Pharmaceutical Industry Tax Compliance Report (2023)

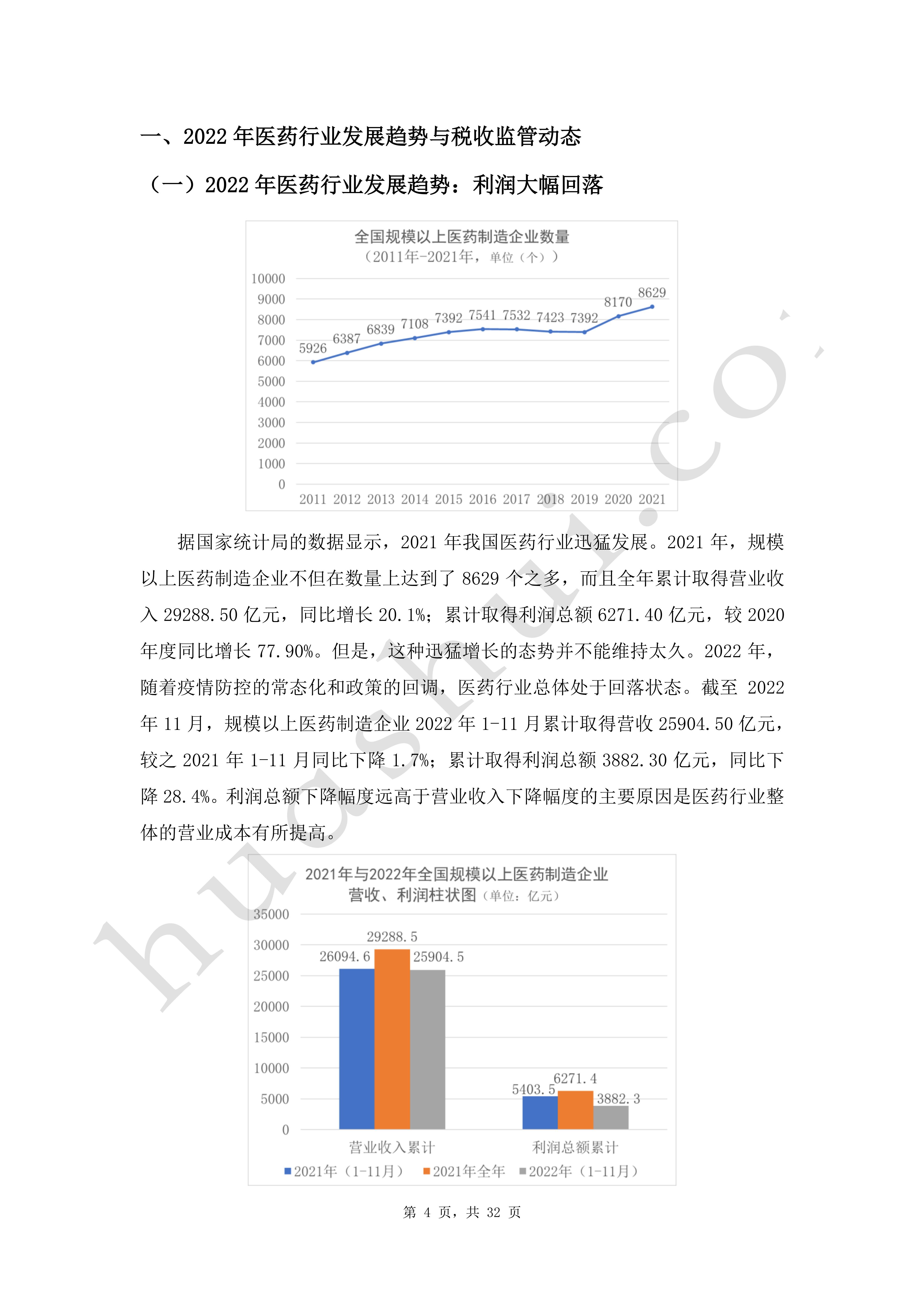

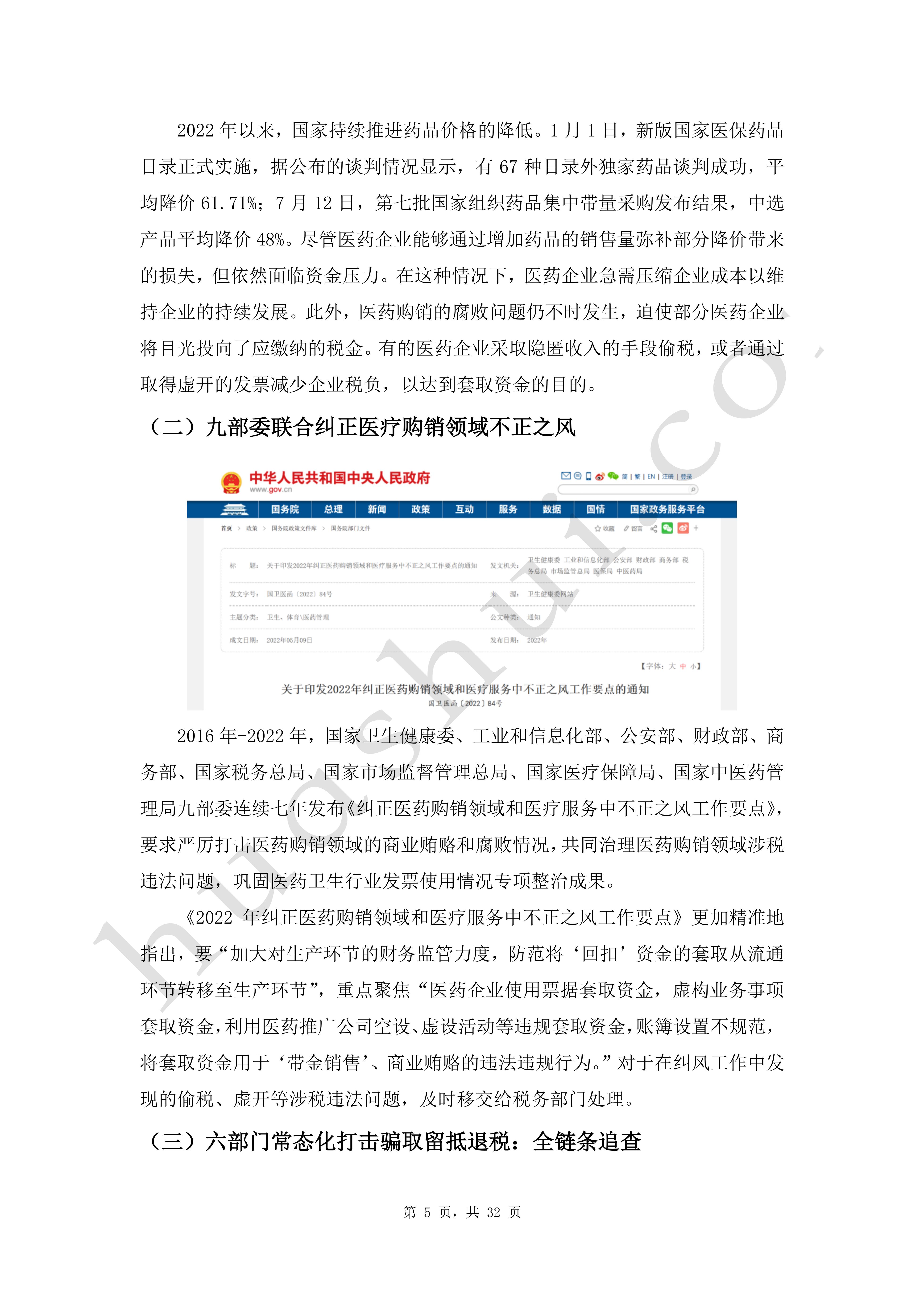

Pharmaceutical industry, refers to the pharmaceutical manufacturing industry including chemical raw material drug manufacturing, medical device manufacturing, proprietary Chinese medicine manufacturing, Chinese medicine tablets manufacturing and other industries. The development of the pharmaceutical industry has experienced the shock of policy changes and is rapidly picking up. According to statistics, the number of pharmaceutical enterprises above the national scale continued to decrease from 7,541 in 2016 to 7,392 in 2019, but it rapidly rebounded after 2020, with a total of 8,629 as of 2021. This is on the one hand related to the gradual stabilization of the pharmaceutical industry's "two-invoice system" and other policies, and on the other hand, thanks to the incentives for a specific period of time. However, the background of the rapid development of hidden worries.

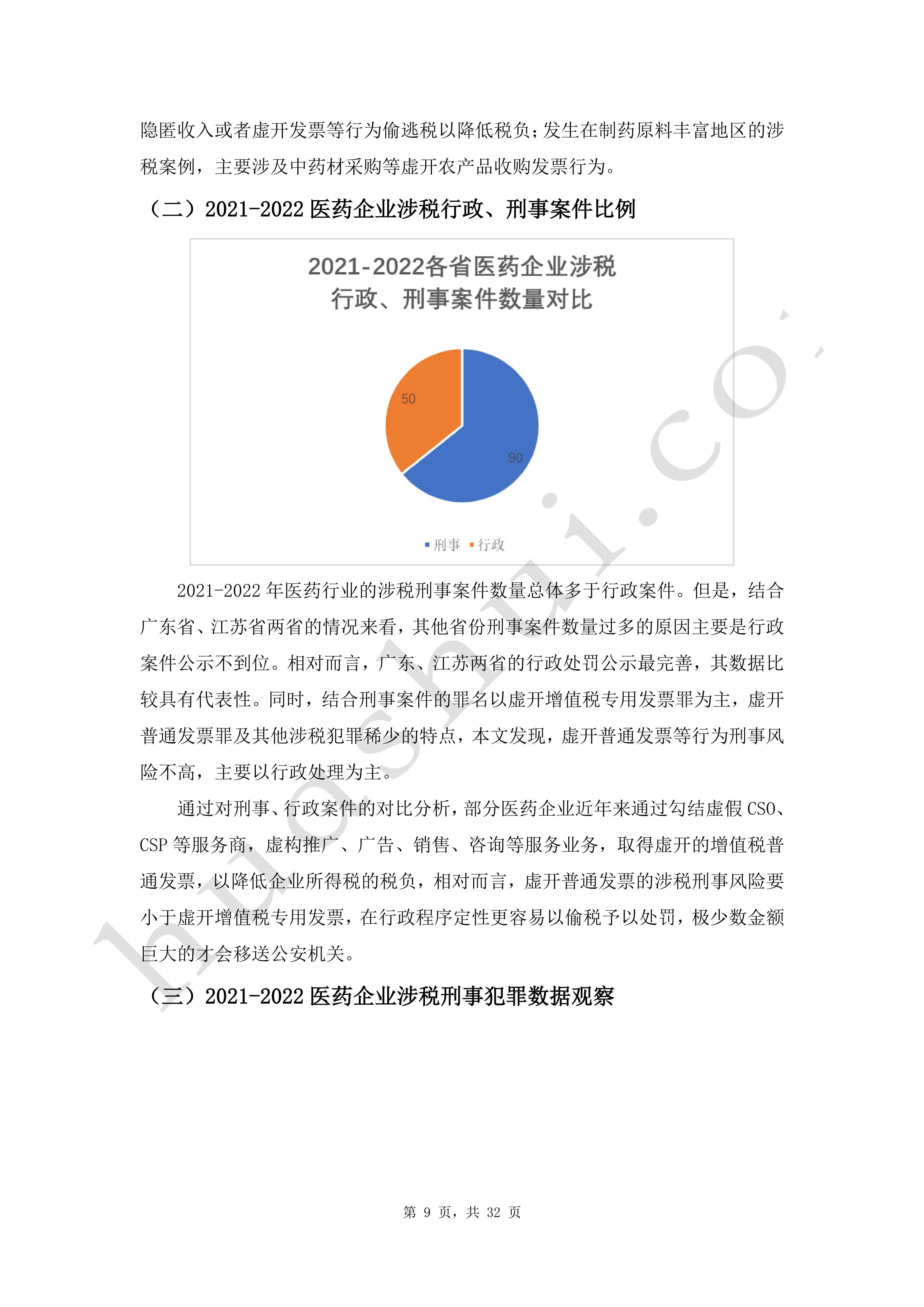

For a long time, in the field of pharmaceutical purchasing and marketing, there is a persistent problem of low efficiency and high cost of drug transportation and distribution, and at the same time, facing the doctors and medical representatives accepting kickbacks, pharmaceutical enterprises "with gold sales" and other corruption problems, forming an interlocking grey chain, the pharmaceutical enterprises due to rebates, kickbacks and costs lead to further compression of profits, thus becoming the Pharmaceutical industry false opening, tax evasion behavior repeated motive. The "two-ticket system" reform and the "4+7" centralized purchasing model seek to eliminate the problem of excessively high drug prices caused by multiple distribution links in the past from the sales chain of pharmaceutical enterprises, but because the existing distribution of benefits and the drug distribution model has not been completely changed, the costs of pharmaceutical enterprises have remained high and have begun to rise. However, due to the lack of a radical change in the distribution of benefits and the drug distribution model, pharmaceutical companies, with high costs, have begun to extract funds through bills from other areas such as the production, marketing and advertising of drugs, making the problem of invoice violations in the pharmaceutical industry still serious.20 From 2021 to 2022, a number of cases of fraudulent invoicing in the pharmaceutical industry erupted across the country, underscoring the necessity for the pharmaceutical industry to strengthen its tax compliance.

Based on the focused research on tax-related criminal cases in the pharmaceutical industry in recent years and long-term observation of the pharmaceutical industry, Huatax team prepares this "Pharmaceutical Industry Tax Compliance Report (2023)". By analyzing the policy changes and typical cases in the pharmaceutical industry since 2022, we summarize the tax risks and put forward targeted tax compliance suggestions and tax risk control and response strategies to help the healthy development of pharmaceutical enterprises.

Click to download: Full Report of Pharmaceutical Industry Tax Compliance Report (2023)