CHINA TAX LAWYERS REVIEW (FOURTH EDITION)

CHINA TAX LAWYERS REVIEW (FOURTH EDITION) contains the excellent results of China Tax Lawyers Forum in 2016 and Huashui Cup Tax Law Essay Competition in 2017, and also has the honor to include some excellent essays by leaders of state tax authorities and famous tax law experts, which are the results of tireless explorations and researches in tax law practice work of the vast number of tax lawyers in compliance with the requirements of economic and social development on the basis of integrating legal theories. On the basis of the theory of law, in the tax law practice work, the results of tireless exploration and research. It reflects some of the typical problems encountered in the field of tax lawyers' practice and the stage-by-stage results achieved in the process of practical operation, and also discusses some fundamental, transformative and global hot topics in the height of tax law theory. The book is divided into four columns, namely, "Legislative Frontier", "System Analysis", "Tax Law Practice" and "International Perspectives", reflecting China's tax law from different perspectives. It reflects the hot and difficult issues in the field of Chinese tax law from different perspectives, which is not only a reflection of the current practice of Chinese tax law and the environment of tax collection and management, but also a microcosm of the unremitting efforts of the aspiring people under the reform of China's fiscal and taxation system, and the advancement of the construction of the rule of law in taxation.

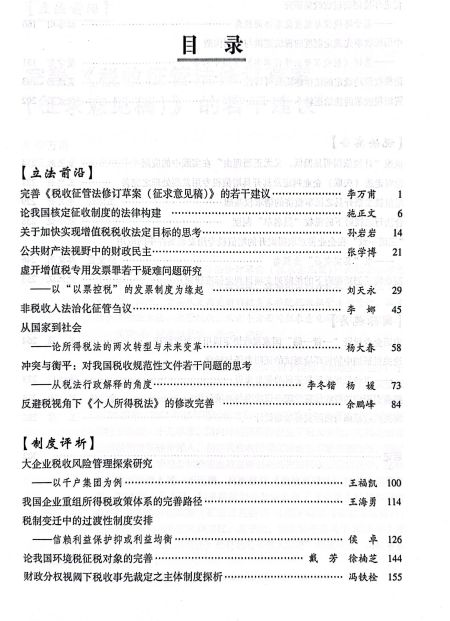

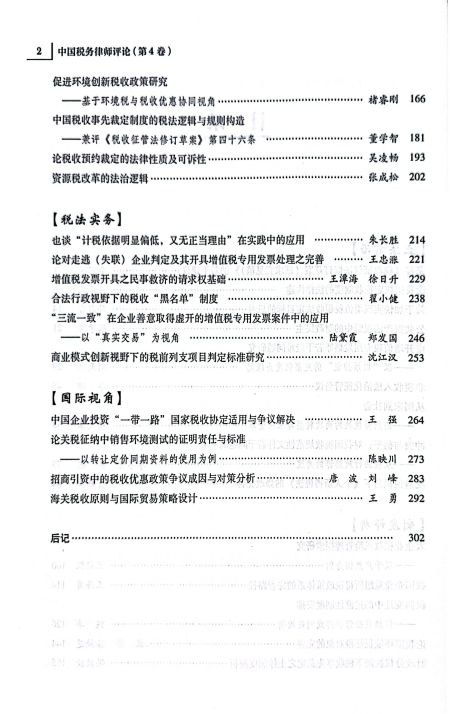

The table of contents of the book is as follows: