High-Income Individuals Tax-Related Risk Report (2022)

Since the implementation of the new individual income tax system in 1994, tax authorities at all levels throughout the country, in compliance with the instructions of the leaders of the CPC Central Committee and the State Council on improving and strengthening the administration of individual income tax collection, have always made the regulation of high incomes and the alleviation of the contradiction of inequitable distribution of income in the society as the key point of the work of collecting and managing individual income tax, and have taken a variety of measures to intensify the efforts of collecting and managing individual income tax on high-income industries and individuals. However, there is no relevant document to determine the basis for the division of high-income and high net worth taxpayers.

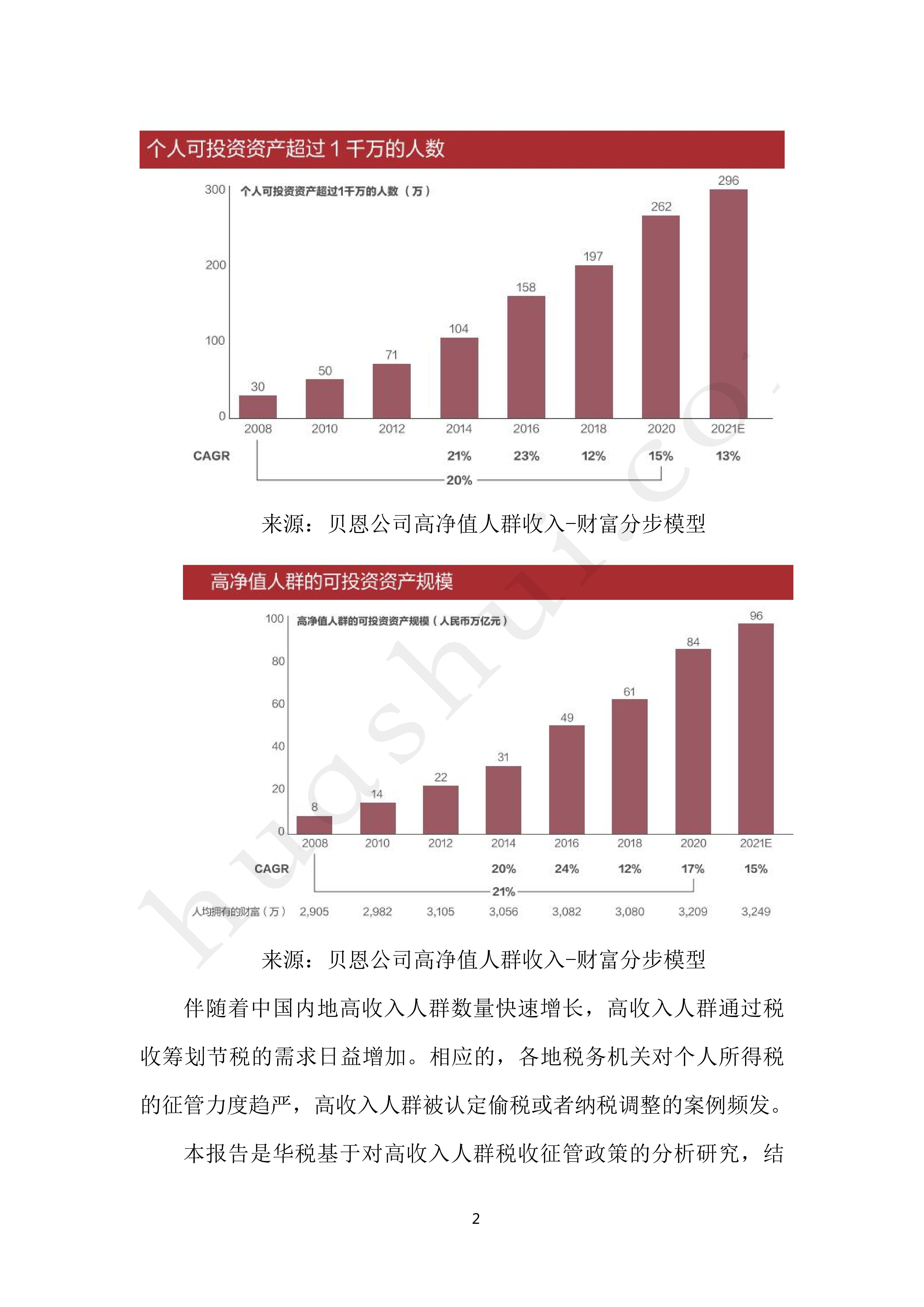

According to the data statistics of China Private Wealth Report 2021 jointly released by China Merchants Bank and Bain, the number of high-net-worth individuals (with investable assets of more than $10 million) in mainland China was 2.62 million by the end of 2020, with a compound annual growth rate of 15% from 2018 to 2020, and is expected to reach 2.96 million by the end of 2021. By the end of 2020, the per capita investable assets held by China's HNWIs will be approximately 32.09 million yuan, with a total of 84 trillion yuan of investable assets; it is expected that by the end of 2021, the size of the investable assets held by China's HNWIs will reach approximately 96 trillion yuan.

Along with the rapid growth in the number of high-income people in Mainland China, there is an increasing demand for high-income people to save tax through tax planning. Correspondingly, tax authorities around the world have tightened up the collection and management of personal income tax, and there are frequent cases of high-income earners being recognized as tax evaders or having their taxes adjusted.

This report is compiled based on Huatax's analysis and research on the tax administration policies of high-income groups, combined with the typical tax-related cases of high-income groups in which Huatax has participated in recent years, with the aim of revealing the major tax risk points of high-income groups both inside and outside the country from the perspective of the characteristics of the tax administration of high-income groups and putting forward targeted compliance suggestions on this basis, with a view to providing guidance and reference for the tax compliance of high-income groups.

It should be noted that the term "high-income group" in this report refers to high-income taxpayers in Mainland China in a broad sense, including high-income groups (e.g., those with income of more than RMB 10 million) and high-net-worth groups (e.g., those with investable assets of more than RMB 10 million).

Click here to download: Full Report of High-Income Individuals Tax-Related Risk Report (2022)