Foreign Trade Industry Tax Compliance Report(2024)

Export tax rebate refers to a tax system in which the State refunds to export enterprises the import tax on raw materials for exported goods, as well as indirect taxes such as value-added tax (VAT) and consumption tax, which have been paid at various stages of domestic production and circulation, so that exported goods can enter the international market at a price that does not include indirect taxes and participate in international competition. In recent years, the country's export tax refund processing time has been speeding up and efficiency has been accelerated, coupled with the successive implementation of customs paperless clearance, reform of the foreign exchange underwriting system, and facilitation services for RMB settlement of cross-border trade, which have played an important supportive role for export enterprises in generating foreign exchange.

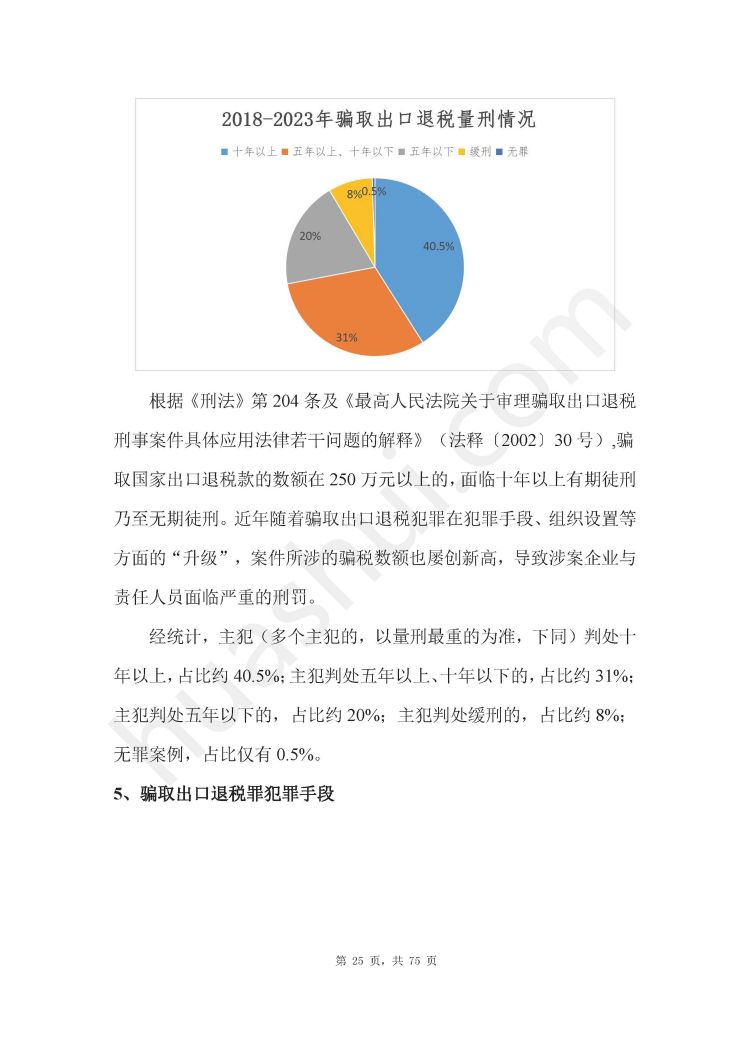

In 2023, China's foreign trade continued to run smoothly. As of the date of the report, the General Administration of Customs released data showing that the total value of China's imports and exports in the first 11 months of 2023 amounted to RMB 37.96 trillion, unchanged from the same period last year. However, along with the steady and continuous development of foreign trade exports, illegal and criminal behaviors such as tax fraud and false invoicing have emerged one after another, impacting the orderly development of China's foreign trade business. In order to protect the orderly development of foreign trade industry and regulate the order of export tax rebates, the state has continued to crack down on illegal and criminal behaviors such as fraudulent export tax rebates with high pressure, and to curb the illegal and criminal behaviors of tax cheating and false invoicing in the foreign trade industry. In addition, under the concept of "who exports, who collects foreign exchange, who refunds tax, who is responsible", the export enterprise bears most of the tax risk, the light is due to the non-compliance of the documents can not be refunded, the heavy is involved in the case of fraudulent invoicing, tax fraud. Therefore, export enterprises need to strengthen tax compliance in 2024.

Based on the in-depth observation of the foreign trade industry and the profound summarization of the experience of representing foreign trade enterprises in tax-related cases in recent years, HUASHUI team has prepared this "Foreign Trade Industry Tax Compliance Report (2024)". This report summarizes the five common types of tax-related risks in the foreign trade industry, the four major areas of high incidence, analyzes the six major causes of tax-related risks by observing the dynamics of tax regulation in the foreign trade industry and the data of tax-related cases, and captures the typical administrative and criminal cases of export tax refunds for in-depth analysis, and puts forward the key points of administrative remedies and criminal defense strategies on the basis of the foregoing in a targeted manner, in order to provide suggestions for the tax compliance in the foreign trade industry, and to make contributions to the sustainable and healthy development of the foreign trade industry. This report is divided into nine sections.

This report is divided into nine sections, and the full text is about 35,000 words.

Click to download: Foreign Trade Industry Tax Compliance Report(2024)