Two Departments Introduce New Regulations! Significant Revisions to Necessity Review of Detention

The necessity review of detention system is an effective remedy granted by the Criminal Procedure Law to crime suspects and defendants for the protection of their legal rights. Recently, the Supreme People's Procuratorate and the Ministry of Public Security jointly issued the "Provisions on the Review and Evaluation of the Necessity of Detention by People's Procuratorates and Public Security Organs" (referred to as the "Provisions"), addressing and improving issues in the current necessity review of detention and further implementing the criminal justice policy of "restraining arrests, cautious prosecution, and prudent detention." This article interprets the changes in the regulations and their impact on tax-related crimes for readers' reference.

In 2012, the amended "Criminal Procedure Law" introduced the necessity review of detention system by the People's Procuratorates. Subsequently, in early 2016, the Supreme Procuratorate announced the "Provisions on the Handling of Cases for the Necessity Review of Detention by People's Procuratorates (Trial Implementation)." Having been in official implementation for nearly eight years, these provisions played a crucial role in safeguarding the legal rights of crime suspects and defendants. However, due to the simplicity of the provisions, practical difficulties such as initiation, modification, and relief persisted. On November 30, 2023, the Supreme People's Procuratorate and the Ministry of Public Security issued the "Provisions," revising and improving the necessity review of detention system. The new regulations have several noteworthy highlights:

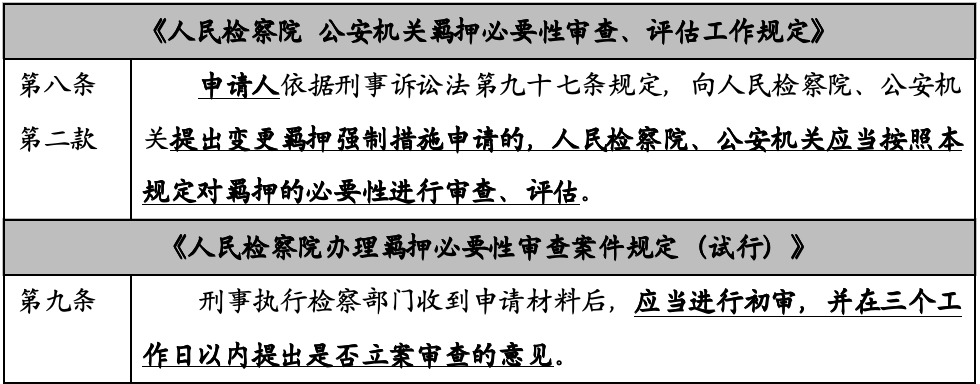

I. If an applicant submits an application, the accepting authority should conduct a necessity review of detention without going through the case filing procedure.

Article 8 of the "Provisions" explicitly states that if an applicant submits an application for the necessity review of detention, the People's Procuratorate and the Public Security organ should immediately conduct the review without going through the case filing procedure, addressing the difficulty in case filing and further promoting the protection of the legitimate rights of the parties involved.

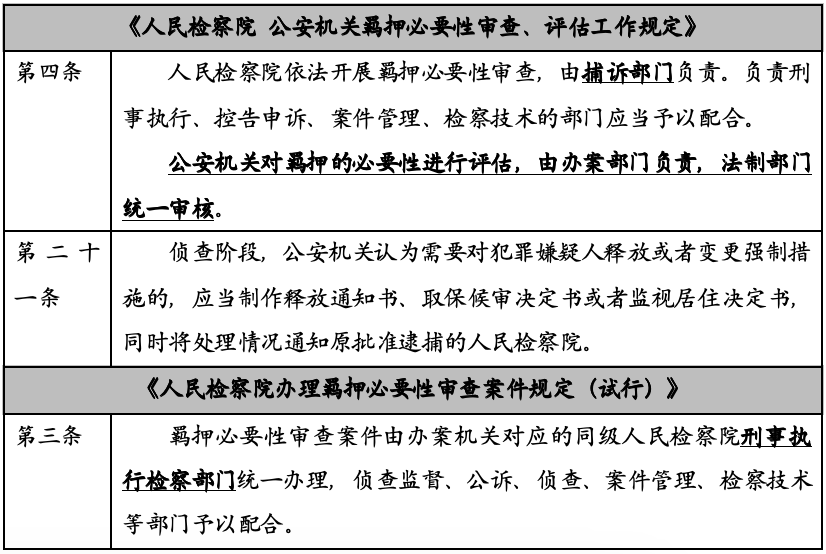

II. Addition of "Public Security Organ" as the reviewing authority, with the prosecutorial review work shifted from the criminal enforcement department to the arresting and prosecuting department.

The revisions introduce the reviewing and decision-making authority of the public security organ in the necessity review process. During the investigative stage, if the public security organ believes that release or modification of coercive measures is necessary, it has the right to issue a decision and notify the original approving People's Procuratorate, ensuring the protection of the legitimate rights of the parties involved during the investigative stage. Previously, as applicants could only apply to the People's Procuratorate for the necessity review of detention, situations arose where the review results were challenging to implement in some regions. It is understood that in some areas, the public security organ accepted less than 20% of the suggestions.

Simultaneously, Article 4 of the "Provisions" specifies that the reviewing work is the responsibility of the arresting and prosecuting department, consistent with the provisions of the "Provisions of the People's Procuratorate on Criminal Procedure" (hereinafter referred to as the "Supreme Procuratorate Rules"). Initially exercised by procuratorial departments, the function of the necessity review of detention gradually shifted to the arresting and prosecuting department with the deepening of judicial system reforms. Therefore, the 2019 amended "Supreme Procuratorate Rules" stipulate in Article 575 that "the department responsible for arresting and prosecuting shall, in accordance with the law, review the necessity of detention during the investigation and trial stages." Now, the "Provisions" designate the arresting and prosecuting department as the competent authority for the People's Procuratorate's necessity review of detention work, aligning with practical situations and the "Supreme Procuratorate Rules" to ensure the smooth implementation of the reviewing work.

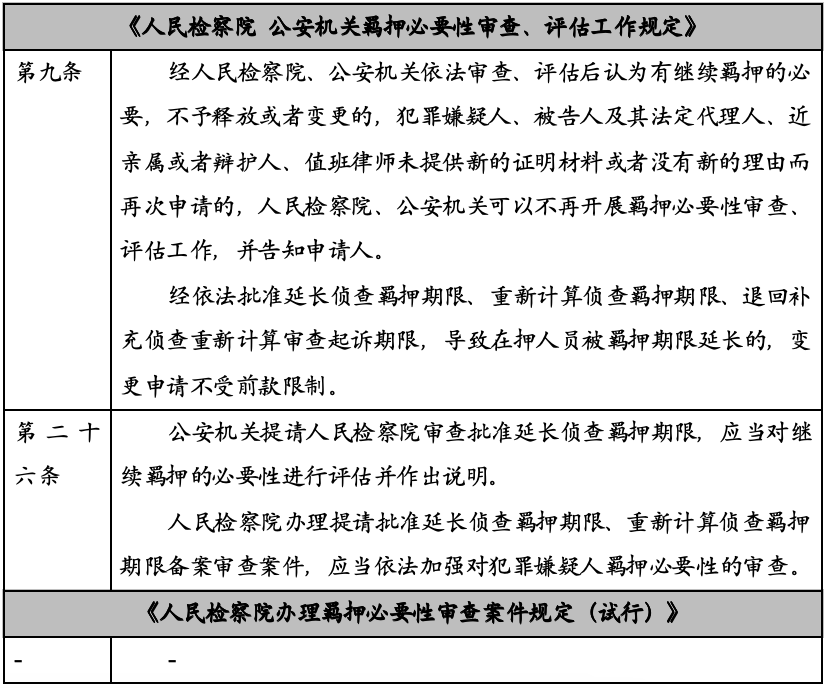

III. Inclusion of "application for extension of detention period by the public security organ" in the scope of review, allowing the party the right to reapply for review if the detention period is extended.

Article 20 of the "Provisions" specifies that if the public security organ requests the People's Procuratorate to review and approve the extension of the investigative detention period, a necessity review should be conducted. This provision helps alleviate infringements on personal freedom rights caused by applying for an extension of the investigative detention period. Article 9 of the "Provisions" stipulates that if the necessity review of detention has been applied for and the release or modification is not granted, and there are circumstances such as "legally approved extension of the investigative detention period, recalculation of the investigative detention period, return for supplementary investigation and recalculation of the review and prosecution period," a reapplication for review is allowed. For cases involving tax-related crimes, where the circumstances are complex and the evidence retrieval process is arduous, the provision allowing a second application for the necessity review of detention provides the party with greater relief space, offering more opportunities for involved enterprises.

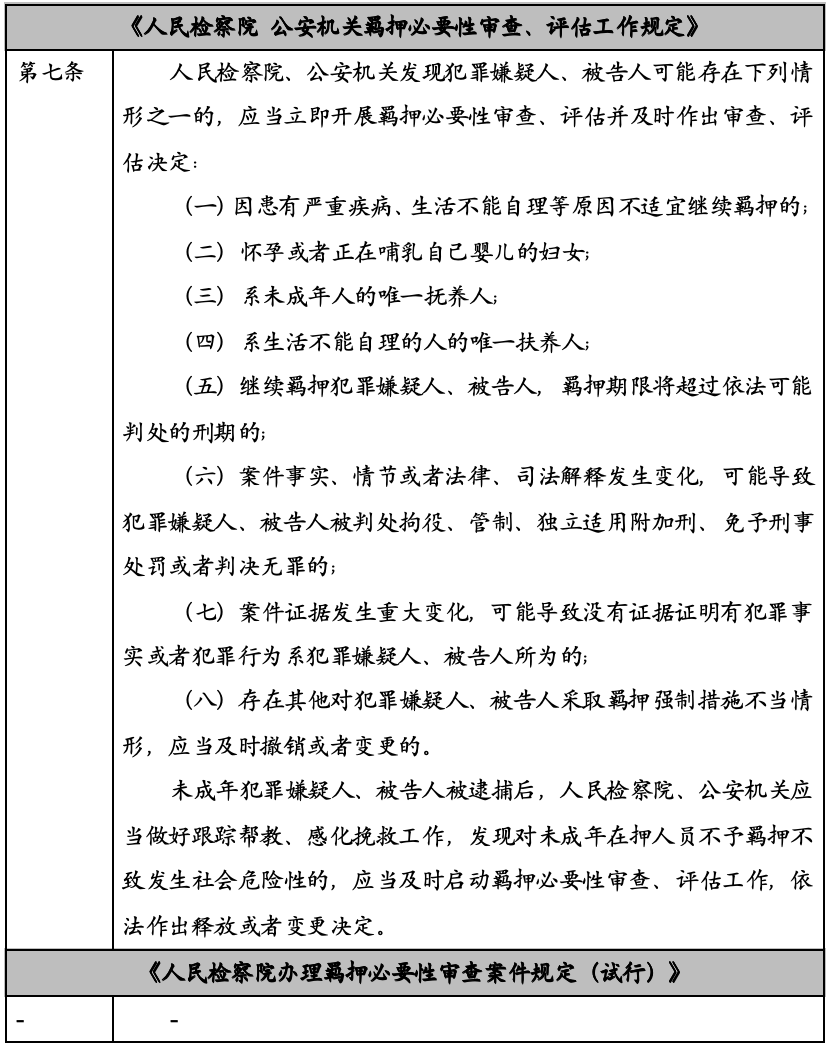

IV. Addition of situations requiring an "immediate necessity review of detention."

Article 7 of the "Provisions" introduces eight situations that "require an immediate necessity review of detention," covering scenarios such as health reasons, family circumstances, prolonged detention, and significant changes in the case or charges. This reflects a humane spirit. For tax-related crimes, changes in case determination may occur due to the emergence of new evidence or a new understanding of business models. Therefore, Article 7 of the "Provisions" specifies situations where an immediate necessity review of detention should be conducted, making reasonable adjustments in line with the dynamic progress of cases and enhancing operational feasibility.

V. For those who may be sentenced to imprisonment of less than three years, at least one necessity review of detention is required during the review and prosecution stage.

Article 6 of the "Provisions" stipulates that the requirement for at least one necessity review of detention applies to most crimes defined in the sixth section of the "Criminal Law" concerning "crimes endangering tax administration." Therefore, the provision in Article 6 of the "Provisions" can be widely applied to tax-related crimes, ensuring that individuals suspected of crimes that may result in imprisonment of less than three years undergo at least one necessity review of detention before prosecution, safeguarding the legal rights of crime suspects.

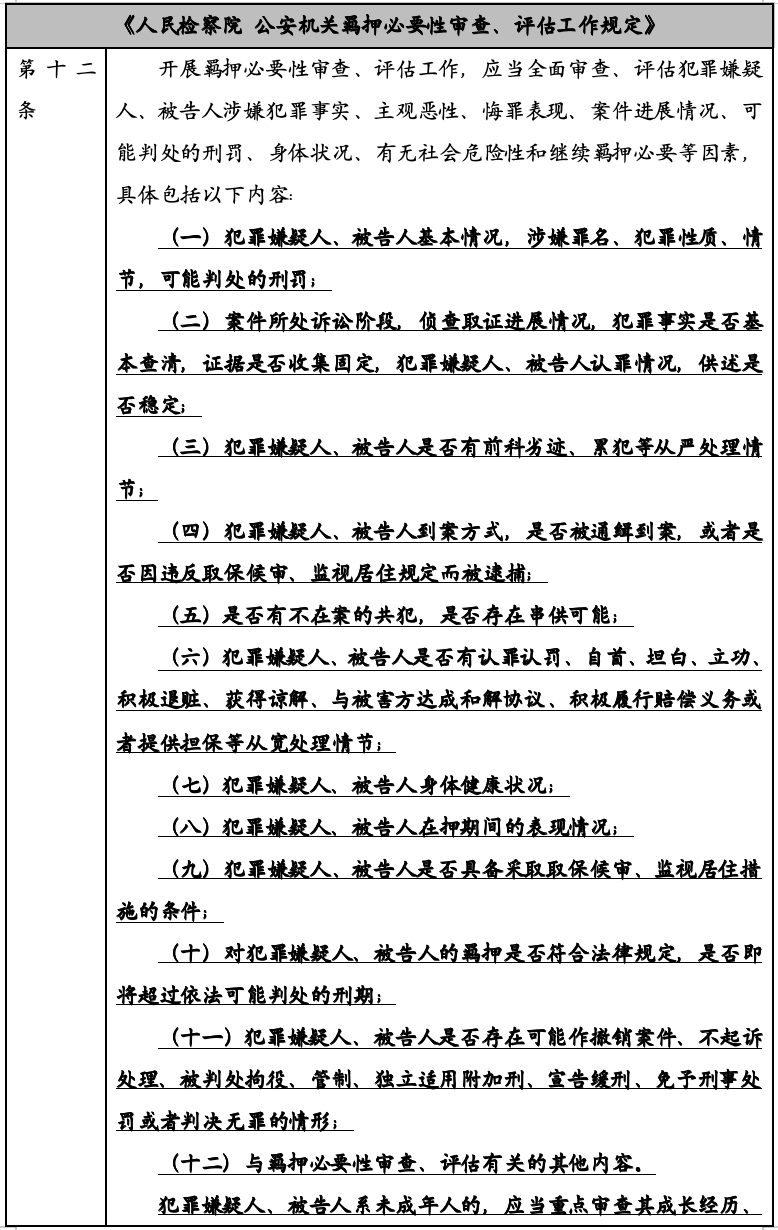

VI. Clear specification of the comprehensive considerations during the review process.

In practice, due to limitations in personnel and funding at the grassroots procuratorial organs, it was challenging to conduct precise assessments of "social dangerousness." There were significant differences in the review content across different regions. Therefore, Article 12 of the "Provisions" stipulates that while the reviewing work should be comprehensive, it lists 12 aspects that reviewing authorities must consider, including the criminal facts of the suspect or defendant, sentencing circumstances, social harm, physical condition, and possible terms of imprisonment applicable to the case. This effectively promotes the substantive review work of reviewing authorities, ensuring basic consistency in review content across different regions.

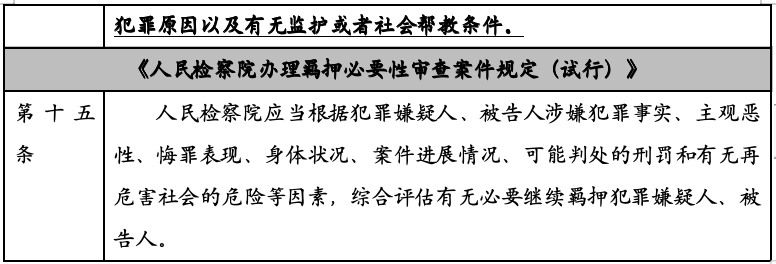

VII. Inclusion of social investigation, quantitative assessment, and other evaluation methods.

In practice, procuratorial organs often employed a unilateral written review method. The revision of the "Provisions" not only expands the content of written review but also specifies methods such as entrusting social investigations, conducting quantitative assessments, and performing psychological evaluations. The elevation of the status of detention hearings enriches the sources of review content and enhances the diversity of reviewing methods.

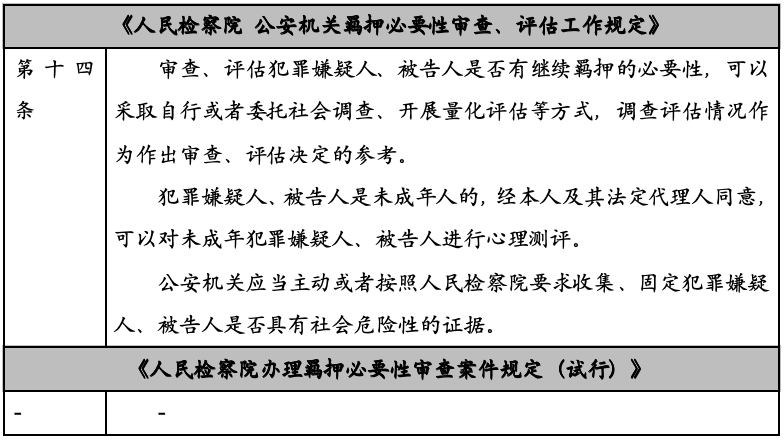

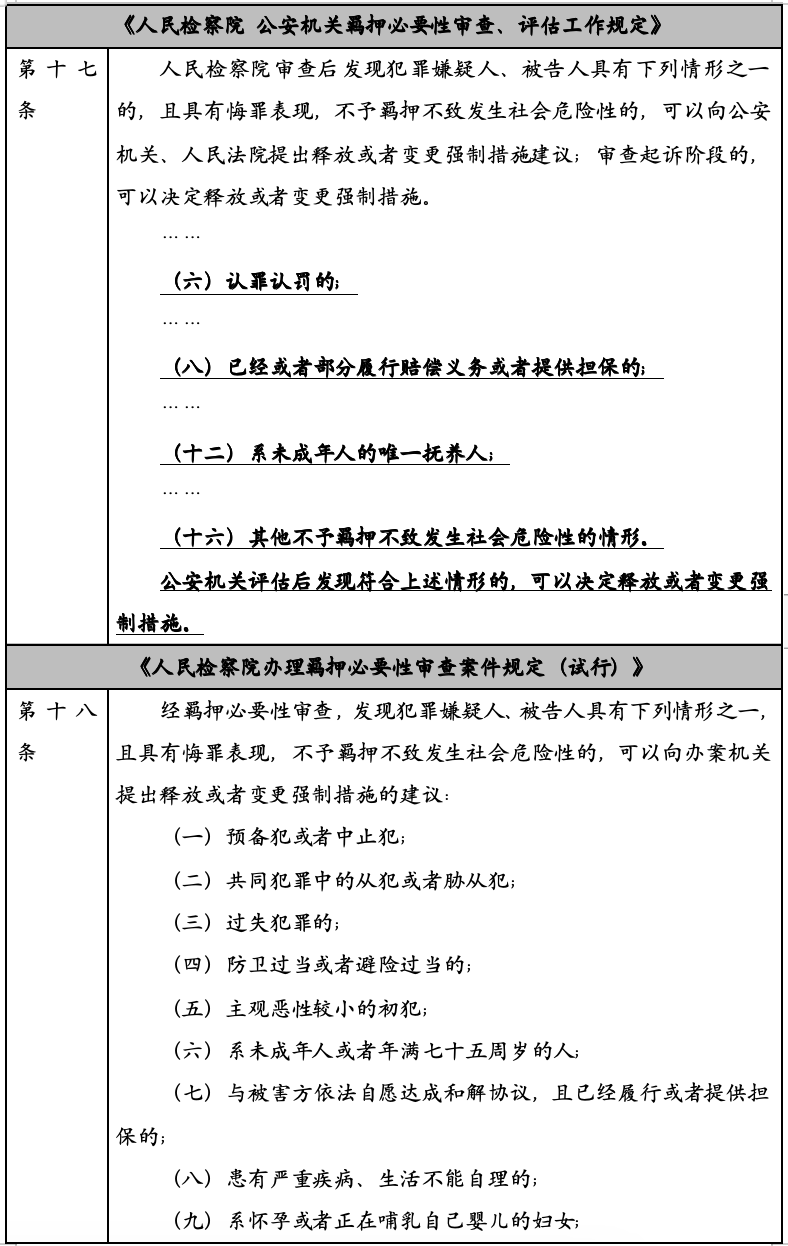

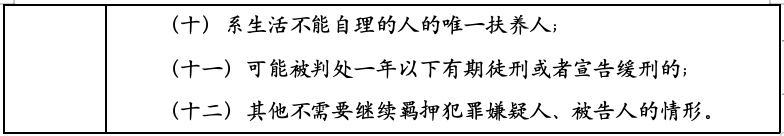

VIII. Addition of four situations where coercive measures can be modified.

The "Trial Implementation Provisions" primarily focused on situations related to the crime stage and identity characteristics of the suspect that "could decide on release or modification of coercive measures" and did not include "admission of guilt and acceptance of punishment" and "payment of overdue taxes or return of illegal gains" within the scope of deciding on release or modification of coercive measures. Article 17, paragraph 6, and paragraph 8 of the "Provisions" include "admission of guilt and acceptance of punishment" and "partial or complete fulfillment of compensation obligations or provision of guarantees" within the scope of "deciding on release or modification of coercive measures."

For tax-related crimes, admitting guilt and accepting punishment, paying overdue taxes, or returning illegal gains are factors considered during court trials. Therefore, the expansion of the scope of "deciding on release or modification of coercive measures" by the "Provisions" is beneficial for safeguarding the legal rights of individuals involved in tax-related crimes and reflects the embodiment of the "restraining arrests, cautious prosecution, and prudent detention" philosophy.

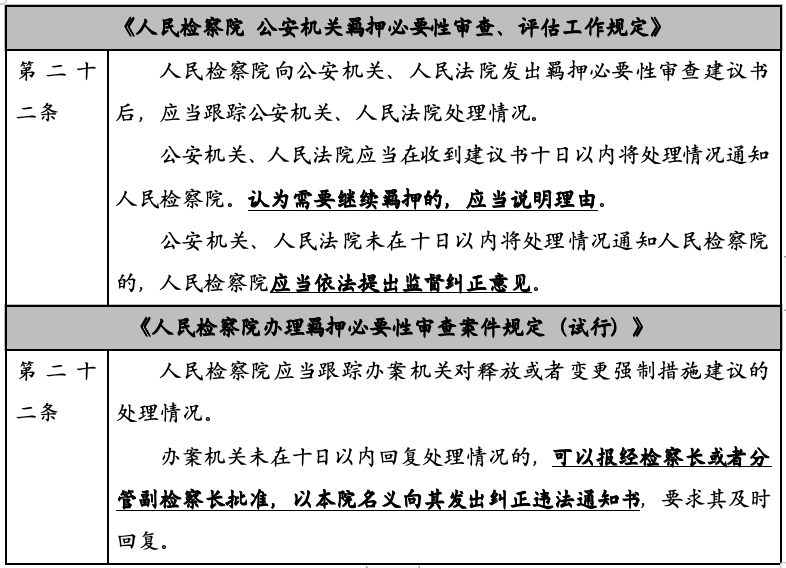

VIIII. If the public security or court receives a recommendation for necessity review and believes that continued detention is necessary, they must provide reasons.

Article 22 of the "Provisions" states that during the investigative and trial stages, if the public security or court applies to the procuratorate for a review, and the procuratorate believes that release or modification of coercive measures is necessary, it must produce a recommendation and deliver it to the public security and court. If the public security or court believes that continued detention is necessary and fails to notify the procuratorate of the processing situation within the stipulated time, the procuratorate should supervise and correct it and promptly inform the applicant in writing of the processing situation of the public security or court. The revision of the above clauses to a certain extent ensures the implementation of review results.

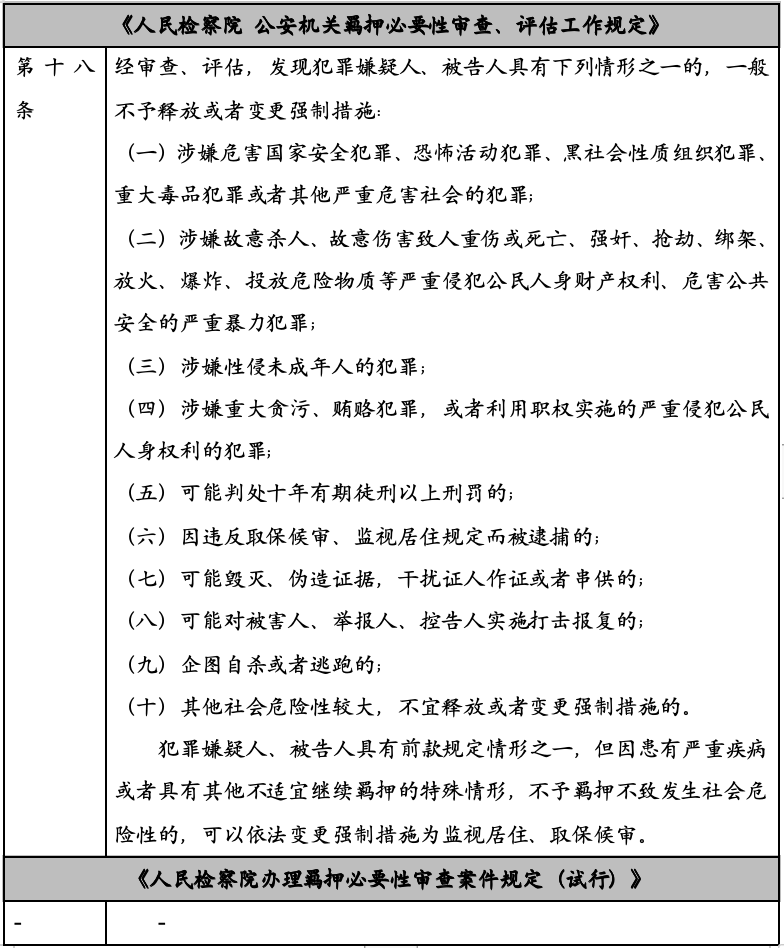

X. Explicit identification of the "blacklist" for the necessity review of detention, with the determination of tax-related crime charges becoming a key factor.

The "Provisions" specify the "blacklist" for the necessity review of detention, including those "subject to a possible sentence of more than ten years of imprisonment." For crimes such as fraudulent issuance, Article 205 of the "Criminal Law" stipulates that those suspected of significant fraudulent issuance of value-added tax special invoices shall be sentenced to more than ten years of imprisonment or life imprisonment. According to the second provision of the "Notice of the Supreme People's Court on Issues Concerning the Application of the Law on the Sentencing Standards for Crimes of Fraudulent Issuance of Value-added Tax Special Invoices," "For fraudulent issuance with a tax amount exceeding 2.5 million yuan, it is deemed as the significant amount specified in Article 205 of the Criminal Law." For enterprises with a large scale of operations and high-value goods, if their business models are invalidated, the implicated special invoice tax amount is likely to surpass the "2.5 million" threshold, making it difficult for the party to apply for a modification of coercive measures.

However, the "Criminal Law" stipulates a maximum sentence of seven years for tax evasion and five years for the illegal purchase of value-added tax special invoices. Therefore, during the case handling process, the key factor in modifying coercive measures for tax-related crimes will be the determination of charges related to the business and actions involved. Typically, judicial authorities classify such cases as fraudulent issuance of value-added tax special invoices crimes, but there are also many instances where individuals are sentenced for tax evasion or the illegal purchase of value-added tax special invoices in practice. Therefore, parties can engage defense attorneys to actively communicate with judicial authorities regarding the charges and push for the initiation of the necessity review of detention.