In the context of tax-related judicial interpretations, how should a network freight platform suspected of false opening be defended?

The repeated outbreak of cases of false invoicing on network freight platforms is due to the inherent difficulties of the industry. That is, part of the consignment enterprises and individual drivers have completed the transport services, found that individual drivers can not issue invoices, so find network freight platform invoicing. These irregularities are recognised as false invoicing by the case-handling authorities due to the subsequent recording of documents and the appearance of the return of funds. In the past, the platform is mainly based on the Law Research [2015] No. 58, arguing that the behaviour of truthful invoicing does not have social harm. However, after the introduction of the two new judicial interpretations, the act of truthful opening has fallen into the dispute of understanding again. Recently, with the Supreme Court judge issued on the two high interpretation of the "understanding and application", clear truthful opening is not a crime. In view of this, this article combines the recent network freight platform of the latest cases, to explore the two high judicial interpretation of the introduction of network freight platform how to defend, for readers' reference.

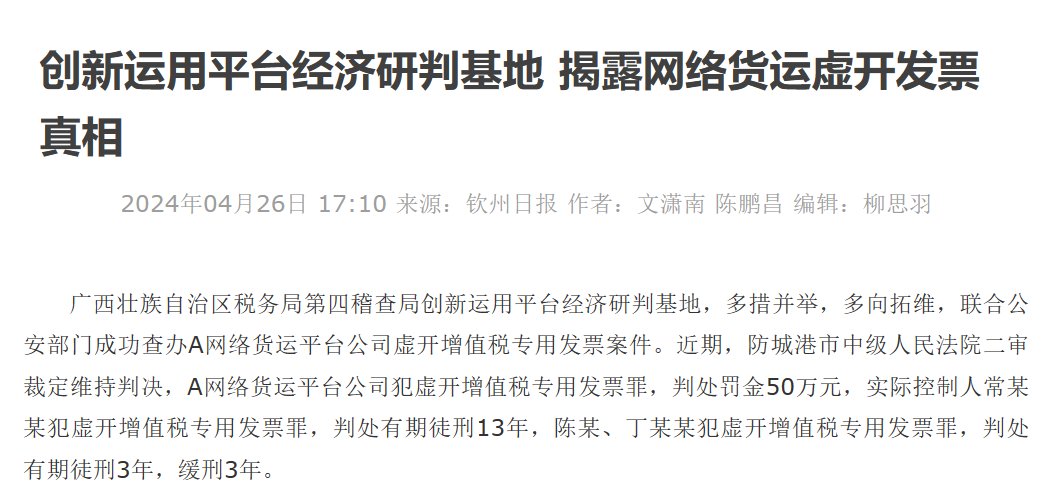

I. Case introduction: A network freight platform and the real controller was found to be false opening offence

(i) Basic facts of the case: the case-handling authority denied the business substance of A network platform

According to Qinzhou Daily, the basic facts of the case are: after tax inspection, the actual controller Chang Moumou and others in Fangchenggang City, set up A network freight platform company. However, the company has neither the traditional transport intermediary service of aggregation nor the network freight transport operation without vehicle, and only uses the network freight platform to record false transport trajectories, transport contracts and other business information, and during the period of August 2019-May 2020, the platform falsely issued a total of 4,727 VAT invoices, with a total of 455 million yuan of price and tax. The court ruled that Network Freight Platform Company A committed the crime of false VAT invoicing and was sentenced to a fine of 500,000 yuan, and the actual controller, Chang Moumou, committed the crime of false VAT invoicing and was sentenced to 13 years' imprisonment.

(ii) Two service types of network freight transport platforms: aggregation and carrier transport

Whether it is the predecessor of car-free transport or the current network freight platform, it has an important role to play in improving the efficiency of logistics and transport as a link for the integration of freight transport resources, and the State Administration of Taxation and the Ministry of Transportation have repeatedly issued documents to support the development of the platform. In practice, there are two types of network freight platform services:

One is the actual contracting business. Specifically, according to the provisions of Article 2 of the Interim Measures for the Management of Road Cargo Transportation Operations on Network Platforms (Jiaotong Transportation Regulation [2019] No. 12), it signs a transport contract with the shipper in the capacity of a carrier, commissions the actual carrier to complete the transport of road cargo, and undertakes the duties of the carrier, such as assuming the risk of damage and loss of the goods. At the same time, it is necessary to record service information in accordance with the provisions of the record transaction information such as driving track, online transaction diary, payment settlement, etc.. Under this business model, the network freight platform can issue VAT invoices with a tax rate of 9% to shippers and apply to the tax authorities for input credits on behalf of individual drivers.

Second, the aggregation business. Specifically, according to the provisions of the Notice of the State Administration of Taxation on the Pilot Work of Issuing VAT Special Invoice on Behalf of Road Cargo Transport Enterprises on Network Platforms (Tax General Letter [2019] No. 405), the network freight transport platform plays the role of aggregation and provides a bridge between individual drivers and shippers, and the platform is responsible for contacting and communicating with freight transport business and other matters, and in this case, the network freight transport platform can issue 3% special invoices on behalf of individual drivers who have registered as platform In this case, the network freight platform can issue 3% VAT invoices for individual drivers who are registered as members of the platform.

The above two types of services are exactly the "aggregation" business and "carrier" business mentioned in the case. However, in practice, network freight transport platforms do not strictly follow the above provisions in their business development, and there are some "deformations" and "deviations", i.e., "issuing invoices on behalf of others" and "replacing invoices later". "After the invoice" and other businesses.

(iii) the consignment enterprise using the network freight platform truthful invoicing by most of the case-handling organs identified as false invoicing

Because the network freight platform can provide the two services, consignment enterprises can rely on the network freight platform to obtain VAT invoices for input deduction, thereby reducing the tax burden on the enterprise's costs, to a certain extent, to alleviate the problem of the past due to the inability of individual drivers to provide a compliant invoice. It is precisely for this reason that, in practice, there are many consignment enterprises in and individual drivers have actually completed the transport business, found that individual drivers can not issue invoices, and then find the network freight platform for its invoicing, but often because of the aftermath of the supplementary recording of documents, the driver's registration of the time than the provision of the time of the trip track later than the time of the return of funds to the surface of the appearance of the problem, by the tax authorities, the driver's authorities found to be false invoicing. In the aforementioned case, such a situation may also exist, and that part of the invoicing on behalf of the driver may also be considered as false invoicing by the judicial authorities.

In fact, prior to the issuance of the judicial interpretations by the two high courts, we believed that, despite the fact that Fafa [1996] No. 30 listed the act of "carrying out actual business activities, but having others issue VAT invoices on behalf of oneself" as one of the criminal acts of false invoicing, the Supreme Court had already clarified that this provision was not in line with the current Criminal Law through FAR [2015] No. 58, and no longer continued to apply it as a defence. Criminal Law and will not continue to apply as a defence. At the same time, in the defence, it also proposed that the act of proxy opening does not have administrative illegality, and that the crime of false VAT invoicing must be constituted with subjective intent and objective tax loss consequences.

However, the effectiveness level of the Law Research [2015] No. 58 is insufficient after all, and in practice, for some of the case-handling authorities, the view that the false opening crime is a behavioural crime is deeply rooted, and the defence may not be recognised by all the case-handling authorities.

II. after the two high judicial interpretation, how to understand "truthfully open", whether it constitutes a false opening offence?

(i) in accordance with the literal interpretation of the two high interpretations, the truthful opening seems to belong to the false opening behaviour

On 15 March 2024, the two high schools issued a judicial interpretation of tax-related crimes, Article 10 of the crime of false VAT invoices to make provisions for the simultaneous repeal of the Law [1996] No. 30. Paragraph 1 of Article 10 makes detailed provisions on the conduct of the offence of false invoicing, and paragraph 2 stipulates the causes of the offence of false invoicing.

Among them, the third item of the first paragraph of Article 10, which stipulates that "for the business that cannot be offset against tax according to law, issuing special VAT invoices and other invoices used for fraudulent export tax refunds and offsetting tax by falsely increasing the subject of the transaction", is more difficult to understand. For a while, what is the business that cannot be deducted according to the law has become a hot topic of discussion. In particular, there is a view that the provision will be truthful invoicing behaviour also included in the scope of false invoicing, the reason is: unable to obtain a compliant invoice, invoicing through a third party, from the surface of the situation is also in line with the subject of the transaction through the virtual increase, so the provision denies the past truthful invoicing does not constitute a crime of the judicial point of view.

In addition, the second paragraph of Article 10 clearly defines the crime of false invoicing, but the provision only lists "inflated performance, financing, loans, etc.", then the paragraph is "etc., etc., etc., etc., etc., etc., etc. Whether this paragraph is "inside etc." or "outside etc." is debatable. Whether the truthfulness of the opening on behalf of the second paragraph of the circumstances of the offence is also controversial.

(ii) Teng Wei and four other judges issued an article to make it clear that whether it constitutes an offence must take into account both the subjective purpose and the objective result.

On 18 April 2024, four judges of the Supreme Court, Teng Wei, Dong Baojun, Yao Longbing and Zhang Shufen, published an article entitled "Interpretation of the Two High Courts on Several Issues Concerning the Application of Law in Handling Criminal Cases of Endangering the Administration of Tax Revenue", in which the background of the drafting of the 10th Article was elaborated. The article pointed out that when the Interpretation was solicited for comments, the relevant departments agreed that a certain restrictive interpretation should be made for the offence of false opening to prevent the expansion of the scope of the crackdown, but there was a great deal of controversy as to how to define the scope of the restriction. Therefore, Article 10(2) defines it by way of an exception.

The article first points out that "the core function of VAT special invoices is to offset taxes, and only those who make use of this core function to falsely offset, i.e., fraudulently offset taxes, can be considered to have committed the offence of falsely issuing VAT special invoices." This viewpoint overturns the past viewpoint of "behavioural crime" and has positive significance for the unification of judicial practice.

Secondly, the article points out that the "crime provision" of Article 10(2) is not limited to the three behaviours of "inflated performance, financing, loan, etc.", and as long as "the purpose is not to fraudulently offset the tax, and there is no loss of tax due to offsetting As long as "the purpose is not to fraudulently offset the tax, and no loss of tax is caused by the offsetting", it does not constitute the offence of falsely issuing VAT invoices. This view is also consistent with the provisions of LRC [2015] No. 58.

Thirdly, the article points out that false invoicing can be categorised as "false invoicing without goods", "false invoicing with goods", "false invoicing with fictitious transaction subjects" and false invoicing by tampering with electronic information of invoices. Among them, "false invoicing with goods" refers to the fact that although there is an actual transaction, the deductible tax on the invoice exceeds the actual tax to be deducted, including false invoicing by purchasing goods at a price excluding tax and obtaining an invoice from a third party to offset the cost. Based on this interpretation, the article argues that a substitute invoice-type false invoicing must be fraudulently set off against state taxes, with the tax-exclusive price paid and the amount of tax deducted exceeding the amount of tax that should actually be deducted. In other words, if an enterprise pays a tax-inclusive price and obtains an invoice that is consistent with the tax-inclusive price paid, it is not "false invoicing with goods".

(iii) In conjunction with LRC [2015] No. 58, truthful opening on behalf of a person still does not constitute the offence of false opening

The above understanding and application are in fact consistent with the interpretation of LRC [2015] No. 58. According to the "Reply Letter to the Supreme People's Court's Research Office Seeking Opinions on How to Determine the Nature of the Act of Carrying Out Business Activities in the Name of a "Dependent" Relevant Company and Allowing the Relevant Company to Fraudulently Issue VAT Exclusive Invoice for Itself" (FaY [2015] No. 58), "For the act of issuing on behalf of a company where there is an actual transaction existence, if the perpetrator subjectively does not have the intention of fraudulently deducting tax and objectively does not cause the loss of the state's VAT payment, it is not appropriate to deal with the crime of falsely issuing VAT invoices", therefore, truthful opening is precisely the objective result of not having the intention of fraudulently deducting tax and not causing the loss of the VAT payment.

Combined with the interpretation of the two high courts, the truthful issuance of VAT invoices does not constitute a crime as it does not have the purpose of cheating the tax and does not cause the loss of national tax. This can be used as a defence for network freight platforms and consignment enterprises. The network freight platform in the aforementioned case can adopt the strategy of complaint if there is the situation of truthful opening. The following author on how to defend for network freight platform and consignment enterprises to put forward a brief idea.

III. the existence of the truth on behalf of the act of network freight platform and consignment enterprises can be such a defence

(i) the truth on behalf of open behaviour does not belong to the false open behaviour

First of all, the network freight platform and consignor is based on the real occurrence of transport business invoicing, does not belong to no goods false opening. The consignor allowed the network freight platform to issue VAT invoices with equal amount and input tax amount in line with the actual business, and there was no over-opening and over-opening, which was not "false invoicing with goods".

Secondly, the individual driver could have applied to the tax authorities for invoicing, but he was unwilling to invoice for the consignment enterprise due to his unwillingness to pay personal tax and other reasons, which led the consignment enterprise to allow the network cargo platform to invoice on behalf of the consignment enterprise, which does not belong to the business that can't be deducted according to the law, and does not conform to the constituent elements of Article 10, paragraph 1, item 3.

As for the bottom item, the four judges also explained is to prevent the enumeration is incomplete or the future emergence of a new type of false invoicing means to make, it is clear that the truthful invoicing is a long-existing, has been recognized by the judiciary and master, there is a dispute over the matter, and does not belong to the bottom item.

Accordingly, if the act of truthful opening does not belong to the act of false opening, the network freight platform and the consignment enterprise do not constitute the crime of false opening of VAT invoices.

(ii) The network platform issued transport invoices and the consignor obtained transport invoices, and subjectively did not have the purpose of fraudulent tax credit

The article of the four judges pointed out that the second paragraph of Article 10 "does not have the purpose of fraudulently offsetting taxes" is the essence, and the enumerated "inflated performance, financing, and loans" are the forms of expression, and "etc." indicates that the offence is not limited to the three forms enumerated. It is not limited to the three forms listed. Specifically to the act of truthful invoicing, for the consignor, its procurement of transport services to the individual justice, to pay the tax-inclusive transport fees, according to the "Provisional Regulations on Value-added Tax", according to the law, to obtain the right of deduction of the substance of the right should not be invoiced in the form and disappearance of the consignor to find the network freight transport platform invoice for the purpose of the law is to exercise the right of deduction, is not a fraudulent purpose of offsetting the tax. As for the network freight platform, the purpose of invoicing for the consignor is to help the consignment enterprise to realise the right of deduction which it should enjoy in accordance with law, and it does not have the purpose of cheating the tax.

(iii) The network platform issues the transport invoice and the consignor obtains the transport invoice, which will not result in tax loss due to deduction.

According to the principle of value-added tax, the value-added tax is a chain tax. As long as the service provider in the service circulation segment pays the value-added tax on time and in full, the receiver of the transport service obtains the VAT invoice issued by the service provider to offset the tax, which will not cause loss of tax to the state. And because the individual driver did not issue invoices for the consignor, the consignor looked for the network platform to issue invoices on behalf of the consignor, and the platform paid VAT to the state on behalf of the individual driver on time and truthfully, even if the taxpayer and the actual taxpayer are not the same, but to the state, the actual VAT collected is the same as the amount of VAT that should have been collected, and the state's VAT payment has not been reduced by a single cent, the consignor, as a recipient of the service, pays input tax on the If the shipper, as the recipient of the service, pays the input tax amount, makes tax deduction in accordance with the law, and does not cause fraudulent loss of the state tax amount due to the deduction, the network freight transport platform, as the invoicing party, pays the sales tax amount to the state, and there is even less fraudulent loss of the tax amount due to the deduction.

IV. the conclusion: strengthen the business authenticity audit, healthy operation is the right way

Network freight platform in the specific business, must adhere to the authenticity of the business. Whether it is normal business, or "truthfully open", the essence is based on the authenticity of the business. If purely no business false opening, it will certainly constitute false opening, the criminal risk is very high. At the same time, the platform in the business process, still need to try to avoid the back-up documents, truthful opening behaviour, from the source to avoid being involved in the crime of false opening.

If the network freight platform has been identified by the judicial authorities as false opening due to the act of truthful opening, then in addition to the active defence in the application of the law, it is also necessary to comprehensively and in detail sort out the business materials at the factual level and it is necessary to let the consignor to provide the information of the real business with the individual driver, such as the flow of funds, the situation description, etc., to claim that the business is real, and to put forward the evidence information that it does not have the purpose of fraudulently offsetting the state tax and does not cause the loss of the state tax.