Foreign Trade Industry Tax-related Criminal Risk Report (2021)

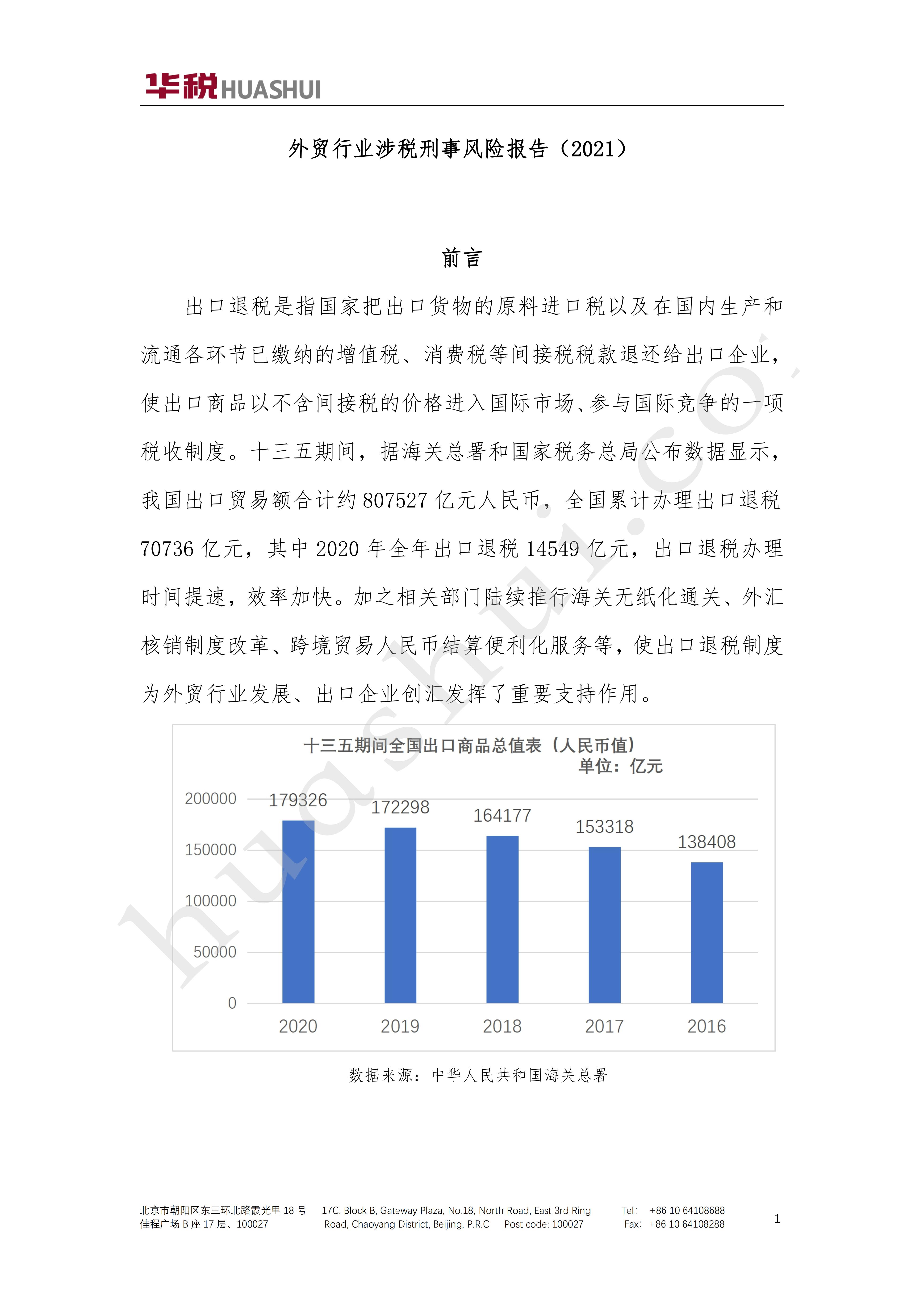

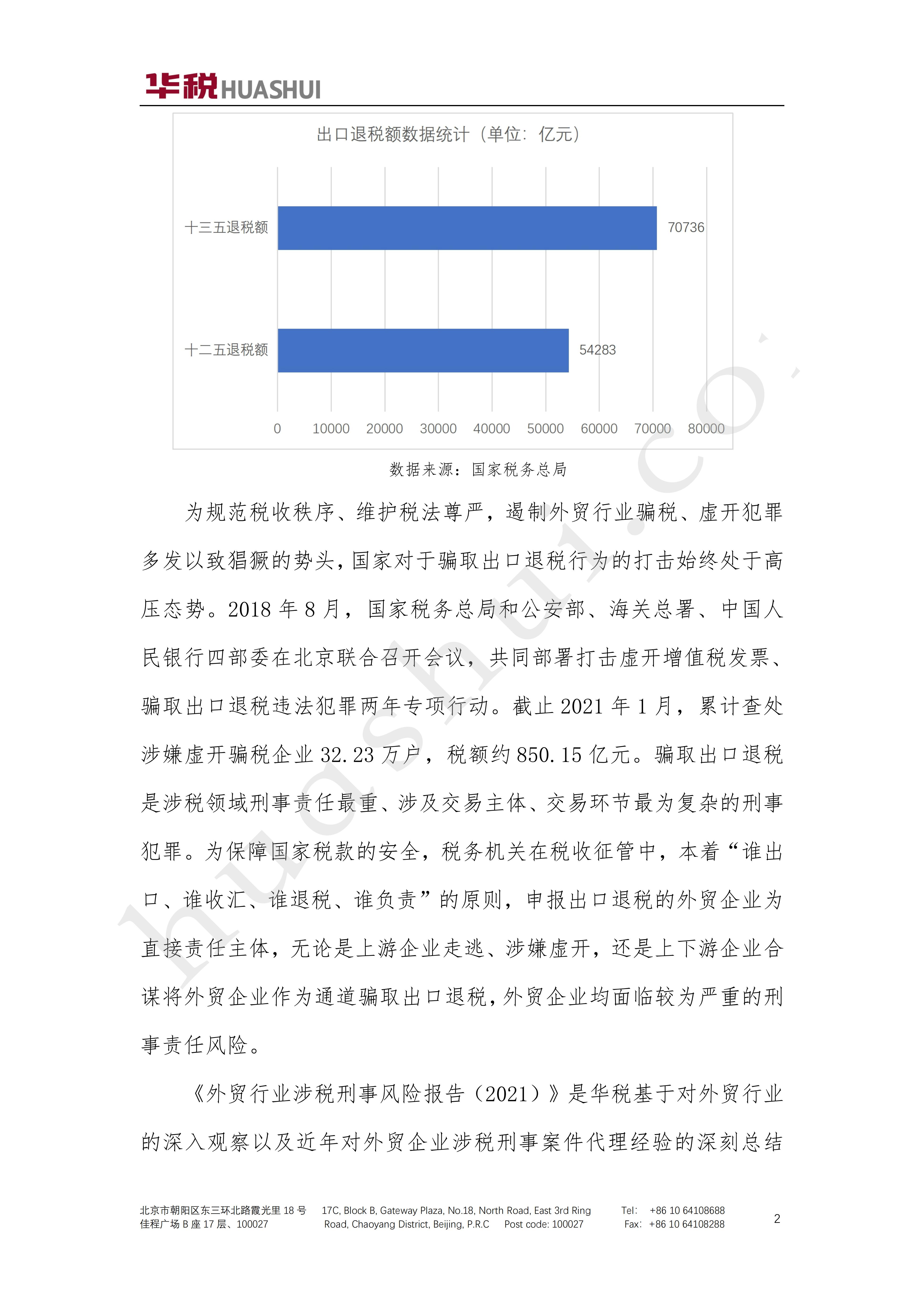

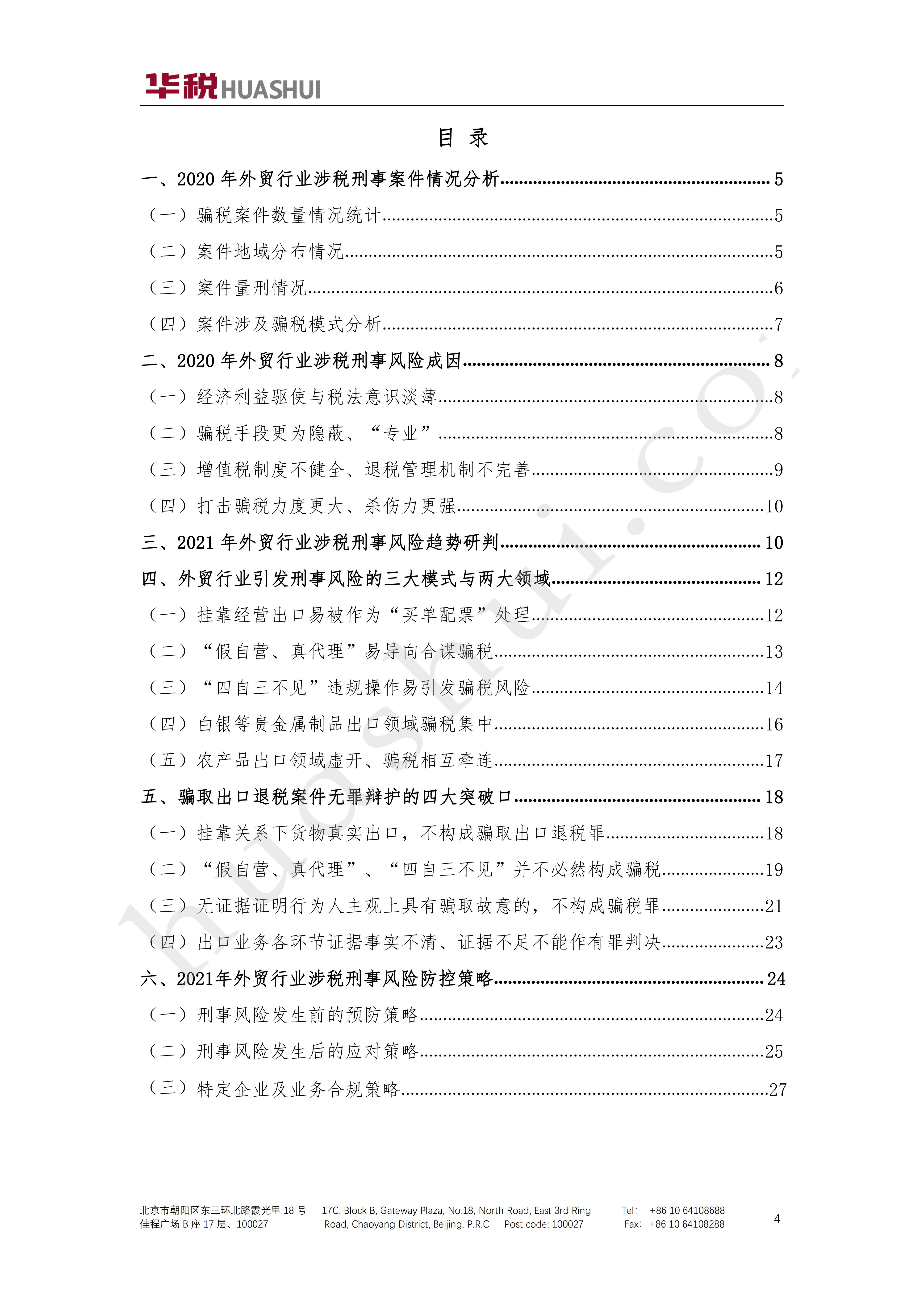

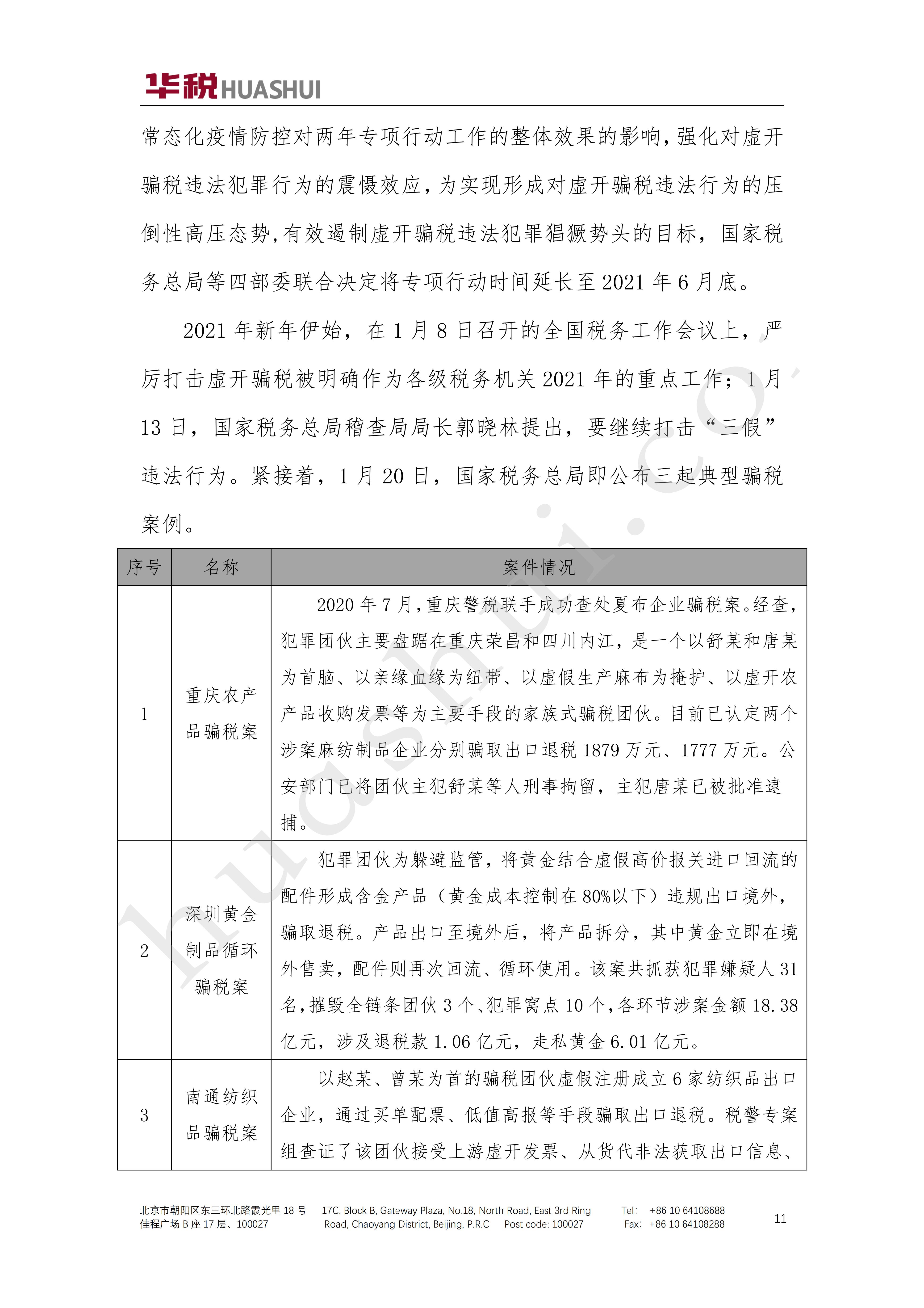

Export tax rebate refers to a tax system whereby the State refunds to export enterprises the import tax on raw materials for exported goods, as well as indirect taxes such as value-added tax (VAT) and consumption tax (CST) that have already been paid at various stages of production and circulation in the country, so that exported goods can enter the international market and participate in international competition at a price that does not include indirect taxes. During the 13th Five-Year Plan period, according to the data released by the General Administration of Customs and the State Administration of Taxation, China's export trade volume totaled about 807,527,700,000,000 RMB, and the country handled a cumulative total of 7,073,600,000,000 RMB of export tax refunds, of which 1,454,900,000,000 RMB of export tax refunds were granted in the whole year of 2020, and the time of handling the export tax refunds has been speeding up and efficiency accelerated. Coupled with the successive implementation of paperless customs clearance by relevant departments, reform of the foreign exchange underwriting system, and facilitation of RMB settlement services for cross-border trade, the export tax rebate system has played an important supportive role for the development of the foreign trade industry and the generation of foreign exchange by export enterprises. In order to standardize the tax order, safeguard the dignity of the tax law, and curb the momentum of tax fraud and false invoicing crimes in the foreign trade industry, the state has always been in a high-pressure situation to crack down on fraudulent export tax rebates.In August 2018, the State Administration of Taxation (SAT), the Ministry of Public Security (MPS), the General Administration of Customs (GAC) and the People's Bank of China (PBOC) held a joint meeting in Beijing to deploy a two-year special action to crack down on the crimes of falsely issuing value-added tax (VAT) invoices and fraudulently obtaining export tax refunds. Two-year special action. As of January 2021, a total of 322,300 enterprises suspected of false invoicing and tax fraud have been investigated and dealt with, with a tax amount of about 85.015 billion yuan. Fraudulent export tax refund is a criminal offense with the heaviest criminal liability in the tax-related field, involving the most complicated transaction subjects and transaction links. In order to protect the security of national tax money, tax authorities in the tax collection and management, in line with the "who exports, who collects foreign exchange, who refunds, who is responsible for" principle, declared export tax rebates of foreign trade enterprises for the direct responsibility of the main body, whether the upstream enterprises flee, suspected of false openings, or upstream and downstream enterprises conspire with the foreign trade enterprises as a channel to fraudulent export tax refunds, the foreign trade enterprises are facing a more serious problem. Foreign trade enterprises are facing more serious criminal liability risks. The Report on Tax-Related Criminal Risks in Foreign Trade Industry (2021) is compiled by Huatax based on its in-depth observation of the foreign trade industry and the profound summary of its experience in representing foreign trade enterprises in tax-related criminal cases in recent years, with the aim of revealing the characteristics of the causes of the tax-related criminal risks in the foreign trade industry and the new direction of investigating and dealing with the cases of tax cheating in 2021, and on the basis of which, it puts forward the targeted defense strategies and compliance suggestions, with a view to providing a good opportunity for the foreign trade enterprises to avoid criminal risks and realize lawful and compliant operation. The report is divided into six parts. This report is divided into six parts, and the full text is about 15,000 words.

Click to download:Full Report of Foreign Trade Industry Tax-related Criminal Risk Report (2021)