Registration for the "2024 National Top Ten Excellent Tax Law Case Papers" Selection Activity Opens on the 13th

In order to encourage lawyers, tax practitioners, scholars, postgraduates and other tax-related people to actively carry out tax law case studies, explain the law in case law, and improve the level of practice, law enforcement and research, the Professional Committee of Finance and Taxation Law of the All-China Lawyers' Association hosted the "National Top Ten Excellent Tax Law Case Papers" in 2019-2023. The selection of papers has caused a strong reaction and resonance in tax-related service organizations, tax authorities, colleges and universities, and research institutes, etc. The 40 awarded "National Top Ten Excellent Tax Law Case Papers" have been compiled into the "China Tax Lawyer's Review" (Volume 7-10), and published by Law Press, which plays a positive role in spreading the concept of the rule of law on tax and implementing the rule of tax according to law. They have played a positive role in spreading the concept of the rule of law in taxation and implementing the rule of law in taxation. In order to continue to support and encourage the theoretical and practical research on tax law in China, the "2024 National Top Ten Excellent Tax Law Case Papers" competition is scheduled to start on 13 March 2024, with the following specific requirements:

I. Purpose of the Selection

The purpose of establishing the "Annual National Top Ten Excellent Tax Law Case Papers" is to give full play to the important role of typical tax law cases in guiding the handling of cases, improving tax legislation and developing tax law theories, and to encourage the majority of tax-related practical and theoretical workers to actively carry out tax law case studies.

II. Objects of Call for Papers

Tax lawyers, tax accountants, certified public accountants, scholars, postgraduate students of universities, tax cadres, enterprise finance and taxation personnel who are concerned about the construction of the rule of law on taxation and the development of the tax service industry in China are eligible to apply for participation.

III. Scope of Cases

All kinds of tax-related cases and programmes closed from 1 June 2023 to 31 May 2024, including tax administrative penalty cases, tax administrative reconsideration cases, tax administrative lawsuits, tax criminal lawsuits, tax civil lawsuits, tax planning programmes, etc.; the cases can be handled by the participants themselves or by others; the selected cases will have a certain or different impact on the influence, representativeness, legal issues, jurisprudence, facts, and so on. The selected cases should be of research significance in terms of influence, representativeness, legal issues, jurisprudence, facts and other aspects.

IV. Writing Requirements

(i) The title of the case paper shall be in the format of "xxxxx case review".

(ii) Each person is limited to submitting one paper, with a word count of 10,000-20,000 words.

(iii) Participating papers must be original, plagiarism is strictly prohibited, has been published or participated in other essay activities, shall not participate in the selection.

(iv) The participating essays shall conform to the specifications. The first page of the manuscript should include the following information: author's name, unit, title, contact phone number, mailing address, email address.

(v) The main text should include at least the following four parts:

1. Preface. Introduce the background situation of the case and the significance of the study.

2. Brief description of the case. Complete description of the main information of the case, the main facts of the case, the controversial issues, the views of the parties, the main reasons, the tax authorities and the judicial organs to deal with the opinions.

3. Legal analysis. For the controversial focus of the case, from the factual findings, legal application, legal analysis, etc., to carry out a comprehensive, in-depth discussion and analysis.

4. Conclusion and Revelation. Refinement in the factual findings, the application of law and other aspects of the viewpoints, conclusions, drawings and insights.

5. The thesis must be inserted or attached to the case materials, including but not limited to the case-related contracts, appraisal reports, law enforcement instruments of tax authorities (notices, processing decisions, penalty decisions, etc.), judicial instruments of judicial authorities (judgments, rulings, etc.), tax planning programmes, tax advisory opinions, etc.

V. Selection Method

(i) The organizing committee will organize experts to select all the participating papers, among which 10 papers will be selected as "2024 National Top Ten Excellent Tax Law Case Papers".

(ii) The winning papers will be compiled into China Tax Lawyer Review (Volume 11), which is scheduled to be published at the end of 2024.

(iii) The winning authors will be invited to attend the "2024 China Tax Law Forum and the 12th China Tax Lawyers and Tax Accountants Forum" to have face-to-face exchanges with the "big names" in China's tax law sector.

VI. Application and Paper Submission

(i) Deadline of application: 31 March 2024

(ii) Deadline of paper submission: 16 June 2024

(iii) Application and paper submission email address: taxlawyer2015@126.com, the subject of the email should be marked as "2024 National Top Ten Excellent Tax Law Case Papers Competition".

(iv) Registration Methods:

Mode 1: Click the "Read Original Text" in the lower left corner to register online.

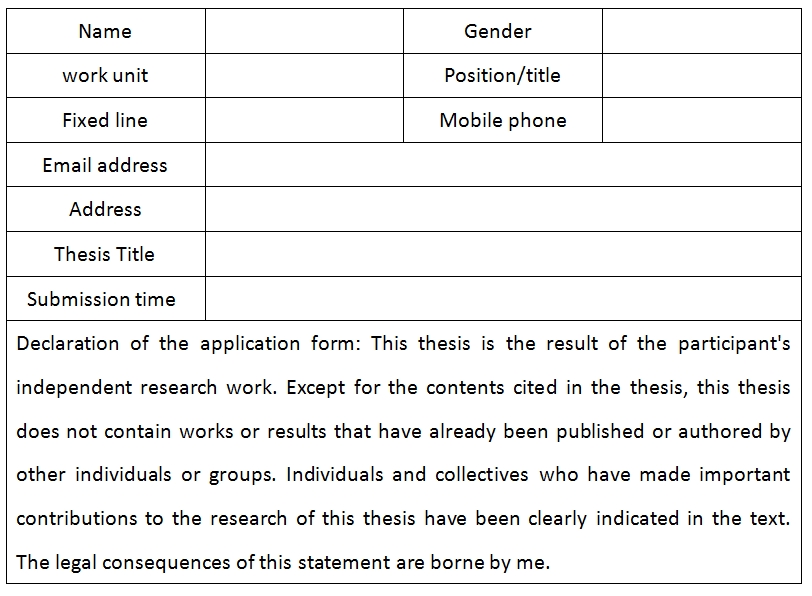

Mode 2: Fill in the following application form and send it to the designated email address.

“2024 National Top Ten Excellent Tax Law Case Papers”enrolment form