Supreme People's Court, Supreme People's Procuratorate These coal industry cases convicted of false VAT invoices can be actively appealed after the introduction of the judicial interpretation

Editor's Note: Due to the operating characteristics of the coal industry, a large number of coal enterprises have the chronic problem of separation of invoices and goods at the purchasing end. In the past, due to the false VAT invoices legislation adopts a simple crime, the judicial authorities that there is a false invoicing that constitutes the crime, the coal industry, the separation of votes and goods belongs to the original judicial interpretation of the false invoicing, but also the false invoicing of the crime of criminal responsibility. Recently, the Supreme People's Court and the Supreme People's Procuratorate issued the "Interpretation of Several Issues Concerning the Application of Law to the Handling of Criminal Cases of Endangering the Administration of Tax Collection" (Law No. 4 [2024] ), which makes clear provisions on the elements of the crime of false invoicing, and at the same time, also makes clear that false invoicing that does not aim at fraudulently offsetting the taxes and does not result in fraudulent loss of tax due to the offsetting should be out of the crime. For cases involving invoices in the coal industry in which the court trial process directly qualifies the offence of fraudulent invoicing without examining the subjective purpose of the perpetrator or the objective harmful consequences of the act, a complaint may be actively lodged.

I. How to understand the incriminating and exculpating provisions of the crime of false invoicing under the new judicial interpretation

(i) False invoicing offences remain unspecified as purpose and result offences

The nature of the offence of false invoicing of VAT has been controversial. According to the "behavioural crime theory", as long as the perpetrator commits the objective act of falsely issuing VAT invoices, he or she satisfies the constitutive elements of this crime and should be held criminally liable for the crime of false invoicing. On the other hand, the "purpose crime theory" and the "result crime theory" hold that the constitution of the false invoicing offence requires that the perpetrator of the false invoicing has the purpose of "fraudulently offsetting the value-added tax" and that the false invoicing act causes a "loss of national value-added tax interests". and the harmful result of "loss of national VAT interests" caused by the act of false invoicing. However, the views of the "purpose offence theory" and the "result offence theory" have all along lacked a direct and applicable legal basis, and there are disputes and obstacles as to whether they can be applied in judicial practice.

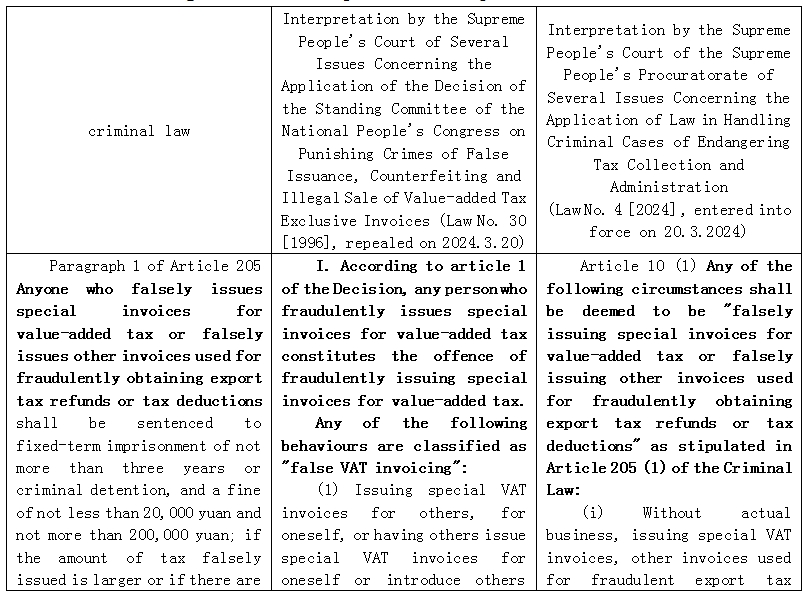

In fact, this problem has not been solved after the introduction of the new judicial interpretation. From the perspective of the logic of legal application, the Criminal Law stipulates that "falsely issuing VAT special invoices or falsely issuing other invoices used for fraudulently obtaining export tax refunds or tax credits" constitutes the crime of false invoicing, and both the Law [1996] No. 30 and the new Judicial Interpretation only refine and explain "falsely issuing VAT special invoices or falsely issuing other invoices used for fraudulently obtaining export tax refunds or tax credits" into several types of false invoicing behaviours. Whether it is Law No.30 [1996] or the new judicial interpretation, it only explains "false invoicing of VAT invoices or false invoicing of other invoices used to fraudulently obtain export tax rebates and tax credits" as several types of false invoicing behaviours, without further setting preconditions for the false invoicing behaviours, and incorporating factors such as having the purpose of fraudulently offsetting taxes and the results of causing loss of taxes into the elements of the false invoicing behaviours. If this offence is a purpose and result offence, the new judicial interpretation should add the expression "with the purpose of fraudulently offsetting taxes and causing tax losses" before each type of false invoicing behaviour. According to the existing provisions, it can still only be concluded that there are five types of false invoicing behaviours constituting "false invoicing of VAT invoices or false invoicing of other invoices used for fraudulently obtaining export tax refunds and tax credits", which in turn constitutes the criminal law of false invoicing crimes. Therefore, from the text of the new judicial interpretation, it cannot yet be considered that it adjusts false invoicing to a purpose or result offence.

(ii) Further expansion of the pattern of false invoicing behaviour

As for the definition of the act of "false invoicing of VAT special invoices", the Criminal Law stipulates: "false invoicing for others, false invoicing for oneself, letting others falsely invoicing for oneself, and introducing others to falsely invoicing", which is a more general provision. And for a long time, the judicial practice for false invoicing behaviour is based on the determination of the law [1996] No. 30, Article 1 of the provisions of the false invoicing of goods, goods, high open, on behalf of the opening of the three types of behaviour. The new Judicial Interpretation has adjusted the determination standard of the act of false invoicing of VAT, and has adopted the "enumeration + underlining" style to clarify the circumstances of "false invoicing". Among them, paragraph 1, subparagraph (1) of Article 10 of the new judicial interpretation can correspond to the act of false invoicing without goods of Fafa [1996] No. 30, and subparagraph (2) can correspond to the act of false invoicing with goods, but subparagraph (3) has been expanded, specifically:

Subparagraph (c) applies to "operations that cannot be tax-deductible according to law". According to the Provisional Regulations on Value-added Tax and other provisions, four conditions need to be met for tax deduction, namely, that the purchasing party is a general taxpayer, that the second is a purchasing of a taxable item, that the third is the payment of input tax, and that the fourth is obtaining an invoice from the selling party. For those that do not satisfy one of the above four conditions, they belong to the business that is not tax deductible according to law, and the issuance of invoices through a fictitious transaction subject for the business that is not tax deductible according to law constitutes the act of fictitious invoicing in item (c), including:

1. Sales to individuals and small-scale taxpayers selling taxable items (which are not tax-deductible according to law), but invoicing other general taxpayers;

2. The purchaser procures non-taxable items (e.g., accepting labour provided by employees) but obtains VAT invoices issued by a third party;

3. The purchaser purchases taxable items without paying input tax (e.g., personal procurement services that never reach the threshold), but obtains VAT invoices issued by a third party;

4. The purchaser pays input tax on the purchase of taxable items but does not obtain an invoice from the seller and instead obtains an invoice from a third party.

Among them, the first type of behaviour belongs to the sales side of the separation of invoices and goods, in the Law No. 30 [1996] has not been provided for, is a new judicial interpretation of the new matters. The second to fourth type of behaviour is the procurement side of the act of opening, in the law [1996] No. 30 unified as invoicing to be stipulated. It should be noted that these three types of behaviour in the new judicial interpretation of the new judicial interpretation is still not differentiated as a false invoicing, but three types of behaviour, the subjective purpose of the perpetrator and the consequences of the opening of the different, need to be combined with the new judicial interpretation of the second paragraph of article 10 to further analyse the possibility of their crimes.

In addition, the new judicial interpretation also added (d) "illegal tampering with the electronic information related to the bill of lading" and (e) "violation of the provisions of other means of false invoicing," the bottom of the provisions of the same beyond the provisions of the Law No. 30 [1996].

(iii) Add reasons for excluding criminal responsibility

According to the foregoing discussion, the judicial practice can be fully equated with the false invoicing behaviour and the false invoicing offence, and at the same time, due to the further expansion of the type of false invoicing behaviour, resulting in a significant increase in the criminal risk of the false invoicing offence, but, on the other hand, the new judicial interpretation of the same time, the provisions of the crime, to the parties suspected of the false invoicing offence to provide the peaks and troughs of a ray of hope.

According to the second paragraph of article 10 of the new judicial interpretation, "those who do not aim at fraudulently offsetting taxes for the purpose of inflating performance, financing, or lending, and who do not cause fraudulent loss of taxes due to the offsetting, shall not be punished for this offence, and if they constitute other offences, they shall be held criminally liable for other offences in accordance with the law." This provision should be understood in the following four ways:

1. Legal effect: it is not a constituent element of a crime, but it is a provision of the offence and has the effect of crime deterrence. It is not a constituent element of a crime, which means that it is not a factor that must be taken into consideration in the incriminating link, and the judicial authorities can fully determine the crime of false invoicing in accordance with the provisions of the first paragraph of Article 10 of the new Judicial Interpretation, and the parties concerned whether there is the purpose of fraudulent tax credit and whether it causes the loss of tax money do not constitute the category of reasonable doubt, and the judicial authorities do not need to take the initiative to collect the related evidences. It is an exculpatory provision, which means that the parties are given the opportunity to prove their guilt, and if the parties with the act of false invoicing can prove that they do not have the purpose of fraudulent tax credits and do not cause fraudulent loss of tax according to the second paragraph, and if the judicial authorities verify the establishment of the crime, the judicial organs can be blocked from convicting the crime. Although this provision seems to violate the basic principle of criminal law that a party cannot be required to prove its innocence, from the perspective of the logic of the new judicial interpretation, the burden of proof of the offence remains on the party concerned, and from the perspective of practical experience, there have been few cases in which the judicial authorities have taken the initiative to collect evidence to prove that the party involved in the fraudulent invoicing did not cause any loss of tax money, among other results.

2. Understanding of the purpose of not fraudulently offsetting tax: "etc." in the phrase "for the purpose of falsely increasing performance, financing and lending, etc." means that the article is not an exhaustive list, i.e., it is not limited to the three situations of falsely increasing performance, financing and lending. The phrase "not for the purpose of fraudulently offsetting taxes" emphasises "fraudulently offsetting", i.e. fraudulently obtaining credits. According to the foregoing discussion, the purpose of the three types of behaviour of invoicing in the procurement process is different. In the two cases of non-purchase of taxable items and non-payment of tax-containing price, the purchaser itself has no right to offset, and if the invoice is issued to offset the tax that should not have been offset, it is a fraudulent offsetting behaviour, whereas in the third case, the purchaser actually purchases the taxable items and pays the tax-containing price, and chooses to invoice from third party just because the seller does not issue invoices, which is due to the invoicing. The third case, the purchaser actually purchases the taxable items and pays the tax-containing price, but only because the seller does not issue the invoice and chooses to issue it on behalf of the purchaser from the third party, which belongs to not being able to offset due to the invoice defects according to the law, rather than not being able to offset due to the lack of the right to offset according to the law, and on the contrary. In addition, the act of separation of goods and tickets in the sales process cannot be uniformly determined to have the purpose of fraudulent tax credit. In the case of invoicing, the key to determine whether there is a right of deduction in the invoiced party rather than the purchasing party, the sales direction of individuals, small-scale taxpayers, sales, do not issue invoices and hidden income, indeed have the purpose of infringing on the interests of national tax, but this purpose is achieved through the act of hiding income, false declarations, rather than through the realization of false invoices, the essence of the evasion of tax rather than false invoicing. As for the seller to invoice the invoiced party, it constitutes a new legal relationship of invoicing, whether this link has the purpose of cheating tax, need to be further combined with the invoiced party with or without the right of deduction to judge, the invoiced party has the right of deduction, the invoicing does not have the purpose of cheating tax, can not because of the separation of the ticket and goods are uniformly found to have the purpose of cheating tax.

3, there is no understanding of fraudulent loss of tax due to offsetting: at present, there are two understandings of this article, one of which is that obtaining false invoices and offsetting is equal to causing loss of tax, and this article stresses that there is no implementation of offsetting behaviours after the false invoices are issued; and the second one is that obtaining false invoices and offsetting is not equal to causing loss of tax, and this article stresses that offsetting "and" causes loss, i.e., "and" is omitted. This article stresses that the offsetting of false invoices "and" causes losses, that is, "and" is omitted, according to this understanding, it means that there is no necessary causal relationship between the acquisition of false invoices and losses, and that the acquisition of false invoices and offsetting may or may not cause tax losses, and the acquisition of false invoices and offsetting that do not cause tax losses can be The offence can be committed according to this article. The author prefers the second understanding. False invoicing and offsetting is not equal to loss, such as the right of offsetting on behalf of the opening that is such a situation, will be analysed later in the coal industry with typical cases involving invoices.

4. Level of effectiveness: This article can be directly invoked as a legal basis. As a matter of fact, this clause is not a brand new clause, and the spirit of this clause has been reflected in the past in documents such as Law Research [2015] No. 58 and the Supreme Prosecutor's Opinions on the Six Stabilisation and Six Guarantees, etc. However, Law Research [2015] No. 58 is of a lower effectiveness level, which only reflects the understanding of the Research Office of the Supreme Court, and it cannot be directly invoked as a legal basis for the criminalisation of the act of falsely issuing VAT invoices, and many courts believe that it cannot be judicially Many courts believe that it cannot be directly invoked in judicial trials. The opinions of the Six Stabilisation and Six Guarantee are issued by the Supreme Prosecutor alone, and there are disputes on how to understand and apply them in judicial trials. The new Judicial Interpretation has for the first time made clear provisions on this article in the form of judicial interpretation, which means that the judicial organs can directly invoke this article to convict the parties concerned, which is of great significance in terms of progress.

II. Observations on typical bill-related cases in the coal industry in recent years

(i) Invoicing for over-mining coal mines

In order to promote the optimisation and upgrading of the energy industry, China has implemented a quota system for coal mining, and the part of the quota exceeding the mining quota cannot be sold normally. Some coal trading enterprises or coal-using enterprises actually purchased coal, but due to the over-mining of coal, the buyer could not obtain VAT invoices. In order to solve the problem of insufficient input invoices for deduction and realise the rights and interests of VAT input deduction, some coal enterprises will take the form of paying invoicing fees to the third-party counterparts for the transfer of "surplus invoices" to solve the problem of high tax burden. Some coal enterprises will take the form of paying invoicing fees to their third party counterparts to transfer "surplus tickets" in order to solve the problem of high tax burden. Although the quantity and amount of goods contained in the invoices issued by the third party are in line with the actual transaction, the tax authorities believe that the invoicing party is inconsistent with the seller of the goods, and are still inclined to characterise the invoicing as false and transfer it to the public security authorities for criminal proceedings.

As the VAT chain is interlocked, whether the upstream enterprises issue VAT invoices legally and in compliance with the law and whether they pay VAT on time and in full directly affects whether the downstream enterprises can declare and deduct VAT input tax normally and whether their deduction behaviour will cause VAT loss to the state. In the cases of false invoicing in the coal industry, a considerable part of the cases is due to the false invoicing problems of the upstream enterprises and then implicate the downstream enterprises. The downstream enterprises receiving the invoices may be subject to tax inspections and carry out the transfer of inputs, which will affect the continuous operation of the enterprises; and the heavier ones may be transferred to the public security organs for investigation of the criminal cases of false invoicing.

(ii) Invoicing for small coal kilns

On the one hand, due to the restriction of coal mining quota, coal mining enterprises selling coal mined in excess of the quota could not sell and provide VAT invoices in their own names, and therefore some small-scale coal mines were unable to directly supply coal to coal-using enterprises. On the other hand, although the administrative licensing system for coal operation was cancelled in 2014 and individuals holding small-scale coal mines can also engage in coal distribution activities, for small-scale coal miners, engaging in coal distribution activities in their own name faces the legal obligation to issue VAT invoices to coal-using enterprises and is required to pay VAT, personal income tax and other taxes in accordance with the law. Therefore, due to the cumbersome procedures of applying for invoices from the tax authorities and the economic factors of taxes and fees, small-scale coal miners are usually reluctant to directly supply coal to coal-using enterprises in their own names. In order to alleviate the above problems, in reality, there are many small coal mines seeking regular large coal mines to carry out coal sales business through the mode of dependent operation.

However, in practice, this kind of dependence business mode is easy to appear "ticket and goods separation" situation, and funds receipt and payment is easy to exist in advance, borrowing and lending and other situations, easy to be recognised by the tax authorities, public security organs for not having the real goods transaction of the funds back to the flow. And because of the dependent party, the dependent party's weak legal awareness, after reaching a verbal dependent agreement, negligence in signing a written dependent contract, leading to the relevant authorities on the authenticity of the dependence of the suspicion, and then denied the establishment of the dependence mode, that the enterprise there is a false invoicing behaviour.

III. Characterisation of cases involving cheques in the coal industry under the two high judicial interpretations

As can be seen from the provisions of the new Judicial Interpretation, if a person commits an act of false invoicing, whether the perpetrator can prove that there is no subjective intent to fraudulently obtain tax credits and that there is no objective loss of national tax due to the credits is the core point of whether he or she can be convicted of the offence. In the case of a false invoicing with the right of set-off, the parties may argue that they meet the conditions for the offence from the following perspectives, to be more specific:

1. the seller: the seller has not invoiced and declared the sales of taxable items, which belongs to the act of tax evasion by concealing the income and does not belong to the act of false invoicing, and it has not participated in the act of invoicing on behalf of the purchaser, which does not constitute the crime of false invoicing. For its tax evasion behaviour, it can be pursued for administrative responsibility for tax evasion.

2. Purchaser: The purchaser purchases taxable items and obtains the right to offset, because the seller does not issue invoices and issues invoices on behalf of the purchaser from a third party in order to realise the right to offset, and there is no intent to fraudulently offset the tax. At the same time, the purchaser has the right to offset if there is a real purchase, and the tax deducted on behalf of the purchaser is the input tax already paid by the purchaser in the actual purchase, and the deduction did not cause tax loss. It should be emphasised that the seller and the purchaser are independent legal subjects and should bear the responsibility for their own actions, and the tax obligations and the right of deduction of both parties should be determined separately, and whether or not the seller receives input tax is actually declared for tax purposes does not affect the purchaser's right of deduction. If the seller hides the income and causes tax loss, it has nothing to do with the deduction behaviour of the purchaser, and the seller should be held responsible according to the aforementioned analysis.

3. Invoicing party: If the invoicing party has fulfilled its auditing obligation and confirmed that the invoiced party has real purchasing behaviour, the subjective purpose of invoicing is to help the invoiced party to realize the right of deduction, not to help the invoiced party to cheat the tax, and it does not have the purpose of cheating the tax. According to the provisions of the Provisional Regulations on Value-added Tax, the tax obligation of value-added tax depends on whether there is a sales behaviour or not, there is no tax obligation if there is no sale, even if the invoicing is made by false invoicing, there is no tax obligation. Even if the invoicing party has no sales behaviour, the false invoicing will only confirm more sales items and pay more tax, but not pay less tax, and will not cause tax loss. In practice, if the upstream enterprise does not offset the sales tax generated by its false invoices by means of false enhancement, the offsetting will not result in a tax loss because the sales tax itself does not correspond to any legal tax obligation.

Therefore, when defending a coal-related invoice case, it is necessary to analyse the perpetrator's mode of transaction, focusing on refining and emphasizing whether the mode of transaction will result in the loss of state VAT payment, as well as the perpetrator's motives and reasons for choosing this mode of transaction, and to see whether he or she has the subjective intention of cheating the state VAT payment, and if the above conditions are not fulfilled, he or she can actively adduce evidence to achieve an out of the crime. In addition, how to accurately grasp the difference between the offences and accurately apply the relevant provisions remains a difficult point in future practice. False invoicing may also exist in other tax-related crimes, such as the crime of tax evasion, the crime of illegally selling VAT invoices and the crimes of illegally purchasing VAT invoices, purchasing forged VAT invoices, etc., and the perpetrator may not constitute the crime of false invoicing of VAT, but may still constitute other crimes.

Actual case: obtaining invoices on behalf of the truthfulness of the invoices constitutes the offence of illegal purchase of VAT invoices

Basic facts: There are two coal trading enterprises in a certain area, namely Company A and Company B. Company A mainly purchases commercial coal from coal chemical enterprises and sells it directly to local residents or small factories that use coal. Because these consumers do not require invoices, Company A has a large surplus of inputs, while Company A sells commercial coal without invoices and fails to declare unbilled income in accordance with the law.Company B mainly purchases raw coal from small coal kilns and sells it to coal chemical enterprises. Due to the over-exploitation of small coal kilns and the inability to issue invoices in accordance with the law, Company B had the problem of insufficient input for a long period of time. when Company B sells to downstream coal chemical enterprises, the downstream enterprises require to obtain invoices, but Company B will bear an excessive VAT obligation if it issues invoices for the full amount of the insufficient inputs. company B, through the introduction of an intermediary, contacted Company A. Company B obtains the input invoices from Company A by paying Company A a certain invoicing fee. Company B obtains input invoices from Company A by paying a certain invoicing fee to Company A. In the invoicing process, Company B provided Company A with the documents such as the weighing list and the bill of settlement made by Company B for the purchase of raw coal, and Company A issued the invoices according to the quantity and amount recorded in the documents.

The local tax authorities, after analysing the big data, found that there were tax-related risks in the two companies and decided to open an audit case. The tax authority believes that: Company A sells goods to consumers, Company B purchases goods from small coal kiln, there is no goods purchase and sale relationship between Company A and Company B. However, Company A issues invoices to Company B, which belongs to "not purchasing and selling goods, but issuing VAT invoices for others and letting others issue VAT invoices for themselves", and it constitutes false invoicing of VAT invoices, which should be investigated for legal responsibility and transferred to judicial authorities for handling. The legal responsibility for false invoicing shall be investigated and transferred to the judicial organ for handling.

The court ruled that Company B purchased raw coal from a small coal kiln without obtaining a VAT invoice in accordance with the law, and chose to obtain a truthful invoice from Company A. Subjectively, it had the intention and purpose of destroying the order of the state's invoice management, and objectively it violated the state's prohibitive provisions on VAT invoices, and carried out the act of purchasing VAT invoices from a subject that was not entitled to sell VAT invoices by paying invoicing fees. The act undermined the State's administrative order on special VAT invoices, and his act met the constituent elements of the offence of illegally purchasing special VAT invoices, and he was ultimately convicted of the offence of illegally purchasing special VAT invoices.

IV. Cases in which the coal industry is convicted of issuing false invoices can be actively appealed

(i) The review of criminal complaints for retrial should still be subject to the provisions of the new judicial interpretation.

The difference between judicial interpretation and laws and regulations is that it is an independent form of law, while at the same time it is related to or dependent on the relevant laws and regulations. In the author's view, according to the principle of the law of crime and punishment, if adjustments are made to the basic issues of criminalisation, such as the elements of crime and the grounds for the prevention of crime, they must be achieved through the amendment of the criminal law. Judicial interpretation cannot replace legislation and law revision. The provisions on incriminating and exculpating clauses in judicial interpretation are in themselves made for the better understanding and application of the legal provisions, and they are the interpretation of the original intent of the legal provisions. In other words, the criminal and incriminating provisions of the judicial interpretation of criminal law are the proper meaning of criminal law, and they do not overturn old legislation or create new legal rules.

To sum up, for the past cases of issuing false invoices that have been adjudicated in the coal industry, if the parties concerned have not fully exercised their right to prove that they did not have the purpose of fraudulently offsetting tax and did not cause the result of tax loss, they can still file a complaint according to the new judicial interpretation, and in the review stage of the re-trial, the court shall also apply the incriminating and exculpating provisions of the new judicial interpretation to comprehensively assess whether the parties concerned constitute the offence of issuing false invoices.

(ii) Grievance strategy for coal industry convicted of false invoicing cases

If the parties concerned have the crime-deterrent cause of "for the purpose of inflating performance, financing, loans, etc., not for the purpose of fraudulently offsetting taxes, and no fraudulent loss of taxes due to offsetting", they must take the initiative to put forward and adduce evidence, which can only be verified and established in order to realise the effect of deterring the crime. Enterprises should pay attention to the original business retention for inspection, in order to form a complete chain of evidence to prove the authenticity of the transaction, to avoid the risk of no real transaction. The coal industry has tax-related risks in all links, so no matter in the mining link, purchase and sale link, transport link and processing link, attention should be paid to complete the business process and focus on business approval. In specific business, enterprises should improve the system of retaining and reviewing written contracts. In addition, when purchasing coal or accepting transport services, special attention should be paid to whether the seller is dependent on the phenomenon of timely investigation of whether there is inconsistency in the three streams of the situation, if there are instructions for delivery, advances on behalf of the payment of such behaviour, the other side must be retained in the description of the documents, the other side of the agreement of dependence, etc., and, if necessary, should be required to the other side of the contract or the actual provider of the issuance of a statement of the situation, in order to prove the authenticity of their own business. In the design of contract terms, the type of invoices to be issued, the project, the tax rate, the invoicing time, the main body to bear the tax, the out-of-the-price costs, the liability for breach of contract and other tax-related terms should be clearly agreed. Relevant contracts, invoices, transport documents, remittance statements and other transaction-related information and evidence need to be preserved after the transaction is completed. When evidence is collected, the real transaction chain should be restored as fully as possible to verify the authenticity of the transaction.

(iii) Specific procedures for legal appeals in criminal cases

The criminal appeals procedure is a trial supervision procedure within the overall litigation process, aimed at reviewing and correcting judgements or rulings that have already been handed down. The parties concerned, their legal representatives and close relatives may lodge a complaint with the court of first instance or the procuratorate at the same level against a judgement or ruling that has become legally effective. Complaints in major and complex criminal cases may also be lodged with the people's court at a higher level that issued the criminal judgement or ruling at second instance. The time limit for filing a complaint is generally two years from the completion of the execution of the sentence. Upon accepting a complaint, the court or procuratorate shall conduct a comprehensive review, which shall include the facts of the case and the applicable law. After reviewing a criminal complaint, the people's court of last instance, if it finds that the original judgement or ruling was correct, persuades and educates the complainant so that he or she will accept the judgement and put the complaint to rest; if he or she persists in his or her unjustified complaint, he or she may be dismissed by written notice and informed that he or she may not file a further complaint. If, after the review, it is found that the original judgement was in fact erroneous and a new trial is required, a separate collegial panel shall be formed to conduct the retrial in accordance with the trial supervision procedures.