Flexible Employment Platform Invoice Risk Escalation, Tax Compliance is Imminent

Editor's Note: By combing through cases in practice, there are two main types of business models for Flexible employment platforms, namely, the "Agent Invoicing" model, which controls the invoicing of enterprises in the park, or the "Self-invoicing" model, which directly invoices in its own name. However, whether it is the "Agent Invoicing" model or the "Self-invoicing" model, Flexible employment platforms are subject to greater tax risks, and can easily be considered by public prosecutors and law enforcement authorities as having committed crimes of false invoicing. In the context of the increasingly strict regulation of tax rebate policy and the gradual strengthening of the national authority's crackdown on tax-related crimes, how should Flexible employment platforms deal with the tax-related risks? This article will focus on two invoicing modes and comment on them from the perspective of tax law principles and practices.

Ⅰ

The Tax-related Risk of Invoicing Mode of Flexible Employment Platform Should Not Be Underestimated

Under the background of sharing economy prosperity and Internet technology, Flexible employment platform can break the information barrier between employing units and talent resources more efficiently, and plays an important role in promoting employment and protecting people's livelihood. However, many people abuse the special tax policies available to Flexible employment platforms, resulting in continuous cases of false invoicing and tax evasion in the Flexible employment industry. Currently, there are two main invoicing models for Flexible employment platforms: "Agent Invoicing" and "Self-invoicing" model. However, no matter what kind of invoicing model is adopted, the tax-related risks of Flexible employment platforms should not be underestimated.

(I) Invoicing is recognized as controlling shell enterprises to make false invoices

From November 2019 to December 2020, a certain entrepreneurial service limited company in Texas made a great deal of publicity through a certain internet platform under a certain enterprise management limited company in Shenzhen, for which it introduced individuals with the demand for input invoices to register and set up more than 800 shell companies in economic industrial parks, which in turn led to false invoicing for the invoiced companies, involving more than 500 invoiced companies in 24 provinces, municipalities and autonomous regions, such as Shandong, Guangdong and Jiangsu. Involving more than 500 companies in 24 provinces, municipalities and autonomous regions such as Shandong, Guangdong and Jiangsu, the VAT invoices involved totaled more than 27,000, and the amount involved was more than RMB 2.1 billion. The public security authorities believe that this case is a criminal gang packaged as a platform for "Flexible employment platform, payroll, task crowd sourcing, and financial and tax services", but in reality, it is engaged in the business of selling invoices and transferring money illegally, which should be cracked down on.

(Ⅱ) Self-Invoicing recognized as falsely making out invoice

The Shanghai High Court recently announced a case of false VAT invoicing involving a Flexible employment platform. The defendant, Company A, set up a subsidiary in the tax source and obtained the qualification of entrusted levy, and during the period of 2020-2022, operated Platform A, claiming externally that it could solve the problems of lack of input invoices and expense settlement for the enterprises in public-to-private transfers and, in the case of not being able to confirm the authenticity of the employment personnel and employment scenarios, issued funds to individuals in the name of Flexible Employment Platform for the enterprises and used the company in the tax source to directly issue VAT Special invoices were issued directly for the enterprise using the company of the tax source, or special VAT invoices were issued for the enterprise by other companies at the request of the enterprise.

The People's Court of Jinshan District, Shanghai, after hearing the case, held that the defendant, Company A, had falsely issued VAT invoices for others without actual transactions, and its behavior had constituted the crime of falsely issuing VAT invoices, and it was a relatively large amount. Defendant Wang Mou, as the supervisor directly responsible for the company, and Defendants Sun Mou, Liu Mou and Shao Mou, as the other directly responsible persons of the company, their behaviors have constituted the crime of false invoicing of VAT special invoices, and the amount is relatively large. According to the circumstances of the defendant unit and each defendant in the crime, Company A was sentenced to a fine of RMB300,000, and Wang Mou and the other four were sentenced to fixed-term imprisonment ranging from one to three years, with probation ranging from one to four years.

(III) Summary

Through sorting out cases in practice, we found that whether it is the "Agent Invoicing" model or the "Self-invoicing" model, Flexible employment platforms are subject to greater tax risks, and are easily considered by public prosecutors as committing the crime of false invoicing. In the context of the increasingly stringent regulation of tax rebate policy and the gradual strengthening of the national authority's crackdown on tax-related crimes, how should Flexible employment platforms deal with the tax-related risks? Next, the article will focus on the two invoicing modes and comment on them from the perspective of tax law principles and practices.

Ⅱ

Common Invoicing Modes of Flexible Employment Platforms

Before analyzing the tax risks of Flexible employment platforms, it is helpful to understand the current practice of the invoicing mode of Flexible employment platforms to help readers better understand the relevant contents. The two common invoicing models of Flexible employment platforms are "Agent Invoicing" model and "Self-invoicing" model based on the differentiation standard of the invoicing body.

(Ⅰ) "Agent Invoicing" model

The "Agent Invoicing" model means that the Flexible employment platform issues invoices in the name of the client based on the documents provided by the client. Under this model, the main body of the invoice is the actual employing unit, and the funds are directly transferred from the employing unit to the individual, with the Flexible employment platform only assuming a role similar to that of an intermediary. Usually, the individual and the employer sign a contract directly, and then the individual provides the company with services such as promotion, marketing, and consultancy, and the Flexible employment platform files tax returns for individuals who are not convenient to file on-site tax returns, and collects service fees.

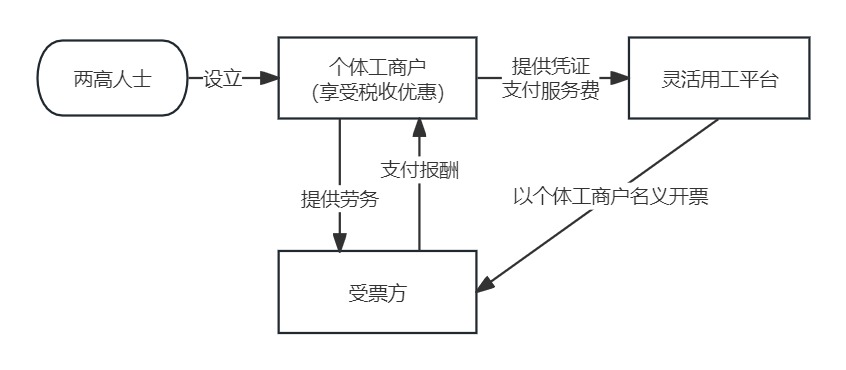

The "Agent Invoicing" model has been extended to many scenarios in practice, the most typical of which is the Flexible employment platform's provision of agent invoicing services for high-net-worth individuals and high-income individuals (the two high-income individuals). On the one hand, economically backward regions and specific industries have the need to attract investment. In order to help the development of these regions and industries, the state has set up a number of policy parks and implemented tax rebate policies in the parks; on the other hand, the two high-income individuals have the need to reduce their tax burden. The Flexible employment platform utilizes its information advantage to match the parks that need to attract investment and the two senior citizens. Specifically, the two-high-ranking individuals first register as individual businessmen in the park and sign a new contract with the original work unit in the name of individual businessmen, changing the full-time labor relationship to a cooperative relationship of providing services. In this way, the individual can enjoy the fiscal rebate and tax approval policy in the park, and his/her tax burden is reduced from 3%-45% of the comprehensive income tax rate, and the tax rate is lowered to the approved tax rate in the park, which greatly reduces the tax burden. At the same time, in order to prevent tax incentives from being abused, enterprises enjoying tax incentives are required to do taxes in the park, but enterprises in the park usually do not actually work in the park. Flexible employment platform, as a service provider, in addition to providing intermediary services, will also be on-site for enterprises to pay taxes in the tax bureau with tax incentives, and invoices issued on behalf of the tax bureau will be given to the enterprises, and a certain amount of service fees will be charged.

Figure 1: "Agent Invoicing" model

(Ⅱ) "Self-invoicing" model

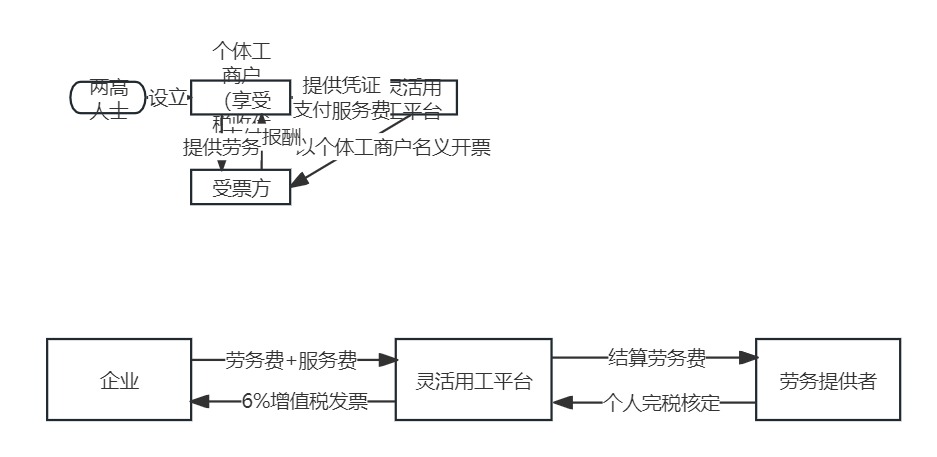

As opposed to the "Agent Invoicing" model, the "Self-invoicing" model means that the Flexible employment platform issues invoices in its own name, forming an invoicing chain of "Individual - Flexible employment platform - Employer" and a financial chain of "Enterprise unit - Flexible employment platform - Individual". The "self-invoicing" model means that the Flexible Employment Platform issues invoices in its own name, forming the "individual - Flexible Employment Platform" invoicing chain, and the "enterprise - Flexible Employment Platform - individual" financial chain.

The background of this model is that enterprises need to pay salaries to part-time laborers and collaborators, and withhold and pay personal tax according to the remuneration for labor services, but enterprises cannot obtain invoices from individuals, and this part of the cost cannot be deducted before tax. However, through the Flexible employment platform with the qualification of "entrusted collection", on the one hand, the personal tax of the labor provider can be paid according to the approved tax rate, and the income is not included in the year-end remittance; on the other hand, the enterprise can obtain the VAT invoice for deduction and cost deduction.

Figure 2: "Self-invoicing" model

III.

Tax Risk Analysis under Two Invoicing Models

(Ⅰ) Over-reliance on tax policies

The "Agent Invoicing" model mainly relies on the tax rebate policy of the policy park, while the "Self-invoicing" model mainly relies on the "Entrusted Collection" qualification of the Flexible employment platform and the approved collection policy. These policies are highly unstable.

In order to maintain fair competition in the market and prevent the loss of national tax, the relevant departments have issued a number of documents to stipulate tax incentives. As early as 2022, the General Office of the State Council in the "Guiding Opinions on Further Promoting the Reform Work of the Fiscal System Below Provinces" (Guo Ban Fa [2022] No. 20) clearly pointed out that, "Except as otherwise provided by the State, the policy of full retention of fiscal revenues or incremental return of fiscal revenues to all types of regions shall be gradually abolished, and those that do need support shall be arranged through standardized transfer payments ...... Gradually clean up subsidy or rebate policies that unduly intervene in the market and are linked to tax and fee revenues." Recently, the National Development and Reform Commission (NDRC) issued the Announcement on the Cleanup of Laws and Regulations and Policies Involving Unequal Treatment of Enterprises, proposing the cleanup of laws and regulations and policies that unequally treat enterprises, and the breaking down of systemic barriers restricting the development of enterprises. Among them, the cleanup work related to finance and taxation mainly includes: "illegal and unlawful granting of preferential policies to specific enterprises in terms of financial subsidies, access to elements, taxation, environmental protection standards, and sewage disposal authority; illegal and unlawful arrangement of financial expenditure linked to taxes or non-tax revenues paid by specific enterprises", covering illegal granting of tax preferences and illegal tax rebates Both aspects.

In the foreseeable future, the state will gradually promote the reform of the fiscal and taxation system, more standardized and strictly control tax preferential policies, and gradually tighten the space of using "tax depressions" and approved levy policies.

(Ⅱ) Risk of tax evasion by changing the type of income

As mentioned above, in the case of "invoicing on behalf of", in order to reduce the tax burden, individuals, through the establishment of individual business households, will originally apply the maximum tax rate of 45% of the "wages and salaries" into the approved levy policy of the "operating income". "Business Income". The public, legal and prosecution authorities may consider that this behavior is suspected of tax evasion by means of yin and yang contracts, splitting income and changing the nature of income.

From the legal point of view, it is reasonable for the tax authorities to find that the behavior violates the "principle of substantive taxation" and to impose penalties or criminal liability. Substantive taxation principle means that the tax administration is not bound by the complicated or multiple circuitous legal or formal arrangements made by the taxpayer, but based on the economic purpose that the taxpayer wants to achieve, to formulate the form of the transaction that should be made for the realization of the economic purpose both conventionally and substantively and to carry out the tax administration in accordance with this form. Usually, a taxpayer may choose various forms of transactions to realize an economic purpose. According to normal trading habits and experience, there exists a "conventional" form that matches the purpose. If the taxpayer chooses this "conventional" form, a corresponding tax obligation will arise. However, the taxpayer may choose an alternative form of transaction that results in the same economic purpose as the "regular" form, but avoids the tax liability. In this case, the taxpayer's choice of the alternative form of transaction does not match the purpose of the transaction, and the legal form does not correspond to the economic substance. The tax authorities may apply the "principle of substantive taxation" to make tax adjustments.

From a practical point of view, the State Council and local tax bureaus have already taken action against the issue of tax evasion by the two high profile individuals using authorized levies. The Report of the State Council on the Rectification of Problems Identified in the Audit of the Execution of the Central Budget and Other Financial Income and Expenditures for the Year 2020" issued by the Standing Committee of the Thirteenth National People's Congress at its 32nd meeting highlights the problem of "loopholes in the authorized collection of individual income tax, which some high-income earners use to evade tax". The General Administration of Taxation verified the main ways in which the persons concerned evaded tax, and through in-depth analysis, argumentation and assessment, studied and determined ways of dealing with tax adjustments and tax recovery. Local tax authorities have strengthened internal and external coordination and taken multiple measures to promote rectification. A number of influential performers have already been publicly penalized for shifting their income.

Once an individual who has changed the nature of his or her income is held accountable, the Flexible employment platform, as an intermediary service provider, is also likely to be recognized as an accomplice, and thus "get into trouble".

(Ⅲ) Flexible employment platforms are susceptible to fraudulent invoicing

The "Self-invoicing" model has two scenarios. In the first case, the employer outsources its business to the Flexible employment platform and pays the relevant fees, and the Flexible employment platform is responsible for recruiting service providers, issuing remuneration and withholding and paying personal income tax on behalf of the employer. In the whole process, the business outsourcing, contract signing, invoicing and individual tax withholding are all in compliance with the tax regulations, and there is a real business and the three streams are in one, therefore, the tax authorities usually recognize the authenticity of this kind of business, and consider that there is no risk of false invoicing. In the second scenario, the employer has a service provider before using the Flexible employment platform, but as the individual is unable to issue invoices, the employer chooses to establish a cooperative relationship with the service provider through the Flexible employment platform. Since the individual service provider was originally employed by the employer, this kind of fund flow and invoicing through the Flexible employment platform is likely to trigger the tax authorities to question the authenticity of the contract and the legitimacy of the invoice. Not only that, in practice, the relevant problematic enterprises often assign their employees to register for the Flexible employment platform, and after the invoicing of the Flexible employment platform, the funds paid to the employees are flowed back through the private account. This situation does not even have real service activities, which is an explicitly prohibited illegal behavior, but due to the difficulty of the platform to discover the private account transactions of the refluxed funds, the Flexible employment platform is susceptible to deception by the enterprises and false invoicing.

(Ⅳ) Individual flexible employment platforms embark on the path of false invoicing crime

In practice, some Flexible employment platforms from the beginning of their establishment are designed to drill the loopholes of the system, and collude with enterprises to make up business false invoices and cheat tax rebates, and are the positive offenders of false VAT invoicing. In practice, there are also some businessmen who, in order to pursue performance, may collude with enterprises and freelancers to carry out false invoicing and other irregularities in an attempt to evade the compliance review of enterprises by concealing the truth and making false statements, which leads to enterprises being caught in the quagmire of false invoicing crimes. In this case, the business on which the Flexible employment platform's invoicing is based is completely false and is a clear-cut crime.

IV.

Common Allegations and Defense Strategies in the Scenario of "Being Deceived into Making a False Invoice"

As mentioned above, flexible employment platforms are susceptible to being deceived by enterprises to make false openings, so why is a "deceived" flexible employment platform also subject to the criminal risk of false openings?

(I) Common allegations

By combing through past cases, the public security organs and the procuratorate's reasons for the accusation are mainly the following two points:

1. From the objective behavior, the flexible employment platform has the appearance of "control"

Under the "Agent Invoicing" model, enterprises usually hand over their U-shields, passwords, accounting books, contracts, etc. to flexible labor units for the convenience of filing tax returns, which to some extent constitutes "control". In practice, a flexible labor unit may hold the tax return information of dozens or even hundreds of enterprises at the same time. On the surface, the Flexible employment platform has the suspicion of "controlling" individual businessmen and using them as a criminal tool to cheat tax rebates. In the "Self-invoicing" model, the Flexible employment platform even implemented the invoicing behavior in its own name, and was the direct perpetrator of the false invoicing crime.

2. From the subjective aspect, there is subjective fault for not curbing the false invoicing behavior

First, the Flexible employment platform "should have known" the false invoicing behavior. Under the "Agent Invoicing" model, the Flexible employment platform has the obligation to review the authenticity of the business before invoicing, and its failure to fulfill the obligation of reasonable review constitutes a crime of omission. Secondly, the Flexible employment platform "knows" the false invoicing behavior. Flexible employment platform knows that the customer's business is false, the information provided is obviously untrue, the demand for invoicing is unreasonable and so on "a glance of the false" situation, the Flexible employment platform has a high probability to suspect the authenticity of the business, but did not take reasonable measures to check or stop, it can be regarded as the Flexible employment platform should be aware that the customer is carrying out the behavior of false invoicing, belongs to the letting go! The customer's false opening behavior constitutes an indirect intentional act.

(Ⅱ) Common defense strategies

The above allegations have no room for maneuver in terms of objective behavior, but there is still room for refutation in terms of subjectivity.

1. The flexible employment platform has no obligation to review the authenticity of the business

Flexible employment platform and its customers are equal civil relationship, not the administrative relationship between tax authorities and taxpayers. Flexible employment platform belongs to the entrusted party of fiscal and taxation agency in law, and has no obligation to review the authenticity of business. On the one hand, the current law clearly stipulates that the principal is the responsible body for the authenticity of the business and has the legal obligation to ensure the authenticity of the business. Article 13 of the Measures for the Administration of Agency Bookkeeping (2019 Amendment) provides that the principal shall fulfill the following obligations:...... (c) Provide true and complete original documents and other relevant information to the agency bookkeeping organization in a timely manner. Accordingly, it is clear that the law specifies that enterprises should provide true, complete and lawful original documents and other relevant information to the Flexible employment platform, and that the enterprises are the subject of responsibility for the authenticity of the business. On the other hand, the industry association's business guideline clearly stipulates that the entrusted unit of the tax agency does not have the obligation to examine the authenticity of the business. According to the guidelines of industry associations, including but not limited to the "Guidelines on Tax-related Professional Service Procedures of Taxation Professionals (Trial)", "Guidelines on Invoice-Related Agency Business (Trial)", "Guidelines on Agency Business for Other Tax Matters (Trial)", "Guidelines on Agency Business for Other Tax Matters (Trial)", the entrusted party shall be responsible for the accuracy, completeness, authenticity and legitimacy of the materials provided, and the entrusted party's obligation of examination is limited to "completeness of the application materials, authenticity of the application materials and other relevant information". The entrusted party's auditing obligations are limited to "completeness of application materials, compliance with tax matters, and timeliness of application processing".

2. Flexible employment platform does not constitute "knowingly"

As mentioned above, the Flexible employment platform only undertakes the obligation to examine whether the formal elements are available in the information provided by the agent for accounting, whether the application materials are complete and whether they are in compliance with the legal form, and does not examine the authenticity and legality of the application materials. With respect to the three streams of consistent information provided by the client, in the absence of evidence to the contrary, the Flexible employment platform had reason to believe that the business was genuine, and even if it was ultimately proved that the client's business was spurious and was a fictitious business, the Flexible employment platform should be deemed to be free of subjective fault because it had fulfilled its duty to conduct a reasonable formal examination. In addition, the finding that the Flexible Employment Platform had indirectly and intentionally "knowingly and negligently" made a false invoice on the basis of only a few pieces of questionable information was clearly insufficient to meet the standard of conviction.

Ⅳ

How Flexible Employment Platform to Prevent the Risk of Fraudulent Invoicing

The root cause of the frequent occurrence of tax-related cases of flexible employment is the "disorder" of employment business. Specifically, some employers fraudulently obtain invoices by fictionalizing their business, while some freelancers try to evade taxes by changing the nature of their income or splitting their income. In this process, Flexible employment platforms either collude with them in the pursuit of profits, or fail to fulfill their supervisory duties effectively due to carelessness and inadequate supervision, further exacerbating the problem. In order to ensure that the risk of fictitious opening is within a reasonably controllable range, Flexible employment platforms can do the following:

(Ⅰ) Fulfill formal review obligations to ensure business authenticity

As mentioned earlier, in the case of collusion between labor-using units and freelancers and no real business, the flexible employment platform is vulnerable to fraudulent false invoicing. In the event of a case, the Flexible employment platform may be implicated for its negligence in fulfilling its duty to supervise the platform. Therefore, the platform should firstly build a reasonable review process, require customers to provide detailed qualification documents, regularly check the validity of qualifications, and carry out unscheduled reviews, and refuse to cooperate with labor units that lack real business or operate abnormally. Secondly, the platform also needs to do a good job of reviewing the form of the information, make a good record of the information, ensure that the three streams are united, and call a halt to the business that has obvious doubts in a timely manner. Finally, the outbreak of tax-related cases on Flexible employment platforms is often closely related to the phenomenon of "capital return". Therefore, platforms should make reasonable efforts to remind enterprises and labor providers not to conduct transactions off the platform through pop-up windows or slogans in the chat interface.

(Ⅱ) Establishing a complete evidence retention system to consolidate the chain of evidence

In order to avoid the risk of enterprise false opening being transmitted to the flexible employment platform, the platform should establish a complete data retention system and do a good job of retaining evidence in order to prove the legitimacy of its own behavior. For example, for small labor fees, the platform needs to ensure that the transaction has detailed collection vouchers containing information such as the payee's identity, contact information, expenditure items and amounts; when it comes to large payments, both parties can be required to provide documents such as work records and work results, attach the corresponding contracts, and save bank transfer vouchers and other evidence to form a complete evidence closed loop to prevent fraudulent behavior by enterprises. In addition, enterprises should strengthen internal controls, establish a standardized approval process, and ensure that all approval materials are properly preserved. When a certain employment business generates the risk of fraudulent issuance due to collusion between insiders and others, the actual controller, legal representative, executives and other key personnel of the flexible employment platform will be able to have evidence to prove that they are approving the application in accordance with the company's system in a normal manner, and that they are unaware of, have not conspired in, and have not participated in any form of fraud or fraudulent behavior.

(Ⅲ) Actively seeking professional tax lawyers to resolve tax-related disputes

In the foreseeable future, the state regulation of flexible employment platforms will become increasingly stringent, and many flexible employment platforms have been exposed to high or low tax risks. Flexible employment platforms should seek the help of tax lawyers as early as possible in the various stages of tax audit, administrative reconsideration, litigation and criminal proceedings. Tax lawyers are able to comprehensively grasp the legislative purpose of legal provisions, judicial practice, and the business model of the industry, and help flexible employment platforms resolve risks to the greatest extent possible and safeguard the legitimate rights and interests of Flexible employment platforms.