PRACTICE OF CHINA'S TAX LAWYER (SECOND EDITION)

After the publication of PRACTICE OF CHINA'S TAX LAWYER in 2009, the book has aroused a strong reaction among the tax lawyer profession and tax law practitioners. The book is horizontally centered on the classification of litigation and non-litigation, covering the main areas of tax law services; vertically from the origin and history of the industry, to the reserve of tax law knowledge gradually fine, and with cases to clarify the reasoning. The content of the book is based on the development of China's tax lawyers' industry, and provides an in-depth exposition of the main business issues and common cases in the course of tax lawyers' practice, which is in line with Huashui original intention of providing guidelines for tax lawyers' legal practice, and contributes to the gradual development and growth of the tax lawyers' industry. It has been more than two years since the book went to press. The State Administration of Taxation and other organizations have issued a large number of new regulations, and the main contents of laws and regulations, such as Enterprise Income Tax and Individual Income Tax, have also undergone changes that cannot be ignored. At the same time, Huashui has also gained more professional experience in its work and gained a deeper understanding of tax lawyers' affairs. On the basis of valuable comments from the industry and readers, this book has been formally revised.

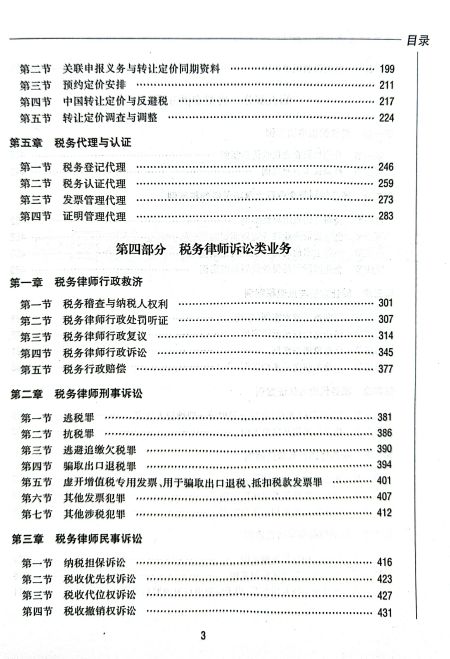

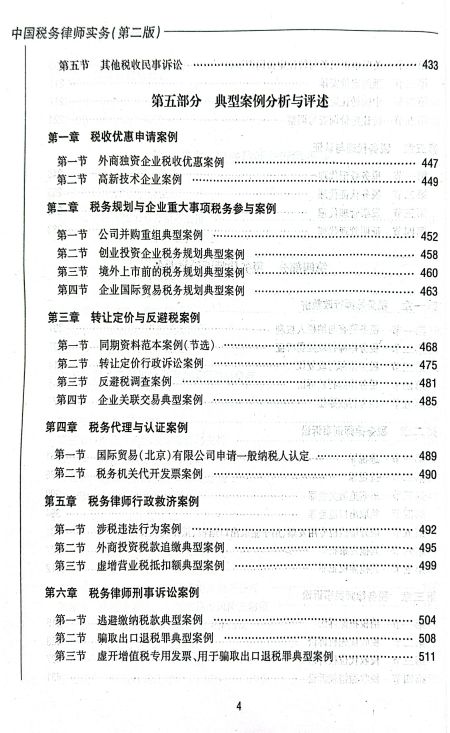

The table of contents of the book is as follows: