Pharmaceutical Industry Tax Compliance Report (2024)

Pharmaceutical industry refers to the research and development, production and sales of pharmaceutical products such as biological drugs, chemical drugs and traditional Chinese medicines. The upstream participants of the pharmaceutical industry chain include manufacturers of pharmaceutical raw materials such as basic chemical materials, animal and plant materials, and medicinal excipients; the midstream subjects of the industry chain are pharmaceutical R&D, production and sales enterprises; and the downstream subjects of the industry chain are the pharmaceutical sales terminals, which mainly include medical aesthetics, health service organizations, retail pharmacies, hospitals, and primary healthcare terminals, etc, and ultimately reach the consumers. With the accelerated aging of the population, people's health awareness, the growing demand for medical care, China's pharmaceutical industry is in a golden period of rapid development. According to statistics, since the "14th Five-Year Plan", China's pharmaceutical industry, the average annual growth rate of income from main business is 9.3%, the average annual growth rate of total profit is 11.3%, the industry continues to improve the scale of efficiency. On the one hand, this is related to the gradual stabilization of the pharmaceutical industry's "two-ticket system" and other policies, and on the other hand, thanks to the support of the policy environment, such as the "Healthy China 2030" Outline of the Plan. However, the rapid development of the pharmaceutical industry also hides hidden worries.

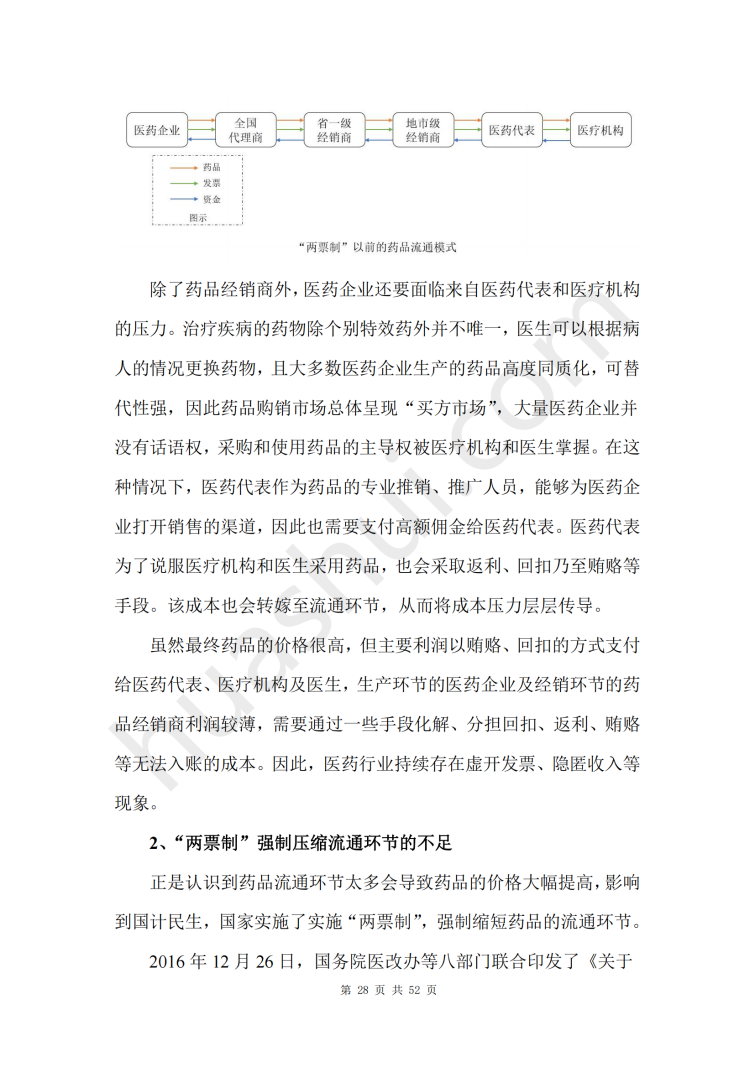

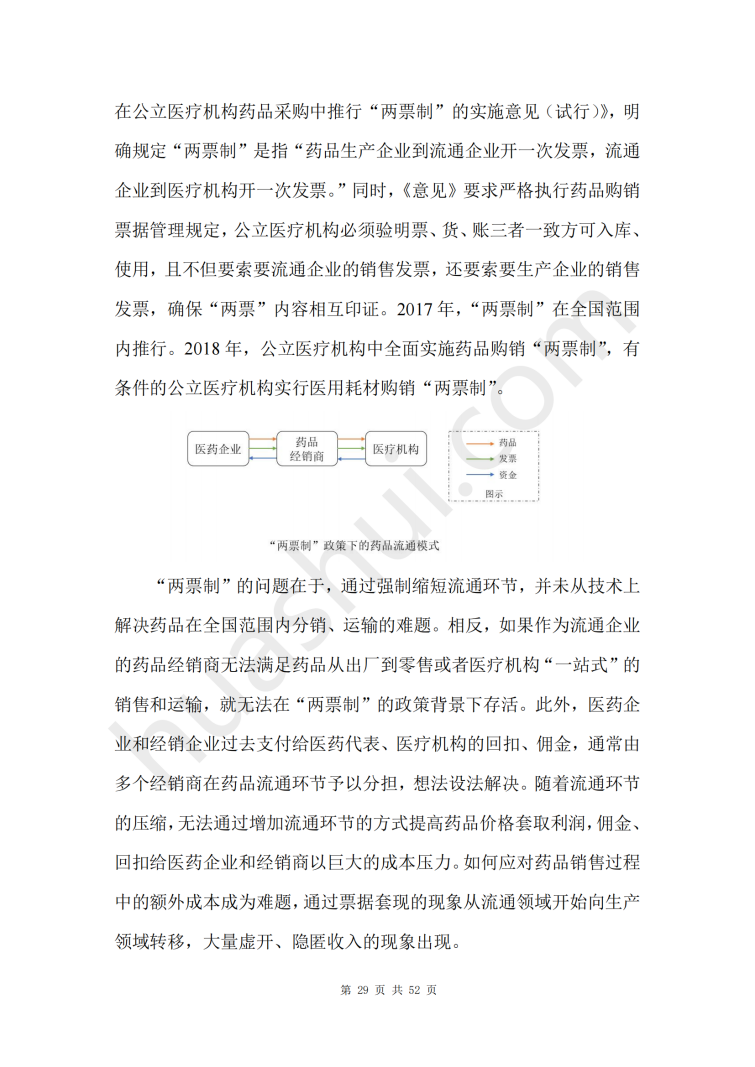

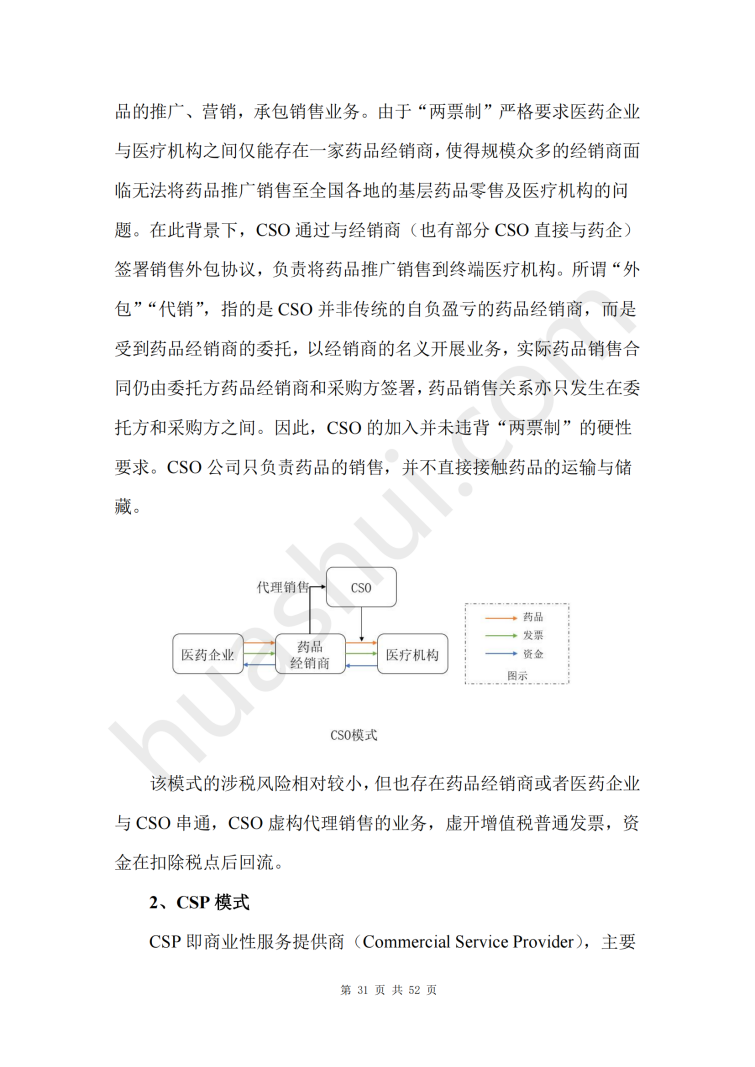

For a long time, in the field of purchase and sale of medicines, the problem of low efficiency and high cost of drug transportation and distribution persists, and at the same time, it faces the problem of corruption such as doctors and medical representatives accepting kickbacks, and pharmaceutical enterprises "selling with gold", which forms an interlocking grey chain, and the profits of pharmaceutical enterprises are further compressed due to rebates and kickbacks, and thus become Pharmaceutical industry false opening, tax evasion behavior repeated motive. The "two-ticket system" reform and the "4+7" centralized purchasing model seek to eliminate the problem of excessively high drug prices caused by multiple distribution links in the past from the sales chain of pharmaceutical enterprises, but because the existing distribution of benefits and drug distribution model has not been completely changed, the costs of pharmaceutical enterprises remain high and have begun to rise. However, due to the lack of radical changes in the distribution of benefits and the drug distribution model, pharmaceutical enterprises, with high costs, have started to extract funds through bills from other areas such as drug production, marketing and advertising, resulting in the invoice violations in the pharmaceutical industry, which remains a serious problem.20 With a number of cases of false invoicing in the pharmaceutical industry erupting across the country since 2023, the pharmaceutical industry is in urgent need of strengthening tax compliance to prevent tax risks.

Based on the in-depth observation of the pharmaceutical industry, HUASHUI Team has prepared this "Pharmaceutical Industry Tax Compliance Report (2024)". This report focuses on the development trend and tax regulation of the pharmaceutical industry, focuses on the typical tax-related cases in the pharmaceutical industry in 2023 and the practice of non-prosecution compliance system in the pharmaceutical industry, analyzes the causes of tax-related risks in the pharmaceutical industry, summarizes the main types of tax-related risks in the pharmaceutical industry on the basis of the aforementioned and puts forward targeted suggestions to deal with them, with the hope of contributing to the construction of tax compliance in the pharmaceutical industry.

This report is divided into eight sections, and the full text is about 25,000 words.

Click to download:《Pharmaceutical Industry Tax Compliance Report 》(2024)