What are the key points to focus on for the recycling industry to obtain financial incentives as the Fair Competition Review Ordinance comes into effect?

On August 1, 2024, the Regulations on Fair Competition Review (Decree No. 783 of the State Council of the People's Republic of China) (herein after referred to as "Regulations") came into force, clarifying for the first time in the form of administrative regulations the object of fair competition review, review standards, review mechanism and supervision and guarantee, filling the legislative gap of the fair competition review system. It fills the legislative gap of the fair competition review system. Chapter II of the Regulations sets out the review criteria for local governments to formulate financial incentive policies, which also suggests that enterprises obtaining financial incentives should pay attention to the compliance of the policies and measures they enjoy. The fiscal subsidy policy has a facilitating effect on the development of the renewable resources industry, and its compliance and stability will have an impact on the business model of renewable resources enterprises. In the period of high-quality development, renewable resources enterprises should take into account the relevant provisions of the Regulations to sort out potential risks and actively adapt to the new development model.

I. The role of financial incentives in the history of the renewable energy industry

For a long time, China's renewable resources industry has been facing the predicament of abnormally high tax burden, which is mainly caused by insufficient VAT input credit and unsmooth VAT credit chain. On the one hand, some suppliers in the renewable resources industry are unwilling to cooperate with recycling enterprises in issuing invoices due to low front-end profits and low tax awareness, resulting in recycling enterprises not being able to obtain sufficient invoices for VAT input deduction and deduction before income tax. On the other hand, recycling enterprises docking with natural persons and individual industrial and commercial households usually obtain invoices with a levy rate of 3% or 1%, but are required to issue invoices with a tax rate of 13% to waste-to-energy enterprises. Therefore, even if the recycling enterprise obtains a compliant input invoice, it will bear a higher VAT burden during the transaction.

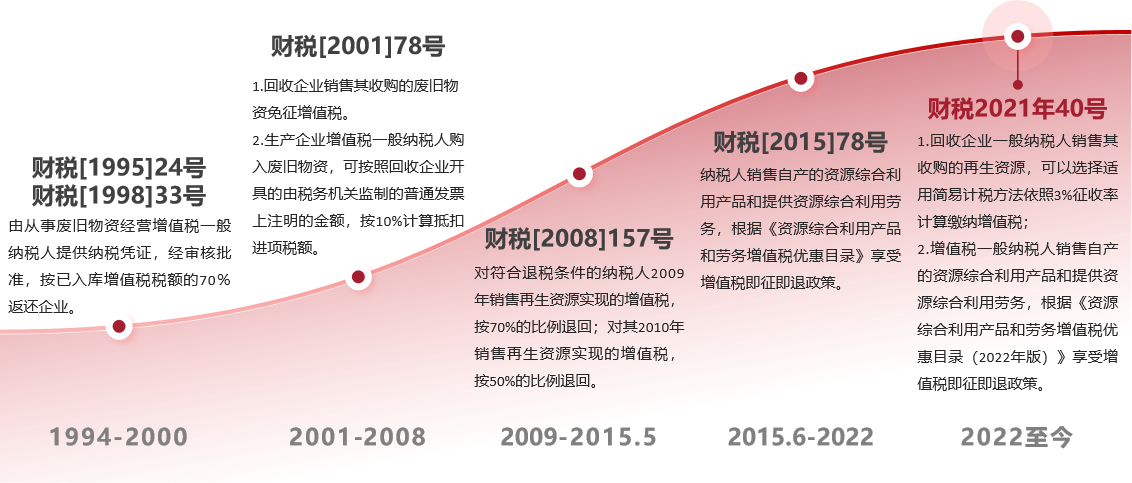

Between 1994 and 2008, the state introduced preferential tax policies for the renewable resources industry, such as tax exemption, first levy and then return, instant levy and instant refund, etc. In 2001, the Circular on the VAT Policies Related to the Business of Recycling of Waste Materials (财税 [2001] No. 78) exempted the recycling enterprises from VAT for sales of waste materials acquired by them, and at the same time authorized the enterprises using waste to calculate input tax credits of 10 percent of the amount stated in the ordinary invoices issued by recycling enterprises and supervised by tax authorities, which greatly promoted the development of the renewable resources industry. At the same time, waste-using enterprises are allowed to calculate input tax deduction at 10% of the amount stated in the ordinary invoices issued by the recycling enterprises and supervised by the tax authorities, which greatly promotes the development of the renewable resources industry.

However, the Circular on Value-added Tax Policies for Renewable Resources (财税 [2008] No. 157) in 2008 abolished the above tax exemption and credit policies, resulting in a significant increase in the tax burden on the renewable resources industry. In practice, in order to support the development of the local economy and the renewable resources industry, some regions have given financial incentives and subsidies to the renewable resources industry in order to alleviate the tax pressure on the recycling enterprises and waste enterprises. In view of this, the provisions of the Regulations relating to fiscal incentives and subsidies have a significant impact on the development prospects of the renewable resources industry.

II. Limitations and exceptions to the financial incentives policy under the Regulations

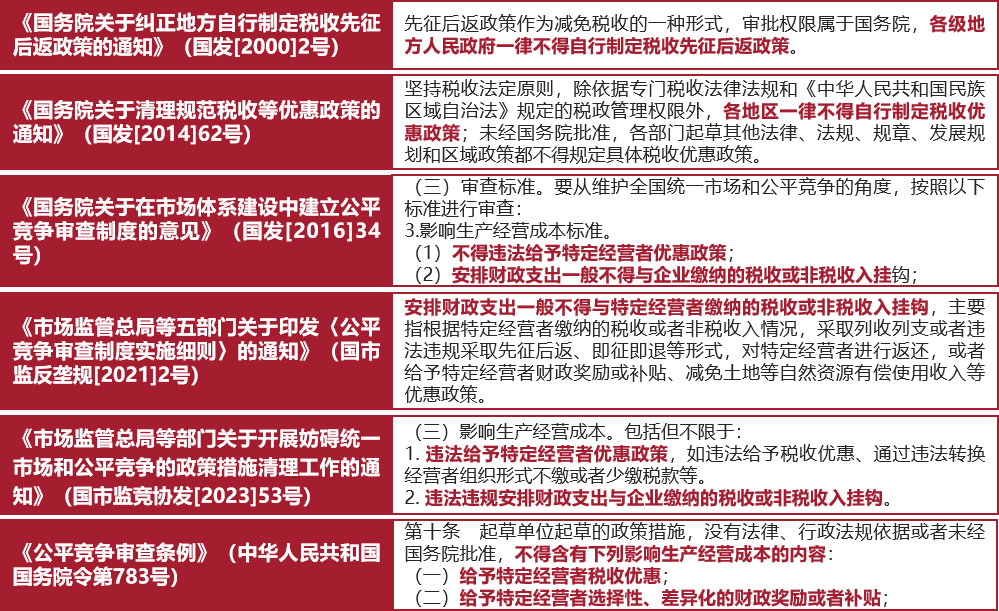

Prior to the official implementation of the Regulations, the State Council and relevant departments had issued a number of documents aimed at regulating the fiscal incentives and subsidies formulated by local governments. The National Audit Work Conference held on January 11, 2024 placed special emphasis on seriously investigating and dealing with "tax haven" and irregular tax rebates. In response to this requirement, Shanghai, Guangzhou and other cities have launched investment promotion and rectification programs to gradually promote the cleanup of illegal tax incentives and fiscal subsidies.

Compared with the previous special clearance tasks, the Regulations have broadened the scope of the review, established a review mechanism with clear powers and responsibilities, and set more targeted and guiding review criteria for the formulation of financial incentive policies.

With respect to the scope of the review, the Regulations not only cover the regulations, normative documents and other policy documents identified in Article 2 of the Implementing Rules for the Fair Competition Review System ( [2021] No. 2), but also further expand the scope of the review to include the laws, administrative regulations, and local regulations within the scope of the fair review.

With regard to the review working mechanism, the Regulations establish a working mechanism for the joint review of major policies and measures on fair competition, and encourage the realization of cross-regional and cross-sectoral fair competition reviews.

With regard to the review criteria, Article 10 of the Regulations requires that, without the basis of laws and administrative regulations or without the approval of the State Council, the financial incentive policy shall not contain content that affects the cost of production and operation, including, but not limited to, granting tax incentives to specific operators, and the implementation of selective and differentiated financial incentives or subsidies, and so on.

The above provisions set higher requirements for local governments to grant financial incentives to the renewable resources industry, and also prompt enterprises that have obtained financial incentives to pay attention to the compliance of the relevant policies.

In addition, the Regulations also specify the exceptions to obtaining financial incentives and the conditions for their application. Article 12 of the Regulations allows enterprises to obtain policy measures that have or may have the effect of excluding or restricting competition for the purpose of realizing the public interests of society, such as energy conservation, environmental protection, disaster relief and assistance, provided that there is no alternative that has a lesser impact on fair competition, and that a reasonable period of time for the implementation of the policy or the termination of the policy can be determined. This provision may provide an opportunity for renewable energy enterprises that meet the above conditions to enjoy the financial incentive policy.

III. Legal Risks of Enterprises Obtaining Financial Incentives under the New Circumstances

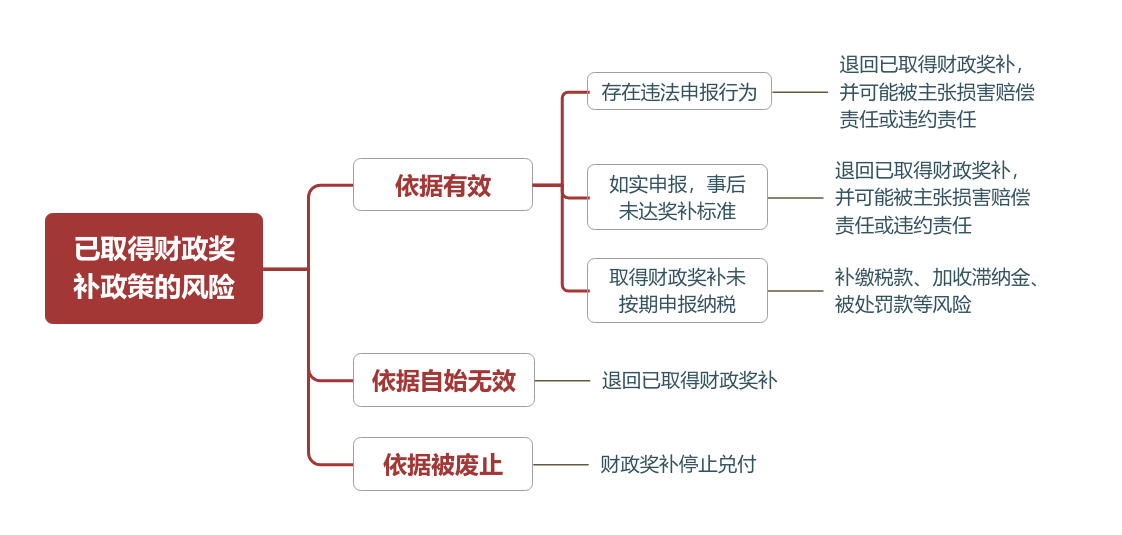

Recently, cases of government awards and subsidies being recovered have broken out in many places, and the specific situations can be categorized as follows: First, the financial awards and subsidies already obtained are required to be returned due to false declarations and other irregularities in the declaration of financial awards and subsidies. Secondly, although the information was true at the time of declaration, the standard of the award was not met afterwards, and thus the financial awards already obtained were required to be returned. In both cases, some enterprises may also be held liable for damages or breach of contract. Third, they were required to return the financial incentives they had obtained because the basis for obtaining the financial incentives was invalid. For example, Angie's Yeast Co., Ltd. disclosed in the Announcement on Return of Government Subsidies that its controlling subsidiary was required to return the relevant subsidy funds based on the request of the higher authorities because the declared special funds were not in line with the current policy.

At the same time, the implementation of the Regulations may also result in the repeal of financial incentives that have already been granted to enterprises, leading to the cessation of the payment of the relevant financial incentives. In the event that the content of an existing local financial incentive policy violates the provisions of the Regulations, the local government may change or repeal the financial incentive policy that has already taken effect in accordance with the law. As a result, enterprises relying on more aggressive investment promotion policies may face the risk that fiscal incentives will cease to be paid, which in turn may affect their business model and return on investment.

In addition, enterprises that have obtained fiscal incentives in compliance may also be required to pay back VAT and enterprise income tax. According to Article 7 of the Enterprise Income Tax Law, the Circular on Issues Concerning Enterprise Income Tax Policies on Fiscal Funds Administrative Charges Government Funds (财税 [2008] No. 151) and the Circular on Issues Concerning Enterprise Income Tax Treatment of Fiscal Funds for Special Purposes (财税 [2011] No. 70), all types of fiscal funds obtained by an enterprise shall be included in the enterprise's total income of that year except for those which belong to the state investment and funds Except for those required to return the principal after use, they shall be included in the total income of the enterprise for the year. However, if an enterprise obtains financial funds from the financial departments and other departments of the people's governments at or above the county level, and can provide the fund allocation documents stipulating the special purpose of the funds, and the financial departments or other governmental departments allocating the funds have special fund management methods or specific management requirements for the funds, and if the enterprise carries out separate accounting for the funds and the expenditures incurred with the funds, the funds may be handled as nontaxable income. Meanwhile, according to Article 7 of the Announcement on Cancellation of the VAT Deduction Voucher Certification Confirmation Deadline and Other VAT Levy and Management Issues (国家税务总局公告2019年第45号), taxpayers shall calculate and pay VAT in accordance with the regulations for financial subsidy income obtained after January 1, 2020, if it is directly linked to its income or quantity from the sale of goods, services, services, intangibles, or immovable property . Some enterprises failed to accurately understand the tax treatment rules of financial funds and failed to make tax declaration on schedule after obtaining financial subsidies, which led to the risk of being required to pay back taxes, late fees and fines.

Besides, for renewable energy enterprises planning to obtain financial incentives, on the one hand, the Regulation's clarification of the content of the fair review has tightened the caliber of local policies on financial incentives. This means that the application standard of the financial subsidy policy has been raised and the review procedure has been tightened, thus increasing the difficulty for enterprises to obtain financial subsidies. On the other hand, some of the standards in the Regulations need to be further refined. For example, in Article 10 of the Regulations, how to define the criteria of "specific operators" and "selectivity and differentiation" is of great significance in confirming the legitimacy of the financial incentive policy. Until the relevant content is further clarified, enterprises may have concerns about the compliance and stability of the financial incentives they intend to receive.

IV. Conclusion

The Fair Competition Review Regulations are committed to creating a fair and competitive market environment for operators and preventing the abuse of administrative power to exclude or restrict competition. Among other things, the regulation of undue market competition and market intervention, as a key task in building a unified national market, will focus on reviewing the compliance of local investment promotion policies. According to the notices issued by various regions, the implementation of the fair competition review system will emphasize both the standardization of incremental policies and the cleanup of stock policies. In the coming period of time, the promulgation of financial incentive policies in various regions will be more rigorous, clean up the work of illegal investment policies will continue to promote, does not have the essence of the business, in the business does not bear the functions and risks of the enterprise to obtain the possibility of financial rebates will be reduced.

For renewable resources enterprises, first of all, they should accurately understand the specific provisions of the Regulations on financial subsidy policy, and make clear the way of articulation between the provisions of the Regulations and the local subsidy policy, in order to grasp the boundaries of the compliance of financial subsidy policy. At the same time, renewable resources enterprises should pay attention to the caliber of the local financial incentive policy, analyze the potential risks of the financial incentive policy they have obtained, and actively prepare countermeasure strategies. In addition, renewable resources enterprises should also pay attention to the support policies issued by the state in the fields of energy saving and carbon reduction, circular economy, and the construction of renewable resources recycling system in the light of the exception clauses of the Regulations, and actively strive for the financial incentive policies that are in line with their own development mode.