Non-Ferrous Metal Industry Tax Compliance Report (2024)

Non-ferrous metals are essential raw materials in fields such as electronics, aviation, automotive, and construction, playing a crucial role in economic and defense development as well as societal progress. In the realm of taxation, the non-ferrous metal industry has witnessed a surge in tax-related cases in recent years. Issues related to taxation in the buying, selling, and transportation of non-ferrous metals have become increasingly prominent, giving rise to numerous tax compliance challenges.

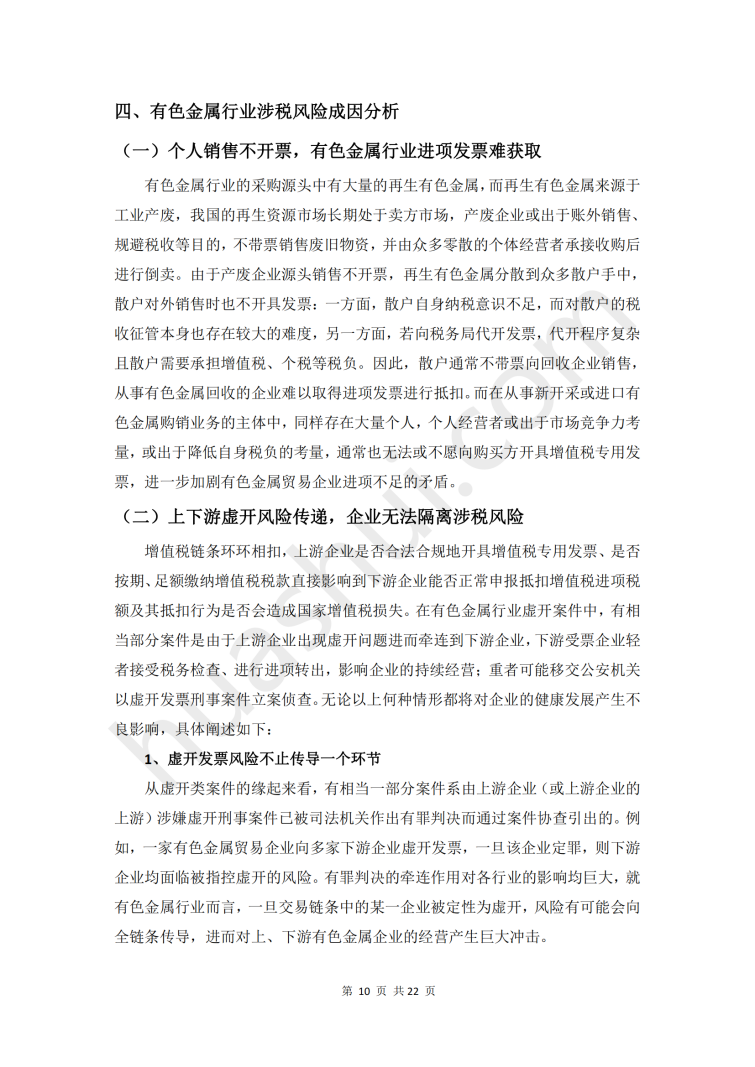

Within the buying and selling transactions of non-ferrous metals, some suppliers, particularly retail ones, are either unwilling or unable to issue value-added tax (VAT) special invoices. This results in non-ferrous metal enterprises struggling to obtain input invoices. In order to bridge this gap and obtain valid pre-tax deduction certificates for corporate income tax, some companies resort to methods such as operating under the umbrella of another business, seeking third-party invoice issuance, or even purchasing invoices. As the "anti-fraud and anti-deception" special campaign intensifies and transforms into a routine effort jointly undertaken by eight government departments, the non-ferrous metal industry has witnessed a surge in cases of fraudulent invoicing, exposing companies and their executives to administrative and even criminal liabilities.

Due to the high transportation costs associated with non-ferrous metal transportation, the industry has adopted a trading model of "unified warehousing and delivery at the end." However, as no actual goods transportation occurs in the intermediary stages, this model is prone to being deemed as lacking genuine goods transactions, thereby triggering risks of fraudulent invoicing.

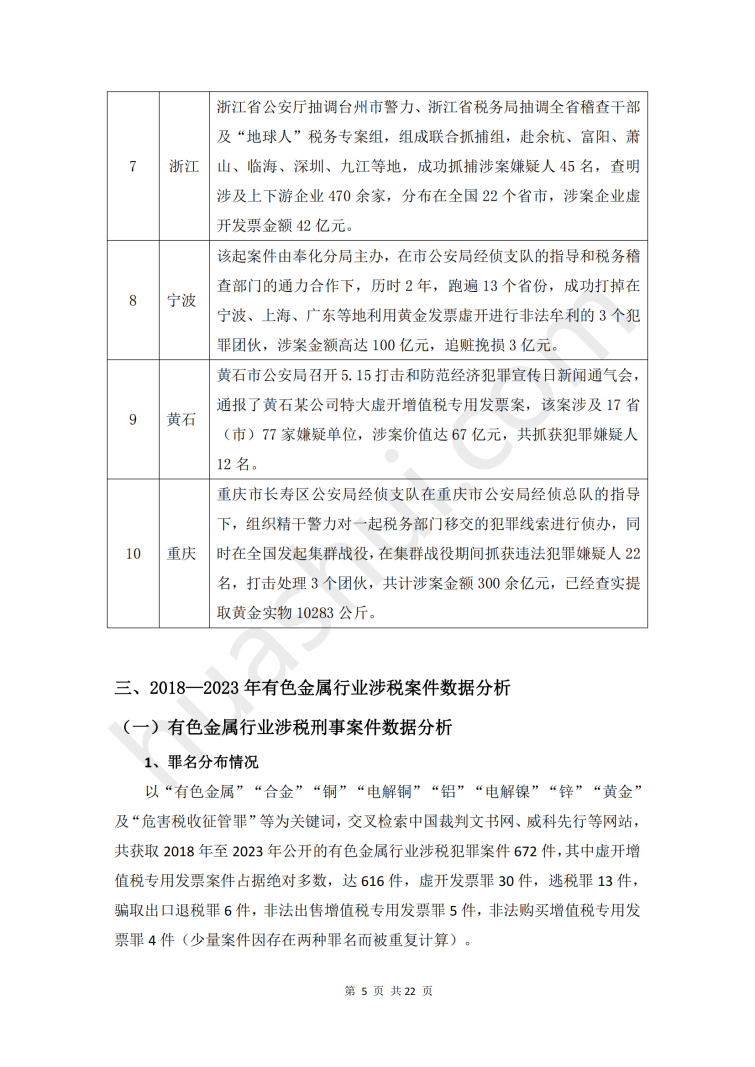

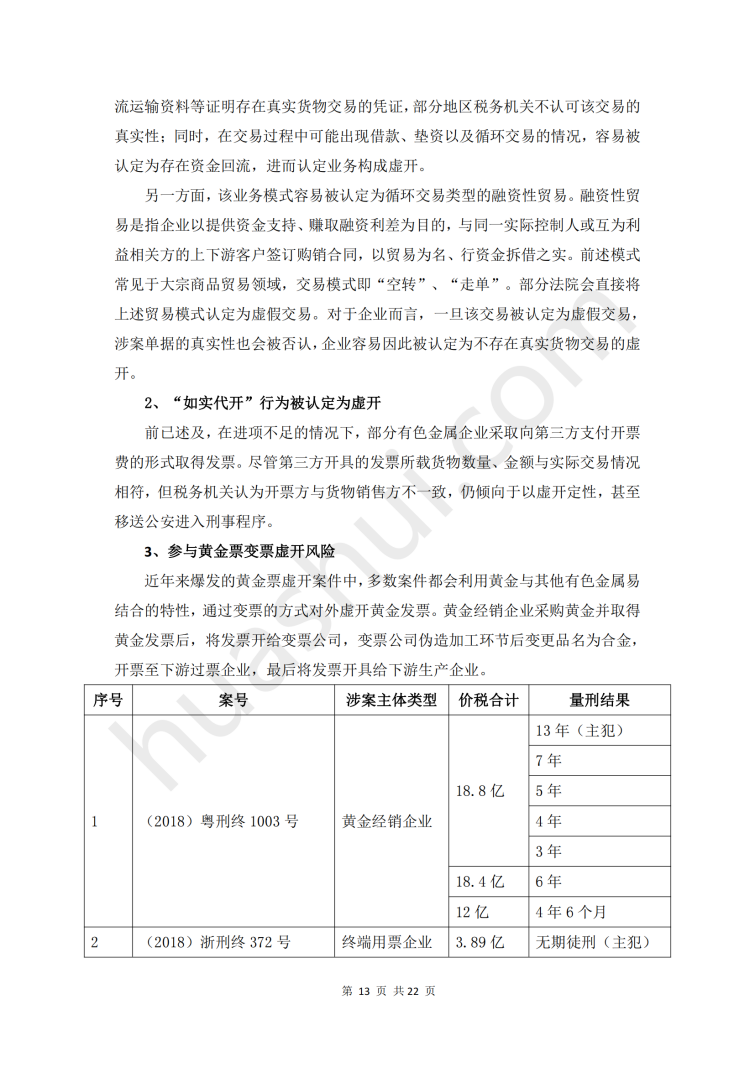

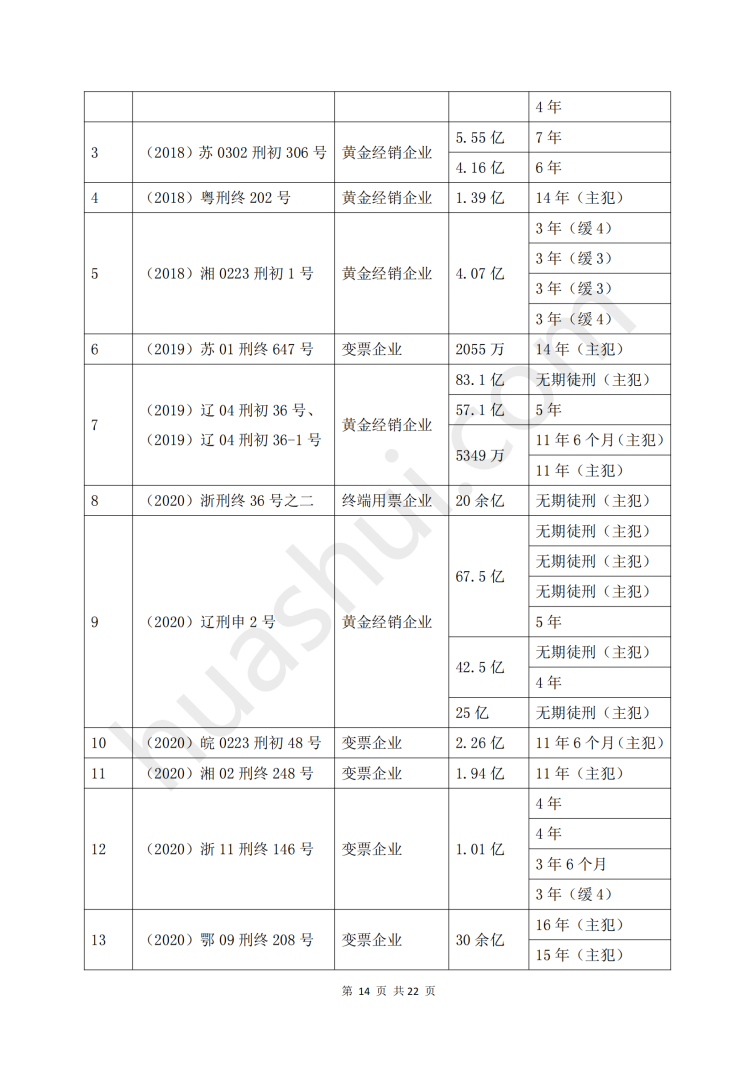

Furthermore, in recent years, tax authorities in various regions have conducted special inspections on gold invoices, uncovering numerous cases of fraudulent issuance. In these cases, individuals involved in the fraud use aliases to fraudulently issue non-ferrous metal invoices. Due to the chain-like deduction features of value-added tax, the risk of fraudulent invoicing is transmitted downstream to non-ferrous metal enterprises.

In terms of judicial practice, publicly disclosed cases of fraudulent invoicing in recent years have included instances where non-ferrous metal companies were charged with the illegal purchase of VAT special invoices despite obtaining genuine invoices through honest means. There have also been cases where the issuance of fake invoices for loan fraud was deemed as not constituting fraudulent invoicing. As the reform of criminal compliance mechanisms by procuratorates is rolled out nationwide, and courts in various regions initiate compliance pilot programs during the trial phase, these developments and changes in judicial practice present new opportunities for non-ferrous metal enterprises involved in tax-related criminal defenses.

Based on our in-depth observation of the non-ferrous metal industry and our experience in handling tax-related cases, this report is crafted by Huashui to thoroughly analyze the tax environment for the non-ferrous metal industry under the new situation of tax administration. We compile and analyze tax-related criminal and administrative cases involving non-ferrous metal enterprises from 2018 to 2023, revealing the current status, causes, and latest changes in tax-related criminal risks for the non-ferrous metal industry. Building upon this analysis, we provide compliance management suggestions for enterprises, aiming to assist non-ferrous metal companies in conducting tax management legally and compliantly, strengthening internal risk control and external risk isolation, and effectively addressing and mitigating tax-related legal risks.

Click to download:《Non-Ferrous Metal Industry Tax Compliance Report》(2024)