How does tax forensic appraisal appraise tax losses in false billing cases according to the judicial interpretations?

Editor's Note: Tax forensics, which sounds like the "Sherlock Holmes" of the tax world, is actually a rigorous and specialized field. It involves tax experts examining, identifying and judging tax issues in court proceedings and providing authoritative appraisal opinions. An objective, fair and scientific judicial appraisal report is like a key to solving tax disputes, which is very important for safeguarding the fairness and justice of criminal law, tax law and the legitimate rights and interests of the parties concerned.

In March this year, the Supreme Court and the Supreme Prosecutor jointly issued a new judicial interpretation on tax-related criminal cases, which delineated the fraudulent tax loss in the crime of false VAT invoices and the false input tax credit in the crime of tax evasion. The judicial interpretations will become one of the important basis for tax judicial appraisal, which will have a significant impact on the appraisal of tax loss, a difficult and complex tax-related issue. This article will take a waste materials recycling company suspected of false invoicing case as an example, introduce the current tax judicial appraisal of the application of the judicial interpretations of the identification of tax loss of two different opinions, and explore what kind of appraisal opinion is more in line with the latest spirit of the tax-related judicial interpretations.

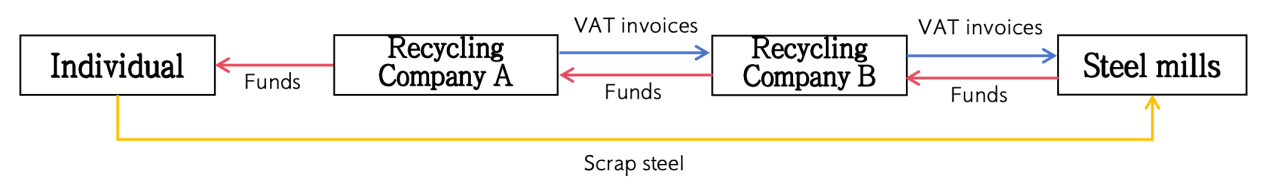

Case introduction: "individual - recycling company - steel mills" scrap materials business chain of the return of funds

The business model of the scrap material recycling company's alleged case of false invoicing is shown in the figure below:

Specific business model: In this case, Recycling Company A is a 3% simple tax enterprise. Recycling Company B is a 13% general taxable enterprise, and is a qualified supplier to many large steel mills in the surrounding areas. Steel mills have a lot of scrap business retailer information, not only through the recycling company to organize scrap steel supply, but also their own organization of scrap steel supply. All parties utilize their own advantages for complementary integration, forming the above multi-link scrap steel trading chain. In the course of business, the retailer delivers the goods to the steel mill, the steel mill passes the retailer's information (name, bank card), settlement documents (amount of payment), weighbridge, logistics documents and other materials to the recycling company B, which then passes the information to the recycling company A. The recycling company A verifies that the relevant documents are correct, pays the retailer for the goods, and then confirms the amount of the sale according to the calculation of a certain percentage of profit and issues invoices to the recycling company B. The recycling company B issues invoices, and the recycling company B issues invoices to the recycling company. Recycling Company B then calculates and confirms the sales amount according to a certain profit percentage and issues an invoice to the steel mill. The steel mill then pays the invoiced tax-inclusive amount to Recycling Company B, and Recycling Company B pays the invoiced tax-inclusive amount to Recycling Company A.

Reason for the crime:

In the above business, as the steel mill had completed the purchase and paid for the goods with two retailers before cooperating with recycling company B, but did not obtain the invoice, the steel mill changed the supply information (name, bank card) of the two retailers into its employee information, together with the settlement materials, weighing materials and logistics materials to form the transaction materials, and provided the materials of the two false retailers together with the transaction materials of the remaining eight real retailers to recycling company B. Recycling company B passed the transaction materials of the ten retailers to recycling company A, of which two retailers paid for the goods to recycling company A. Recycling company A paid for the goods to these ten retailers. The materials of the two false retailers and the transaction materials of the remaining eight real retailers were provided to Recycling Company B. Recycling Company B passed the transaction materials of the ten retailers to Recycling Company A. Recycling Company A paid the payment for the goods to the ten retailers, of which two of the retailer's collection accounts were actually the accounts of the employees of the steel plant, which were controlled and utilized by the financial affairs of the steel plant, thus generating a part of the funds flow back and leading to the issuance of this case as a suspected case of false issuance of special invoices for value-added tax.

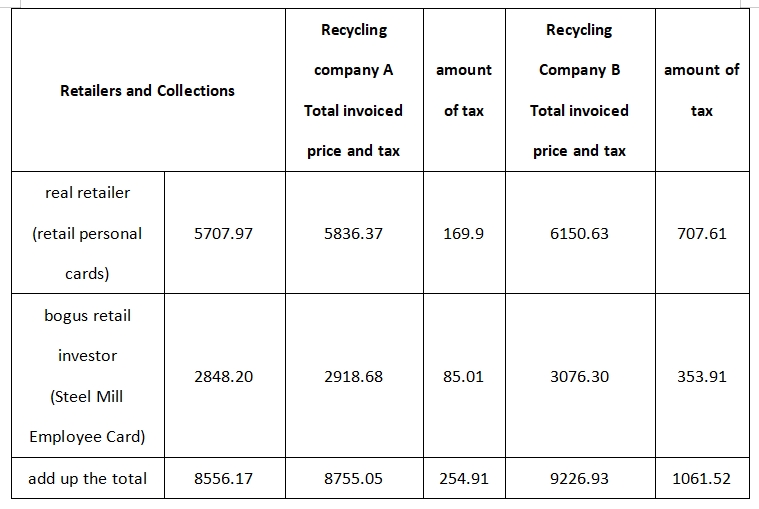

The investigating authorities commissioned the appraisal of tax loss: the public security authorities opened a case for investigation based on the clues of the return of the funds involved in the case with the suspicion of false invoicing of VAT by Recycling Company A and Recycling Company B. The public security authorities also opened a case for investigation based on the evidence collected. According to the investigation and evidence collection, the public security organs initially believe that the scrap steel purchase and sale business involved in the case essentially occurs between the retailer and the steel mill, the recycling company A, the recycling company B fictitious intermediate transaction link invoicing behavior is suspected of constituting the crime of false VAT invoicing, which the recycling company A suspected of false invoicing of the total amount of the price of the crime of tax 87,555,500 yuan, the recycling company B suspected of the crime of false invoicing of the total amount of the value of the crime of tax 9226.93 million yuan.

However, during the investigation of this case, in March 2024, the Supreme Court and the Supreme Prosecutor jointly issued the latest tax-related judicial interpretation, which clearly stipulates that the crime of false invoicing "no fraudulent tax purpose + no tax loss" circumstances. In this case, there is no tax loss has become a problem in the public security organs accused of false invoicing crime. In order to clarify whether there is a tax loss in this case, the public security organs decided to commission a third-party appraisal organization to issue an appraisal opinion on the issue of tax loss. For this suspected case of fraudulent tax loss, there are two very different conclusions of the appraisal.

Opinion 1: Recycling Company A and Recycling Company B have caused the loss of state taxes

The analysis of the appraisal of the A Appraisal Organization is that:

First, Based on the conduct of the business involved, the transaction of goods in this case actually took place and was completed between the retailer and the steel mill. Recycling Company A and Recycling Company B created false facts of purchase and sale transactions by setting up intermediate transaction links without actually participating in the goods transactions, and issued invoices based on the false purchase and sale transactions, therefore, a factual conclusion was reached: it was recognized that the total invoiced price and tax of 87.555 million yuan issued by Recycling Company A to Recycling Company B belonged to the falsely issued VAT invoices, and the total invoiced price and tax of 92.2693 million yuan issued by Recycling Company B to the steel mill belonged to the falsely issued VAT invoices. Recycling Company B's invoices to the steel mill totaling 92,269,300 yuan were false VAT invoices.

Second, the Announcement of the State Administration of Taxation on Issues Concerning the Levy and Repayment of Taxes by Taxpayers on Fraudulently Issued VAT Special Purpose Invoices (Announcement of the State Administration of Taxation No. 33 of 2012) stipulates that "[w]here a taxpayer fraudulently issues VAT Special Purpose Invoices, and fails to declare and pay the VAT in respect of the amount of the fraudulent invoices, the taxpayer shall make a retroactive payment of VAT in accordance with the amount of the fraudulent invoices; and where a taxpayer has already declared and paid the VAT in respect of the amount of the fraudulent invoices, he or she shall not pay back VAT in accordance with the amount of its false invoicing." "A taxpayer who obtains a falsely issued VAT special invoice shall not use it as a legally valid tax deduction voucher for VAT to offset its input tax amount." According to this provision, although Recycling Company A has falsely issued VAT special invoices to the outside world, its VAT obligation is based on its false invoicing behavior, and will not be eliminated due to the fact that it has not made real sales of goods, so Recycling Company A does not have the fact of overpayment of VAT. Similarly, although Recycling Company B did not actually sell the goods to the steel mill, its VAT obligation arose on the basis of its false invoicing behavior, and at the same time, due to the acquisition of the invoice falsely issued by Recycling Company A, it could not deduct the tax, and the deducted tax is the loss of the national VAT caused by Recycling Company A and Recycling Company B.

Third, Article 11 of the Judicial Interpretation stipulates that "if, in the name of the same purchase and sale business, both input VAT invoices and other invoices used for fraudulently obtaining export tax refunds and tax credits are fraudulently issued and the sales items are also fraudulently issued, the larger of these amounts shall be used to calculate the tax loss." According to this provision, Recycling Company B, i.e., the false invoicing of inputs has occurred, and there is also false invoicing of outputs, and its tax loss should be recognized by the larger amount.

Conclusion of Accreditation Body A:

1. Recycling Company A's false invoicing to Recycling Company B resulted in a loss of state taxes in the amount of $2,549,100, the amount of tax credits for Recycling Company B.

2. Recycling Company B obtained Recycling Company A's false input invoice and offsetting behavior and the behavior of false invoicing to the steel mill caused the loss of state taxes, the loss amounted to 1061.52 yuan, that is, the greater of the two numbers of inputs and outputs.

Opinion 2: Neither Recycling Company A nor Recycling Company B caused the fraudulent loss of VAT.However, there was a VAT underpayment loss

B appraisal agency appraisal analysis that:

First, the business of Recycling Company A and Recycling Company B involved in the case belonged to the recycling business of waste materials, and the special provisions of the tax law should be taken into account to determine whether their invoicing behavior was false invoicing. The Reply of the State Administration of Taxation on the Relevant Taxation Issues on the Business of Recycling of Waste Materials (Guo Shui Han [2002] No. 893) stipulates that the recycling enterprises may issue real VAT invoices based on the actual business between the retailers and the waste-using units, therefore, the business behaviors of the Recycling Company A and Recycling Company B in this case are in general in line with the stipulations of the Guo Shui Han [2002] No. 893, and the invoicing behaviors of them should not be recognized as false invoicing in an "across-the-board" way. Therefore, the business behavior of Recycling Company A and Recycling Company B in the case generally conformed to the provisions of the State Taxation Letter [2002] No. 893, and their invoicing behavior should not be recognized as false invoicing "across the board. Findings of fact:

In the business involved in the case, there were real goods transactions in the business chain corresponding to eight real retail customers, and the corresponding invoiced amount of 58.3673 million yuan for Recycling Company A and 61.563 million yuan for Recycling Company B belonged to the normal invoicing behaviors. The corresponding invoicing amount of 29,186,800 Yuan for Recycling Company A and 30,763,000 Yuan for Recycling Company B belongs to the "invoicing that does not correspond to the actual operation of the business" as stipulated in Article 21 of the Measures for the Administration of Invoices.

Second, the issue of tax losses on the corresponding invoices of eight real retail customers. As this part of the business involved was a real purchase and sale of goods transaction that took place at , VAT was declared and paid truthfully at all stages of the entire transaction chain, and the tax deducted was the same as the tax declared and paid, and there was no VAT loss.

Third, the issue of tax losses on two false retail counterpart invoices. According to the Provisional Regulations on Value-added Tax, the prerequisite for the occurrence of value-added tax obligations is the occurrence of taxable acts. In the false business corresponding to the two false retailers involved in the case, Recycling Company A and Recycling Company B did not engage in taxable acts of goods transaction, which did not give rise to substantive and legal tax obligations, but only gave rise to proposed tax obligations due to the act of false invoicing. In the already false and non-existent VAT chain, the will of the State is neither to advocate the payment of tax nor to allow tax credits, while the subjects in this case pay both full tax and full credits, which is in fact consistent with the results pursued by the will of the State, and will not produce fraudulent loss of national tax.

However, according to the Circular of the State Administration of Taxation on the Handling of Issues Concerning Taxpayers Obtaining Fraudulently Issued VAT Special Invoices (Guo Shui Fa [1997] No. 134), "If the party to whom the invoice is issued utilizes other people's fraudulently issued special invoices and declares to the tax authorities to set off tax for tax evasion, the tax shall be recovered and paid in accordance with the Taxation Administration Law and relevant regulations ", therefore, Recycling Company B utilized the false retailer corresponding to the invoices issued by Recycling Company A to offset the tax in the total amount of RMB 29,186,800,000 to produce the consequence of underpayment of VAT, resulting in the loss of VAT underpayment of RMB 851,100,000, which is in the nature of evasion of payment of tax. Similarly, the steel mill's use of the invoices issued by Recycling Company B, corresponding to the false retailer, to offset the tax in the amount of 30,763,300 yuan also had the effect of underpayment of value-added tax, resulting in an underpayment of value-added tax loss of 3,539,100 yuan, which was in the nature of evasion of payment of tax.

B Appraisal Body Conclusion:

1.Recycling Company A issued invoices to Recycling Company B for a total of RMB 29,186,800 (corresponding to the false retailer portion) which was an act of false invoicing, resulting in helping Recycling Company B not to pay the underpaid value-added tax (VAT) of RMB 850,100.

2.Recycling Company B used Recycling Company A to issue invoices for a total of 29,186,800 yuan (corresponding to the part of false retailers) to offset the tax of 850,100 yuan belongs to the false offsetting of input tax and tax evasion, resulting in the loss of tax evasion of 850,100 yuan of non-payment of underpayment of value-added tax; Recycling Company B issued invoices for a total of 30,763,000 yuan to the steel plant (corresponding to the part of false retailers) belongs to the behavior of false invoicing and caused the result of helping the steel plant not to pay 3,539,100 yuan of underpayment of value-added tax. the result of helping the steel mill not to pay the underpaid VAT of RMB 3,539,100.

3. There is no fraudulent VAT loss in the overall chain of business involved.

Which appraisal opinion is more in line with the provisions of the tax-related judicial interpretations?

The two types of tax judicial appraisal ideas already described in the foregoing section start from different analytical paths and arrive at opposite conclusions as to whether or not they have caused a loss of tax money. Comparison of the two, can be found three main differences: (1) on the authenticity of the goods transaction factual determination of different conclusions. The former denied the authenticity of the goods transactions in the intermediate links, while the latter defined the business in question in two distinctions based on the criterion of supply at source. (2) Different analysis on whether to generate VAT obligations. The former considered that the tax obligation arose once the invoice was issued, while the latter considered that the tax obligation arose only after the taxable behavior occurred. (3) Different tax law perspectives in determining the loss of state tax. The former analyzes from specific taxpayers and single VAT link, while the latter analyzes from the whole VAT chain and overall perspective. In the author's opinion, the second viewpoint is more in line with the principle of VAT taxation, and is also more in line with the provisions of the judicial interpretations on tax-related matters and the latest spirit contained therein.

The second paragraph of Article 10 of the Judicial Interpretation on Tax-Related Matters stipulates that "for the purpose of falsely increasing performance, financing, loaning, etc. not for the purpose of cheating the tax offset, and without the loss of the tax cheated due to the offset, the crime shall not be punished by the present crime, and if it constitutes any other crime, the crime shall be investigated for the criminal responsibility by the law in accordance with the other crimes", which is the outlawing provision for the crime of falsely issuing a special invoice and emphasizes the following "Deception", that is, fraudulent offset, is essentially the purpose of illegal possession, fraudulent state property behavior, infringement of national tax property rights. Therefore, the tax judicial appraisal of the tax loss in the case of false invoicing, its starting point and landing point should be to argue that there is no cause of national tax fraud loss. The first appraisal idea obviously deviates from this key requirement and confuses the different behaviors of infringing on the state tax property right and infringing on the state tax claims. The second appraisal idea really distinguishes between "cheating" and "fleeing", and does not recognize the behavior of infringement on the state tax claims as "cheating" and "fleeing". The second appraisal idea really makes a distinction between "cheating" and "fleeing", and does not recognize the act of non-payment and underpayment, which infringes on the national tax claims, as fraudulent tax credits, which is consistent with the core spirit of the judicial interpretation on tax-related matters in limiting the circle of the crime of false opening.

In addition, the tax-related judicial interpretations of Article 1, paragraph 1, item 3 of the new "false offsetting of input tax" as one of the "deception and concealment means" of the tax evasion crime, the Supreme Court interpreted the article to discuss the crime of false invoicing and the crime of tax evasion, "within the scope of taxable obligations, the taxpayer by means of false offsetting of input tax to pay less tax, even if the subjective purpose is not to pay less tax, according to the interpretation article. "Taxpayers within the scope of taxable obligations, through false enhancement of deductions in order to pay less tax, even if the means of false invoicing deductions, but subjectively still in order not to pay less tax, according to the principle of subjective-objective consistency, shall be punished by the crime of tax evasion". It can be seen that the first appraisal thought in the preceding paragraph does not have the thinking of the boundary between this crime and the other crime, and incorrectly identifies the false offsetting of input tax as fraudulent offsetting of tax, while the second appraisal thought divides the business involved in the case into two, and it is obvious that there is no fraudulent loss of tax in the real business, and the false offsetting of input tax in the spurious business only results in the loss of VAT nonpayment of underpayment rather than the loss of being defrauded, which is the same as that in the judicial interpretations of the tax-related judicial interpretations on the crime of false invoicing and the crime of tax evasion. This is in line with the logic of the tax-related judicial interpretations on the delineation between the crime of false invoicing and the crime of tax evasion.

One of the more confusing points in the first opinion is that it relies on the Announcement of the State Administration of Taxation on the Issues of Taxpayers Levying and Repaying Taxes on Fraudulently Issued VAT Invoices (Announcement No. 33 of 2012 of the State Administration of Taxation) to conclude that the tax obligation arose as a result of the fraudulent invoicing, and thus argues that there is an obligation of VAT on the Recycling Company A and the Recycling Company B, and then argues for the loss of the tax. In the author's view, the State Administration of Taxation Announcement No. 33 of 2012 does stipulate that taxpayers who fail to pay the tax after the false invoicing should be obliged to pay back the tax. Substantively, the provision belongs to the proposed tax obligation, i.e., the taxpayer has not incurred taxable behavior, and is deemed to incur tax obligation due to its false invoicing. As the effect of this provision is a normative document, breaking through the provisions of Article 1 of the Provisional Regulations on Value-added Tax as a higher administrative regulation, the second appraisal made a reminder of this, and combined with the principle of substance over form of the tax law to conclude that the false invoicing actor only has a proposed tax obligation but no substantive tax obligation, and the conclusion of the non-statutory tax obligation. Obviously, the taxpayer's violation of the proposed tax obligation does not actually produce the national VAT fraudulent loss, but only produces the loss of VAT underpayment. The first opinion failed to correctly distinguish the difference between the fictitious tax obligation and the statutory tax obligation, and equated the fictitious tax obligation with the statutory tax obligation, thus arriving at an erroneous conclusion on the loss of tax.

Conclusion:Entrusted by China Tax Association, China Tax Lawyer Tax Attorney Team participated in the preparation of Tax Judicial Appraisal Business Guidelines (Trial) in 2019 and Tax Judicial Appraisal Business Operation Guidelines in 2021. The introduction of the two documents laid the foundation for business standardization. From the point of view of Huatax team's own practice, tax judicial appraisal is more often used in criminal cases such as false invoicing and tax fraud, and there is still much room for improvement in the overall level, professionalism and scientificity of the appraisal opinions. In March this year, the Supreme Court and the Supreme Prosecutor jointly issued the latest tax-related judicial interpretation, which made significant adjustments and improvements to the crime and non-crime of false invoicing and tax evasion, and made significant adjustments and improvements to the crime and non-crime of false invoicing and tax evasion, as well as added the concepts of "fraudulent loss of tax" and "false offsetting of input tax", which will be the key concepts for the future of VAT. The concepts of "fraudulent loss of tax" and "false offset of input tax" have been added in line with the principle of VAT, which will become an important legal basis to guide the judicial appraisal of tax in the future. Appraisal organizations should follow the principles of VAT levy and the latest provisions of the judicial interpretations to accurately identify and differentiate the difficult and complicated facts such as fraudulent loss of tax and loss of non-payment and underpayment of tax in criminal cases such as fraudulent invoicing, so as to provide more scientific, professional and accurate appraisal opinions for the judiciary, and to contribute to the implementation of the criminal policy to limit the circle of fraudulent invoicing crimes.