Registration opens today for the “2025 National Top Ten Outstanding Tax Law Case Papers” competition

In order to encourage the majority of lawyers, tax practitioners, scholars, graduate students and other tax-related people to actively carry out case studies on tax law, explain the law with case law, and improve the level of practice, law enforcement and research, we have organized five “National Top Ten Excellent Tax Law Case Papers” selection activities since 2019, which has aroused a strong reaction and resonance in the tax-related service organizations, tax authorities, colleges and research institutes, and has been compiled into several volumes of China Tax Lawyers' Review and published by the Law Press, The award-winning “National Top Ten Excellent Tax Law Case Papers” have been compiled into several volumes of China Tax Lawyers' Review and published by Law Press, which have played a positive role in spreading the concept of the rule of law in taxation and implementing the rule of taxation in accordance with the law. In order to further implement the spirit of the 20th CPC National Congress and the decision of the 3rd Plenary Session of the 20th CPC Central Committee, fully implement the principle of tax law, promote the construction of tax rule of law with high quality, and promote the in-depth fusion of tax law research and practical experience, the selection of “2025 National Top Ten Outstanding Tax Law Case Papers” is scheduled to be launched for registration on February 20, 2025, with the following specific requirements. The specific requirements are as follows:

I. Purpose of the Selection

The purpose of establishing the “Annual National Top Ten Excellent Tax Law Case Papers” is to give full play to the important role of typical tax law cases in guiding the handling of cases, improving tax legislation and developing tax law theories, and to encourage the majority of tax-related practical and theoretical workers to actively carry out tax law case studies.

II. Objects of Call for Papers

Tax lawyers, tax accountants, certified public accountants, scholars, postgraduate students of universities, tax cadres, enterprise finance and taxation personnel who are concerned with the construction of the rule of law on taxation and the development of the tax service industry in China are eligible to apply for participation.

III. Scope of Cases

Various tax-related cases and programs closed from June 1, 2024 to May 31, 2025, including tax administrative penalty cases, tax administrative reconsideration cases, tax administrative litigation cases, tax criminal prosecution cases, tax civil litigation cases, tax planning programs, etc.; the cases can be handled by themselves or by others; the selected cases are influential, representative, legal issues, jurisprudence, facts, etc. in one or the other way. The selected cases should be of research significance in terms of influence, representativeness, legal issues, jurisprudence, facts and other aspects.

IV. Writing Requirements

(a) The title of the case paper is formatted as “xxxxx case review”.

(b) Each person is limited to submitting one paper, with a word count of 1-20,000 words.

(c) Participating papers must be original, plagiarism is strictly prohibited, has been published or participated in other essay activities, shall not participate in the selection.

(d) The participating essays shall conform to the specifications. The first page of the manuscript should include the following information: author's name, organization, title, contact phone number, mailing address, e-mail address.

(e) The body should include at least the following four parts:

1. Preface: introduce the background situation of the case and the significance of the study.

2. Brief description of the case: a complete description of the main information of the case, the main facts of the case, the issues in dispute, the views of the parties, the main reasons, the tax authorities and the judicial organs to deal with the opinions.

3. Legal analysis: comprehensive and in-depth discussion and analysis of the disputes involved in the case in terms of factual determination, legal application and legal analysis.

4. Conclusion and revelation: Refinement of the views, conclusions, lessons and revelations in factual findings, legal application and other aspects.

5. Case materials shall be inserted or attached to the thesis, including but not limited to case-related contracts, appraisal reports, law enforcement documents of tax authorities (notices, processing decisions, penalty decisions, etc.), judicial documents of judicial authorities (judgments, rulings, etc.), tax planning programs, tax consulting proposals and so on.

V. Selection Method

(a) The organizing committee will organize experts to select all the participating papers, among which 10 papers will be selected as “Top 10 Excellent Tax Law Case Papers in 2025”.

(b) The “Top 10 Excellent Tax Law Case Papers” will be compiled into the “China Tax Lawyer Review” (Volume 12), which is scheduled to be published at the end of 2025.

(c) The authors of the “Top 10 Excellent Tax Law Case Papers” will be invited to participate in the “2025 Tax Legal Service Business Exchange Conference” to have face-to-face exchanges with the “big names” in the tax law field in China.

Ⅵ.Application and Paper Submission

(a) Deadline of application: March 15, 2025

(b) Deadline of paper submission: June 20, 2025

(c) Application and paper submission e-mail: taxlawyer2015@126.com, the subject of the e-mail should be marked as “2025 National Top Ten Excellent Tax Law Case Papers Competition”.

(d) Registration Methods:

Mode 1: Click “Read Original Text” in the lower left corner to register online.

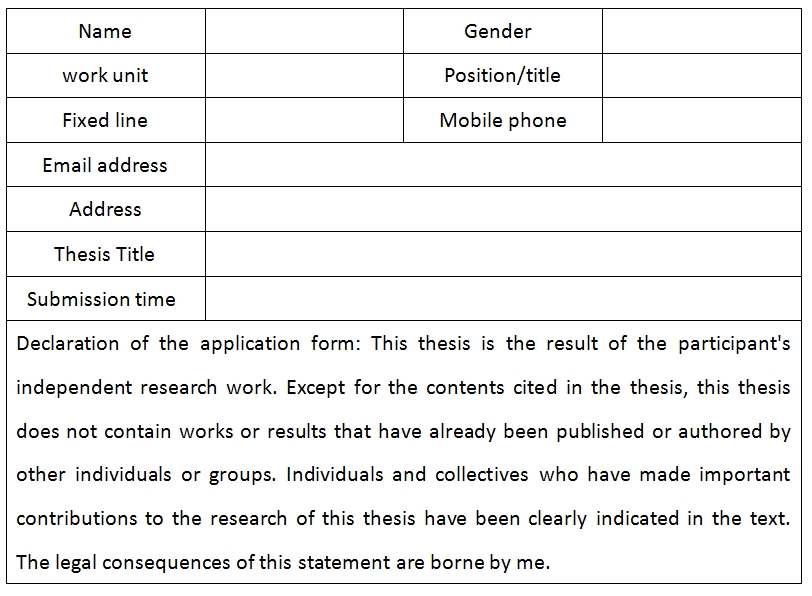

Mode 2: Fill in the following application form and send it to the designated e-mail address.

“2025 National Top Ten Outstanding Tax Law Case Papers”