Industry Insight: Why agricultural products are repeatedly involved in fraudulent export tax rebates, 5 major risks in one article inventory

Editor's Note: With the release of the “two high” tax-related judicial interpretations, as well as the Supreme Prosecutor in conjunction with the Ministry of Public Security and other departments jointly issued the “handling of the use of agricultural products export tax fraud criminal cases joint meeting minutes”, the current export enterprises due to the acquisition of agricultural products invoices false open, high open, open, fill in the list of errors and other factors outbreak of the risk of tax fraud is increasingly high! . However, due to the decentralized nature of agricultural production and the characteristic of “self-invoicing and self-counterbalancing” of agricultural products purchase invoices, the phenomenon of non-compliance and mis-invoicing is not uncommon in practice. In order to deeply analyze the mode of agricultural export industry and its key points of defense, this article will take the case as the entry point, deeply analyze two common export modes and their risks, and give suggestions to effectively reduce the tax-related risks according to the previous case experience.

I. Introduction : production and trade export enterprises are easy to suspected tax fraud due to agricultural products

(I) Production enterprises: purchasing agricultural products on their own, high risk of misfilling and over-invoicing.

According to China's export tax rebate regulations, foreign trade enterprises shall not directly apply for export tax rebate with agricultural invoices, but production-oriented enterprises have no such restrictions. Therefore, the production enterprises may have the characteristics of using the agricultural products acquisition invoice for self-credit, falsely fill in the information of farmers, fill in the false agricultural products filing base, as well as forging the self-production and self-sale certificate, and other means, to falsely open the agricultural products acquisition invoice, false credit or used to fraudulently obtain the export tax rebate.

Recently, Dalian Taxation released in its official microblog a typical case of fraudulent opening of agricultural products to obtain export tax rebates. The enterprise involved in the case was a food enterprise in the Free Trade Zone of Dalian City, which was suspected of fraudulently issuing 240 million yuan of invoices for the purchase of agricultural products and fraudulently obtaining export tax refunds of more than 10 million yuan. Although the report did not disclose more details, according to the description, the enterprise, as a food production enterprise, should have tried to solve its input problem through the false invoicing of agricultural products and declared the export tax refund with the false invoice. This pattern is also the most common pattern of tax fraud involving agricultural products in practice.

By coincidence, China Taxation News also published a case of shell processing enterprise cheating national export tax rebate through false export. Company S of Zhejiang Province is an enterprise engaged in exporting shell crafts, and most of its input items are purchase invoices for agricultural products, but some of the farmers and sellers listed in the purchase invoices are not found, and some of them are not engaged in the business of pearl shell farming at all. At the same time, the investigation confirmed that the enterprises involved in the agricultural products provided by the self-production and self-sale certificate is also a false document, the relevant information and official seal of the village committee are forged. Eventually, it was confirmed that the individuals and enterprises involved in the case falsely issued invoices for the purchase of agricultural products involving an amount of about 1.3 billion yuan, through the fictitious shell crafts production and export business, defrauded the state of export tax rebates of 110 million yuan, was transferred to the public security organs.

(Ⅱ) Trade export enterprises: grafting domestic trade enterprises to acquire agricultural products, both internal and external trade were investigated and dealt with

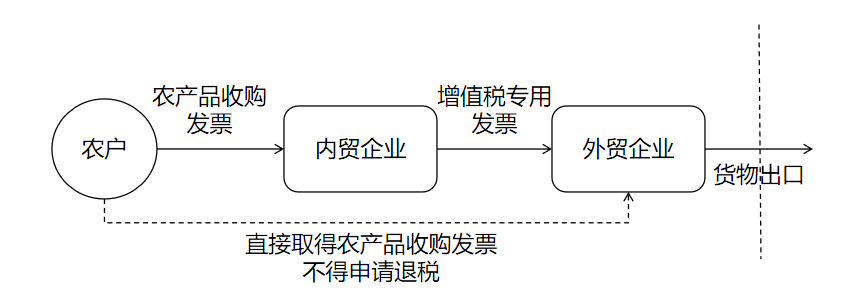

Foreign trade enterprises and production enterprises apply different policies. According to the “Ministry of Finance, State Administration of Taxation on the export of goods and services of value-added tax and consumption tax policy notice” (Cai Shui [2012] No. 39), Article 6, paragraph 1, item 1, the eleventh item, foreign trade enterprises to obtain ordinary invoices, the acquisition of waste materials vouchers, the acquisition of agricultural products invoices, the government's non-tax revenue bills of the goods are exempt from the scope of the policy of value-added tax can not be handled for the refund of tax. In order to break the dilemma, in practice, foreign trade enterprises usually set up a domestic trade enterprise first, and the domestic trade enterprise acquires agricultural products from farmers and issues purchase invoices for agricultural products, and then the domestic trade enterprise sells the agricultural products to the foreign trade enterprise and issues special VAT invoices. The foreign trade enterprise then declares the export tax refund with the VAT special invoice.

However, the risk of fraudulently filling out invoices for the purchase of agricultural products continues to be transmitted with the flow of invoices. In practice, this model also carries greater risks and tax cases are frequent. In January of this year, a local tax bureau in Fujian Province served the Notice of Tax Administrative Penalty Matters and the Decision on Tax Processing to Fujian A Trading Company on its official website.

Company A is a foreign trade enterprise that operates tea export, and during the period from September 2019 to March 2023, the company allowed nine companies, including Fujian Certain Tea Company Limited, to issue VAT invoices for Company A that did not correspond to the actual operation, totaling 2,124 falsely issued special invoices involving an invoice amount of 209 million yuan and a tax amount of 27.18 million yuan. Tea is a typical category of agricultural products, so this case still involves the false filling of purchase invoices for agricultural products from the source.

Ⅱ. Five major outbreaks of agricultural export tax fraud risk point summary

(I) Acquisition of agricultural products from intermediaries, retailers and buyers, and filling in false information about agricultural households

According to the Provisional Regulations on Value-added Tax and related documents, the sales of self-produced agricultural products by agricultural producers are exempted from value-added tax, and the acquiring enterprises can fill in the invoices for the acquisition of agricultural products based on the information of agricultural producers. However, if the purchasing enterprise purchases agricultural products from intermediaries, retailers, substitute buyers and other intermediaries, it does not comply with the regulations for issuing agricultural products purchase invoices.

China's agricultural production is characterized by the existence of decentralized, a large number of export enterprises can not go directly to the rural front line to the farmers themselves to buy agricultural products, only by the village chief, the village of the large households, buy, cattle and other people on behalf of the purchase. Acquiring enterprises acquire agricultural products from these non-direct agricultural producers, and cannot obtain compliant VAT invoices, so they issue invoices for the acquisition of agricultural products with non-farmers as the main body, and fill in these middlemen in the invoices for the acquisition of agricultural products, which is essentially in violation of the provisions of the Invoice Management Law.

(Ⅱ) Acquisition of agricultural products across provinces, the listed farmers are not the original ones

At present, there is no specific regulation at the level of the General Administration of Agricultural Products Purchase Invoice, but rather by the local authorities to stipulate their own management rules. Some provinces will provide that the acquisition of agricultural products invoices shall not be issued across the prefecture-level city, some provinces are restricted from issuing across the province. However, as the acquisition of agricultural products involves a large number of dispersed natural persons and the production and circulation of agricultural products often crosses multiple administrative regions, in order to circumvent this restriction, some enterprises may choose to fill in the invoices with information about people who are not the actual sellers (e.g., employees of the enterprise, intermediaries, etc.), or falsely use the information of local farmers in the issuance of invoices. Risks erupt due to the lack of compliance awareness on the part of some enterprises, which do not retain other evidence that can prove the authenticity of the acquisition.

(Ⅲ) Domestic trade enterprises grafted on by foreign trade enterprises are considered to be shell invoicing platforms

Because of the need to graft domestic trade enterprises, the risk of the foreign trade model is compared to the risk of ordinary production enterprises filling out acquisition invoices in violation of the law, in addition to the risk of the absence of real transactions between domestic and foreign trade enterprises.

Foreign trade mode, although the invoice flow for “farmers - domestic trade enterprises - foreign trade enterprises”, but part of the foreign trade enterprises for simple operation, often directly from the foreign trade enterprises directly to the farmers to pay the payment, the goods are also directly transported to the foreign trade enterprises, the domestic and foreign trade enterprises between also There is no sales contract between the domestic and foreign trade enterprises, resulting in the inconsistency of the three streams. Therefore, the acquisition behavior of the domestic trade enterprises may be due to the subject of the transaction is not true to be recognized as input false opening, and the transaction of domestic and foreign trade enterprises may be inconsistent because of the three streams of the transaction is recognized as false opening.

(Ⅳ) The risk of false invoicing by domestic trading companies can easily escalate into the risk of tax fraud by foreign trading companies

According to Article 7 of the Interpretation of the Supreme People's Court and the Supreme People's Procuratorate on Several Issues Concerning the Application of Law in Handling Criminal Cases of Endangering Tax Collection and Administration (Legal Interpretation [2024] No. 4), if a person declares an export tax refund by using falsely issued, illegally purchased, or otherwise illegally obtained VAT invoices or other invoices that can be used for export tax refunds, he or she shall be deemed to have made a false export declaration as stipulated in Paragraph 1 of Article 204 of the Criminal Law. False export declaration or other deceptive means” as stipulated in Paragraph 1 of Article 204 of the Criminal Law. However, we usually understand that the false invoices shall be the invoices directly obtained by the export enterprises and used for declaring export tax refund, such as the invoices directly obtained by the production enterprises for the purchase of agricultural products, and the invoices directly obtained by the foreign trade enterprises for the special value-added tax (VAT).

However, in the mode of foreign trade enterprises set up domestic trade enterprises, there are some cases in which the three streams of domestic and foreign trade enterprises are consistent, and the input invoices obtained by the foreign trade enterprises are flawless, but the domestic trade enterprises are not strict in supervision, and there are natural difficulties in the procurement of agricultural products, which leads to non-compliance with the input items of agricultural products procurement invoices. At this time, because the actual controller of domestic and foreign trade enterprises are often the same, the tax authorities tend to view the domestic and foreign trade enterprises as a whole, even if the foreign trade enterprises input and declare export tax rebates in compliance with the provisions of the link, but also may be recognized as through the control of the domestic trade enterprises issued false invoices of agricultural products purchases, tax fraud.

(Ⅴ) Customs supervision of agricultural products, backtracking triggers the risk of tax fraud

The above four types of risks are from the source of agricultural procurement outbreak. In practice, there are also risks from the customs link to foreign trade enterprises and even upstream of the risk of supply enterprises. Specifically, as agricultural products are now a sensitive export commodity, tax, customs, public security, foreign exchange and other management departments are increasingly strict supervision of agricultural products, and there are more informative means of supervision of the origin, source, category and quantity of agricultural products.

For example, if a local customs office, through data comparison and screening, finds that the quantity of timber and mushrooms exported from a prefecture-level city in a certain province as the place of origin and shipment has seriously exceeded the local production capacity, the customs office may suspect that there is a suspected over-invoicing or wrong invoicing in these export operations, thus pushing the risk clues to the local tax authorities, which will lead to tax audits.

Ⅲ. Agricultural products purchase invoices filled out non-compliance, export enterprises should actively claim the defense

(Ⅰ) Claiming the authenticity and legality of export business

Whether it is false invoicing or tax fraud, the nature of its illegality is to undermine the national invoice management order, which may result in the loss of national tax. In the author's opinion, the non-compliance of filling in the invoice for the purchase of agricultural products may lead to difficulties in meeting the formal elements of input credit or export tax rebate, but the conclusion that the business is not real cannot be drawn directly, and it cannot be inferred directly that the business is not real, so as to find that it is suspected of false invoicing or tax fraud.

When responding to the audit of the tax bureau, the enterprise can use the authenticity of the business as the basis of defense. As long as the business is authentic, even if there are certain formal non-compliance, it is only a violation at the administrative level, and should not be easily categorized as a crime of fraudulent invoicing or cheating of tax. In the previous defense cases, the author through the collection of local acquisition of agricultural products of the general practice of practice, combing the business retained by the enterprise can be side to prove the authenticity of the business evidence, such as the acquisition contract, weighing sheets, warehousing orders, transportation costs settlement documents, receipt and payment vouchers and other original documents to prove the authenticity and integrity of the transaction, restore the true picture of the whole business, have achieved a better defense effect.

(Ⅱ) Truthfully issued invoices for the acquisition of agricultural products does not constitute false invoicing

In practice, due to the acquisition of decentralized and more natural persons and other reasons, some of the export enterprises to the actual acquisition of farmers, the use of intermediaries or purchasers to fill in the identity. The author believes that, as long as the acquisition activities really happen, only the invoice does not reflect the real situation, and did not violate the provisions of the direct procurement of agricultural products to agricultural producers, not to mention the loss of national taxes, this truthful “on behalf of” the purchase of agricultural invoices does not constitute false invoicing.

The author also noted that some local tax bureaus had issued guiding documents or replies, recognizing the centralized filling behavior of agricultural products acquisition enterprises, i.e., allowing enterprises to fill in the acquisition intermediary in the agricultural products acquisition invoices, and also fought for the defense of a certain amount of space. Due to different policies in different places, enterprises can seek professional help when facing tax-related disputes, and give dispute solutions in a more targeted manner by sorting out local policies and practices.

(Ⅲ) Argument that the exporting enterprise has already borne the tax and does not constitute tax fraud.

The substantive condition of export tax refund is “real export of taxed goods”. If the perpetrator of the real export of agricultural products, and because of the characteristics of the natural negative tax on agricultural products, tax rebates declared that the person has actually borne the tax, to fully meet the essence of the export tax rebate, the export tax rebate will not cause the loss of national tax, administrative tax recovery, as domestic sales can be dealt with, it is not appropriate to identify the crime of obtaining export tax refunds by deception. This part of the author in the previous article has been discussed more comprehensively, and in practice has been recognized by some authorities handling cases.

(Ⅳ) Actively engage professionals to intervene and put forward defenses

If the export enterprise has been due to the acquisition of agricultural invoices into the false, fraudulent export tax rebate risk, should be sober enough to recognize that the case may lead to serious criminal consequences. At the same time, the enterprise should recognize the complexity and professionalism of the tax-related issues of agricultural products, such as agricultural products are tax-paid goods under the tax law, and the relationship between the invoice of agricultural products and the loss of tax and so on. Therefore, export enterprises need professional tax lawyers to intervene in the case, through sorting out the business materials, discussing and communicating with the authenticity of the goods and the loss of national export tax rebates, etc., so as to safeguard the rights of the enterprises.