CHINA TAX LAWYERS REVIEW (TENTH EDITION)

CHINA TAX LAWYERS REVIEW is a professional serial publication in the tax industry compiled and issued by the Finance and Taxation Law Committee of the All-China Lawyers Association and edited by Liu Tianyong,a lawyer of Hwuason Law Firm, and it has been published in 10 consecutive volumes so far. The first 9 volumes have received wide attention and favorable comments in the legal and taxation circles.

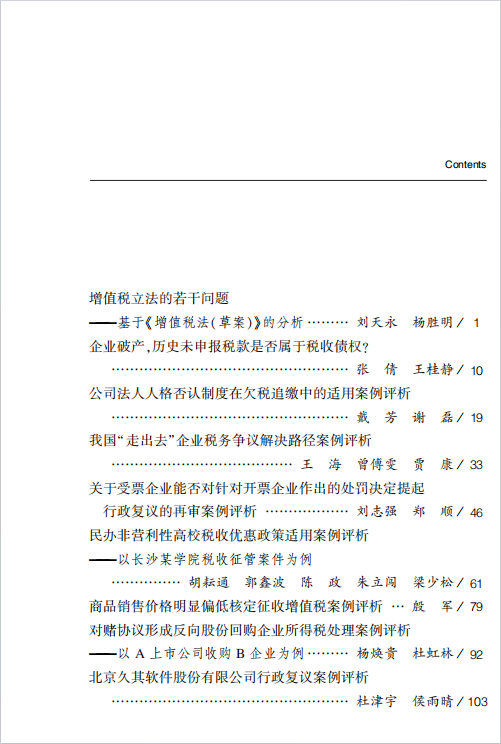

The 10th volume of this publication contains the outstanding works of the "2023 National Top Ten Excellent Tax Law Case Papers", and 10 papers have been selected for inclusion in this book after the evaluation by the experts:

Dai Fang, Xie Lei: "Case Commentary on the Application of Corporate Personality Denial System in the Recovery of Tax Arrears".

Wang Hai, Zeng Fuwen and Jia Kang: "Case Commentary on Tax Dispute Resolution Path for Enterprises Going Global in China".

Liu Zhiqiang and Zheng Shun: "Review of the Case on Whether the Invoicee Enterprise Can Initiate Administrative Reconsideration Against the Penalty Decision of the Invoicing Enterprise".

Hu Weitong, Guo Xinbo, Chen Zheng, Zhu Libao, Liang Shaosong: "Case Commentary on the Application of Tax Preferential Policies for Privately-run Non-profit Colleges and Universities - Taking the Case of Tax Administration of a College in Changsha as an Example" .

Yin Jun: Commentary on the Case of Approved Collection of Value-added Tax on Obviously Low Sales Price of Goods

Yang Huangui and Du Honglin: "Case Commentary on Enterprise Income Tax Treatment of Reverse Share Repurchase Formed by Gambling Agreements--Taking the Acquisition of Enterprise B by Listed Company A as an Example".

Du Jinyu and Hou Yuqing: "Commentary on the Case of Administrative Reconsideration of Beijing Jiuqi Software Co.

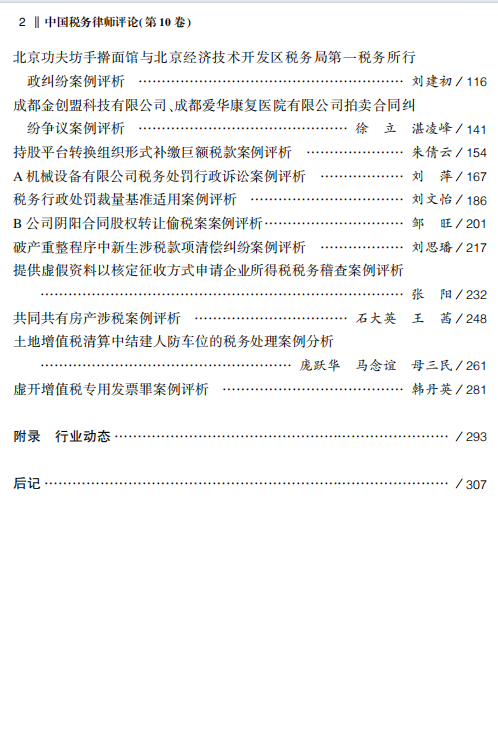

Liu Jianchu: A Case Commentary on the Administrative Dispute between Beijing Kungfu Square Hand-Rolled Noodle House and the First Taxation Office of Taxation Bureau of Beijing Economic-Technological Development Area

Xu Li and Zhan Lingfeng: "Case Commentary on the Dispute of Auction Contract Dispute between Chengdu Jinchuangmeng Technology Co.

Zhu Qianyun: Commentary on the Case of Converting Organizational Forms of Shareholding Platforms to Pay Huge Taxes

These papers cover typical tax-related cases in different industries and fields, reflecting some of the typical problems encountered by tax lawyers in the field of practice, as well as the successful experience and useful reference of practical operation. There are cutting-edge discussions on hot topics such as value-added tax legislation and tax claims of bankrupt enterprises, as well as in-depth explanations on typical difficult tax cases such as conversion of organizational form of shareholding platform to make up for the tax, and reverse repurchase enterprise income tax treatment of betting agreement. It is sincerely hoped that this book will inspire more outstanding students and young lawyers to devote themselves to the field of tax law services, continue to explore the major topics and cutting-edge issues in the construction of the rule of law in China's taxation, focus on advancing the innovation and upgrading of tax-related professional services, and contribute to the modernization of tax governance and the construction of the rule of law.

Editor

Mr. Liu Tianyong, founder and director of Hwuason Law Firm, senior tax attorney, doctor of law from China University of Political Science and Law, post-doctoral fellow in economics from Central University of Finance and Economics, "the first batch of national leading talents in taxation" from State Administration of Taxation, and the first batch of legal experts from Ministry of Finance's financial talent pool. Director of the Finance and Tax Law Committee of the All-China Lawyers Association for the 9th and 10th Terms, Member of the Expert Committee for the Review and Approval of Statutory Rules and Regulations of Returned Overseas Chinese by the Supreme People's Procuratorate, member of the Expert Committee for the Review and Approval of Statutory Rules and Regulations of the Ministry of Justice, special Researcher of the Institute of Taxation Science of the State Administration of Taxation, executive member of the 11th Committee of All-China Federation of Statutory Rules and Regulations of the Ministry of Justice. He is also a member of the 11th Standing Committee of the China Overseas Chinese Federation of Industry and Commerce, one of the first group of "professionals of the third-party supervision and assessment mechanism of compliance" of the All-China Federation of Industry and Commerce, and a part-time professor of Peking University and Renmin University. He has been invited by the Standing Committee of the National People's Congress, the State Council, the Ministry of Justice, the Ministry of Finance, and the State Administration of Taxation to participate in legislative and revision seminars on the Tax Administration Law, the Individual Income Tax Law, the Enterprise Income Tax Law, the Value-added Tax Law, the Consumption Tax Law, and other draft laws. Over the years, he has successfully represented hundreds of tax-related criminal and administrative cases with significant social impact.

Preamble:

Contents:

This book is published by Law Press, scan the QR code below to buy this book: