Pharmaceutical Industry Tax-Related Criminal Risk Report (2022)

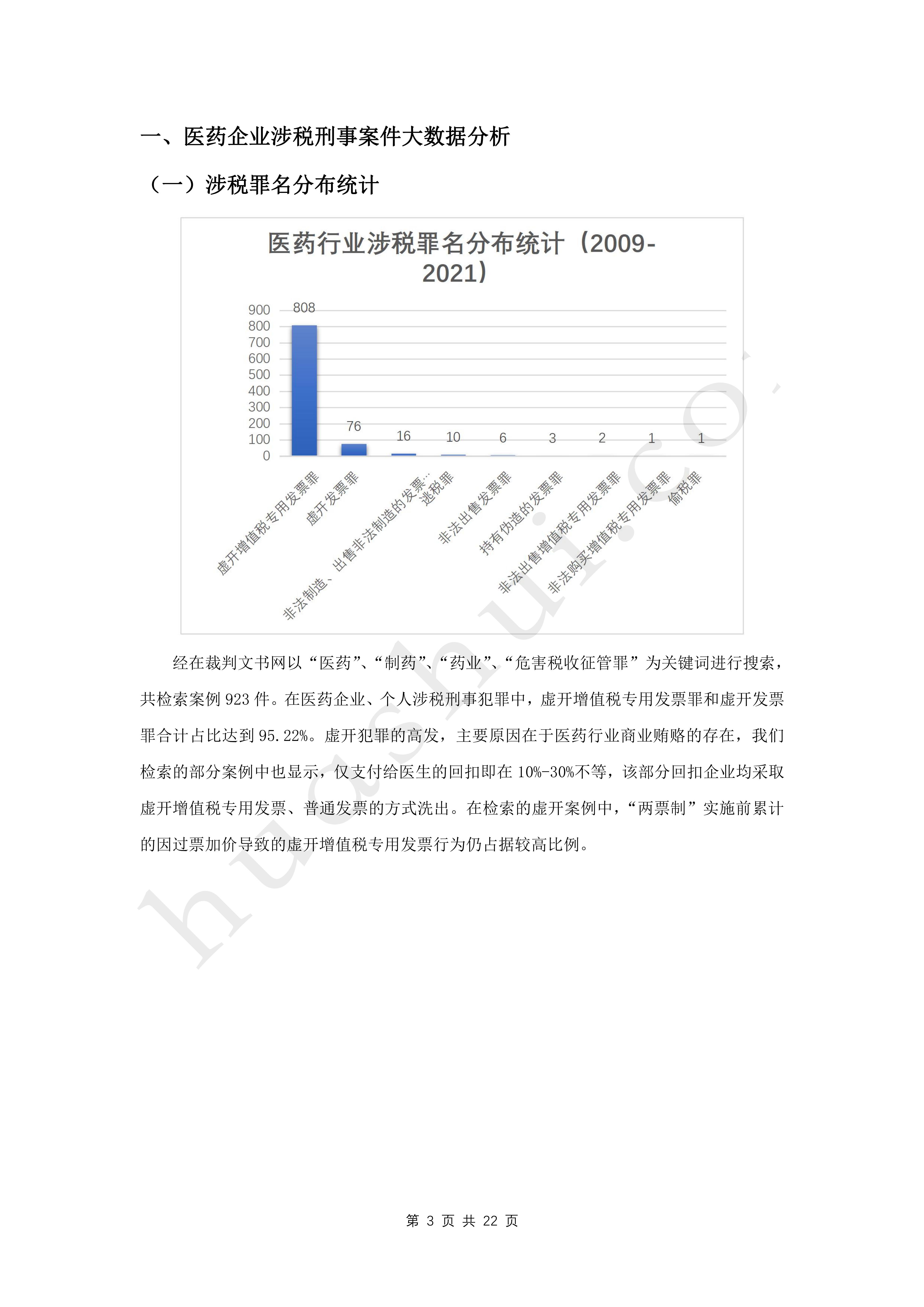

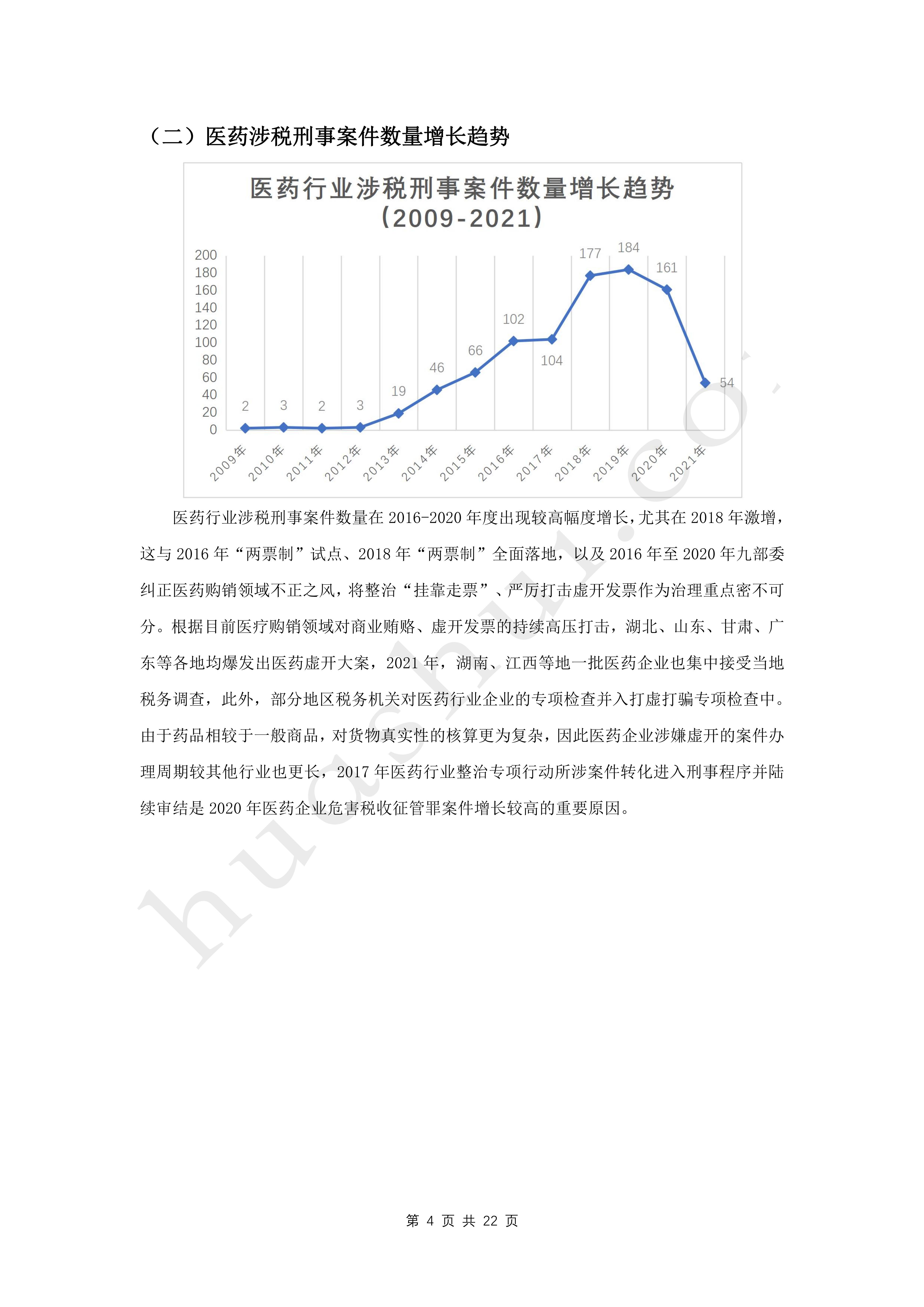

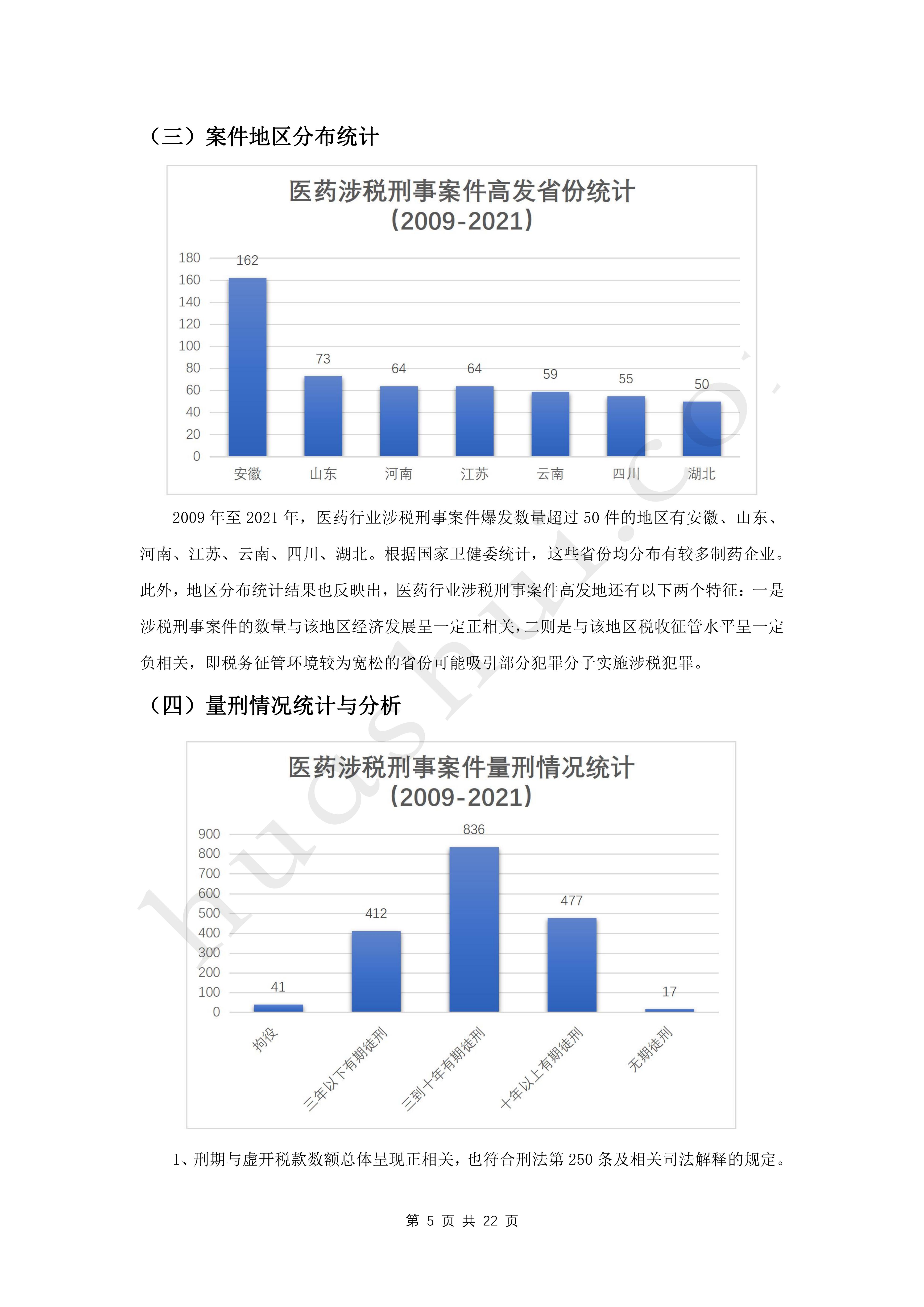

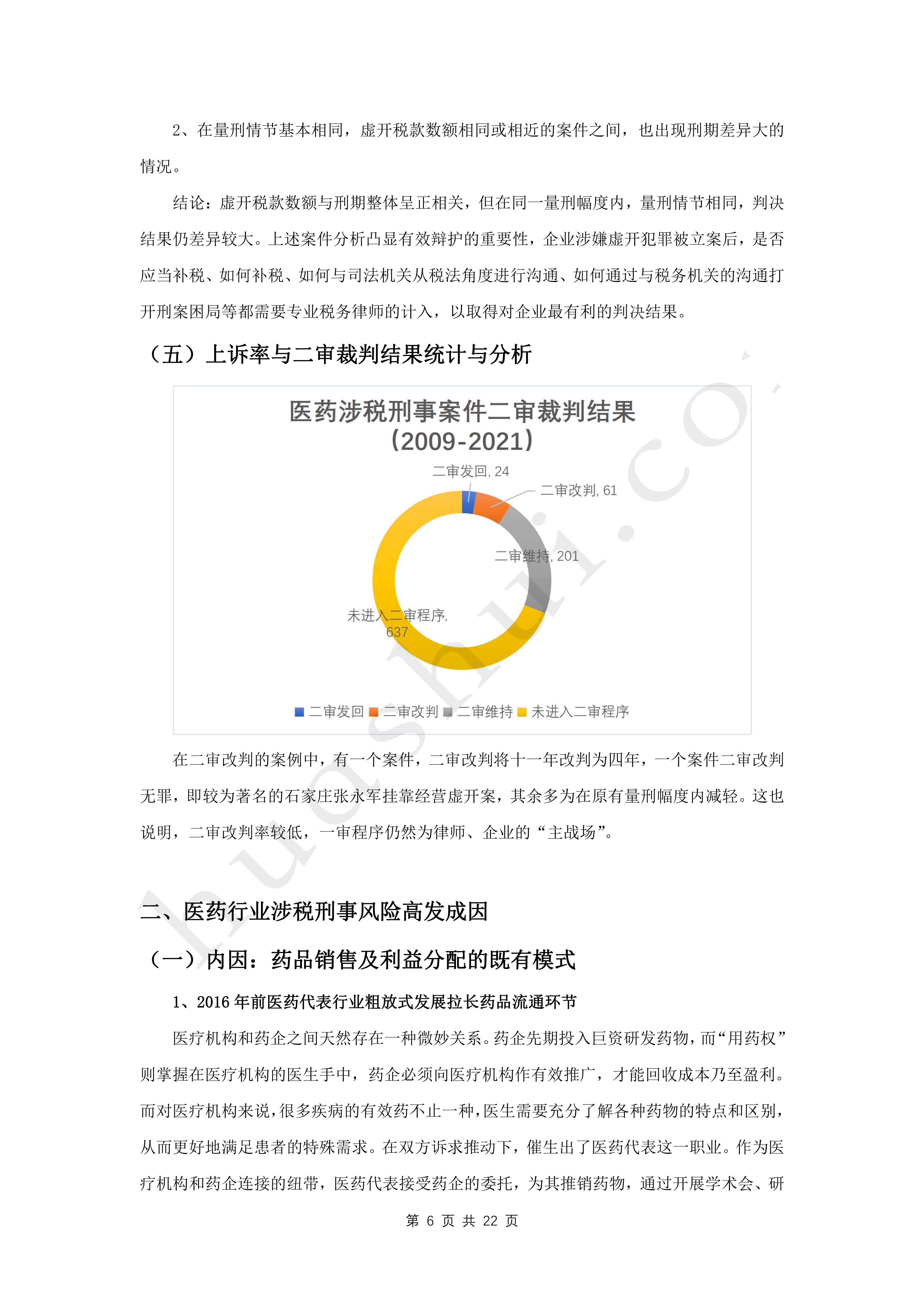

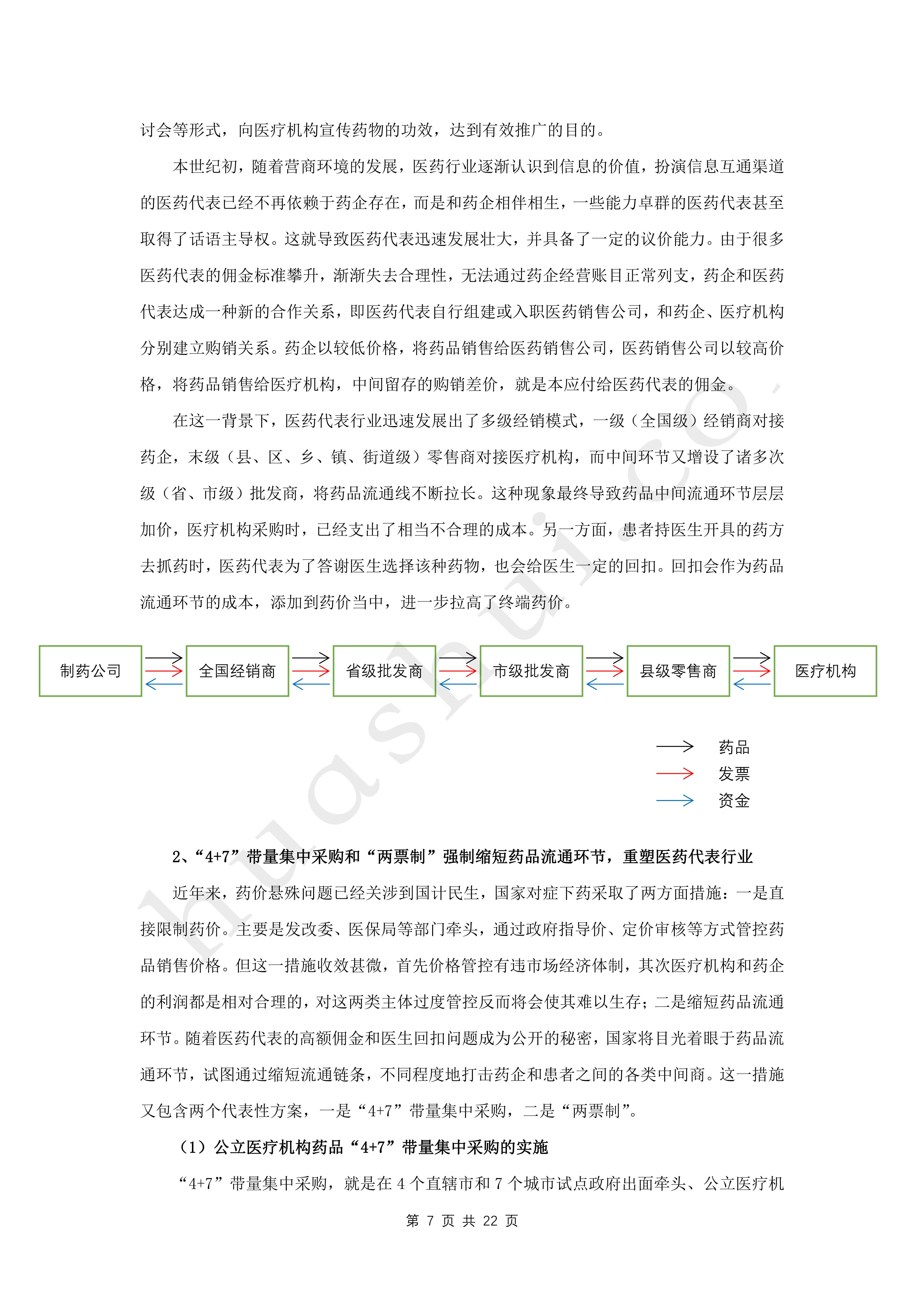

The pharmaceutical industry is an important part of China's national economy. In recent years, the "4+7" centralized purchasing with quantity, "two-ticket system" and other reform measures continue to land, the pharmaceutical industry in the past multi-level distribution model collapsed, a large number of pharmaceutical sales companies transformed into CSO, CSP, CMO, CRO outsourcing service providers. However, subject to the established mode of product sales and benefit distribution, the problem of commercial bribery in the pharmaceutical industry is serious, and the emergence of new types of business provides new possibilities for profit arbitrage. The pharmaceutical industry presents the phenomenon of coexistence of false driving and commercial bribery, and false driving and bribery cases are implicated in each other. The complexity of tax-related criminal cases superimposed on the special background of the pharmaceutical industry highlights the importance of tax-related risk management and control in the pharmaceutical industry, and invoice management compliance remains the keyword for pharmaceutical enterprises to avoid criminal risk liability in 2022.

This report is compiled based on Huatax's in-depth observation of the pharmaceutical industry and profound summary of its experience in representing pharmaceutical enterprises in tax-related criminal cases in recent years, aiming to reveal the causes and characteristics of tax-related criminal risks in the pharmaceutical industry as well as the direction of the investigation and trial of the cases in 2022, and based on which, it puts forward targeted defense strategies and compliance suggestions with a view to providing references for the pharmaceutical enterprises in avoiding criminal risks and realizing their operation in compliance with the law.

Click to download: Full Report of Pharmaceutical Industry Tax-Related Criminal Risk Report (2022)