Non-trading transfers to obtain the company's shares were audited, the holding platform to dismantle the tax-related risks to be concerned about

Editor's Note: It is a common structural arrangement for most enterprises to implement equity incentive to build a shareholding platform through partnerships, limited liability companies and other organizational forms. The shareholding platform has great advantages in controlling the number of direct shareholders, ensuring the founder's control rights and improving the convenience of changes in equity. In addition, in the past, some places adopted the approved levy policy for shareholding platforms, which greatly reduced the tax burden compared with direct shareholding. However, in recent years, there have been cases of tax evasion by using the approved collection policy to split income and transfer profits. The "tax depression" formed based on the approved collection policy has also been controversial because of its lack of legal basis, undermining fair competition in the market and leading to competition for tax sources. In 2021, in the interpretation of Opinions on Further Deepening the Reform of Tax Collection and Management, State Taxation Administration of The People's Republic of China Inspection Bureau pointed out that the use of "tax depressions" to evade taxes was one of the key areas to be cracked down. At the end of 2021, the Announcement on the Collection and Management of Personal Income Tax from Equity Investment Management made it clear that all equity investment partnerships are subject to audit and collection, and recently, auditing and taxation departments have also clearly put forward the "small policy" to clean up the irregularities in attracting investment. Based on the aforementioned collection and management situation, the application space of the approved collection policy has been tightened, and the tax burden advantage of building a shareholding platform through partnerships and limited liability companies is no longer available. Therefore, in recent years, there have been many transactions that cancel the shareholding platform and change to direct shareholding. In the cancellation of shareholding platforms such as partnerships or limited liability companies, many issues such as whether the non-trading transfer of shares requires tax, and the joint liability of shareholders when the cancelled enterprises owe taxes have caused heated discussions. Based on two cases of dismantling the shareholding platform, this paper analyzes the tax liability and tax-related risks of non-transaction transfer for readers' reference.

I.Case: Non-transaction Transfer without Tax Clearance, Individual Shareholder Recovered Tax

(I) Dismantling of partnership structure and non-transaction transfer to acquire listed company shares without declaring individual tax was audited

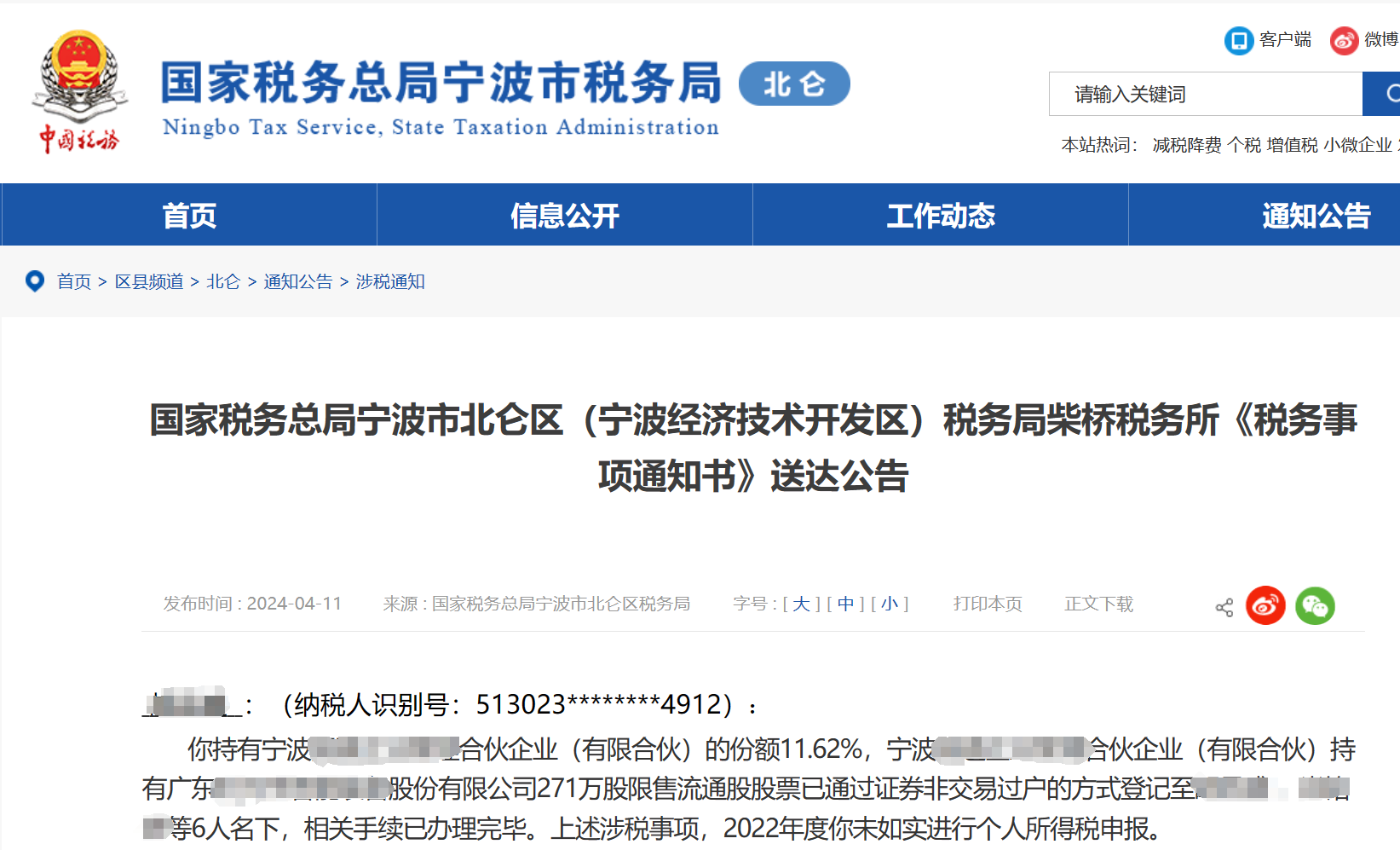

On April 11, 2024, Ningbo Municipal Tax Bureau of the State Administration of Taxation published a Notice of Tax Matters, which showed that Hu held 11.62% of the share of Partnership A. 2.71 million shares of a listed company had been registered in the name of Hu and other six persons by way of non-transactional transfer of securities, and the relevant procedures had been completed. Hu did not file an individual income tax return in respect of the aforesaid matters and is now notified by the tax bureau to file a tax return.

According to the 2022 Annual Report of the listed company, the shares of the Company held by Hu and the other 6 persons were acquired on October 27, 2022 through the non-transaction transfer of the Company's original shareholders, A Partnership and B Partnership. Public information shows that Partnership A was established on August 4, 2017, with the business scope of enterprise management, enterprise management consulting, etc., and Hu's capital contribution ratio is 11.62%. Partnership A has been canceled on November 3, 2022.

(II) Limited liability company shareholding platform was written off without tax clearance, and the tax bureau recovered 130 million yuan of tax from the individual shareholders

A public Notice of Tax Matters of Kaifeng Tax Bureau of the State Administration of Taxation showed that an enterprise management company held 34,492,500 shares of unlimited outstanding shares of a listed company (accounting for 9.77% of the total share capital of the company), which had been registered to the name of Shao Mou1, Shao Mou2, Qiu Mou, Chen Mourong and Chen Moubin by way of non-transactional transfer of securities, and the relevant formalities had been completed. There was underpayment of enterprise income tax by the enterprise management company. According to Article 2 of the Circular on Issues Concerning the Income Tax Treatment of Disposal of Assets by Enterprises (Guo Shui Han [2008] No. 828), "The following situations in which an enterprise transfers its assets to another person are not internal disposal of assets due to the fact that the ownership of the assets has been changed, and shall be regarded as sales to determine the income in accordance with the regulations. ...... (d) for dividend distribution; ... (f) for other purposes that have changed the ownership of the assets", the Company distributes physical assets such as stocks to its shareholders through "non-transaction transfer". The distribution of shares and other physical assets by the company to its shareholders through "non-trading transfer" shall be subject to enterprise income tax at the enterprise level, and the realization of enterprise income shall be recognized when the transfer agreement becomes effective and the procedures for changing the shareholding are completed.

As the company had been deregistered, the tax bureau recovered RMB 13,445,367,675.77 from the original shareholders Shao Mou1, Shao Mou2, Chen Moubin, Chen Mourong and Qiu Mou in accordance with the shareholders' investment ratio.

II. The new situation of tax administration under the non-transaction transfer behavior increased, individual shareholders need to pay attention to the tax-related risks

(I) Frequent dismantling transactions of equity structure under the new situation of tax administration

Compared with the direct shareholding of individuals, the implementation of equity incentives through partnerships, limited liability companies and other shareholding platforms is the choice of most enterprises, and the construction of shareholding platforms has a greater advantage in controlling the number of direct shareholders, safeguarding the founder's right of control, and improving the convenience of equity changes. In terms of taxation, some local governments, in order to attract investment, have given shareholding platforms the policy of authorized collection of personal income tax or enterprise income tax, which has led to the introduction of a large number of equity investment enterprises.

With the promulgation and implementation of the Announcement on the Administration of Collection of Individual Income Tax on Business Income from Equity Investments (Announcement No. 41 of 2021 by the Ministry of Finance and the State Administration of Taxation), all partnerships holding equity investments such as shareholdings, stocks and partnership property shares are subject to checking and levying; and in recent years, the clean-up and standardization of preferential policies on taxes for undue intervention in the market have been gradually rolled out, and in April 2021 the State Administration of Taxation In April 2021, the SAT Audit Bureau pointed out in its interpretation of the Opinions on Further Deepening the Reform of Tax Levy and Administration that tax departments around the world should be oriented by tax risks, take "double random and one open" as the basic method, targeting at the key areas where tax evasion is frequent, appropriately increase the ratio of random inspection, carry out random inspection in an orderly manner, precisely implement tax supervision and crack down on tax-related illegal acts. Tax-related illegal behavior, in which the use of "tax pits" to evade taxes is one of the key areas to be combated; in December 2021, commissioned by the State Council, Auditor General Hou Kai reported to the Standing Committee of the National People's Congress on the rectification of the problems detected in the audit of the execution of the central budget and other financial revenues and expenditures of the 2020 fiscal year, which, for the the problem of tax evasion by high-income earners applying the approved collection method, the State Administration of Taxation (SAT) has selected areas with more approved collection situations for piloting, adjusted sole proprietorships and partnerships that meet certain circumstances to checking accounts, strengthened the supervision of tax evasion by individual equity transfers, and set up additional indicators for daily monitoring to improve the ability to accurately supervise the tax; this year's auditing, taxation and other departments have clearly proposed to This year, the auditing, taxation and other departments have explicitly stated that "in-depth revelation of some local investment promotion in violation of the introduction of "small policies", the formation of "tax puddles" and other issues". Under the aforementioned trend of tax regulation, the tax advantage of building a shareholding platform structure based on partnership or limited liability company is exhausted, and the applicable space for authorized levy is tightened. The transfer of equity by a natural person through a partnership or a limited liability company will result in a steeper tax burden compared to a direct shareholding structure.

Therefore, against the background of the aforementioned policy, the removal of shareholding platforms has become a common issue in the structural adjustment of listed companies or proposed listed companies in recent years. The dismantling of shareholding platforms mainly involves the cancellation of shareholding platforms such as partnerships or limited liability companies, in which most of the shares held by the shareholding platforms are restored to the investors in the form of non-transactional transfers, in which the tax implications are worth paying attention to.

(II) Are non-trading transfers taxable?

Non-trading transfer refers to the completion of transfer of ownership of shares between the transferor and the transferee without the form of trading. According to China Securities Depository & Clearing Corporation's Implementing Rules for Non-transaction Transfer of Securities (China Depository & Clearing [2023] No. 28), non-transaction transfers mainly include inheritance, donations to registered domestic charitable organizations and foundations, division of property according to law in the case of divorce, loss of legal personality, and transfer of securities involved in private asset management and other cases recognized by the China Securities Regulatory Commission. Individual shareholders after non-trading transfer can enjoy differentiated tax treatment for dividends and bonuses when obtaining dividends from listed companies; they can enjoy personal income tax exemption when transferring shares subsequently.

In practice, there have been quite a number of cases in which individuals have not filed tax returns or limited companies have not cleared tax due to non-trading transfers and have been subject to tax audits. On the one hand, some of the parties to the transaction do not understand the tax substance of non-transaction transfer, and believe that the above non-transaction transfer does not involve payment of money or other economic benefits by the transferee to the transferor as a consideration, and is not subject to tax obligations. However, under the tax law, such cases should be treated as "deemed sales". On the other hand, some parties to the transaction take advantage of the loopholes in the interface between tax collection and securities registration information to evade the tax in the process of non-transaction transfer, for example, the "China Securities Clearing Corporation, Shenzhen Branch, Securities Non-transaction Transfer Business Guide" on the non-transaction transfer of tax-related information required to be provided only clarifies the requirements for the management of the stamp duty information, and only when the client is a natural person shareholder (natural person shareholder non-transaction transfer to other shareholders), the tax payment of personal income tax is verified. Verify the tax completion certificate of individual income tax and require the provision of "Individual Income Tax Clearance Return on Income from Transfer of Restricted Shares". For shareholders of limited liability companies or shareholders of partnerships to handle non-transaction transfers, i.e., non-transaction transfers of shares from legal person shareholders or shareholders of partnerships to other natural person shareholders, there is no need to provide relevant tax-related information. In addition, as most of the shareholding platforms have not dealt with tax-related matters, have not received invoices, have no tax debts and fines, and have no other outstanding tax-related matters, they are often subject to the simplified write-off procedures when going through the write-off procedures, and are exempted from applying for tax clearance certificates from the tax authorities, and apply for simple write-offs from the market supervision authorities directly. Therefore, in practice, there are "tax planning" behaviors to take advantage of the above information asymmetry to avoid non-transaction transfer income tax.

Through the non-transaction transfer of shares, the dismantling of the shareholding platform reverts to direct shareholding by a natural person, which is a change in the ownership of shares among different subjects and is treated as a sale under the tax law. For partnership-type shareholding platform, natural person partners have income tax obligations based on the principle of "share first, tax later"; for company-type shareholding platform, limited liability companies should be liquidated before cancellation, and if there are tax debts in the canceled company, such as the case mentioned above, the individual shareholders may be asked to bear joint and several liabilities and to pay back the tax.

III. Tax-related risks of non-transactional transfers in the event of dismantling of holding platforms

(I) Risk of tax adjustment of past transactions

Under the recent policy background of strict investigation of illegal "small policies" in investment promotion and cleaning up of tax depressions, non-transactional transfers in the dismantling of the shareholding platform of the past partnership may be adjusted retroactively and required to change to the checking and collection method for payment of individual income tax, and the natural partners will face the risk of payment of additional tax and late payment charges.

(II) Risk of failure to file tax returns within the prescribed period, characterization of tax evasion and imposition of fines

According to the provisions of the Tax Collection and Administration Law, taxpayers must truthfully make tax declaration within the declaration period stipulated by laws and regulations. If a taxpayer fails to make a tax declaration and fails to pay or underpays the tax due, the tax authorities shall recover the unpaid or underpaid tax, late payment fees, and impose a fine of not less than 50% and not more than 50% and not more than 50% of the unpaid or underpaid tax. If a taxpayer still fails to file a declaration after being notified to do so by the tax authorities, the taxpayer will also be triggered to be liable for tax evasion and face the legal risk of paying back taxes, late fees and fines, and if the taxpayer fails to pay back the tax in a timely manner, the taxpayer may also be faced with the risk of criminal liability for the crime of tax evasion.

(III) Recovery of tax from original shareholders by the tax bureau after the shareholding platform is canceled

In practice, for enterprises that have been written off and incur tax arrears, some tax bureaus require shareholders to make up for the tax owed by the company in proportion to their capital contribution and late payment fees. Article 240 of the new Company Law makes it clear that shareholders of a simplified canceled enterprise with false promises are jointly and severally liable for the debt. Then, in the process of dismantling the shareholding platform, the shareholders face the risk of tax recovery if the company-type shareholding platform is canceled without fulfilling the tax obligations. For example, in the second case mentioned above, the tax authorities found out the outstanding tax matters after the limited liability company was canceled, and then recovered the tax from the original shareholders.

IV. Suggestions on how to deal with the tax-related risks of non-transaction transfers

(I) If the conditions of authorized collection are met, the tax adjustment can be applied when facing tax adjustment.

The Law on Administration of Tax Collection has made clear provisions on the conditions for authorized collection, in which "account books should be set up but are not set up" and "the accounts are chaotic or the cost information, income vouchers and expense vouchers are incomplete, making it difficult to check the accounts" are the legal grounds for authorized collection. For qualified enterprises, they can strive to apply the approved levy when facing the tax adjustment of checking accounts levy.

(II) If an individual partner of a non-transaction transfer fails to file a tax return, the tax recovery by the tax bureau is subject to the limitation of the recovery period.

The second paragraph of Article 64 of the Tax Collection and Management Law provides for the legal consequences of not making a tax declaration, "Where a taxpayer fails to make a tax declaration and fails to pay or underpays the tax due, the tax authorities shall recover the unpaid or underpaid tax, late fees and impose a fine of not less than fifty percent and not more than five times of the unpaid or underpaid tax". The Reply of the State Administration of Taxation on the Issue of the Period of Recovery of Undeclared Taxes (Guo Shui Han [2009] No. 326) provides that "Article 52 of the Law on the Administration of Tax Revenue stipulates that for tax evasion, tax resistance, or tax cheating, the tax authorities may, for an indefinite period of time, recover the unpaid or underpaid taxes, late fees, or fraudulently obtained taxes. The situation of non-payment or underpayment of tax payable caused by taxpayers' failure to make tax declaration as stipulated in paragraph 2 of Article 64 of the Tax Administration Law does not belong to tax evasion, tax resistance or tax cheating, and the period for its recovery is generally three years in accordance with the spirit of Article 52 of the Tax Administration Law and can be extended to five years under special circumstances." That is, the taxpayer's failure to file a tax return should be distinguished from tax evasion, tax resistance, and tax fraud, and a recovery period of three to five years should apply. Therefore, individual partners facing tax audits and demands for back taxes due to non-transactional transfers that have exceeded five years can use the recovery period as one of their defenses.

(III) There are prerequisites for penetrating the corporate veil and pursuing the joint and several liability for the payment of back taxes from the shareholders

The tax authorities penetrate the corporate veil and require the shareholders to bear the liability for back taxes with strict conditions. If the shareholders have abused the independent status of the corporate legal person to harm the interests of the company and its shareholders and creditors, or falsely liquidate, maliciously dispose of or conceal the company's property in the cancellation process, or liquidate the company without lawful liquidation, and fraudulently obtain the registration of the cancellation by means of false liquidation report, etc., the tax authorities may claim to pierce the corporate veil and require the individuals to pay back the taxes owed by the company. shareholders to make up for the unpaid taxes and late payment fees owed by the company. If the shareholders fulfill the full amount of capital contribution obligations in accordance with the law and regulations, and there is no evasion of capital contribution, false liquidation, malicious transfer of property, etc., then the tax authority lacks legal basis to pursue the joint and several liability of the shareholders to make up for the tax payment.