Is there still room for the application of false VAT special invoices obtained in good faith?

Editor's note: In August 2025, the Fushun Intermediate People's Court made a judgment on whether the container bag factory constituted a case of obtaining false VAT special invoices in good faith. This judgment has prompted many tax professionals to think about obtaining false VAT special invoices in good faith. This article intends to explore the historical origin of the false VAT special invoice obtained in good faith, and believes that under the current era background, the constituent elements of the false VAT special invoice obtained in good faith should be revised for readers' reference.

I. Case introduction: The container bag factory obtains false VAT special invoice, which constitutes good faith acquisition

(I) The basic case

From July 2018 to April 2021, the container bag factory signed multiple purchase and sales contracts with Company B and Company C, agreeing to purchase woven fabric and plastic film from them. After the container bag factory purchases the goods for the outer packaging of the products, the funds are transferred from the corporate account of the container bag factory to the corporate account of Company B and Company C, and there is no fund inflow. The container bag factory obtains the VAT special invoices issued by Company B and Company C, which are certified and deducted.

Company B and Company C, the competent tax authorities of the Shenyang Municipal Taxation Bureau, issued "Notice of Confirmed False Issuance" to the competent tax authorities of the container bag factory, Fushun Municipal Taxation Bureau, on November 8, 2022 and June 2023 respectively. Based on this, the Fushun Municipal Taxation Bureau Inspection Bureau initiated an investigation into the container bag factory and issued a "Tax Treatment Decision" to the container bag factory on June 7, 2024, requiring the factory to pay value-added tax and impose corresponding late fees. The container bag factory believes that it constitutes obtaining false VAT special invoices in good faith, and the Fushun Municipal Taxation Bureau's inspection bureau should not charge late fees and applied for reconsideration to the Fushun Municipal Taxation Bureau.

In September 2024, the Fushun Municipal Taxation Bureau issued an "Administrative Reconsideration Decision" to uphold the handling decision of the Fushun Municipal Taxation Bureau's Inspection Bureau. The container bag factory is still dissatisfied and has filed an administrative lawsuit with the Wanghua District Court in Fushun City. The court believed that the container bag factory met the constitutive elements of obtaining false VAT special invoices in good faith, and ruled to revoke the decision to impose late fees in the "Tax Treatment Decision" and the decision to maintain the late fees in the "Administrative Reconsideration Decision". The Fushun Municipal Taxation Bureau Inspection Bureau and the Fushun Municipal Taxation Bureau appealed to the Fushun Intermediate People's Court. The Intermediate Court rejected the appeal and upheld the original judgment.

(II) The view of the tax authorities

The tax authorities believe that there is no real transaction between the container bag factory and Company B and Company C, mainly for three reasons: First, the "Notice of Confirmed False Issuance" and "List of Entrusted Investigation Certificates" sent by the Shenyang Municipal Taxation Bureau have confirmed that the invoices obtained by the container bag factory in the case are false invoices, indicating that there is no real goods transaction between the container bag factory and Company B and Company C. Second, the "Tax Administrative Penalty Decision" issued by the Shenyang Municipal Taxation Bureau's Inspection Bureau confirmed that Company B and Company C do not have the ability to produce, operate, trade, or transport goods, let alone fulfill their obligations. Third, the contract signed between the container bag factory and Company B and Company C lacks the delivery location, transportation method, freight bearing, contact person for both parties, and contact information. The quantity and specifications of individual contract goods are inconsistent with the warehouse receipt, and the contract does not have actual performance content. Considering that the first element of obtaining false VAT special invoices in good faith is "the existence of a genuine transaction between the buyer and the seller," and there is no genuine transaction between the container bag factory and Company B and Company C, it does not constitute obtaining false VAT special invoices in good faith.

(III) Business perspective

The container bag factory believes that there is a genuine transaction between it and Company B and Company C, specifically: First, the "Tax Treatment Decision" made by the Fushun Municipal Taxation Bureau Inspection Bureau indicates that the container bag factory is operating normally, and the contract signing, goods acceptance, production use, and fund flow all comply with regulations. The tax authorities have determined that this case is a genuine transaction. Second, the quantity and specifications of the goods in the contract do not match the warehouse receipt, which is an individual case. This situation is caused by trading habits, industry terminology, and inadequate management, but it cannot be used to deny the authenticity of the business with the container bag factory. At the same time, the container bag factory was unaware of the false invoicing of Company B and Company C, and there was no subjective fault, so it constituted obtaining false VAT special invoices in good faith.

(Ⅳ) The views of the two-instance court

Both the first and second instance courts supported the views of the container bag factory. Specifically:

Whether the container bag factory obtains false value-added tax special invoices in good faith depends on whether the subjective state of the container bag factory when obtaining the false value-added tax special invoices issued by Company B and Company C is good faith or knowing. The known circumstances include: 1. There is no real goods transaction between the container bag factory and Company B and Company C. 2. Even if there is a genuine transaction between the container bag factory and Company B and Company C, the container bag factory clearly knows when obtaining the invoice that Company B and Company C obtained the invoice through illegal means, or the sales party stated in the invoice is not Company B or Company C, or the invoice is an invoice from outside Liaoning Province. In addition to the above circumstances, it should be considered subjectively good faith.

In this case, the "Tax Treatment Decision" made by the Fushun Municipal Taxation Bureau's Inspection Bureau investigated the case from three aspects: the flow of goods, the flow of invoices, and the flow of funds. The three-tier situation cannot deny the authenticity of the transaction between the container bag factory and Company B and Company C. At the same time, the authenticity of the entire transaction process should not be denied solely by the imperfections of individual transactions such as the inconsistency between the contract quantity of container bag factory and the quantity of storage documents. Moreover, the container bag factory was unaware of the false invoicing of Company B and Company C, and had fulfilled its duty of caution. There was no other evidence to prove that the container bag factory knew that Company B and Company C had falsely issued special VAT invoices. Therefore, the container bag factory did not know that Company B and Company C issued false invoices, and it can be determined that it constituted obtaining false VAT special invoices in good faith.

Ⅱ. Case analysis: This case does not constitute a bona fide acquisition of false issuance, and the container bag factory should claim that the invoice is legal and compliant

(I) The historical origin of obtaining false VAT special invoices in good faith

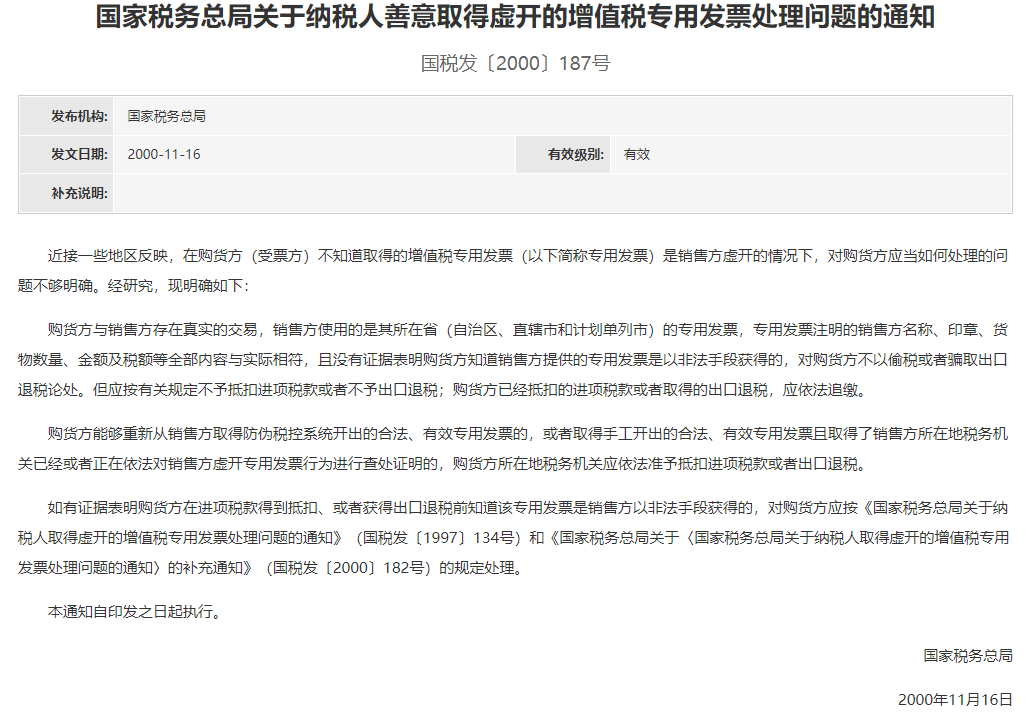

The birth of "good faith obtaining false VAT special invoice" is closely related to the historical development of VAT invoice management in China. 1994 On January 1, the "Interim Regulations on Value-Added Tax" came into effect, establishing a "circular deduction" value-added tax system, allowing taxpayers to deduct input tax with special value-added tax invoices. At that time, due to the inadequacy of the invoice management system, a large number of false issuances occurred, infringing on the order of invoice management and the interests of national value-added tax. In 1995, the Standing Committee of the National People's Congress issued a document specifically to regulate the behavior pattern of the crime of issuing false VAT special invoices. The Supreme People's Court issued a judicial interpretation of this regulation in 1996, and it was forwarded by the State Administration of Taxation. The criteria for criminal identification of false claims have also been inherited in the tax law. According to the "Notice of the State Administration of Taxation on the Interpretation of the Supreme People's Court on Several Issues Concerning the Application of the Decision of the Standing Committee of the National People's Congress on Punishing the Crime of False Issuance, Forgery, and Illegal Sale of Value-added Tax Special Invoices" (Guo Shui Fa [1996] No. 210), Virtual opening mainly includes three types: virtual opening without goods, high opening with goods, and proxy opening. On August 8th, 1997,the State Administration of Taxation issued the "Notice on the Handling of Taxpayers Obtaining Falsely Issued Value-added Tax Special Invoices" (Guo Shui Fa [1997] No. 134), which made provisions on how to handle falsely issued invoices.

The 1990’s, China was still in the era of manual invoicing. Enterprises first needed to apply with the tax authorities with proof documents. After approval by the tax authorities, they could purchase a certain number and amount of blank value-added tax special invoices. After the enterprise has a sales business, it can manually fill in the invoice externally. Since the information on the blank invoice is very simple, only the province, code, and the seal of the selling tax authority, including the name of the seller, can be manually filled in. This means that the blank value-added tax special invoice purchased by one company can still be handed over to other companies for use. At the same time, the invoice purchase process was inconvenient, and the quota was strictly limited. Some enterprises were hindered by the complexity of the approval process. In order to facilitate the purchase of invoices from tax authorities, they purchased blank VAT special invoices from other enterprises. Some enterprises were unable to meet their business needs due to the invoice quota. They also choose to purchase blank value-added tax special invoices from other companies, resulting in some shell enterprises engaged in the reselling of blank value-added tax special invoices. Some even illegally print value-added tax special invoices and then resell them, seriously disrupting the order of invoice management. At that time, there was still a lack of unified and clear national regulations on whether the illegal purchase of blank VAT special invoices and the illegal purchase of forged or altered VAT special invoices and then filling in them were considered false invoices and how to handle them. In this case, On November 6, 2000, the State Administration of Taxation issued a supplementary notice on the "Notice of the State Administration of Taxation on the Handling of Taxpayers Obtaining Falsely Issued Value-added Tax Special Invoices" (Guo Shui Fa [2000] No. 182), which clarified the relevant issues.

Document No. 182 clearly states that even if there is a real goods transaction between the purchaser and the seller, the purchaser still accepts false invoices in the following three situations:

1. The name and seal of the sales party indicated on the value-added tax special invoice obtained by the buyer do not match the actual sales party of the transaction.

2. The value-added tax special invoice obtained by the buyer is from a region outside the province (autonomous region, municipality directly under the central government, and separately planned city) where the seller is located;

3. Other evidence shows that the purchaser knowingly obtained the value-added tax special invoice was obtained by the seller through illegal means.

The first and second situations actually correspond to the act of proxy issuance and are still one of the three types of false issuance as stipulated in Document No. 210. The third situation breaks through the provisions of Document No. 210 and includes the reissuance of value-added tax special invoices through illegal means into the category of false issuance. This means that if the seller does not legally purchase blank value-added tax special invoices from the tax authorities, but illegally obtains invoices through illegal purchase of blank value-added tax special invoices, illegal purchase of forged or altered value-added tax special invoices, theft of value-added tax special invoices, etc., and then issues them externally, Even if there is a real business with the purchaser, it is considered a false opening behavior. However, at that time, the Golden Tax Project was not perfect, and the purchaser could only manually verify whether there were problems with the invoice itself, and could not distinguish whether the invoice issued by the seller was legally obtained or obtained through illegal means such as purchasing from other companies. For the purchaser, If they do not know that the seller has obtained the value-added tax special invoice through illegal means and still treat them as obtaining false invoices, it is obviously unfair. Therefore, just 10 days later, the State Administration of Taxation issued the "Notice on the Handling of Taxpayers Obtaining Falsely Issued Value-added Tax Special Invoices" (Guo Shui Fa [2000] No. 187), establishing the system of obtaining falsely issued value-added tax special invoices in good faith.

In summary, the acquisition of false opening in good faith must meet four constitutive elements:

1. There is a genuine transaction between the purchaser and the seller.

2. The seller uses special invoices from the province (autonomous region, municipality directly under the central government, and separately planned city) where they are located.

3. The seller's name, seal, quantity, amount, and tax amount indicated on the special invoice are consistent with the actual situation.

4. There is no evidence to show that the buyer knew that the special invoices provided by the seller were obtained through illegal means.

Therefore, it can be seen that the system of obtaining false invoices in good faith has its historical background, specifically targeting the situation where the seller illegally obtains blank VAT special invoices and then issues invoices in accordance with the law. The claim that there is a real transaction between the purchaser and the seller, and the name of the seller indicated on the invoice matches the actual situation, directly excludes the act of issuing on behalf of the agent. Therefore, the premise of obtaining false invoices in good faith is that the business is consistent. Since the purchaser has checked that all elements of the invoice are indeed consistent with the actual transaction situation, and there is no other evidence to prove that the purchaser knows that the VAT special invoice provided by the seller was obtained through illegal means such as purchase, the responsibility for obtaining the false invoice cannot be attributed to the purchaser. In essence, the purchaser is also a victim. Therefore, on the one hand, Document No. 182 characterizes this situation as obtaining false VAT special invoices in good faith, and on the other hand, it also provides a remedy for the purchaser. If the purchaser can re-obtain the invoices legally obtained and issued by the seller, it can still be deducted according to law.

(II) The constitutive elements of obtaining false VAT special invoices in good faith under the background of tax governance by data are basically untenable

With the nationwide launch of the third phase of the Golden Tax Project and the implementation of the value-added tax electronic invoice system, taxpayers can no longer issue paper value-added tax special invoices to the public, and blank value-added tax special invoices will gradually disappear, and manual invoicing will be phased out of history. On December 1st,2024, digital invoices were promoted nationwide. Tax authorities no longer need to determine the types of invoices and receive invoices for taxpayers. After verifying identity through real-person authentication and other methods, taxpayers can issue invoices through the electronic invoice service platform. This has now fully entered the era of tax governance based on digital methods. The blank value-added tax special invoices no longer exist, and there is no possibility of illegally purchasing blank value-added tax special invoices. The prerequisite for obtaining false VAT special invoices in good faith is false issuance. At present, if the purchaser and the seller's business is true and consistent, then the invoice itself is legal and compliant, and it cannot constitute false issuance, let alone the problem of obtaining false VAT special invoices in good faith.

(Ⅲ) The value-added tax special invoice obtained by the container bag factory is consistent with the actual business, and it should be claimed to be legal and compliant

In this case, the Fushun Municipal Taxation Bureau Inspection Bureau mainly determined that there was no real transaction between the container bag factory and Company B and Company C based on the "Proven False Issue Notice" and the "List of Entrusted Investigation Certificates" issued by the Shenyang Municipal Taxation Bureau Inspection Bureau. The "Notice of Confirmed False Issuance" is stipulated in the "Measures for the Management of Tax Violation Cases Invoice Investigation (Trial)" (Tax General Office [2013] No. 66). It is applicable when the inspection bureau, i.e., the entrusting party, entrusts the inspection bureau, i.e., the entrusted party, with jurisdiction, to investigate and collect invoices that need to be investigated and collected in a different location. This means that although the entrusting party has determined that the invoice issued by the issuing party is a false invoice, due to the cross-regional invoice, it is still necessary to issue a "Proven False Invoice Notice" and relevant evidence materials to the entrusted party in accordance with the provisions of Document No. 66 for further investigation and evidence collection. After the entrusted party accepts the case, it needs to independently conduct a case filing inspection and trial in accordance with the "Procedures for Handling Tax Inspection Cases", and make corresponding handling according to the actual situation. If the entrusted party does not have any tax violations, a tax inspection conclusion should be made. At the same time, a reply letter is issued to the entrusting party stating that there is no tax violation by the invoice recipient. Obviously, the purpose of the invoice investigation is to further investigate and request the entrusted party to assist in obtaining evidence when the entrusting party believes that the invoicing party is suspected of issuing false invoices but there is no solid and sufficient evidence to prove that the invoicing party has issued a "Notice of Proven False Invoices". It is inevitable to conclude that there is no real transaction between the payee and the issuer.

In this case, after the investigation was initiated by the Fushun Municipal Taxation Bureau Inspection Bureau, it has been found that the goods, invoices, and funds of the container bag factory are consistent, and there is no return of funds. Therefore, it should reply to the Shenyang Municipal Taxation Bureau Inspection Bureau in accordance with the law that the container bag factory does not have any tax violations. After receiving the reply letter, the Inspection Bureau of the Shenyang Taxation Bureau shall exclude the invoice amount involved in the transaction between Company B and Company C and the container bag factory from the relevant handling and punishment decision. For the container bag factory, in the case of the Fushun City Tax Bureau's inspection bureau insisting on determining that it does not have real business with Company B and Company C, and requiring it to transfer the input tax amount and pay the corresponding late payment penalty, The container bag factory should insist on having genuine business transactions with Company B and Company C, and the value-added tax special invoices obtained are completely legal and compliant, rather than claiming to obtain false value-added tax special invoices in good faith. At the same time, we can learn from the case of the Shanghai Railway Court and apply to the court for the Shenyang Municipal Taxation Bureau Inspection Bureau to participate in the litigation as a third party, allowing the court to comprehensively verify the situation of the transaction involved in the case through the third party's evidence, cross-examination, and debate, and restore the truth of the original transaction involved in the case. The Fushun Municipal Taxation Bureau Inspection Bureau and the Shenyang Municipal Taxation Bureau Inspection Bureau reached a consensus on the real business of the container bag factory and Company B and Company C, fundamentally resolving the pressure on the Fushun Municipal Taxation Bureau Inspection Bureau. To avoid the predicament of downstream tax authorities being unable to make a conclusion of no illegal facts due to the preliminary conclusion of the determination of illegality made by upstream tax authorities, and to realize the fairness and justice of tax law.

Ⅲ.The constitutive elements of obtaining false VAT special invoices in good faith should progress with the development of the times

This paper holds that the system of obtaining false VAT special invoices in good faith has certain historical limitations, and it should be given a new meaning at this stage, so that this system will not become empty talk and can be used in practice without controversy. The first three elements should be simplified, and the fourth element should be mainly emphasized, and if conditions permit, the act of invoicing on behalf of others should be included. In practice, if the actual seller is an individual who claims to be the manager of the invoicing party and issues an authorization letter stamped with the official seal of the invoicing party, the purchaser can believe that the seller is an employee of the invoicing party, and the seller has signed a contract with the purchaser in the name of the invoicing party. The flow of goods, invoices, and funds is completely consistent. In this case, even if the seller is not actually an employee of the invoicing party, the ownership of the goods in question does not belong to the invoicing party, but it already meets the constitution of apparent agency in civil law. The purchaser obtains the invoice issued by the invoicing party, and there is no subjective negligence. Even if there is no fault, it can be deemed that the purchaser has obtained a false VAT special invoice in good faith. Regarding the judgment of the subjective state of the payee, this article suggests that good faith should include the absence of fault and the absence of gross negligence. The proof of subjective state should be provided by the taxpayer and confirmed by the tax authorities.