After the implementation of the "Housing Rental Regulations", how should landlords prevent tax risks?

Editor's note: Recently, the 62nd executive meeting of the State Council passed the "Regulations on Housing Rental" (hereinafter referred to as the "Regulations"). The "Regulations" put forward new requirements for housing rental filing, providing a higher-level legal basis for the sharing mechanism of housing rental information data, and providing a powerful tool for the tax authorities to accurately identify taxpayers' undeclared rental income. This article intends to analyze the regulations on housing rental filing and how taxes should be paid for rental housing in the "Regulations" in order to help taxpayers accurately identify their tax obligations, achieve tax compliance, and prevent tax risks.

ⅠWhat are the changes in the housing rental filing regulations in the "Regulations" compared to the past?

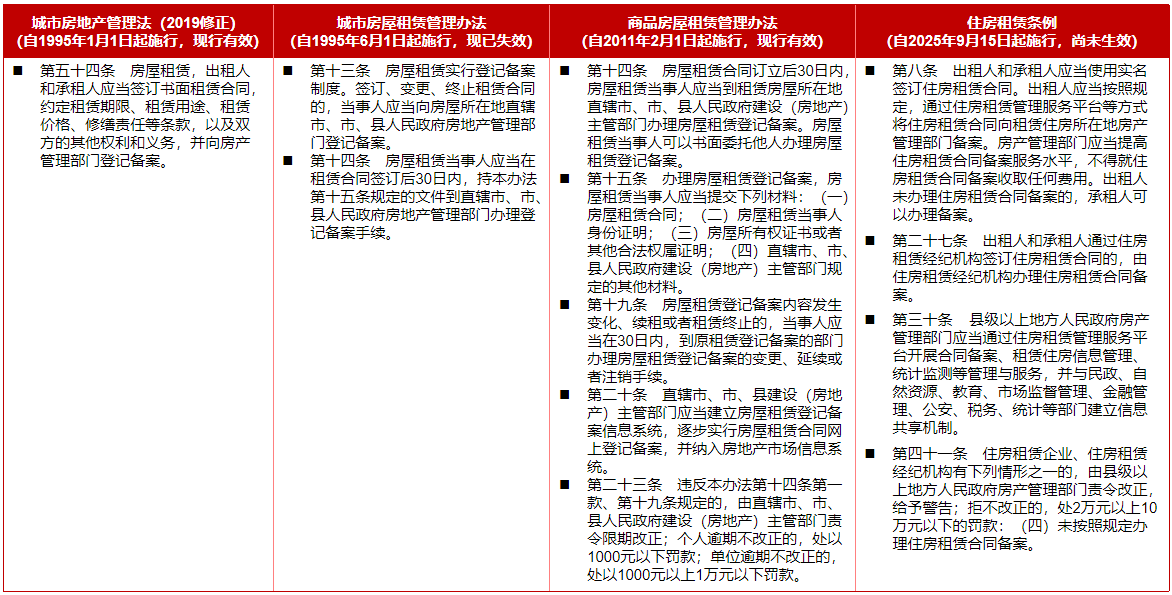

In fact, housing rental filing is not a new thing. 1995 The "Urban Real Estate Management Law" and "Urban Housing Lease Management Measures" implemented in (Now abolished by the "Management Measures for the Leasing of Commercial Housing") It clearly stipulates the implementation of a filing system for house leasing, and both parties to the lease should file with the real estate management department. According to the different uses of houses, houses can be divided into residential and non-residential. This "Regulations" specifically make specific provisions for the filing of housing leasing. Compared with the "Measures for the Administration of Commercial Housing Leasing" (hereinafter referred to as the "Measures"), there are six changes, specifically:

First, the mandatory requirements for lessee registration have changed. Article 14 of the "Measures" stipulates that both parties to the lease should file with the real estate management department. Article 8 of the "Regulations" stipulates that the lessor should file with the real estate management department, and the lessee can handle the filing. For housing tenants, the mandatory filing requirements have decreased.

Second, the filing materials are simplified. Article 15 of the "Measures" stipulates that the parties involved in the registration of house leasing shall submit the house leasing contract, the identity proof of the leased party, the property ownership certificate, and other materials specified by the property management department to the real estate management department. Currently, the requirements for other materials vary from local real estate management departments, which to some extent increases the difficulty for both parties to handle the registration of housing leases. Now, Article 8 of the "Regulations" stipulates that landlords only need to submit a house lease contract to the real estate management department for filing, greatly simplifying the procedures for housing lease filing.

Third, the filing method has been increased. Article 8 of the "Regulations" provides a new way to handle rental filing. Housing landlords can fill in relevant information on the housing rental management service platform to complete the filing, no longer limited to offline filing with the real estate management department, which can effectively save resources.

Fourthly, the punishment for units engaged in housing leasing that have not been registered has been increased. Article 23 of the "Measures" stipulates that units that fail to complete the filing as required and fail to rectify within the specified period shall be fined between 1,000 yuan and 10,000 yuan. Article 41 of the "Regulations" increases the punishment range for housing rental enterprises that fail to file a record. For housing rental enterprises that fail to complete the filing as required and refuse to rectify, a fine of between 2,000 yuan and 100,000 yuan will be imposed. It should be pointed out that the connotation of units is obviously greater than that of housing rental enterprises. For units that occasionally rent out housing and do not primarily engage in rental housing, they will still be punished according to Article 23 of the "Measures", but the punishment for housing rental enterprises will be even greater.

Fifth, the legal responsibilities of the filing subjects and those not filed have been expanded. Article 27 of the "Regulations" adds a new type of filing entity, namely housing rental brokerage agencies, such as Lianjia and other third-party housing rental agencies. If the lessor and the lessee sign a housing rental contract through a housing rental brokerage agency, the obligation to register the housing rental is borne by the housing rental brokerage agency. While the "Regulations" have added the obligation of filing for housing rental brokerage agencies, they have also correspondingly increased their legal responsibilities for failure to file. Housing rental brokerage agencies that fail to file housing rental contracts in accordance with regulations will be ordered to make corrections, and warnings will be given. Those who refuse to make corrections will be given. A fine of no less than 20,000 yuan and no more than 100,000 yuan will be imposed. In addition, it should be emphasized that for individuals who fail to register for housing rentals as required, the "Regulations" do not make new penalties, and they will still be dealt with according to Article 23 of the "Measures". For example, if natural person A leases a house to natural person B but does not register, The property management department can order rectification, and if the case is not filed, it will face a maximum administrative fine of 1,000 yuan.

Sixth, the housing rental information sharing mechanism has been established. Compared with more than ten years ago, China's informatization level and data processing capabilities have significantly improved. From Article 20 of the "Measures" in the past, which required the real estate management department to establish a housing rental registration and filing information system and incorporate the filing information into the real estate market information system, to the "Regulations" requiring the real estate management department to establish an information sharing mechanism with tax and other departments, this means that the data sharing technology has matured. The real estate management department will synchronize the filing information of housing rental contracts, property ownership data, and the operating information of housing rental companies and brokerage agencies to the tax department. This move will provide the tax department with a complete leasing transaction data chain, significantly improve the efficiency and accuracy of tax collection and management, further promote the transformation from "tax control with invoices" to "tax management with numbers", and ensure that the tax sources are fully stored. At the same time, due to the relatively light legal responsibilities of individuals who have not filed for rental housing, the housing rental information sharing mechanism may also force the housing rental market entities to choose "point-to-point" and "hidden" direct leasing methods for rental housing. Do not rent houses through "third-party" or "explicit" indirect leasing, in order to avoid the housing rental brokerage agency filing the housing rental contract with the real estate management department, and the tax department will have access to leasing transaction data and conduct comprehensive and detailed investigations on landlords who have not declared taxes.

Overall, the promulgation of the "Regulations" marks a new stage in the housing rental filing system. On the one hand, it will promote the awareness of housing rental market entities to strengthen their awareness of housing rental filing, actively and actively carry out housing rental contract filing, and regulate the behavior of the housing rental market. On the other hand, it will break the long-standing "information islands" in the housing rental market. The tax authorities will monitor rental income through housing rental filing data and strengthen the tax source management of rental housing.

ⅡUnder the rental information sharing mechanism, how should landlords fulfill their tax obligations in accordance with the law?

In the past, some provinces have issued regulations on tax protection, requiring county-level governments to incorporate tax informatization construction into the digital government construction plan, and to achieve cross-departmental tax-related information sharing based on the provincial integrated big data platform. However, due to the low level of effectiveness of these regulations, the implementation of grassroots governments is not strong. The tax-related information sharing mechanism has not played a substantial role. The promulgation of the "Regulations" provides a higher-level legal basis for the real estate management department to provide housing rental information to the tax department, effectively solving the problems of insufficient legal basis and enforcement in practice for information exchange, and enabling the tax department to accurately grasp the tax-related information such as rental housing of landlords. Therefore, the landlord should comprehensively and specifically grasp how to fulfill the tax obligations of the rental housing in accordance with the law.

According to the different subjects of rental housing, it can be divided into enterprise rental housing and individual rental housing. (This article refers to individual industrial and commercial households and natural persons) For rental housing, different types of entities have different tax obligations, and the basis for tax payment and tax preferential policies are different

Ⅰ、Tax Obligation of Enterprises Renting Housing

(1)corporate income tax enterprise

The tax-exclusive income obtained from rental housing belongs to the economic inflow of the enterprise and constitutes the taxable income of the enterprise. It is a part of the taxable income and is subject to corporate income tax at a rate of 25%. If the enterprise is a small and micro-profit enterprise, the taxable income is calculated at a rate of 25%, and the enterprise income tax is paid at a rate of 20%.

(2)value-added tax enterprise

If it is a general taxpayer, the housing lease contract signed before the pilot date of the "business tax to value-added tax reform" that has not been fully executed can be calculated using the general tax calculation method to calculate the output tax amount based on the tax-excluded rental income and a tax rate of 9%, and pay value-added tax after deducting the input tax amount. The simplified tax calculation method can also be used to obtain tax-exclusive rental income and a 5% tax rate to calculate and pay value-added tax. If a housing lease contract is signed after the pilot date of the "business tax to value-added tax" reform, the general tax calculation method should be used to pay value-added tax in accordance with the aforementioned rules. If the enterprise is a small-scale taxpayer, it should adopt the simplified tax calculation method to calculate and pay value-added tax based on the tax-exclusive rental income and a 5% tax rate. At the same time, small-scale taxpayers with monthly sales not exceeding 100,000 yuan and quarterly sales not exceeding 300,000 yuan are exempt from value-added tax. In particular, for housing rental enterprises, if they rent out housing to individuals, they can calculate and pay value-added tax at a rate of 5%, reduced by 1.5%.

(3)Urban construction tax

The tax base for enterprises is the amount of value-added tax paid for rental housing. The applicable tax rate varies depending on the location of the enterprise. If the enterprise is located in the urban area, the urban construction tax is calculated and paid at a rate of 7%. If the enterprise is located in a county or town, the urban construction tax is calculated and paid at a rate of 5%. If the enterprise is located outside the city, county, or town, the urban construction tax is calculated and paid at a rate of 1%.

(4)property tax

The enterprise calculates and pays property tax based on the tax-exclusive rental income obtained, and calculates and pays property tax at a rate of 12%. If renting out housing to individuals and specialized large-scale housing rental enterprises, the property tax can be paid at a reduced rate of 4%. It is worth noting that if the lease contract signed by the enterprise for renting out housing stipulates a rent-free period, the property rights owner will still pay property tax according to the original value of the property during the rent-free period.

(5)Urban land use tax

In general, enterprises with land use rights in cities, county towns, administrative towns, and industrial and mining areas are taxpayers. Enterprises should calculate and pay land use tax based on the actual land area used, and calculate and pay land use tax according to the prescribed unit tax amount.

(6)stamp duty

Both parties to the lease shall calculate and pay stamp duty based on the tax-excluded rent amount specified in the property lease contract, at a rate of 1‰. If the lessee is an individual, the lessee is exempt from stamp duty. In addition, if the enterprise is a small-scale taxpayer or a small and micro-profit enterprise, urban construction tax, property tax, land use tax, and stamp duty can also enjoy preferential tax reduction policies, and pay taxes by an additional 50% of the tax amount on the basis of the above.

Ⅱ、Tax Obligation of Individuals for Renting Housing

(1)Personal income tax

For individual rental housing, the tax basis is based on the tax-exclusive rental income obtained each time. If the income does not exceed 4,000 yuan, the statutory expenses of 800 yuan will be deducted. If the income exceeds 4,000 yuan, the statutory expenses will be deducted by 20%. If there are repair expenses and allowable tax deductions, Each time, a maximum of 800 yuan can be deducted for repair costs and taxes, and the final personal income tax is calculated at a 10% tax rate.

(2)value-added tax

Value-added tax declaration is divided into periodic and per-time, and the threshold for the two is different. Whether to pay taxes on a regular basis or on a per-time basis, the criteria for tax registration or temporary tax registration are as follows: For those who have registered, they can pay taxes on time, with a tax threshold of 500 yuan to 20,000 yuan. (Determine the specific starting point according to the actual situation of the province); For those who have not registered, they will be subject to per-time taxation, with a tax threshold of 300 yuan to 500 yuan. Those who have not reached the threshold will not bear the obligation to pay value-added tax and do not need to handle tax declaration in accordance with the law. If the rent exceeds the threshold, the tax liability shall be determined according to the organizational form. For individual industrial and commercial households that are small-scale taxpayers, value-added tax is calculated and paid based on the tax-exclusive rental income and a 5% tax rate. For natural persons, the value-added tax is calculated at a rate of 5% of the tax-exclusive rental income, reduced by 1.5%. It should be noted that exceeding the tax threshold does not mean that the actual tax payment is required. If the tax preferential conditions are met, it can be exempted from tax, but tax declaration still needs to be processed according to regulations. Regarding tax preferential policies, they mainly include: 1 The tax-exclusive rental income obtained from renting out housing in the form of one-time rental collection can be evenly distributed during the corresponding lease period. If the monthly rental income after distribution does not exceed 100,000 yuan, it is exempt from value-added tax. 2 Small-scale taxpayers (including natural persons) can enjoy tax preferential policies. If the sales amount does not exceed 100,000 yuan and the quarterly sales amount does not exceed 300,000 yuan, they are exempt from value-added tax. However, it should be emphasized that rental housing with special VAT invoices cannot enjoy the VAT exemption policy.

(3)Urban construction tax

The rental of housing for individuals and enterprises is the same, and will not be repeated here.

(4)property tax

Individuals renting out housing can pay property tax at a rate of 4% on non-tax rental income, and enjoy a tax preferential policy of reducing property tax by up to 50% on this basis.

(5)Land use tax and stamp duty are exempt from personal rental housing.

ⅢAfter the implementation of the "Regulations", how can lessors achieve tax compliance?

Under the background of the rental information sharing mechanism, after renting a house, the tenant must fill in the information such as the location of the leased house and the lease time through the personal income tax app to deduct the special additional housing rent in accordance with the law. The tax department will compare this data with the housing rental filing data shared by the real estate management department. It will accurately detect the behavior of the lessor who has not filed or declared taxes. For those not filed, the tax department will synchronize the information to the property management department for processing; For those who fail to declare taxes, an investigation will be conducted on the lessor, and the lessor will face the tax risk of making up for taxes and paying late fees. Furthermore, for lessors who refuse to declare after being notified by the tax authorities and have obvious hidden rental income, They may also face the tax risk of being deemed to have constituted tax evasion and being fined 0.5 to 5 times the amount of tax paid. Therefore, after the implementation of the "Regulations", the lessor should comprehensively comply with tax regulations, fully enjoy tax preferential policies in accordance with the law, make tax declarations, and guard against tax risks.

1、Proactively file housing rental contracts and fully retain transaction vouchers. In order to ensure the legality and compliance of housing rental behavior and effectively reduce tax risks, landlords should actively fill in relevant information on the housing rental management service platform or handle the filing of housing rental contracts with the property management department in the location of the housing. At the same time, it is necessary to keep all rental income vouchers, such as bank statements, receipt documents, and transaction vouchers for the expenses incurred in repairing the house, in order to deduct expenses in accordance with the law and resolve tax disputes.

2、 Fully consider the rental income situation and make tax declaration in accordance with the law and regulations. If the lessor is a natural person, it can decide whether to handle tax registration based on the rental income situation. If the province has set the threshold for value-added tax at 20,000 yuan, and the monthly rental income obtained by a natural person is within 20,000 yuan but exceeds 500 yuan, the natural person can apply for tax registration or temporary tax registration and is exempt from tax declaration. In addition, the lessor should fully grasp the aforementioned tax policies, legally and compliantly handle tax declarations in a timely manner, and avoid tax risks from the source.

3、 With the help of professional tax professionals, actively respond to the tax risks that have erupted. If the tax authorities require the lessor to self-check and pay taxes, the lessor should fully grasp the opportunity to comprehensively, actively, and proactively check whether the lease income has been fully paid the tax. If it is found that there is indeed a situation of underpayment of taxes, it should actively cooperate with the tax authorities to make up for the taxes and pay the corresponding late payment fees to avoid being identified as tax evasion. If the tax authorities have initiated an inspection procedure for the lessor, the lessor should respond cautiously, actively communicate with the tax authorities on the facts of the case and the application of the law, strive for a good characterization, and, if necessary, consider seeking legal remedies and professional support from tax authorities to maximize the recovery of economic losses.