Facing the Frequent Tax Risks Associated with Individuals Issuing Invoices on a Commission Basis, How can the Recipient Strengthen Tax Compliance?

Abstract: According to recently disclosed documents of the Courts, there have been numerous cases across various regions involving individuals who falsely issued VAT invoices on a commission basis. The highest amount involved in these cases reached 3.7 billion yuan, involving 8,437 invoices and affecting over 3,000 recipients. Industries such as construction engineering widely employ the business model of individuals issuing invoices on a commission basis. Due to issues of issuance limits, some companies have engaged in fake invoice issuance through individual on a commission basis. Under the regulatory stance of jointly combating tax-related crimes by eight departments, not only do the issuing individuals face administrative and criminal liabilities, but downstream recipients may also encounter multiple tax risks. This article reviews recent related cases, analyzes the administrative and criminal liabilities that might be triggered by obtaining invoices issued by individual agents, and provides suggestions for the tax compliance construction of recipients and risk response strategies when issuers are determined to have issued fake invoices.

I.Multiple regions have seen criminal cases involving individuals issuing invoices on a commission basis

In past practices, certain regions offered preferential policies for individuals issuing invoices on a commission basis, resulting in a lower overall tax burden for such activities. This led to the proliferation of invoice issuance without real transactions. With improved tax collection capabilities, in the past two years, court announcements and judgments have revealed that individuals in many areas were sentenced for issuing invoices on a commission basis.

(一)Recipients: Cases of individuals being sentenced for issuing invoices on a commission basis.

-

Xu's case of falsely issuing invoices

The public security organ accused the defendant Xu of paying fees to Ye, Yu, Hu (already judged) and others to provide guidance and invoice issuance services, creating false contracts with Ye and others, transforming personal labor income into business income to reduce taxes. Through this method, he had others issue 23 VAT ordinary invoices for his four companies, totaling over 68.47 million yuan in price and tax, all of which were recorded to offset costs. The court ruled that the defendant Xu had others issue fake VAT ordinary invoices for his company, with particularly serious circumstances, constituting the crime of issuing fake invoices.

-

Jiang's case of embezzlement and issuing fake invoices

Upon trial, it was found that from February to December 2012, Wu (handled in another case) used his identity as the actual controller to instruct Jiang and two other defendants to create false contracts and agreements for stripping projects under the names of Wang and Liu (among others), and issued 50 sets of ordinary invoices totaling 197 million yuan at the tax bureau. The three defendants used bank card transfers to reroute the stripping project funds back to the company's off-the-books accounts. The court ruled that the defendant unit and Jiang and the two other defendants issued fake ordinary invoices with particularly serious circumstances, constituting the crime of issuing fake invoices.

-

Zhunge'er Banner Certain Limited Company and Lu's case of issuing fake invoices

The prosecution accused that from 2011 to 2018, Zhunge'er Banner Certain Limited Company, through a board resolution, reimbursed entertainment expenses and purchases of tobacco and alcohol as transportation expenses. The company employee Li reimbursed entertainment expenses and logistics maintenance costs as transportation expenses, using the identity information of Hao, Jia (among others) to issue 100 ordinary transportation invoices at the Zhunge'er Banner State Tax Bureau counter, with a total fake amount of 7,891,837.5 yuan. The tobacco and alcohol supplier Ren settled the tobacco and alcohol goods payments as transportation expenses, using the identity information of Li, Wang, Dong (among others) to issue 124 ordinary transportation invoices at the Zhunge'er Banner State Tax Bureau counter, with a total fake amount of 9,841,606.38 yuan. A total of 224 fake invoices were issued, with a total invoice amount of 17,733,443.88 yuan. The court ruled that the defendant unit had others issue fake invoices for itself with particularly serious circumstances, constituting the crime of issuing fake invoices, and the defendant Lu constituted the crime of issuing fake invoices.

(二)Issuers: Cases of individuals being sentenced for issuing invoices on a commission basis.

-

Tang, Sun, and others' case of issuing fake invoices

From September 2020 to January 2021, seven individuals at two locations used a large number of ID cards from members of their gang or others to log into the electronic tax bureau. They filled in company addresses, invoice amounts, reasons, etc., according to the requirements of the receiving enterprises and issued fake VAT ordinary invoices totaling over 3.7 billion yuan within five months, illegally profiting over 17 million yuan. On October 27, 2022, the Wendeng District Court of Weihai City, Shandong Province, sentenced the defendants Tang, Sun, and others to fixed-term imprisonment ranging from five years and six months to six months with a suspended sentence of one year, along with fines ranging from 500,000 yuan to 30,000 yuan, and the illegal gains were recovered.

-

Wang, Lan, and others' case of issuing fake invoices

Upon trial, it was found that from May 25 to 30, 2022, the defendants Wang, Lan, Lan1 issued six VAT ordinary invoices at the Nasa Town post office of Guangnan County and the Nanhuan Road business hall of China Post Group Yunnan Guangnan County Branch under the identity information of others, without verifying whether there was actual business between the natural persons and relevant enterprises, with a total face value of 2.47 million yuan. The court ruled that the three defendants issued VAT ordinary invoices with the intent to illegally profit and under serious circumstances, constituting the crime of issuing fake invoices.

-

Shi, Chen's case of issuing fake invoices

Upon trial, it was found that the defendants Shi and Chen contracted the invoice agency point of Jishou City Certain Business Office of China Postal Savings Bank to issue invoices for others. From January 2019 to June 2021, Shi issued 203 invoices in his name with a total amount of 2,637,099.67 yuan; Chen issued 446 invoices in his name with a total amount of 2,616,188.86 yuan; under Wu's name, 196 invoices were issued with a total amount of 2,914,087.43 yuan; about 190 invoices under Wang1's name; about 31 invoices under Huang's name. The two issued approximately 1,066 invoices in total, with a total fake amount of about 8,167,375.96 yuan. The court ruled that the two defendants violated the national invoice management system by issuing fake VAT ordinary invoices, constituting the crime of issuing fake invoices.

From the above cases, it can be seen that on one hand, some enterprises misunderstand China's tax collection and invoice management regulations, instructing employees to issue fake VAT ordinary invoices for pre-tax deduction. On the other hand, criminals target enterprises' needs to obtain invoices for accounting purposes, exploiting the concealment of individual agents issuing invoices on a commission basis and illegally profiting by using others' identities to issue invoices. From these cases, it is known that cases of individuals issuing fake invoices through proxy methods are characterized by a large number of involved invoices, large amounts, and many affected enterprises. When issuers are determined to have issued fake invoices and even sentenced to criminal liability, recipients are also easily implicated, triggering multiple tax risks including administrative and criminal liabilities.

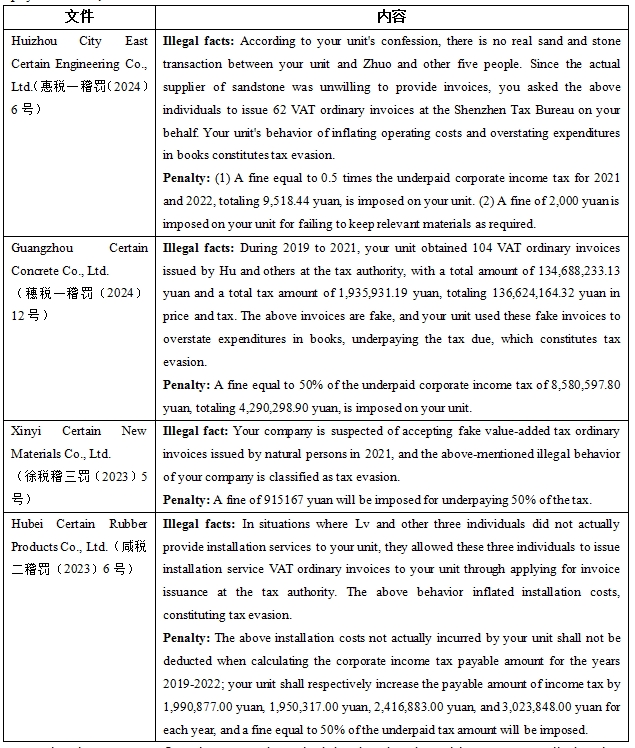

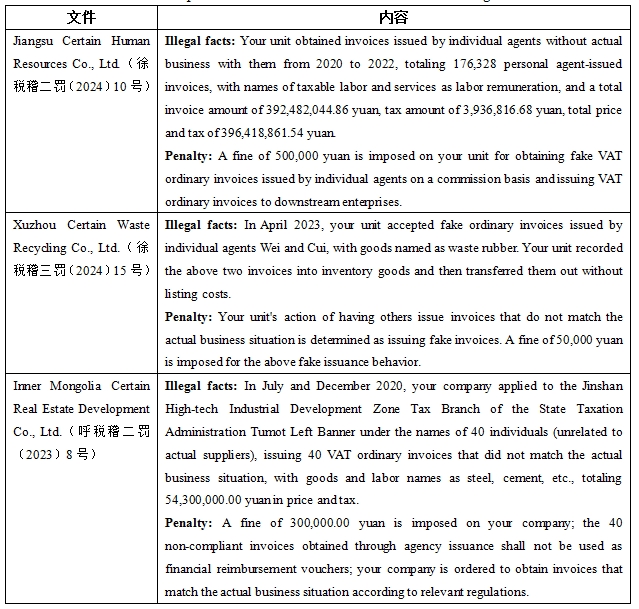

II.Multiple industry enterprises trigger administrative liabilities due to obtaining invoices issued by agents

Being identified as having received fake VAT ordinary invoices may lead to recipients being unable to deduct before corporate income tax; those who have already deducted may be required to adjust their corporate income tax declarations, facing the risk of having to pay additional taxes and late payment fines; some recipients may also be deemed to have evaded taxes or violated invoice management regulations, thus facing fines and other administrative liabilities.

(一)Risk of being unable to deduct before tax and being required to adjust tax declarations

According to Articles 12 to 16 of the "Corporate Income Tax Pre-Tax Deduction Voucher Management Measures" (Announcement No. 28 of 2018 by the State Administration of Taxation), fake invoices are considered non-compliant and cannot be used as pre-tax deduction vouchers. If the expenditure is real and has actually occurred, the recipient should obtain a reissued or exchanged invoice or other external vouchers that comply with regulations as pre-tax deduction vouchers. If the recipient fails to reissue or exchange compliant invoices or other external vouchers within the specified period and fails to provide relevant materials to prove the authenticity of its expenditure, the corresponding expenditure cannot be deducted before tax in the year of occurrence.

In practice, once the issuer is confirmed to have issued fake invoices, it is often difficult for the recipient to reissue or exchange invoices, or to obtain proof of the reasons why reissuing or exchanging invoices or other external vouchers is impossible to prove the authenticity of its expenditure. This leads to enterprises obtaining fake invoices possibly facing the risk of being unable to deduct actual expenditure costs before tax or being required to adjust their tax declarations if deductions have already been made.

The author believes that an invoice is merely a deduction voucher, and enterprises obtaining non-compliant invoices cannot completely negate the authenticity of actual expenditure costs. Enterprises obtaining fake invoices should promptly seek help from tax lawyers, organize materials to prove the authenticity of expenditures, actively communicate with tax authorities, and strive for proper resolution of corporate income tax.

(二)Risk of being deemed to have evaded taxes, with additional income tax, late payment fines, and fines

Some enterprises receive invoices issued by individual agents because upstream suppliers are unable to provide compliant invoices, making it impossible to account for actual costs, thus receiving invoices issued by individual agents on a commission basis. However, there is no real purchase and sale transaction between the above enterprises and the individual agents issuing invoices, easily leading to being deemed as "overstating expenditures in books" and qualitatively as tax evasion, thus facing the administrative liability of having to pay additional taxes, late payment fines, and fines.

The above cases reflect that enterprises obtaining invoices issued by agents usually involve long durations and large business volumes. This also results in high additional tax payments and fines required by tax authorities when deemed to have evaded taxes. If recipient enterprises cannot properly respond, they may further be pursued for criminal liability.

(三)Being fined for violating invoice management regulations

Obtaining invoices issued by agents may not only lead to administrative liabilities such as additional tax payments due to violations of the "Tax Collection Administration Law," but may also result in administrative penalties due to violations of the "Invoice Management Measures."

According to Article 35 of the Invoice Management Measures, those who illegally issue invoices on a commission basis shall have their illegal income confiscated by the tax authorities; if the fake amount exceeds 10,000 yuan, a fine of not less than 50,000 yuan but not more than 500,000 yuan shall be imposed; if a crime is constituted, criminal responsibility shall be pursued according to law. Some enterprises misunderstand China's invoice management system, instructing their employees to issue VAT ordinary invoices for accounting purposes or receiving invoices issued by individual agents, being deemed as having others issue fake invoices on their behalf and being fined administratively.

In summary, due to some enterprises obtaining invoices issued by agents involving long durations and large business volumes, when related administrative liabilities erupt, it usually means having to pay a high amount of additional taxes and fines. The author found through retrieval that industries such as construction and renewable resources, characterized by scattered sources and mostly individuals, also see concentrated outbreaks of cases involving suspected fake invoice issuance by individual agents in the aforementioned industry fields. It is recommended that the aforementioned enterprises should pay attention to invoice compliance management and guard against administrative and criminal liability risks.

III. Obtaining invoices issued by agents faces multiple criminal liabilities

Enterprises letting individuals issue invoices on their behalf will face the criminal liability risk of being sentenced for the crime of issuing fake invoices. According to Article 205-1 of the Criminal Law, units and individuals who issue fake VAT ordinary invoices constitute the crime of issuing fake invoices. If a unit commits this crime, its directly responsible person in charge and other directly responsible personnel shall be punished according to the provisions of the preceding paragraph.

In practice, due to the typically large volume of business involved, individuals who engage in issuing invoices on a commission basis and enterprises that allow natural persons to issue invoices for them are particularly susceptible to meeting the threshold for criminal liability for the offense of issuing false invoices. According to Article 57 of the Provisions on the Standards for Filing and Prosecution of Criminal Cases under the Jurisdiction of Public Security Organs (II) issued by the Supreme People's Procuratorate and the Ministry of Public Security, cases involving a cumulative amount of more than 500,000 yuan in falsely issued invoices, more than 100 instances of false invoicing with a face value exceeding 300,000 yuan, or those who have received criminal penalties or administrative punishments twice or more within five years for issuing false invoices and then issue false invoices again, reaching over 60% of the amounts stipulated in the first two criteria, should be filed for prosecution. Additionally, according to Articles 12 and 13 of the Interpretation on Several Issues Concerning the Application of Law in Handling Criminal Cases Involving Tax Collection and Management (法释[2024] 4号) issued by the Supreme People's Court and the Supreme People's Procuratorate, issuing false invoices with a face value exceeding 500,000 yuan, more than 100 instances of false invoicing with a face value exceeding 300,000 yuan, or having received criminal penalties or administrative punishments twice or more within five years for issuing false invoices and then issuing false invoices again, with the face value reaching over 60% of the amounts stipulated in the first two criteria, shall be considered as "serious circumstances"; issuing false invoices with a face value exceeding 2.5 million yuan, more than 500 instances of false invoicing with a face value exceeding 1.5 million yuan, or having received criminal penalties or administrative punishments twice or more within five years for issuing false invoices and then issuing false invoices again, with the face value reaching over 60% of the amounts stipulated in the first two criteria, shall be considered as "particularly serious circumstances."

Moreover, since obtaining invoices issued on a commission basis often accompanies other illegal and criminal activities, such as concealing accounting vouchers, account books, embezzlement, and infringement of citizens' personal information, clues to other criminal activities may be discovered during the investigation of false invoicing cases. Similarly, clues related to false invoicing may be uncovered during the investigation of other cases, ultimately leading to significant criminal liability. In the case of Yu's issuance of false invoices and concealment of income ((2023)赣0926刑初59号), Yu organized 11 staff members to issue false ordinary VAT invoices for construction materials at the tax bureau to misappropriate project funds, with a face value amounting to 19,584,956.46 yuan. Ultimately, Yu was convicted of the crime of issuing false invoices and concealing accounting vouchers and account books, and was subjected to combined punishment for multiple offenses.

IV. How the Recipient of Falsely Issued Invoices Should Respond

The digital and intelligent upgrade of tax collection and management has further enhanced the precision of tax authority supervision. The routine joint mechanism for combating tax-related illegal activities by eight departments has also intensified efforts to crack down on crimes related to false invoicing. Under the current regulatory regime, not only are the illegal acts of natural persons issuing false invoices on a commission basis unconcealable, but enterprises that obtain such invoices from natural persons will also face multiple administrative and criminal liabilities. Based on this, enterprises can strengthen their tax compliance construction and actively respond to tax risks caused by the issuer being identified as issuing false invoices in the following ways:

From the perspective of tax compliance construction, enterprises should first establish and improve internal control systems, pay attention to business approval processes, and retain complete, standardized, and mutually corroborating business documents to prove the authenticity of transactions. Additionally, enterprises should exercise reasonable due diligence with respect to their counterparties, paying attention to the tax credit dynamics of the invoice issuers. Finally, enterprises should enhance invoice management, regularly conduct tax health self-examinations, and check whether the names, quantities, specifications, unit prices, and other elements of the documents and invoices match the actual business, and whether the invoice issuer and the counterparty are consistent.

From the perspective of responding to tax risks, once an invoice issuer is identified as having issued false invoices, the recipient enterprise should adopt a proactive attitude. The determination that an issuer has issued false invoices can only serve as a tax lead, and cannot solely be used to determine the administrative or criminal liability of the recipient based on the issuer's false invoicing. Enterprises should proactively explain the authenticity of the business, communicate appropriately with tax authorities, and consult tax lawyers in a timely manner when necessary to understand their rights and the measures they should take.