CHINA TAX LAWYERS REVIEW (FIRST EDITION)

As the first of its kind in the tax lawyers' industry, CHINA TAX LAWYERS REVIEW (FIRST EDITION) contains papers that fully reflect the comprehensive and open nature of the discipline of tax law, demonstrate the originality and rigor of analyzing tax issues with jurisprudential principles and methods, and provide rich materials and informative guidelines for theoretical researches and practical handling by tax law enforcement practitioners and tax-related professional service providers. The first series contains the excellent results of the two sessions of China Tax Lawyers Forum in 2011 and 2013, and also has the honor to include some excellent papers by leaders of state tax authorities and famous tax law experts. The book is divided into "Frontier of Legislation", "Industry Research", "System Review", "International Perspective", "Case Interpretation", "Tax Lawyer Forum", "Tax Lawyer Forum" and "Tax Lawyer Forum". The book is divided into six columns, namely "Legislative Frontier", "Industry Research", "System Commentary", "International Perspective", "Case Interpretation" and "Risk Management", which reflect the hot and difficult issues in the field of Chinese tax law from different aspects. It is also a microcosm of the unremitting efforts of the aspirants under the great era of the advancement of China's fiscal and taxation system reform and the construction of the rule of law in taxation.

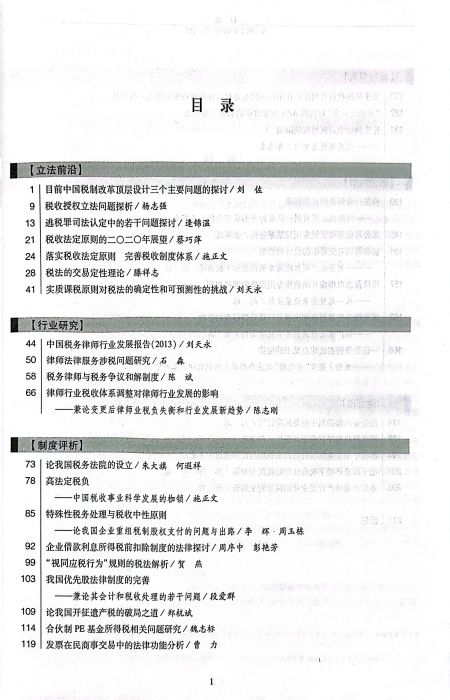

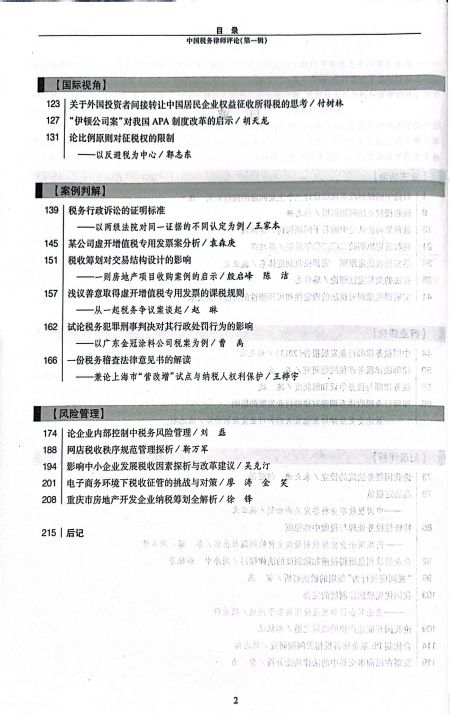

The table of contents of the book is as follows: