Six Important Implications for Tax-Related Cases from the 2024 Supreme Court and Supreme Prosecutor's Work Report

On March 8, 2024, the Second Session of the 14th National People's Congress (NPC) held its second plenary session at the Great Hall of the People. At the meeting, Zhang Jun, president of the Supreme People's Court (SPC), made a report on the work of the SPC, and Ying Yong, procurator-general of the SPP, made a report on the work of the SPP. The reports of the two high courts reviewed the work of the judicial sector since 2023 in promoting the development of the private economy, investigating and handling tax-related cases, and deepening compliance reform, and deployed judicial work in 2024 to continuously optimize the rule of law environment for the development and growth of the private economy and to promote the construction of a national unified large market. Enterprises should pay attention to what points of the judicial work deployment of the two high committees in 2024, and what impact the two high committees' report will have on the judicial processing of tax-related cases this year, as analyzed in this article.

Ⅰ. Assisting the development of private enterprises, as a good private enterprise "maternal uncle"

The Supreme Court report opens with: "resolutely rectify the economic dispute as a crime, the first and second trial of 16 enterprises, 34 business owners and managers acquitted according to law. ...... justice as a good private enterprise 'old lady', focusing on the true love really strict control!"

The Supreme Prosecutor's report emphasized that it is necessary to "implement the new development concept in a complete, accurate and comprehensive manner, adhere to the principle of seeking progress while maintaining stability, promote stability by progressing, and establish and then break the rule of law to provide protection for the rebound of China's economy to a good and long-term good. Carry out 'prosecutorial protection enterprise' special action, with the rule of law to enhance the confidence of enterprise development".

With the CPC Central Committee and the State Council issuing the Opinions on Promoting the Development and Growth of the Private Economy on July 14, 2023, the Supreme Court and the Supreme Prosecutor's Office responded positively to the signals of "enhancing the confidence of private entrepreneurs and encouraging the development and growth of the private economy", and issued the "Supreme People's Court's Opinions on Optimizing the Rule of Law Environment and Promoting the Development and Growth of the Private Economy" in October 2023, respectively. The Guiding Opinions of the Supreme People's Court on Optimizing the Rule of Law Environment and Promoting the Development and Growth of the Private Economy and the Opinions on Comprehensively Performing Procuratorial Functions to Promote the Development of the Private Economy emphasize the importance of adhering to the criminal policy of "leniency and strictness in combination with severity", so as to achieve the goal of "leniency in combination with severity" according to law.

In the above opinions, the Supreme Court and the Supreme Prosecutor's Office emphasize the implementation of the principles of criminal law such as the law of crime and punishment and the principle that no one should be held responsible for a suspected crime, and rectify the excessive practices such as criminalization of economic disputes and criminalization of civil liabilities, so as to effectively guard against the extreme tendency of one-sidedness of leniency and strictness, which has a significant impact on the judicial practice of tax-related crimes at the present time. The current judicial practice of tax-related crimes has positive guiding significance.

The current judicial practice should be alert to the criminalization of tax administrative cases. As tax-related crimes, such as the crime of cheating national export tax rebate and the crime of falsely issuing VAT invoices, belong to administrative crimes, some of the case-handling organs simply "transfer" the constitutive elements of administrative law to criminal law, resulting in the expansion of criminal crackdowns and failing to implement the recommendations of the Supreme Court and the Supreme Prosecutor's Office on the principle of "no subjective purpose of cheating national taxes, and no criminal offense", which is a positive guidance in the current judicial practice. It fails to implement the provisions of the Supreme Law and the Supreme Prosecutor's Office that "the subjective purpose of fraudulently offsetting national taxes is not present, and the loss of national taxes has not been caused", which does not constitute a crime.

Ⅱ. Focus on risk areas, the two high attention to foreign trade, pharmaceutical industry

The work report of the Supreme Court and the Supreme Prosecutor paid special attention to the foreign trade and pharmaceutical industries, and it is worthwhile for taxpayers in the relevant fields to strengthen their own compliance construction.

(Ⅰ) foreign trade industry: Tianjin procuratorial organs to develop a tax fraud case supervision model

The report of the Supreme Prosecutor's Office said: "Developing digital prosecution planning, constructing a working mechanism of "business-led, data integration, technical support, and focusing on application". Tianjin procuratorial authorities developed a monitoring model for tax fraud cases, screened out tens of thousands of abnormal data such as falsely declaring the name of goods, falsely increasing the number of products, and falsely collecting and settling foreign exchange, and forwarded them to the relevant departments for investigation and handling, and urged the administrative authorities to plug the loopholes, strengthen supervision, and recover losses with procuratorial recommendations."

2023 was a year of sustained focus on foreign exports and crackdown on fraudulent export tax refunds. In July 2023, when the seven departments held a meeting to promote the work of jointly cracking down on tax-related crimes, Zhang Zhijie, a full-time member of the Supreme Prosecutor's Procuratorate, made it clear that "cracking down on fraudulent export tax refunds by means of buying and matching bills, circular exports, and low value and high declarations" would be one of the important aspects of the Supreme Prosecutor's efforts to crack down on tax-related crimes.

With the expansion of the regularized joint mechanism for combating tax-related crimes from seven to eight departments, all departments have given full play to their respective functions and continuously increased their efforts in combating "fake exports and fraudulent tax refunds". According to the data released at the press conference on January 18, 2024 on tax services for high-quality development, a total of 2,599 export enterprises suspected of fraudulently obtaining export tax refunds were inspected in 2023, and the loss of export tax refunds was recovered to the tune of about 16.6 billion yuan.58,000 people were prosecuted for tax-related crimes between 2018 and 2022, a rise of 29.3% compared with the previous five years. As the hardest hit area of tax loss, fraudulent tax evasion will remain a common focus of tax inspection in 2024.

(Ⅱ) Pharmaceutical industry: investigating bribes from bribe-taking, implicating tax law issues

In the pharmaceutical industry, the Supreme Court's report puts forward "the implementation of bribery and bribery investigation together, and severely punishing multiple, large, and multiple bribery offenses". The Supreme Prosecutor's report, on the other hand, focused on the full implementation of anti-corruption prosecutorial duties, highlighting the prosecution of 580 people for job-related crimes in the medical field, as well as the "implementation of the investigation of accepting and giving bribes together, and the prosecution of 2,593 people for bribery crimes, an increase of 18.9% year-on-year".

In 2023, since the National Health Commission, in conjunction with a number of departments to focus on rectifying corruption in the medical field conference, the national medical field of anti-corruption issues have received widespread attention, pharmaceutical executives, shareholders by the discipline inspection and supervision to remind the conversation, subject to party disciplinary action, and even be the crime of bribery to the public security and judicial organs of the occurrence of the doctor, the director of hospitals to use the academic sessions, sponsorship fees, air ticket reimbursement, etc. to accept funds for bribery It is common to see, along with the pharmaceutical field in full swing of the special rectification action, bribery cases will inevitably be investigated and dealt with further implicate the pharmaceutical enterprises through fictitious transactions, forged contracts and other ways to obtain funds for bribery tax violations, even those to be listed or already listed, the development of a strong pharmaceutical companies also have to face the Securities and Exchange Commission on the pharmaceutical field of commercial bribery, sales costs accounted for an abnormally high proportion of inquiries or concerns, the risk of Steep increase.

Ⅲ. The rate of approved arrests rose by 47.1%, and the criminal risk is becoming increasingly severe

The Supreme Prosecutor's report pointed out that in 2023 the procuratorial organs in the maintenance of national security and social stability, stable play in accordance with the law to punish the function of crime, "2023, the procuratorial organs approved the arrest of all types of criminal suspects 726,000 people, prosecuted 1,688,000 people, respectively, year-on-year increase of 47.1% and 17.3%." This also reflects, from one side, that the criminal risks faced by criminal suspects in tax-related cases or other types of cases have shown a more severe trend.

At the same time, the Supreme Prosecutor's report also mentioned that the prosecutorial department has been fruitful in safeguarding the development of the market economy in 2023. In order to stabilize social expectations and boost market confidence, the procuratorate "prosecuted 121,000 people for crimes against the market economic order, a year-on-year increase of 20.4 percent," emphasizing the need to "treat all types of business entities equally and protect them equally in accordance with the law."

Looking back at the 2023 work report of the Supreme Prosecutor's Office, the report tallied data from 2018 to 2022 on prosecutors nationwide punishing crimes against market economic order in accordance with the law, prosecuting 621,000 people, up 32.3 percent from the previous five years. The criminal risk of crimes against the order of tax collection and administration, as one of the types of crimes that undermine the market economic order, has remained high.

Ⅳ. Continuing to Deepen Criminal Compliance Reform and Expanding Court Compliance to Administrative Litigation

The Supreme Court reported that "criminal compliance procedures were applied to 658 private enterprises involved in cases. ...... Compliance reform for enterprises involved in criminal cases has expanded from the criminal field to the civil, administrative, and enforcement fields, and the number of related cases has reached more than 1,700."

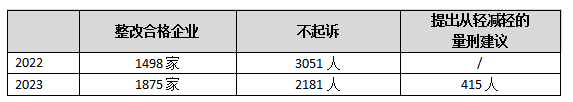

The Supreme Prosecutor's report said, "In 2023, the procuratorial authorities deepened the compliance reform of enterprises involved in cases, and urged enterprises and their principals involved in business-type crimes to make compliance commitments and practical rectifications. It handled 3,866 related cases, decided not to prosecute 1,875 enterprises and 2,181 responsible persons who had qualified for rectification in accordance with the law, and proposed lighter sentences in accordance with the law when prosecuting 415 responsible persons; 42 enterprises had failed to rectify the situation, and prosecuted the enterprises or responsible persons in accordance with the law."

The Supreme Court and the Supreme Prosecutor has continued for many years to pay attention to and promote the compliance reform system of enterprises involved in the case. As the judicial organs "love" private enterprises and private entrepreneurs important judicial system, the criminal compliance of enterprises involved in the case saved a number of inadvertent suspected of criminal offense entrepreneurs, saved a number of good business conditions and has the prospect of development of the enterprise. The Supreme Court, the Supreme Prosecutor's report, revealed three trends:

Movement Ⅰ: continue to save private entrepreneurs

Since the criminal compliance system for enterprises involved in cases was fully rolled out in April 2022, more than 3,000 enterprises have been rectified and qualified, and more than 5,000 people have received decisions not to prosecute. Meanwhile, with the extension of criminal compliance to the trial stage, a number of defendants have obtained lighter and reduced sentences through criminal compliance. This time, the Supreme Court and the Supreme Prosecutor proposed in their work report to continuously deepen the criminal compliance of enterprises involved in cases, signaling that it will continue to serve the function of saving private enterprises and private entrepreneurs in 2024.

Movement Ⅱ: Deep Involvement of People's Courts in Criminal Compliance

In the past, criminal compliance of case-related enterprises was mainly led by the People's Procuratorate. This time, the Supreme Court disclosed that the People's Court applied criminal compliance procedures to 658 private enterprises involved in cases in 2023, indicating that the reform of the system of applying criminal compliance rectification for enterprises involved in cases at the trial stage is in good progress. The extension of criminal compliance to the trial stage is conducive to the rights and interests of enterprises and entrepreneurs involved in cases.

Firstly, in tax-related crimes such as tax evasion, false invoicing and tax fraud, the prerequisite for initiating criminal compliance is to make up for the loss of state tax money, but in the past, the period of the examination and prosecution stage of the Procuratorate was too short, and some enterprises may not yet have raised sufficient funds, thus missing the opportunity for compliance. Now, such enterprises can apply for the initiation of the compliance program at the court stage.

Secondly, the criterion for acceptance of compliance and rectification of the enterprises involved in the case is the resumption of normal operation. However, for enterprises, they may have just resumed production within the time limit for reviewing and prosecuting, and have not yet been able to operate normally. At this point, such enterprises may continue to the first trial stage to continue to rectify in order to meet the acceptance criteria.

Finally, the people's court has more discretionary power and can give different gradations of decisions such as exemption from criminal punishment, probation, mitigation, and lighter punishment depending on the rectification situation. Therefore, we believe that after the compliance system is extended to the trial, it is possible to relax the caliber of carrying out compliance for cases that may be sentenced to more than 10 years of imprisonment, and by lightening and mitigating the sentence of the person in charge, both the protection of private enterprises and the dignity of the criminal law will be realized.

Movement Ⅲ: the enterprise involved in the case of compliance to the extension of administrative litigation

The Supreme Court report this time introduced enterprise compliance in civil, administrative and enforcement. "Enterprise-related administrative compliance" is currently the court is a pilot exploration attempt. According to Xinhua, it refers to the fact that in administrative litigation, enterprises as administrative counterparts can be reduced or exempted from administrative liability through compliance and rectification, and obtaining the approval of the people's courts and administrative organs.

Attempts at administrative compliance involving enterprises help to substantively resolve administrative disputes in the judicial litigation process. In practice, a major factor in the outbreak of tax administrative litigation is the taxpayer's own tax compliance is not sound, risk prevention awareness is not in place and by the tax administrative treatment, penalties. Among them, many enterprises are implicated by the upstream and downstream enterprises and bear serious legal liabilities. If the pilot project of enterprise-related administrative compliance can be extended to the tax field, it will definitely protect the development of private enterprises and substantially resolve tax disputes.

Ⅴ. Play the function of procuratorial supervision, rationalize the two-way road of the convergence of the execution and punishment

In promoting the organic convergence of procuratorial supervision and administrative law enforcement, the Supreme Prosecutor's report proposes "to promote the two-way convergence of administrative law enforcement and criminal justice, urging administrative law enforcement agencies to transfer 5,869 suspected criminal cases, preventing punishment from taking the place of imprisonment; where administrative penalties are due to those who have not been prosecuted, procuratorial advice is given, and 113,000 persons are referred to the competent authorities for processing, preventing impunity. "

Tax-related crimes are administrative offenses, which simply means that they constitute both administrative violations and criminal offenses. Procedurally, administrative law unlawfulness is a necessary condition for criminal unlawfulness. Taking the crime of false opening as an example, only if it constitutes false opening in tax law can we further judge whether it constitutes false opening in criminal law. For those cases that satisfy the constitutive elements of the criminal law and meet the statutory criteria for filing a case for prosecution, the tax department should promptly transfer to the public security when it finds that the violation is obviously suspected of being a crime during law enforcement inspections; the procuratorate should prevent the tax department from substituting punishment for punishment, which will lead to the failure to transfer those that should be transferred. On the contrary, for those cases that do not constitute a crime per se, or due to compliance and rectification and other circumstances by the People's Procuratorate to make a decision not to prosecute, the people's court to make a verdict of acquittal or exemption from criminal punishment, should ensure that the relevant cases can return to the administrative law enforcement procedures, by the tax authorities to review the decision on whether to give administrative penalties, to avoid that should be punished for the violation of law is not punished.

It is worth mentioning that, as the Supreme People's Court pilots the "enterprise-related administrative compliance" system, does it mean that enterprises involved in criminal compliance rectification and acceptance of qualified enterprises can also enjoy the administrative compliance rectification of enterprise-related "benefits", so as to obtain the tax authorities to mitigate or reduce the penalties. Thus, the tax authorities to obtain the results of light, reduced or exempted from administrative penalties? The reform is subject to further observation, but we call for the above concept to become a reality.

Ⅵ. On-line "people's court case library", judges must refer to case handling

The report on the work of the Supreme Court states that "the People's Court Case Database will be created, and the cases reviewed by the Supreme People's Court will be included in the database and must be referred to by judges when handling cases; at the same time, it will be open to the public, and will be available for use by litigants, lawyers, scholars, and members of the public to study the law".

On February 27, 2024, the Supreme People's Court announced the official launch of the People's Court Case Database, which contains authoritative cases of reference value, aiming to promote the unity of the rules and standards of adjudication, avoid "different judgments in the same case", and ensure the correct and uniform application of the law. The launch of the case library not only provides judges with important references for handling cases, but also provides valuable legal resources for parties, lawyers, scholars and the public. The Report on the Work of the Supreme People's Court emphasizes that the cases in the Casebook are those that judges must refer to when making decisions, and will provide authoritative guidance for resolving difficult issues in the application of the law and promote consistency and fairness in judicial decisions.

For example, the widely disputed issue of whether the late payment fee of tax can exceed the principal amount of tax has been clarified in the People's Court's casebook. The case of State Administration of Taxation Nanjing Municipal Taxation Bureau v. Nanjing Company Bankruptcy Claim Confirmation Dispute held that the act of tax authorities to impose late payment fee belongs to one of the ways of administrative enforcement stipulated in the Administrative Compulsory Law, and the administrative authorities have to abide by the restrictive provisions of the Administrative Compulsory Law, i.e., to abide by the requirement that the amount of the late payment fee shall not exceed the amount of the pecuniary payment obligation when they implement this act. This case has been included in the casebook, which provides a clear direction for the handling of similar cases and helps law enforcement and the judiciary to form a consensus on the handling and adjudication of tax late payment fees that shall not exceed the principal amount of the tax.