tax resident country if the offshore location believes the company lacks economic substance. In the case of negative NFIs, such as shell companies and special purpose vehicles (SPVs), the look-through rule applies to identify the beneficial owner to see if it is a reportable situation.

Once an offshore company is recognized as a NNFI, the CRS will penetrate the beneficial owner behind it, and information on the beneficial owner and its hidden assets in the offshore location will be exchanged to the tax resident tax authorities. For example, if a shell company set up in BVI is recognized as a Negative NFI, information on the Chinese resident shareholders behind it will be exchanged to the Chinese tax authorities. Under the CRS environment, owners, controllers and even beneficiaries of wealth will have to face the trend of being transparent.

03 Personal Income Tax Act responds to CRS introduction of anti-avoidance rules

The implementation of CRS has pushed China's anti-avoidance legislation on individual income tax to keep pace with the times.The 2018 amended Individual Income Tax Law introduces anti-avoidance provisions for the first time, and Article 8 explicitly stipulates that, "In any of the following cases, the tax authorities shall have the right to make tax adjustments in accordance with a reasonable method: (a) business transactions between an individual and his/her related parties do not comply with the principle of independent transactions and (a) business transactions between an individual and his/her related parties do not conform to the principle of independent transaction and reduce the tax payable by the individual or his/her related parties without justifiable reasons; (b) enterprises controlled by a resident individual, or jointly controlled by a resident individual and a resident enterprise, which are established in a country (region) where the actual tax burden is obviously low, do not distribute or reduce the distribution of the profits that should be attributed to the resident individual without reasonable business needs; (c) an individual carries out other arrangements that do not have a reasonable business purpose to obtain undue tax benefits. Tax Benefits. Where the tax authorities make tax adjustments in accordance with the provisions of the preceding paragraph and need to levy additional tax, they shall levy additional tax and add interest in accordance with the law." With reference to the relevant anti-avoidance provisions of the Enterprise Income Tax Law, this article empowers the tax authorities to make tax adjustments in accordance with reasonable methods in respect of tax avoidance behaviors such as transfer of property not in accordance with the principle of independent transaction, avoidance of tax in offshore tax havens, and implementation of unreasonable commercial arrangements for obtaining undue tax benefits.

As a matter of fact, China has long established the principle of taxing the income of tax residents both inside and outside the country, but before the implementation of CRS, due to the limitation of the tax authorities' ability to collect and manage, it was difficult to grasp the information on overseas properties, which led to a long-term information blindness in the collection and management of individuals' income outside the country.The international exchange of tax information under the framework of CRS has changed the situation, and the tax authorities have been able to obtain the information on the offshore accounts of the resident taxpayers automatically. If a taxpayer fails to declare and pay tax, he or she will be subject to administrative or criminal liability in accordance with the law. According to article 64 of the Tax Administration Law, the tax authorities may recover the tax, late payment fees and impose a fine; if it constitutes the crime of tax evasion, according to article 201 of the Criminal Law, it is punishable by a maximum of three to seven years of imprisonment and a fine.

It is worth noting that Article 40 of the Tax Administration Law (Revised Exposure Draft) published by the State Administration of Taxation (SAT) and the Ministry of Finance (MOF) on March 28 this year further improves the anti-avoidance rules by creating two types of anti-avoidance adjustments. The first paragraph specifies that business dealings between a taxpayer and a related party shall be in accordance with the principle of independent transactions, or else the tax authorities shall have the right to make reasonable adjustments; and the second paragraph expands to include transactions between unrelated parties, by The second paragraph expands to unrelated party transactions, stipulating that if a taxpayer reduces, exempts or postpones the payment of tax, or increases or refunds the tax in advance by implementing an arrangement that does not have a reasonable business purpose, the tax authorities have the right to make reasonable adjustments. This provision extends the subject of anti-avoidance from enterprises to natural persons, which is in line with the tax adjustment provision in Article 8 of the Individual Income Tax Law.

04 Conclusion

CRS has made the transaction information of offshore financial assets transparent. Detailed information on deposits, custodianship and securities accounts of HNWIs, as well as records of capital operations through offshore shell companies, have been brought into the regulatory vision of tax authorities. Under the combined effect of CRS and the Individual Income Tax Law, cross-border exchange of tax information has been effectively implemented, and the efficiency of anti-avoidance has been significantly enhanced. These measures are undoubtedly "tailor-made" for HNWIs, further reducing the space for them to obtain benefits through tax avoidance. HNWIs need to pay attention to the challenges of CRS compliance, declare their foreign income truthfully, and seek the assistance of professional tax lawyers to cope with the complex regulatory environment and ensure tax compliance of their global assets.