Logistics and Transportation Industry Tax Compliance Report(2024)

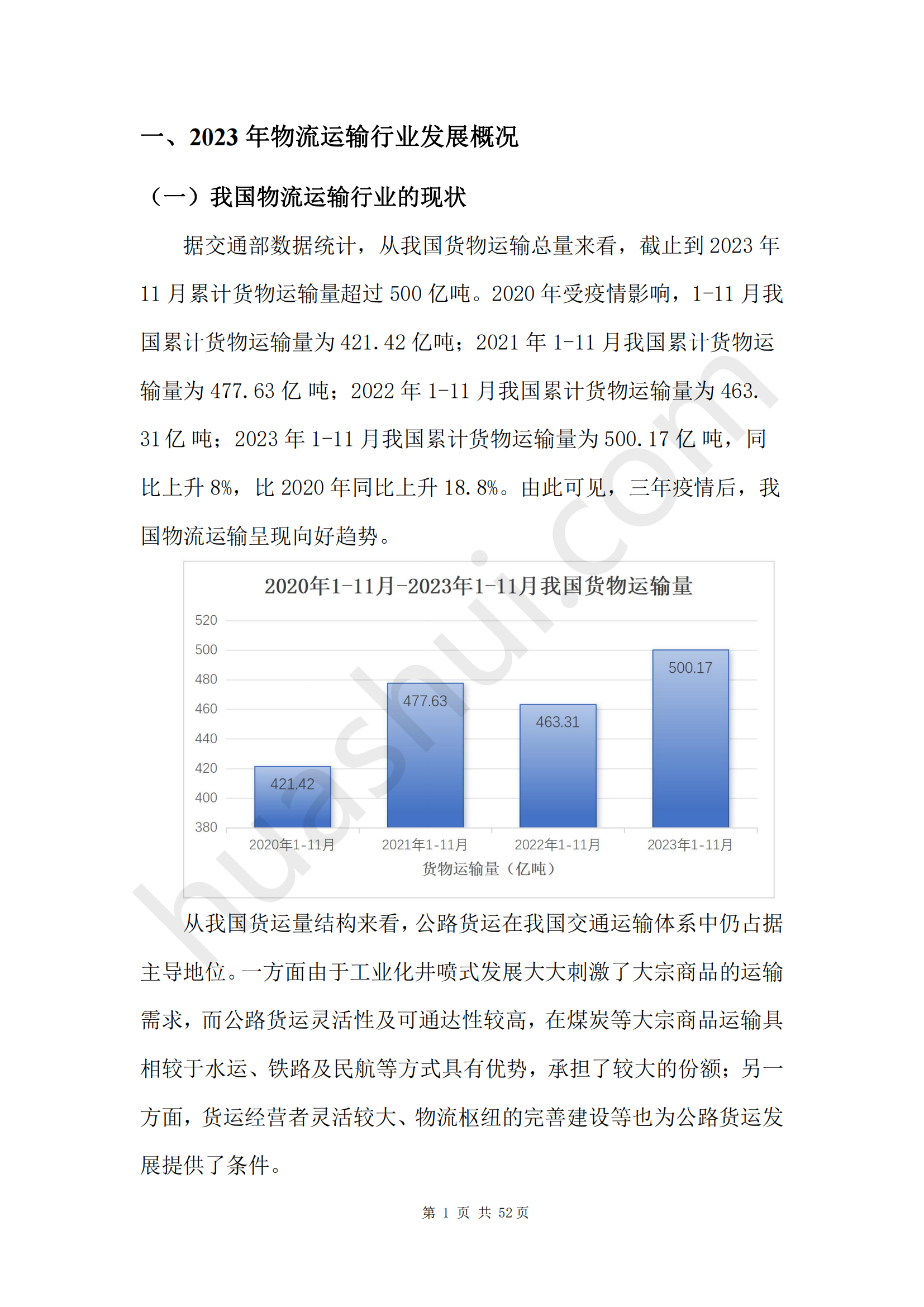

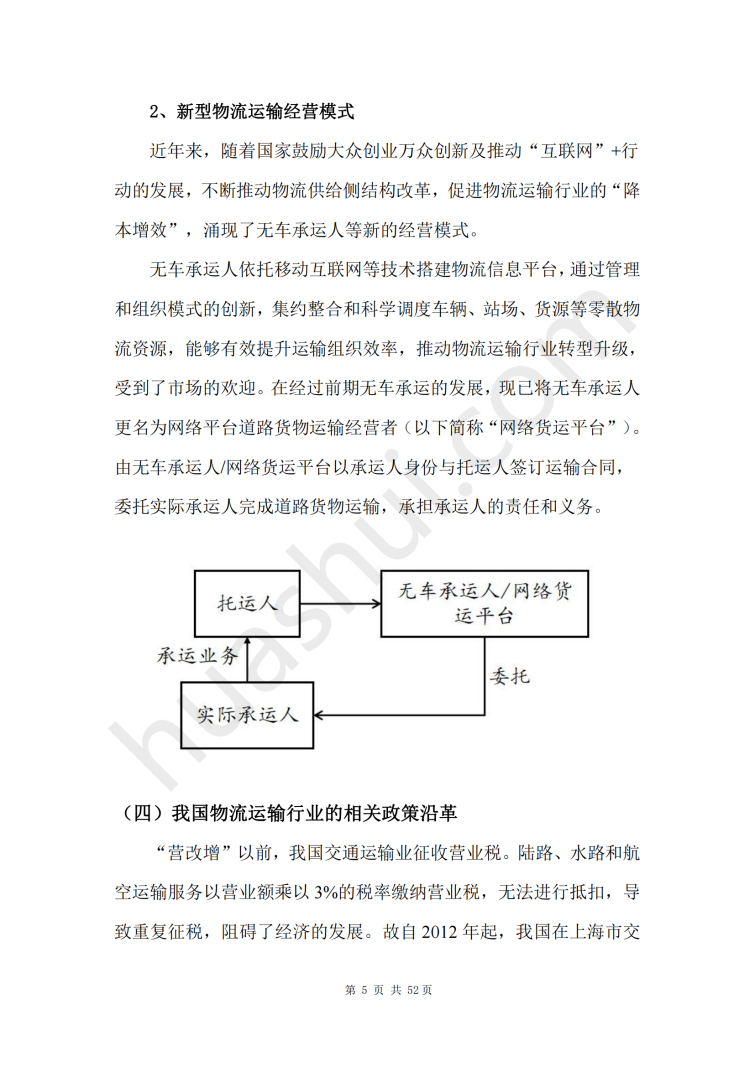

The logistics industry integrates transportation, warehousing, freight forwarding, intermodal transportation, manufacturing, trade and information industries. Among them, transportation is one of the key links in logistics, and the integration of logistics and transportation forms the logistics and transportation industry, which plays an important role in promoting the development of national economy. And road transportation plays a fundamental role in the logistics and transportation industry with its advantages of strong adaptability, mobility and flexibility, fast and direct access. With the in-depth integration of mobile Internet technology and the logistics and transportation industry, the market has emerged as a new business model such as car-free transport, network freight, etc., which relies on mobile Internet technology to build a logistics information platform, and effectively promotes the ability of resource integration through the innovation of the management and organization mode, and promotes the transformation and upgrading of the logistics and transportation industry. At the same time, the basic form of transportation, which is "zero, scattered, small and weak", remains unchanged, the proportion of individual drivers is high, and the VAT deduction chain of logistics and transportation industry is broken, which still restricts its further development. In order to effectively reduce the tax burden, the State Administration of Taxation (SAT) has successively issued the State Administration of Taxation Announcement No. 30 of 2017, the State Administration of Taxation Announcement No. 55 of 2017 and other policies to respond to the voices of the taxpayers and solve the pain points of the industry, but it still hasn't fundamentally solved the persistent problem of insufficient input deduction in the logistics and transportation industry.

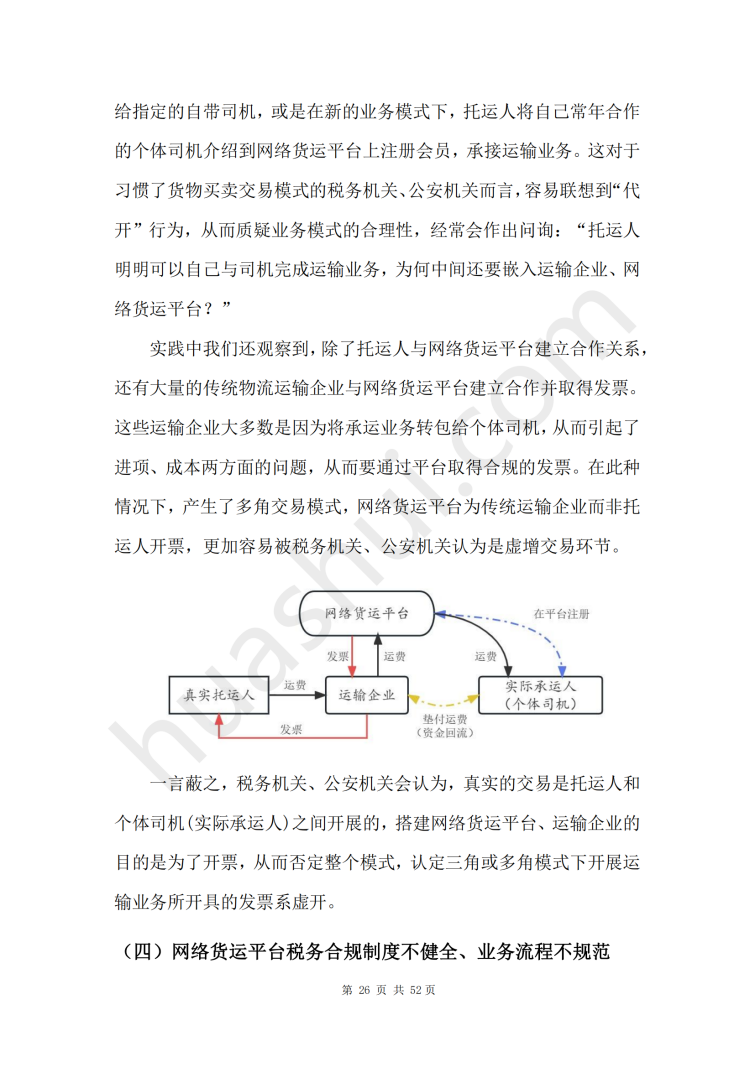

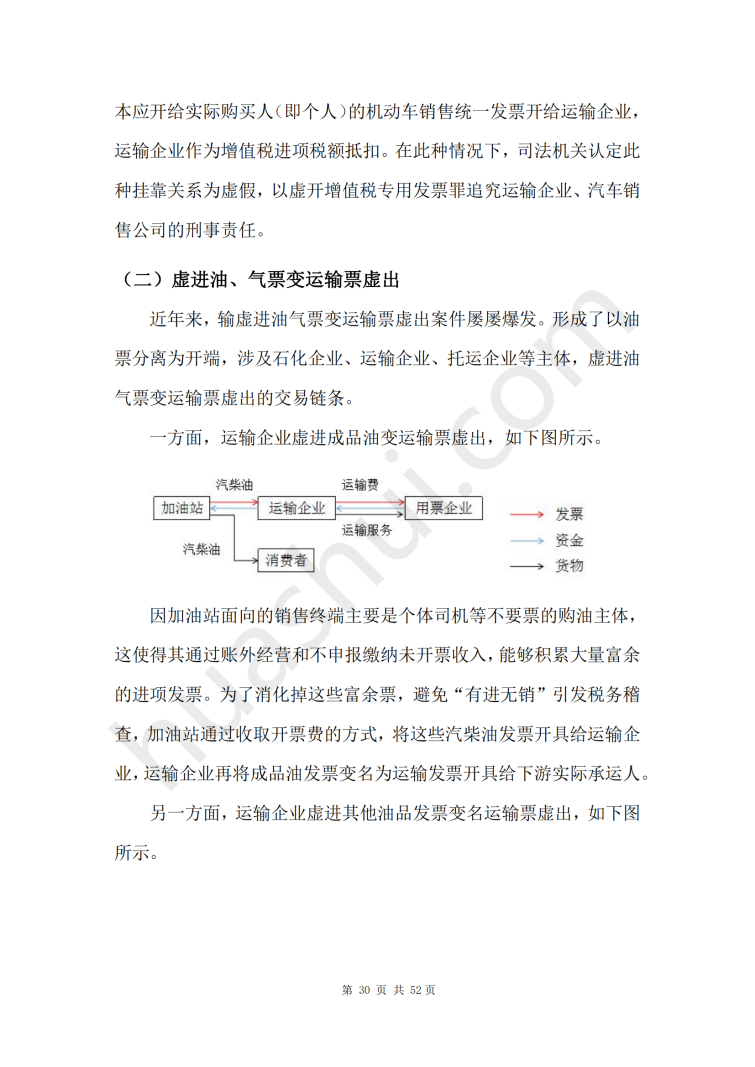

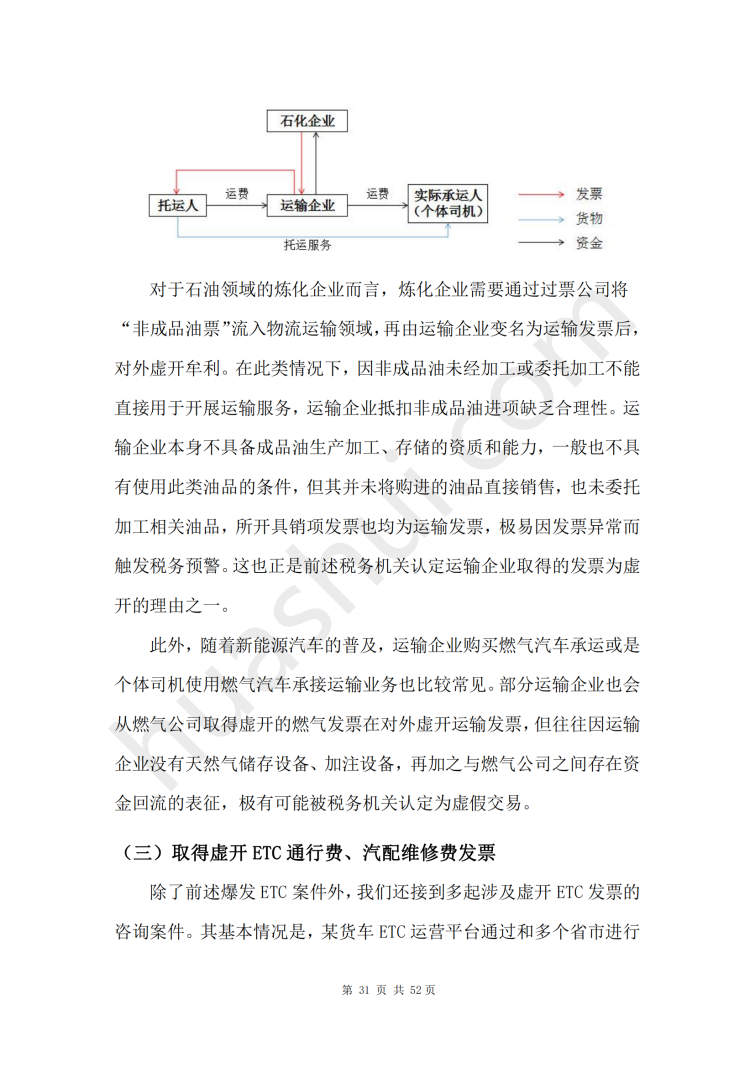

Some logistics and transportation enterprises chose to reduce VAT and EIT by outsourcing invoices or applying for fiscal rebates, thus triggering the risk of tax evasion and false invoicing, with a wide range of implication and impact.2023 A number of cases of external false freight invoicing by means of falsely opening oil and gas invoices, ETC invoices, etc., broke out again. In addition, the new industry such as network freight transportation and non-vessel shipping also broke out with large cases of false invoicing, and the risk was spread to tens of thousands of enterprises downstream, triggering industry shocks. There is an urgent need to strengthen tax compliance in the logistics and transportation industry to prevent tax risks.

Based on the in-depth observation of the logistics and transportation industry, Huashui Team has prepared this "Logistics and Transportation Industry Tax Compliance Report (2024)". This report summarizes the development of the logistics and transportation industry, observes its tax policies and regulatory trends, focuses on typical tax-related administrative and criminal cases in the logistics and transportation industry in 2023, discusses the causes of tax-related risks in the logistics and transportation industry, summarizes the major types of tax-related risks in the logistics and transportation industry and puts forward the key points of defense on the basis of the foregoing, with the hope of contributing to the construction of tax compliance in the logistics and transportation industry.

This report is divided into eight sections, and the full text is about 26,000 words.

Click to download:《Logistics and Transportation Industry Tax Compliance Report》(2024)