Flexible Employment Platform Tax Compliance Report (2024)

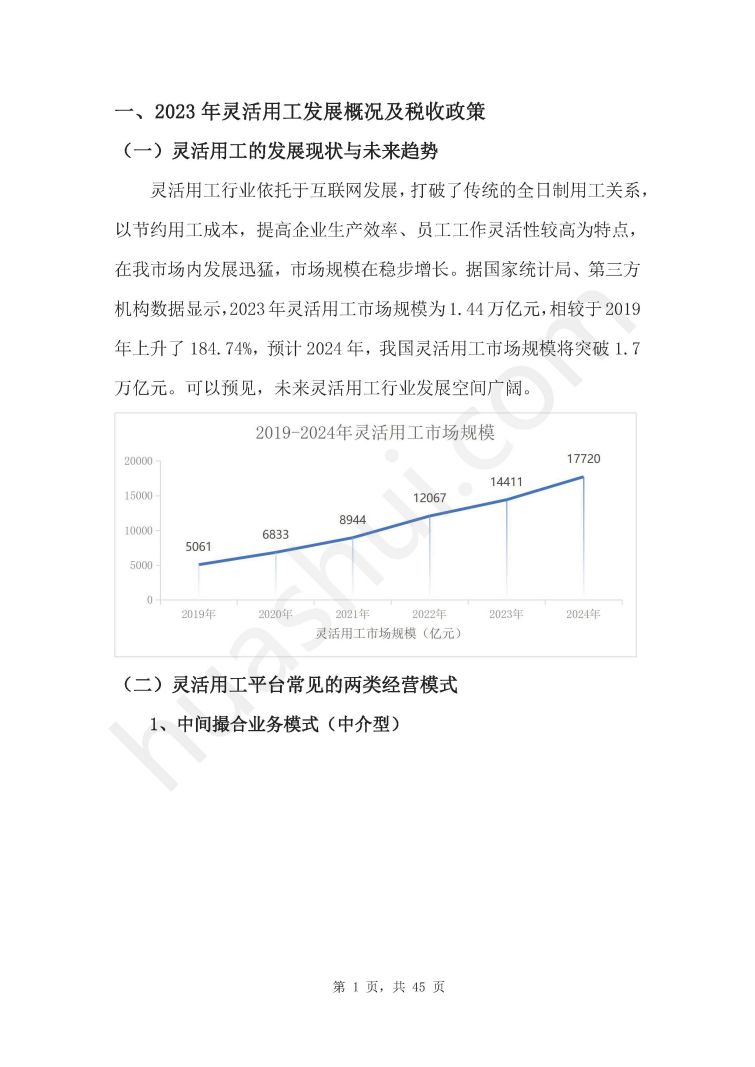

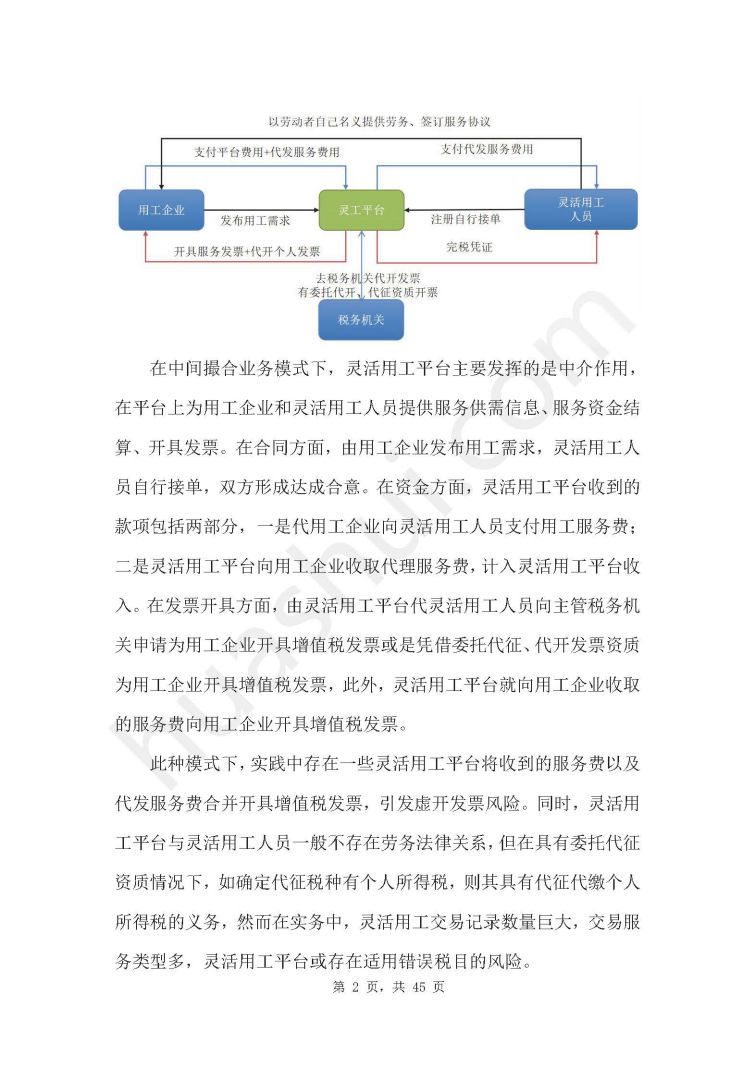

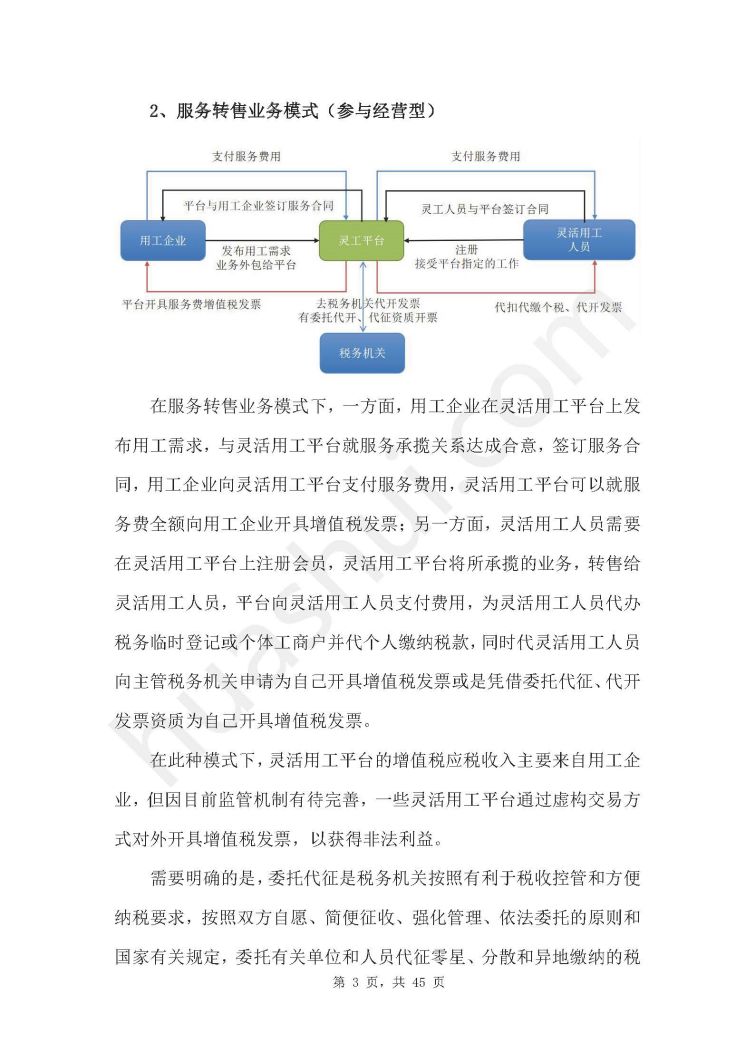

In recent years, with the development of Internet technology and national policy support for the platform economy and flexible labor industry, flexible labor platform, as a bridge connecting labor-using enterprises and flexible workers, has shown a booming trend. Relying on Internet information technology, flexible labor platforms have opened up information barriers between labor-using enterprises and talent resources, improved the efficiency of human resources allocation, and played a key role in promoting employment and safeguarding people's livelihood. In terms of taxation, the flexible employment platform also helps to solve the problem of employing enterprises not being able to issue invoices for employing enterprises due to the provision of labor services by individual workers in the course of their operations, reducing the tax costs of employing enterprises, and has gained the favor of employing enterprises.

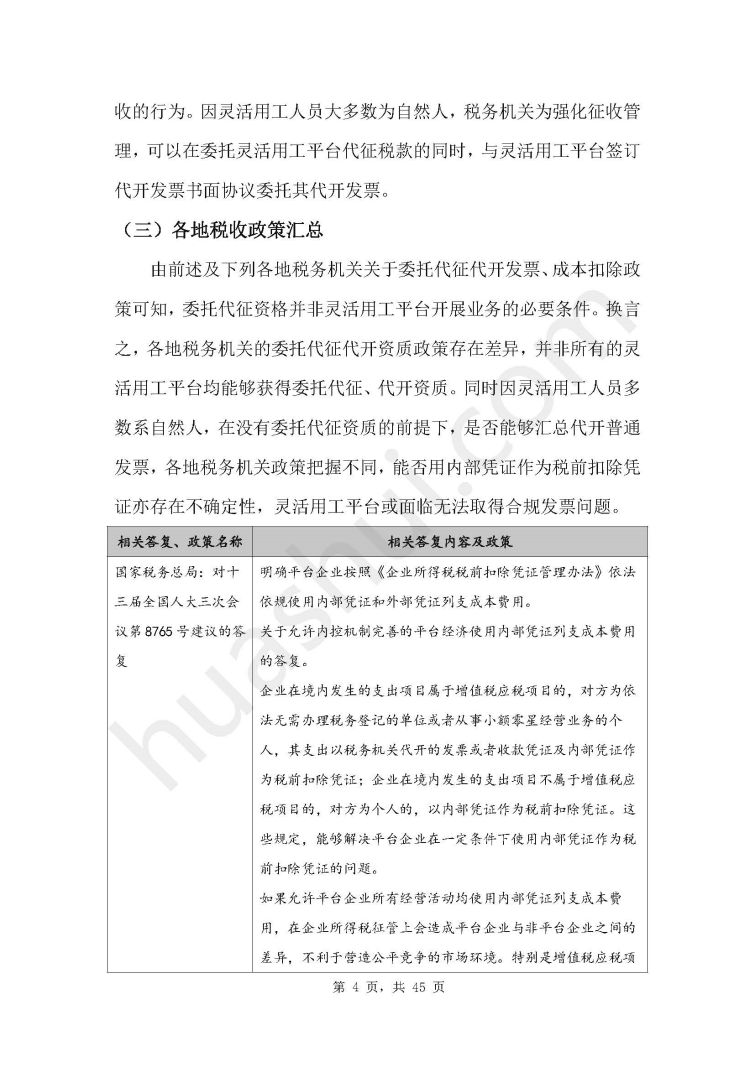

However, as a new industry organization, flexible labor platform is still in a period of rapid development and imperfection, and the relevant national policies are also in the process of further follow-up, the strong regulatory trend in the field of taxation has appeared, and tax preferential policies, such as financial rebates, will be gradually cleaned up.2023 A number of suspected false invoicing cases of the flexible labor platform have erupted, which reflects the weak links existing in the business development and tax processing of the flexible labor platform. On the one hand, some flexible labor platforms have made their business and tax treatment process weak. On the one hand, some flexible labor platforms used the fiscal rebate tax policy as the capital for false invoicing, and wantonly issued false invoices to outsiders in order to make unlawful benefits such as handling fees, resulting in the loss of the national tax interests and disrupting the order of tax collection and management; on the other hand, some flexible labor platforms were oriented on business and profits and neglected the platform tax compliance construction, resulting in the loopholes and deficiencies of the business model, which were utilized by the lawless elements to commit false invoicing and other illegal criminal acts. On the other hand, some flexible labor platforms are business and profit oriented, neglecting the platform tax compliance construction, resulting in loopholes and deficiencies in the business model, which are used by unlawful elements to carry out illegal and criminal behaviors, such as false opening, and fall into criminal risks. Therefore, it is urgent for flexible labor platforms to strengthen tax compliance construction and prevent tax risks.

Based on the in-depth observation of flexible labor platforms, HuaShui team has prepared this "Flexible Labor Platform Tax Compliance Report (2024)". This report summarizes the development of flexible employment industry and flexible employment platforms, observes their tax policies and regulatory trends, focuses on typical tax-related cases of flexible employment platforms in 2023 and discusses the causes of tax-related risks, summarizes the main tax-related risks of flexible employment platforms and their manifestations, puts forward the key points of administrative response and criminal defense strategies on the basis of the aforementioned, and finally provides suggestions for the daily tax compliance management of flexible employment platforms. Finally, it provides suggestions for the daily tax compliance management of flexible employment platforms, hoping to contribute to the sustainable and healthy development of the flexible employment industry.

This report is divided into eight sections, with a total text of about 25,000 words.

Click to download:《Flexible Employment Platform Tax Compliance Report》(2024)