Taxation by Case: Is the Administrative Village under the Jurisdiction of an Established Town Within the Scope of Land Use Tax?

Recently, an enterprise was required by the tax authorities to pay back the tax and pay the corresponding late payment fee due to the non-payment of land use tax for the construction of farms in the administrative villages under the jurisdiction of the established towns, which involves a huge amount of money. It is understood that this kind of controversial case occurs all over the country, and the regulations on whether the scope of land use tax of formed towns includes administrative villages are not the same in different places. In this paper, we would like to briefly analyze the scope of land use tax in relation to this case for the reference of enterprises.

I. Case Sharing: Enterprise A constructed a farm in an administrative village and was recovered nearly ten million yuan in land use tax and late payment fees

Established in 2017, Enterprise A is a large-scale modernized agricultural and animal husbandry enterprise integrating poultry feed processing, poultry production, slaughtering and processing. In order to expand its business, it constructed farms in 2019 in the administrative villages under the jurisdiction of a number of incorporated towns in County A of City A, Province A, for the purpose of raising poultry.2024 In June 2024, the tax authorities of City A requested Enterprise A to make up for the underpayment of the land use tax since FY2019 and to pay the corresponding late payment fees, involving nearly ten million yuan.

Enterprise A believes that both the Interim Regulations on Urban Land Use Tax and the Interim Regulations on Property Tax stipulate that established towns fall within the scope of taxation and that the scope of taxation on established towns for land use tax and property tax should be the same. The relevant interpretation of the property tax specifies that the taxing scope of an organized town is the seat of the town people's government and does not include the administrative villages under its jurisdiction, therefore, the taxing scope of the organized town for land use tax also does not include the administrative villages under its jurisdiction. Although the Company constructed farms in several administrative villages under the jurisdiction of established towns in County A of Municipality A, none of the farms were located in the administrative villages where the town governments were located, and the Company should not pay the land use tax.

According to the tax authorities of City A, the relevant interpretation of the land use tax only stipulates that the taxable area of an organized town is the seat of the town government, but does not explicitly exclude the administrative villages under its jurisdiction. At the same time, in conjunction with the provisions of the province, the taxing scope of the township is the administrative area under the jurisdiction of the township, including all administrative villages under the jurisdiction of the township, so as long as enterprise A constructs farms in the administrative villages under the jurisdiction of the townships in county A, it should pay the land use tax.

How to determine the location of the township government in the taxation scope of land use tax, whether it is the same concept with the location of the township government in the property tax, and whether the provincial government can delineate the administrative villages under the jurisdiction of the established townships as the location of the township government? In this regard, it is necessary to go back to the original source and explore the original intent of the legal text.

II. the legal analysis of the scope of taxation in formed towns

Article 2 of the Provisional Regulations on Urban Land Use Tax stipulates that “Units and individuals using land within the scope of cities, county towns, formed towns and industrial and mining areas ...... shall pay land use tax in accordance with the provisions of these regulations”. Article 1 of the Provisional Regulations on Property Tax stipulates that “property tax shall be levied in cities, county towns, organized towns and industrial and mining areas”. Accordingly, the provisions on the scope of taxation of the two taxes are identical.

The Circular of the State Administration of Taxation on the Review and Issuance of the Interpretation and Provisional Provisions on Several Specific Issues Concerning Land Use Tax (Guo Shui Di Zi [1988] No. 15) provides that “Established towns refer to the established towns that have been approved by the people's governments of provinces, autonomous regions and municipalities directly under the central government. ...... The taxing scope of an established town is the seat of the town's people's government. The specific taxing scope of ...... established towns shall be delineated by the people's governments of the provinces, autonomous regions and municipalities directly under the central government”.

The Interpretation and Provisional Provisions of the Ministry of Finance and the General Administration of Taxation on Several Specific Issues of Property Tax (Cai Shui Di Zi [1986] No. 8) provides that “Established towns refer to established towns approved by the people's governments of provinces, autonomous regions and municipalities directly under the central government. ...... The taxing scope of an established town is the seat of the town's people's government. It does not include administrative villages under its jurisdiction”.

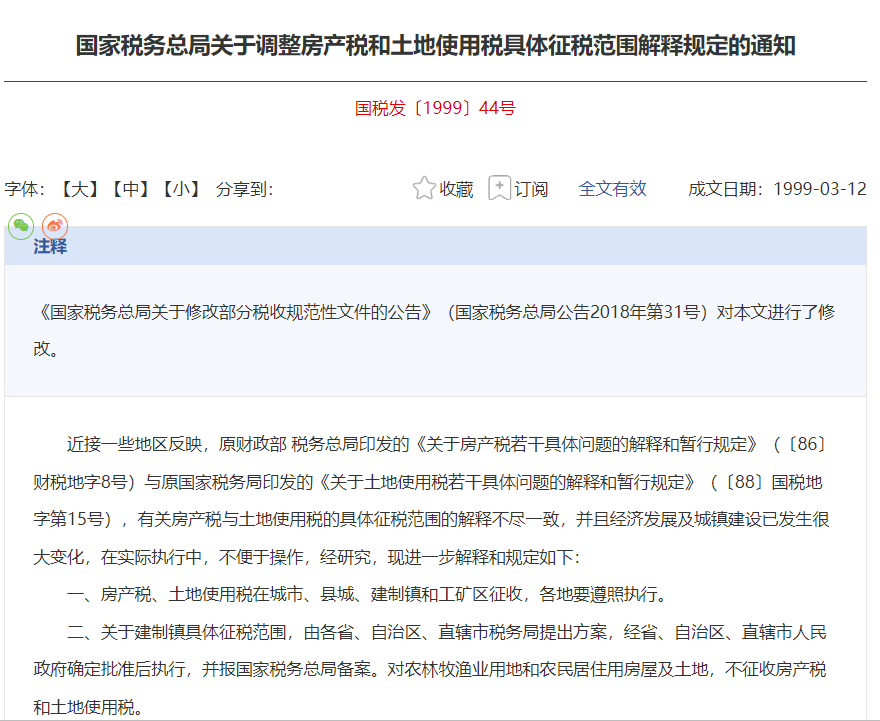

It can be seen that the provisions of the two taxes on whether the taxing scope of the town includes the administrative village under its jurisdiction are not exactly the same. In this regard, the State Administration of Taxation has issued the Circular on the Adjustment of the Interpretation Provisions on the Specific Scope of Property Tax and Land Use Tax (Guo Shui Fa [1999] No. 44) to provide an explanation:

First of all, the paper pointed out that the local reflection of the two tax specific taxation scope is inconsistent with the problem, but in the reply did not make a judgment on this issue, did not clearly point out that the two taxes are inconsistent with the scope of the specific taxation, on the contrary, in the first article, it emphasized that the property tax, land use tax in the city, county, towns and industrial and mining areas, and did not point out that the difference between the two taxes called towns. The author believes that this document is intended to show that the two tax towns are consistent with the specific scope of taxation, are the seat of the town government, excluding the administrative village under the jurisdiction of. Specifically:

From the legislative background of the two taxes, the two taxes were originally a tax. It can be traced back to August 1951, when the State Council of the Central People's Government promulgated the Provisional Regulations on Urban Real Estate Tax, which stipulated that property tax and real estate tax should be levied on the houses in the city together and was called urban real estate tax. 1973 when the tax system was simplified, the real estate tax on the domestic enterprises was merged into the industrial and commercial tax. 1984 when the profit tax was changed to the tax and industrial and commercial tax was reformed, the urban real estate tax was divided into the property tax and land use tax. In 1984, when the profit tax was changed and the industrial and commercial tax system was reformed, the urban real estate tax was divided into real estate tax and land use tax, and in 1986, the State Council promulgated the Provisional Regulations on Property Tax. However, because the 1982 Constitution did not provide for the implementation of land use right transfer at that time, the land use tax was not introduced before the amendment of the Constitution in 1988. It was not until the First Session of the Seventh National People's Congress passed the amendment to the Constitution on April 12, 1988, that the fourth paragraph of Article 10 of the Constitution, which reads, “No organization or individual may encroach upon, buy or sell, lease or otherwise unlawfully transfer land,” was amended to read, “No organization or individual may encroach upon, buy or sell, or otherwise unlawfully transfer land,”. No organization or individual may encroach upon, buy, sell or illegally transfer land in any other form. The right to use land may be transferred in accordance with the provisions of the law”. This cleared the institutional obstacles for the introduction of the September 27, 1988 Provisional Regulations on Urban Land Use Tax. Therefore, the two taxes originally came from one tax, and the specific taxing scope of the two taxes should be the same.

From the viewpoint of the purpose of expanding the scope of taxation to formed towns, since the Third Plenary Session of the Eleventh Central Committee of the Communist Party of China (CPC), the construction of towns and cities has developed greatly, on the one hand, the state has spent a lot of investment on the development and construction of these areas, and on the other hand, the enterprises should make contribution to raising funds for the state to accelerate the construction of the Four Harmonized Construction, so they will be included in the scope of taxation of formed towns and cities. At the same time, because the houses may be located in the rural areas, and the property tax itself is not expressed as “urban property tax”, in order to avoid the property tax on rural properties, CaiShuiDiZi [1986] No. 8 made special instructions, clear property tax of the towns of the establishment of the specific scope of the tax does not include the jurisdiction of the administrative village. Article 1 of the Provisional Regulations on Urban Land Use Tax clearly stipulates the purpose of the legislation, i.e., in order to rationally utilize urban land, the Regulations are formulated. Meanwhile, it is also clearly stated in the Propaganda Outline of Urban Land Use Tax that in order to control the indiscriminate and abusive occupation of arable land, the State Council issued the Provisional Regulations on Cultivated Land Occupation Tax on April 1, 1987, to strengthen the management of arable land by economic means. However, the phenomenon of waste in the use of non-agricultural land in towns and cities still exists. In order to rationally utilize urban land and strengthen the control and management of land by economic means ...... to improve the efficiency of land use, the State Council issued the Interim Regulations on Urban Land Use Tax. Therefore, since the birth of the land use tax, the rural land and urban land to make a clear division, urban land use tax is specialized in urban land use right tax, the tax scope does not include rural land, there is no need in the state tax land word [1988] No. 15 to add to the text of the administrative villages under the jurisdiction of the towns will be excluded.

As for the second article of Guo Shui Fa [1999] No.44, it is just an authorization provision to solve the problem of operational difficulties in the actual implementation of the specific taxing scope of the established towns. In the past, there was no clear provision on the procedure of delimiting the specific taxing scope of the established towns for property tax, and the procedure of delimiting the specific taxing scope of the established towns for land use tax could be delimited directly by the provincial government; now, the delimitation procedure of delimiting the specific taxing scope of the established towns for unified property tax and land use tax is to be proposed by the provincial tax authorities and approved by the provincial government for implementation and reported to the State Administration of Taxation for record. This provision does not change the scope of land use tax, land use tax still needs to be levied within the basic scope of the township seat, and as mentioned before, the township seat can only include urban land, excluding rural land, in other words, the delineation of the specific taxing scope of the established townships of the property tax and the land use tax still needs to be delineated within the scope of the township seat, and it cannot be exceeded or broken through the scope, otherwise it will be obviously against In other words, the specific taxing scope of property tax and land use tax for established towns still needs to be delineated in the scope of the town government, which cannot be exceeded or breached, otherwise it will obviously violate the provisions of the Document No. 15 of the State Council of Taxation and Land Use [1988].

III. should enterprise A pay land use tax?

As for this case, the author believes that enterprise A should not pay land use tax for the construction of farms in administrative villages. Specifically:

Firstly, as mentioned above, the specific taxing scope of land use tax and property tax should be the same as the specific taxing scope of the established towns, excluding the administrative villages under the jurisdiction, so the administrative villages under the jurisdiction of several established towns in County A do not belong to the specific taxing scope of the established towns.

Secondly, from the point of view of the principle of legal taxation, Article 3 of the Tax Administration Law stipulates that no organ or unit shall violate the provisions of laws and administrative regulations and expand the scope of taxation without authorization. The State Tax and Land Word [1988] No. 15 will delineate the specific tax collection scope of the established townships limited to the township government seat, and the provincial government will expand the specific tax collection scope of the established townships to all administrative villages under its jurisdiction, which does not have the legitimacy.

Thirdly, from the viewpoint of legislative purpose, for enterprises, the use of well-located land can save transportation cost, circulation cost, etc., which is conducive to the improvement of productivity, thus obtaining a higher level of income; the use of poorly-located land will get a lower level of income. The level of income is not directly related to the good or bad operation of the enterprise itself, but is formed by the good or bad location of the land. Therefore, the land use tax is levied in accordance with the four grades of large, medium and small cities, county cities, towns and industrial and mining zones, and one of the purposes is to utilize economic means to strengthen the control and management of the land, and to regulate the income from the difference in the grades of the land in different areas and different lots. In this case, if all administrative villages under the jurisdiction of organized towns are included in the scope of land use tax, it will lead to the result that the backward administrative villages are also taxed, which not only violates the legislative purpose of regulating the income of the land level difference, but also makes the poor areas and developed areas bear the same tax burden, which is contrary to the principle of fairness in taxation.

Fourthly, from the State Tax Issuance [1999] No. 44 exception clause, it is clearly stipulated that “the specific tax scope of formed towns does not include the land for agriculture, forestry, animal husbandry and fishery”. In this case, back up a thousand steps, according to the A tax authorities, the specific tax scope of the town includes all administrative villages under the jurisdiction of the administrative village, but the administrative village of agriculture, forestry, animal husbandry and fishery land does not belong to the scope of taxation of land use tax. The land used by enterprise A to build farms in administrative villages to engage in poultry breeding activities belongs to the land for agriculture, forestry, animal husbandry and fishery, and should not be subject to land use tax.

IV.Conclusion

In recent years, land use tax and other small taxes, tax enterprise disputes have become more and more prominent, enterprises should not be paralyzed by small tax compliance management. If disputes arise due to inconsistencies in the understanding of the law, enterprises should respond cautiously, explore the legislative intent, actively communicate with the tax authorities, make statements and defenses in accordance with the law and seek legal remedies and professional support from tax lawyers in a timely manner.