Investment Promotion Tax Compliance Report(2024)

Investment promotion is an important path for local governments to use external resources to promote regional economic development, which is of great significance for promoting local employment, optimizing local industrial structure and expanding the scale of economic development. For a long time, to give investment enterprises tax incentives, financial incentives is a common way for local governments to attract investment, this kind of financial and tax support policies effectively alleviate some of the pressure on the capital turnover of enterprises, reduce the operating costs of enterprises, stimulate the vitality of the development of enterprises, which in turn boosted the development of the regional economy. However, in practice, there are some financial and tax incentives in violation of higher laws to give enterprises the phenomenon of tax rebates, some enterprises in the process of applying the policy of false opening, tax evasion and other issues.

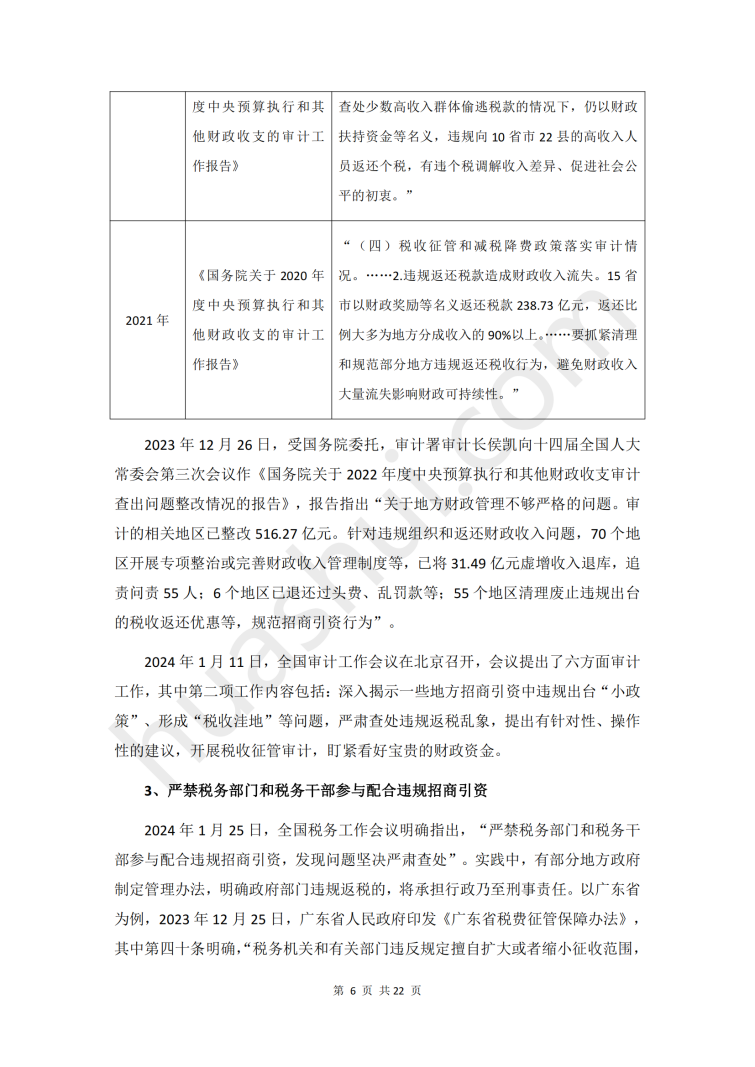

For a long time, there are usually links in the business chain of resources recycling industry, logistics and transportation and flexible labor that run on local fiscal and tax incentives, and the approved levy policy in some regions has also become an important consideration in the design of enterprise equity structure and tax-saving arrangements for high net worth individuals. With the spread of clean-up and standardization of tax and other preferential actions, local illegal tax preferential policies have gradually contracted, and fiscal rebates have gradually become the main local fiscal and tax preferential policies. In recent years, illegal tax rebate behavior and tax puddles in some areas have triggered the attention of many departments. In January, the National Audit Work Conference put forward a six-pronged audit work, the second of which included "revealing in-depth the illegal introduction of 'small policies' in investment promotion in some places, Formation of 'tax depressions' and other issues, and seriously investigate and deal with irregular tax rebates"; Rao Lixin, deputy director of the State Administration of Taxation, also pointed out at a press conference held by the State Council Information Office on January 18, that tax-related issues in the context of investment promotion should be seriously investigated and dealt with. "The National Tax Work Conference also explicitly prohibits the participation of tax departments and tax cadres in cooperating with illegal investment promotion. With the normalization of the eight departments' joint action to rectify tax fraud and the comprehensive advancement of tax collection and management informationization and digitalization, the tax compliance problems in the field of investment promotion are facing a severe situation.

In the cases of false opening and tax evasion involving investment promotion and taxation policies that have broken out so far, the financial cadres of local governments, investment promotion platforms and investing enterprises are facing different degrees of legal liability. Huashui combines its continuous research on investment promotion and its experience in representing the latest tax-related cases to write this report, which analyzes in depth the tax environment of investment promotion under the new situation of tax collection and management, the business model of investment enterprises, the tax-related legal risks of each subject, and the tax compliance management, etc., with a view to providing useful references for the local governments, investment promotion platforms, and investment enterprises.

Click to download:《Investment Promotion Tax Compliance Report》(2024)