CHINA TAX LAWYERS REVIEW (THIRD EDITION)

CHINA TAX LAWYERS REVIEW (THIRD EDITION) is divided into four columns, namely, Legislative Frontier, System Review, Tax Law Practice and International Perspective, which focuses on the hot and difficult issues in the field of China's tax law, and is both theoretical and practical in nature. There are both high-level top-level design studies on the reform of China's fiscal and taxation system and detailed studies on practical tax issues such as corporate restructuring and tax planning; there are both summarized proposals on China's rapidly developing tax legislation and comparative studies on China's tax law system from an international perspective; there are both in-depth interpretations of typical tax law precedents and cutting-edge discussions on modern enterprise tax risk management. As a professional and continuous publication in China's tax industry, this book is of positive learning and reference significance to both tax law theorists and tax law practitioners.

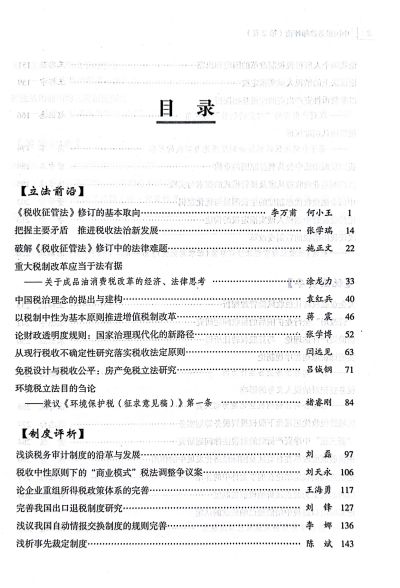

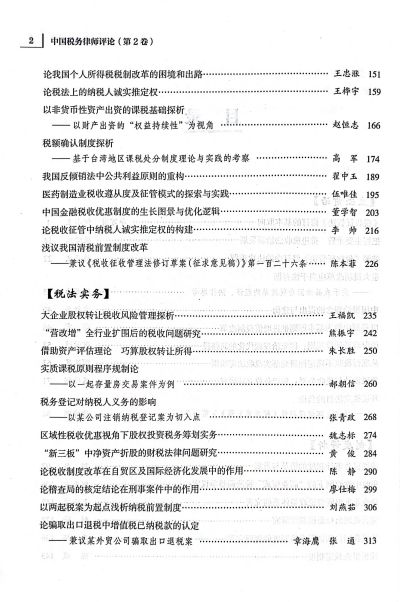

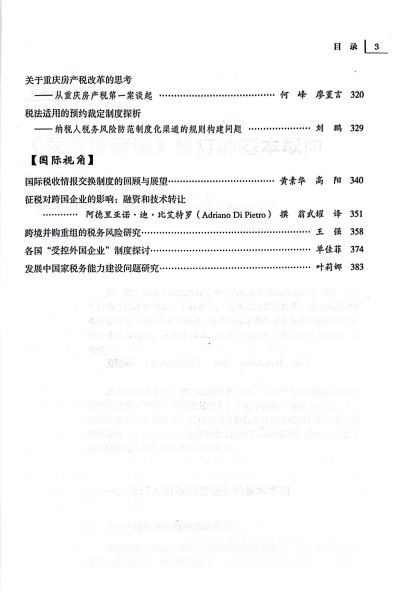

The table of contents of the book is as follows: