Liu Tianyong, Lawyer at Hwuason Law Firm, has accepted the invitation to publish an article titled 'Tax Compliance of Offshore Trusts Under International Tax Transparency' in 'China Forex

Recently, at the invitation of "China Forex," Lawyer Liu Tianyong, Director of Hwuason Law Firm and Director of the Financial and Tax Law Professional Committee of the All China Lawyers Association, has contributed an article titled "Tax Compliance of Offshore Trusts Under International Tax Transparency." The article has been published in the magazine. It's worth noting that "China Forex" is an important publication on foreign exchange regulatory laws and has been honored as one of the "Top 100 Key Journals of the Second and Third National Journal Awards" for two consecutive years. The specific content is as follows:

Offshore Trust from the Perspective of Tax Law

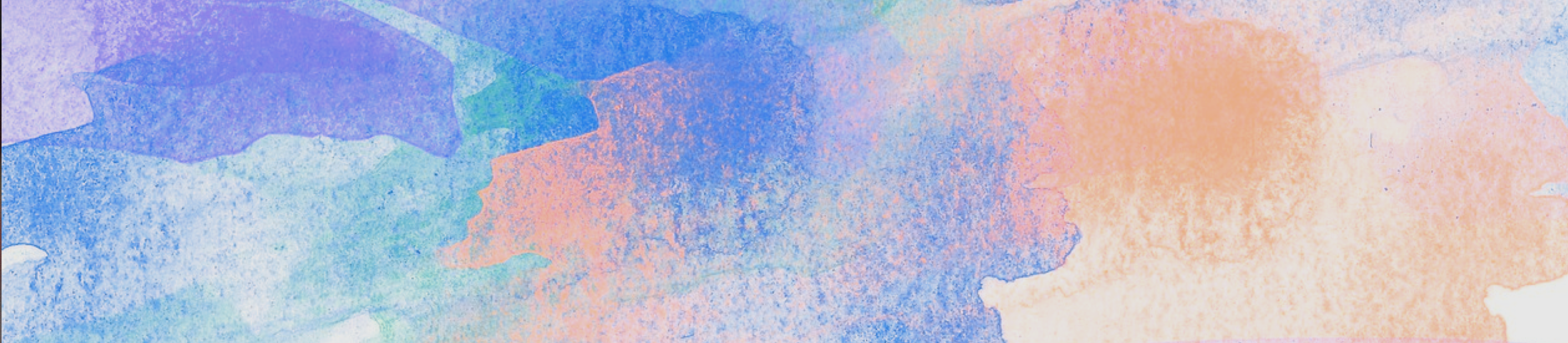

To understand offshore trusts, one must first comprehend how trusts operate. Trusts typically involve three key parties: the settlor (grantor), the trustee, and the beneficiary. The settlor, also known as the grantor, refers to an individual with a need for fund management or operational requirements. The settlor transfers assets to the trustee, entering into a "trust agreement" with them. The trustee manages and operates the funds according to the trust agreement, subsequently distributing the proceeds to the beneficiary. In modern trusts, the trustee is usually a trust institution with a trust financial license.

Apart from classifying trusts based on the criteria of resident and non-resident taxpayers, in some tax havens, trusts may be broadly categorized as "foreign trusts." Taking Singapore as an example, as long as both the settlor and the beneficiary are not Singapore residents, a trust qualifies as a foreign trust and enjoys income tax exemptions, even if the trustee is a resident of Singapore. This broad criterion and associated tax benefits are key attractions for high-net-worth individuals to establish offshore trusts.

As China's economy develops, a growing number of high-net-worth individuals have emerged. According to the "2021 China Private Wealth Report," it is projected that the number of high-net-worth individuals in China will reach 2.96 million by the end of 2021, with total investable assets exceeding 90 trillion yuan. To preserve the value, continuity, and development of their assets, as well as maintain the independence and stability of family assets, many high-net-worth individuals opt for offshore trusts.

Why are offshore trusts favored by high-net-worth individuals? What are the differences between offshore trusts and domestic trusts?

From the perspective of international experience, offshore trusts primarily serve three main functions.

Secondly, due to the high level of confidentiality associated with offshore trusts, they also provide significant risk mitigation. The independence of trust property shields it from being liquidated as part of the settlor's assets, even in the case of company operation liabilities or bankruptcy, preventing it from being reclaimed for debt.

Additionally, offshore trusts also possess somewhat controversial tax avoidance functions. However, in reality, with the deepening of global tax transparency, the tax avoidance functions of offshore trusts have been significantly reduced and may even pose certain tax risks.

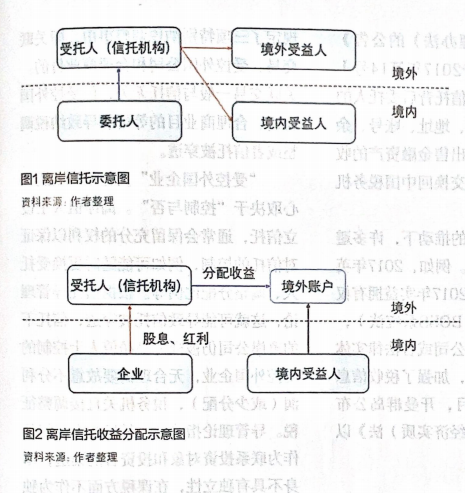

It is important to note that although offshore trusts are established overseas, the income acquired and distributed by them is not beyond the supervision of national taxation authorities. Especially in China, tax jurisdiction adopts the dual provisions of "residency jurisdiction" and "source jurisdiction." Offshore trusts are, in fact, unable to exempt themselves from tax obligations. Taking institutional trusts as an example, if the trust in a tax haven is acquired by an offshore financial institution, according to China's "Enterprise Income Tax Law," it should pay corporate income tax on income from within China. As for domestic beneficiaries, being residents for tax purposes, they are obligated to pay taxes on all domestic and foreign income.

With the revision of China's "Personal Income Tax Law" and the country's active participation in the Common Reporting Standard (CRS), breaking down information barriers between different tax jurisdictions, acts of tax evasion will face further interception.

Can offshore trusts avoid CRS and new individual income tax anti-avoidance measures? The answer is negative. Offshore trusts fall under the negative non-financial institutions category in the CRS definition, drawing the attention of tax authorities worldwide. They also require a look-through to identify the actual controllers behind the trust, including the settlor, fixed beneficiaries, protectors, etc. In other words, if any actual controller is a Chinese tax resident, the information on the trust's financial accounts will be reported back to the Chinese tax authorities. According to the "Announcement of the State Administration of Taxation, Ministry of Finance, People's Bank of China, China Banking and Insurance Regulatory Commission, and China Securities Regulatory Commission on the Issuance of the 'Non-Resident Financial Account Tax-Related Information Due Diligence Management Measures'" (SAT Announcement No. 14, 2017), under CRS, information such as the settlor's name, taxpayer identification number, address, account number, balance, interest, dividends, and income from the sale of financial assets behind the trust may be exchanged with Chinese tax authorities for tax collection purposes.

Therefore, as international taxation becomes more transparent, attempting to evade taxes through practices such as establishing offshore trusts or holding offshore accounts carries significant risks. In practice, individuals who establish overseas family trusts or act as beneficiaries of offshore trusts should theoretically pay taxes on the income received from overseas family trusts. If not reported voluntarily, there is a risk of tax authorities reclaiming taxes and late payment penalties, avoiding potential risks of tax evasion.

The core of the Controlled Foreign Corporation (CFC) anti-avoidance rule depends on "control or not." High-net-worth individuals establishing trusts often retain sufficient rights to ensure control over the trust, such as the ability to change the trustee or adjust the distribution ratio at any time. According to trust management theory, this may lead to the trust being pierced, and the offshore company under the trust is still considered a CFC controlled by the high-net-worth individual. In this case, the tax authorities may directly adjust taxation without reasonable cause for not distributing profits (or distributing fewer profits). Trust management theory refers to the concept that an institution, acting merely as a channel connecting investment targets and investors, without independence in terms of taxation, should be considered as playing the role of a conduit and not as an independent entity.

However, in the current field of individual income tax, although general anti-avoidance provisions have been established, there is a lack of more specific regulations like the "General Anti-Avoidance Rules (Trial Implementation)." Moreover, there are significant differences between individuals and companies, and general anti-avoidance provisions related to corporate income tax cannot be simply applied to individual income tax. Specific measures must be taken based on the characteristics of individual income tax. The economic substance principle grants tax authorities excessive discretionary powers, lacking clear guidance, bringing operational difficulties to both tax authorities and taxpayers.

While offshore trusts may not have tax avoidance functions in the field of taxation, they still possess functions such as risk isolation, family wealth inheritance, and asset protection. However, it is crucial to recognize that offshore trusts should not have the ability to evade taxes. Whether it is the beneficiary, the trust institution, or the settlor, when planning and establishing trusts, this point should be made clear. Ensuring compliance with local tax authorities, avoiding the risk of tax repayment through pierced trusts and potential risks of tax evasion, is necessary for the sustainable continuation of wealth.

(This article was published in the 24th issue of "China Forex" in 2022 and was written by Liu Tianyong, Director of Hwuason Law Firm and Director of the Financial and Tax Law Professional Committee of the All China Lawyers Association.)